Trump infected with coronavirus: uncertainty in markets and stronger dollar

The subject of Friday in the financial markets was unexpectedly coronavirus infection by the US president. For the markets, this means increased uncertainty, which translates, among others, for the strengthening of the dollar. As this uncertainty will not disappear quickly, this may be a permanent situation.

Donald Trump infected with Covid-19

On Friday, investors prepared for the afternoon's data from the US labor market. In the morning, however, US President Donald Trump announced that he and his spouse had the coronavirus, which changed the rules of the game. The financial markets reacted immediately. US indices, Asian indices and prices oil have fallen. The dollar strengthened and rose gold prices.

The nervous reaction of the markets is not surprising. The coronavirus of the US president is not only the topic of the day today, pushing the US labor market data (unemployment, non-farm payrolls, hourly wages) into the background, but also significantly changes the rules of the game.

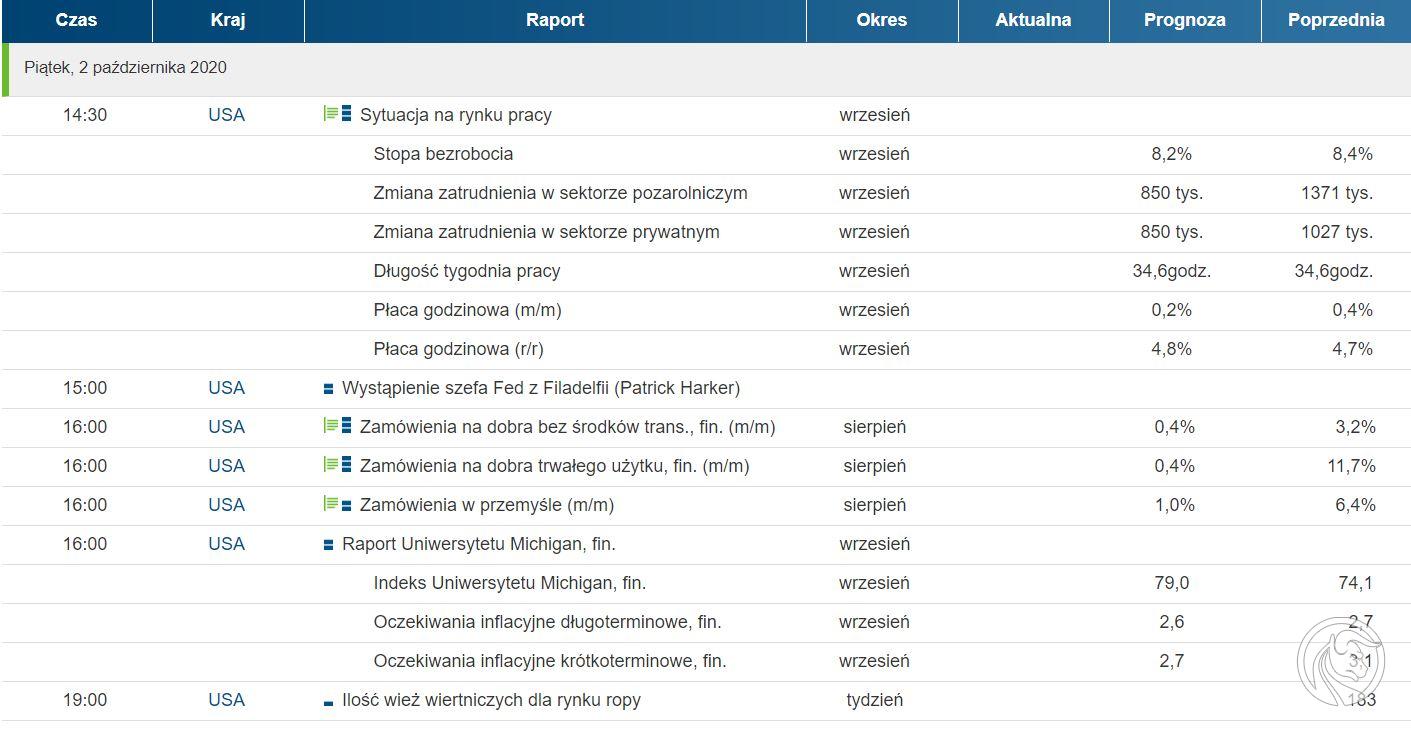

Calendar of economic events. Source: macroNEXT

November presidential elections

The situation with the US president is a source of huge uncertainty in the markets ahead of the November US presidential elections. Choices that in themselves created uncertainty. Moreover, given that President Trump is 74 years old and his opponent in the race for the presidency is even older, uncertainty about the coronavirus will not end today, tomorrow or after the end of the Trump quarantine. She will hold out until the election at least.

Another thing is, how will Trump's personal COVID19 experience affect his decisions? Will they by any chance bring the second lockdown closer? Or maybe quite the opposite. Hard to say. It is clear, however, that this additional uncertainty is detrimental to financial markets, which will translate into profit taking on riskier assets and buying those considered safe, or simply escaping into cash.

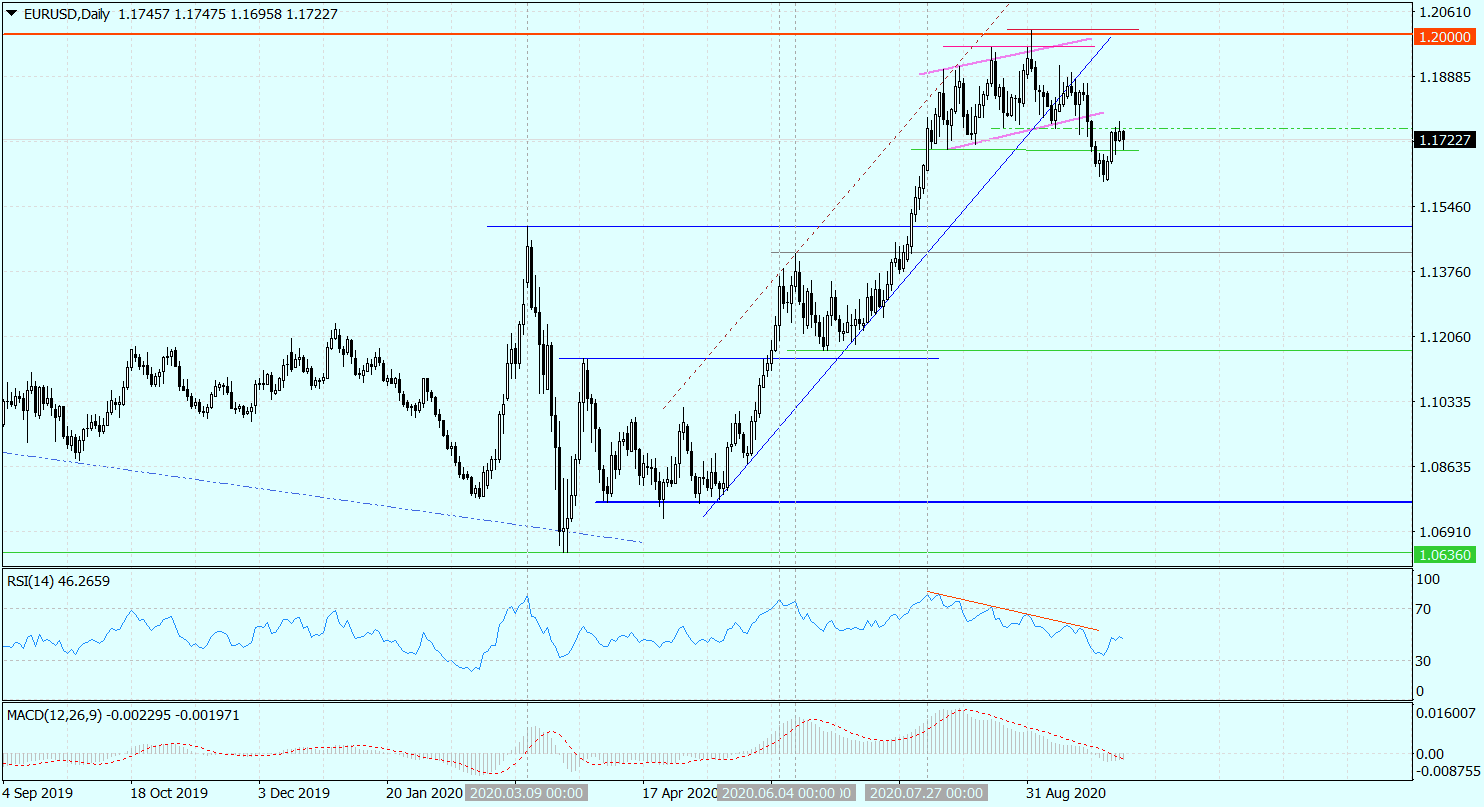

The currency market reacted to the news from the US with the strengthening of the dollar. It's natural. The dollar is considered a safer currency than many others. In case of EUR / USD this strengthening is not yet generating major changes on the daily chart, but it is in line with the current scenario assuming a future decline of this pair to around $ 1,15 as a natural consequence of the September breakout from the monthly upward channel.

Diagram EUR / USD, D1 interval. Source: MT4 Tickmill.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response