Negative dynamics of profits of American companies

Another US corporate earnings season is fast approaching. Investors are waiting with uncertainty for the publication of reports of companies included in the most important stock exchange indices. Analysts' expectations are toned down, and the first quarter of this year may turn out to be the weakest in nearly three years.

Forecast decline in profits

Fears related to the spread of the banking crisis as well as growing risks recession in the American economy translated into revisions of the profit estimates of the companies included the S&P 500 index. Over the first quarter, the median profit forecast decreased by as much as 6.30%. This value is definitely above the average from recent years. The change in expectations regarding the results for the first quarter is also reflected in the forecasts for the entire 2023. The revision of the estimate of earnings per share in this period amounted to 1%.

The pessimistic attitude is also visible in the dynamics of the results. Analysts assume that the estimated profit for the first quarter decreased by 6.60%, which means that the past 3 months will most likely be the worst period since the collapse resulting from the outbreak of the coronavirus pandemic (in Q2020 31.80 profits fell by 2.30%). What's more, the implementation of the baseline scenario will make it the second quarter in a row with a negative result. Currently, it is expected that the situation will improve in the coming months, and the companies will achieve an increase in profits in the third quarter of this year. (9.30%). Acceleration should take place towards the end of the year, when the estimated profit dynamics is to amount to XNUMX%.

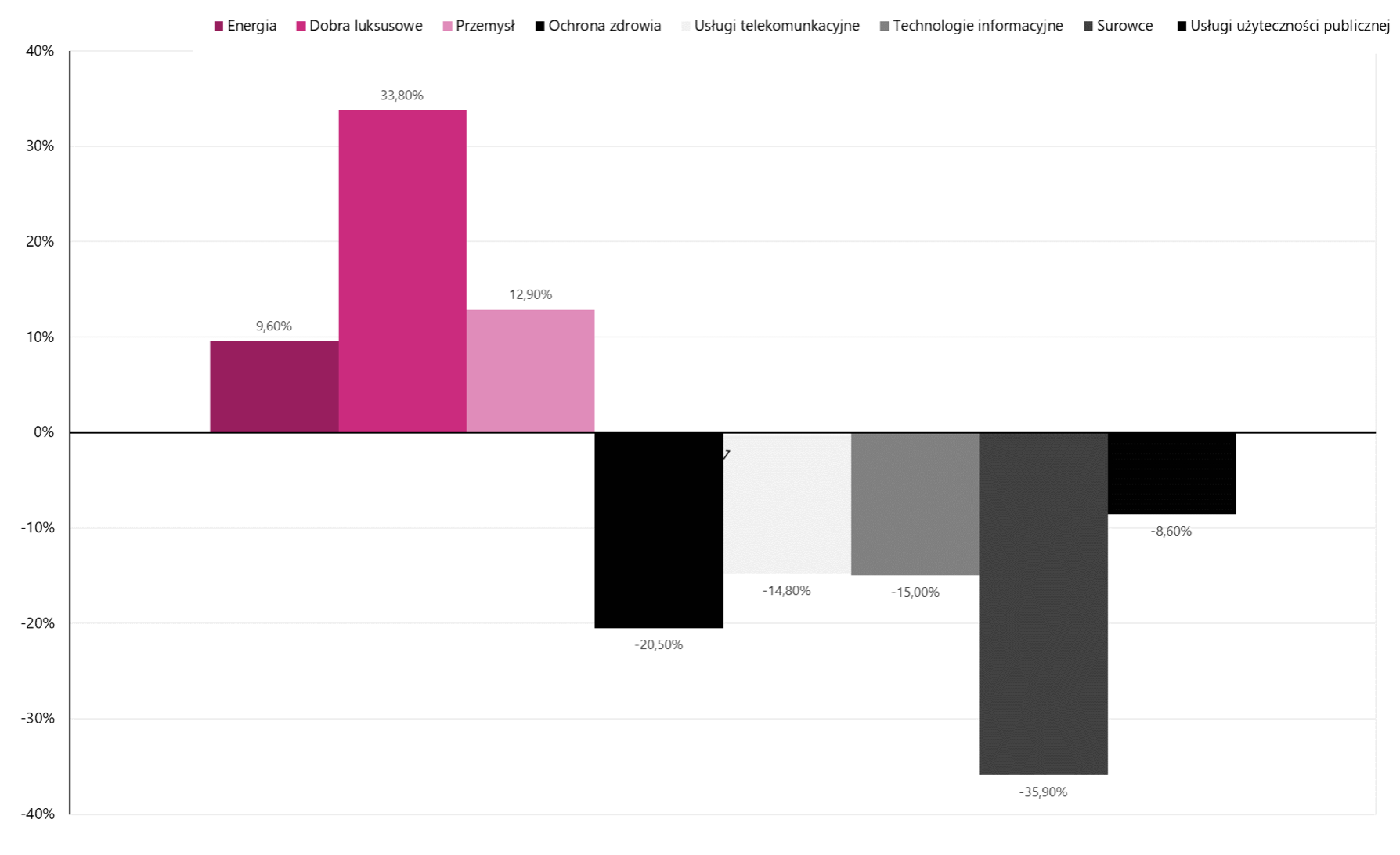

Some kind of dichotomy is expected among companies from particular industries. Analysts predict that five out of 11 sectors will see an increase in profits on an annual basis. At the top of this ranking are companies from the luxury goods sector (33.80%) and industry (12.90%). They will be at the other extreme in the last quarter companies in the raw materials industry (-35.90%), health care (-20.50%), information technology (-15.00%) or telecommunications services (-14.80%).

Estimated profit dynamics in selected sectors in Q2023 XNUMX. Source: own study based on Factset data

At the same time, forecasts for US companies' revenues were lowered. The dynamics will most likely remain positive, but the scale of growth will be limited (1.90%), which is the lowest value since Q2020 1.10 (-XNUMX%). Estimates assume that seven sectors will end the quarter on a positive note, led by the financial industry. On the other hand, the sector of raw materials companies is the weakest in the ranking.

Summation

The beginning of the earnings season of American companies may have a significant impact on the moods on the global stock exchange floors. If market expectations materialize, it will be another signal for investors that the economic situation in companies is deteriorating. Taking into account the increase in market uncertainty as well as the risk of negative development of the macroeconomic situation, the recommended approach for the coming weeks will be to be cautious and monitor events on the stock exchanges on an ongoing basis.

Author: Piotr Langner, Investment Advisor, WealthSeed

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response