How to distinguish a trend market from consolidation [Tips]

One of the most important things a trader must define before trading is sentiment. He is one of the key aspects of investing. A different approach should be taken for trend markets, different for consolidation. Many speculators, even despite experience, face the problem of correctly interpreting a given asset. In this article, we'll provide some tips to help you distinguish a chart in a trend from one that isn't in the trend.

Price action

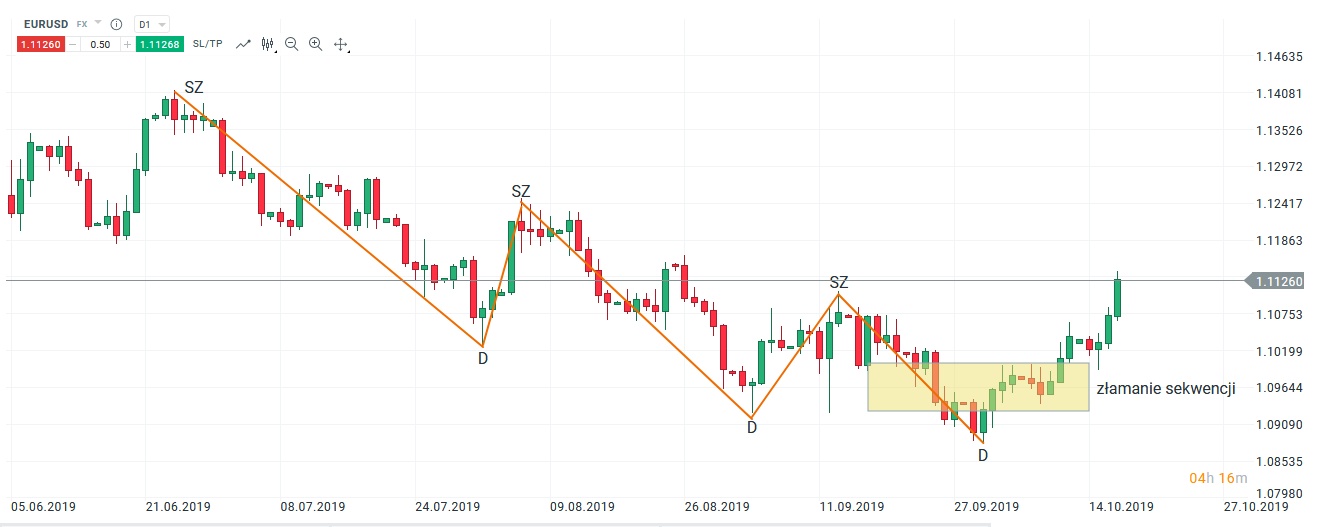

This may seem trivial, but one of the most obvious methods to determine a given sentiment on the market is to pay attention to the price action. The next tops and holes are key. If the sequence of higher peaks and higher holes is maintained, this is undoubtedly a sign of an upward trend. Similarly, lower peaks and lower holes testify to the downward trend. This is obvious, but many traders forget about this type of view of the market. The question often arises, how then to determine when the new trend begins and when the old one ends? If we see a given sequence, for example in a downward trend lower peaks and holes, the sequence is broken by establishing a higher peak, this should be the first indication that a given trend is losing strength and we can look for a long position. After breaking the sequence of a given trend, in this case a downward one, we should see at least one reverse sequence, i.e. a higher peak, a higher hole.

Breaking the downward trend sequence. Chart EUR / USD, D1 interval. Source: xNUMX XTB xStation

Parallel levels

Key levels of support and resistance are also very helpful in determining whether the market is in a trend or not. At the beginning it is worth looking at the price and trying to see if it moves between any levels. If there are bounces from the proverbial one "band" to the other, it may indicate consolidation. There are two types of lateral movement. The first is called "agitated", the second is a move in the range. It is also worth noting that the price does not necessarily have to hit with the accuracy of the pip in a given level, sometimes it may even break through and then return. To facilitate the situation, after setting certain levels, you can look at the closing of the candles at slightly higher intervals.

An example of a market moving in range. NZD / USD chart, D1 interval. Source: xNUMX XTB xStation

Use of moving average

Another tactic that can be used to determine sentiment are the means. They do not always precisely determine the direction, but they can be a good visual clue, especially for beginner traders. In this case a lot depends on the individual approach. If we prefer to trade in shorter periods, it is worth using averages, which will be more "adjusted" to the price and will act as a kind of dynamic support or resistance, e.g. 8- and 20-periodic. When using averages to distinguish trends from consolidation, there are two more aspects to consider. The first is the way of crossing / cutting average, the second is the distance to each other. If we observe a great distance, it proves the strength of a given trend. The main disadvantage of this tactic is that sometimes they can be confusing when dealing with a market in consolidation. In these types of cases, they can be an additional filter, but you should also always look at the individual price action.

Average as mobile support / resistance. Chart EUR / GBP, D1 interval. Source: xNUMX XTB xStation

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to distinguish a trend market from consolidation [Tips]](https://forexclub.pl/wp-content/uploads/2019/10/trend-konsolidacja.jpg)

![Forex training - hit or kitty? [VIDEO] Forex Training - Hit or Kit?](https://forexclub.pl/wp-content/uploads/2021/03/szkolenia-forex-v3a-300x200.png)

![New features on the xStation 5 platform from XTB [September 2020] xstation 5 xtb](https://forexclub.pl/wp-content/uploads/2018/12/xstation-5-xtb-300x200.jpg)

![How to distinguish a trend market from consolidation [Tips] pamm account](https://forexclub.pl/wp-content/uploads/2013/10/konto-pamm-102x65.jpg?v=1594910483)

![How to distinguish a trend market from consolidation [Tips] trading jam xtb](https://forexclub.pl/wp-content/uploads/2019/10/trading-jam-xtb-102x65.jpg)

Leave a Response