VSTOXX - the European equivalent of the American VIX [Guide]

Volatility is the same as risk for many investors. Nothing could be more wrong. Volatility is a natural feature of the stock market and should not be feared. On the contrary, market volatility can be used as one of the ways to make money in the stock market.

One of the instruments that allows you to earn on the increase or decrease in volatility are derivatives (futures contracts, options). The most popular is VIX, which is listed on the US stock exchange. There is a European version of VIX. It is VSTOXX. Although less popular, the instrument can be a very useful tool in the hands of a speculator or investor. In today's text you will learn:

- What is volatility?

- What does volatility affect?

- How is VSTOXX calculated?

- How can you use VSTOXX in speculating and investing?

What is volatility?

According to the Dictionary of the Polish Language, changeability is a feature of something that easily changes. It comes as no surprise to the investor that stock prices or the value of indices change frequently. This is not always due to fundamental reasons, but also the influence of emotions. There is an imbalance between supply and demand, which causes the price to change. The higher the volatility, the greater the price fluctuation. For many investors, a period of rapid price fluctuations gives the opportunity to buy stocks well below their intrinsic value and then sell them when the market price is higher than the fundamental valuation.

Understanding volatility in the market takes a lot of effort, but it is necessary to understand what an index of volatility is and how the option price develops. In the case of stock market volatility, the two most popular ways of presenting volatility are:

- historical volatility

- implied volatility

Historical volatility, as the name suggests, refers to the change in the price of an asset in the past. Typically, historical volatility is computed as the standard deviation of the underlying instrument's price change and converted into annualized volatility. It is a very simple measure that is used to calculate the potential risk of a price change. It is enough to look at the price change chart to see periods of high and low volatility. This parameter is important as it allows the investor to "get used to" the characteristics of the asset.

Of course, historical volatility says nothing about what it will look like in the future. It is worth noting that the volatility of the underlying instruments is not symmetrical. In periods of downturn, volatility is generally higher as market emotions are much stronger. On the other hand, in times of calm growth, volatility is low. The stock exchange sentence is not surprising that bulls are climbing the stairs and bears are jumping from the window. It very often happens that during a market panic, stock prices "reflect the gains" of the last few months.

Implied volatility

As already mentioned, historical volatility is based on the history of price changes, and what is it implied? It determines the volatility of a given asset expected by the market based on the quotation of derivatives (most often options).

Implied volatility does not inform about the past, but about market predictions about the future. Due to the fact that the predictions are constantly changing, the implied volatility is still of a different value. Option prices fluctuate constantly due to changes in supply and demand. For example, if the demand for put options grows, the price of this derivative increases. If the price of the underlying instrument on which the put option price is based does not reflect this change in the option price, the market is expecting more volatility. The implied volatility is influenced by a number of factors, such as:

- macroeconomic events

- publication of financial results

- change in market sentiment

- political events

- market expectations

- other

In a nutshell, the price of an option depends on the change in the price of the asset (S), time to expiry (T) and volatility (IV).

P = f (S, T, IV)

The Black-Scholes model is great for pricing options. However, the price of an option may differ significantly from the theoretical valuation. The option premium (price) may increase due to increased uncertainty in the market. As a result, option writers are demanding more money as they expect the price of the underlying to move significantly. For example, with the upcoming release of macroeconomic data, option prices may rise as the market expects volatility after the performance. This does not mean that investors "know" what these results will be. If that were the case, the stock price would discount future macro data long ago and the delta-adjusted option price would remain unchanged.

Hence, implied volatility is an important parameter in determining the value of an option premium. Market makers who provide liquidity in the options market constantly quote options prices, which can be seen in the changing bid and ask offers.

Implied and historical volatility is expressed as a percentage per year. If an investor wants to calculate daily volatility, he must divide the annual value by 16. Why by 16 and not by 365 (this is the number of days in a year)? 16 is the square root of the total number of trading days in a given year, which is approximately 256. Taking the square root of 256 we get the value we are looking for.

Conversely, you can also calculate the annual volatility from the daily volatility. If the standard deviation of the daily variation is 1,5% then the annualized variation should simply be multiplied by 16 (square root of 256). The result of the action is 24%.

Interpretation of implied variability

VSTOXX volatility is expressed as a percentage. The index represents the range of movement of the EuroSTOXX50 index expected by the market. If the implied volatility is 32%, it means that its daily fluctuation is 2%. When applying the normal distribution, this means that during 68,2% of trading days the index will oscillate between -2% and + 2%. More volatility is expected on other days. Conversely, during 95,4% of trading days, the price movement will not be greater than 2 daily standard deviations. This means that the index should not fall by more than -95,4% and grow by more than + 4% for 4% of the time.

Of course, the assumption that you should use the normal probability distribution is quite a simplification, but most of the time it does not affect the conclusions to be drawn from volatility studies.

Additional volatility considerations

Option traders are familiar with the phenomenon of the so-called "volatility smile". This phenomenon is due to the fact that the implied volatility for non-money options is higher than for ATM options. This is because the market expects different price movements for a different strike price. Options deep beyond money are insurance against "market disasters" or "winning the lottery". OTM deep put options provide insurance against sharp drops in the underlying instrument. On the other hand, OTM deep call options are a hedge against sharp increases in the underlying instrument. For this reason, option writers who risk such events expect a higher risk premium.

The volatility skew expresses the implied volatility difference for options with the same expiry date but with different strike prices. Note, however, that the volatility implied for an option varies with the time until the option expires. It is therefore worth taking a look at the maturity structure for options. Not surprisingly, as the time to expiry of options increases, the implied volatility increases. Quite simply, option writers are exposed to a higher risk of movements in the price of the underlying asset.

Of course, the upcoming financial results also have an impact on implied volatility. With the publication of the results, the risk of sharp changes in the share price decreases, which causes option writers to demand lower option premiums. Thus, the market expects lower implied volatility. It is worth noting that in the period of market sell-offs, implied volatility grows stronger in the case of options close to expiry than in the case of long-term options.. This is because the market expects the period of higher volatility not to last for an extended period of time and is therefore a temporary anomaly and therefore has no impact on long term options.

How VSTOXX is calculated

According to the specification of the EURO STOXX 50 Volatility Index (VSTOXX), it does not measure the implied volatility only for ATM options on the EURO STOXX 50 index but it calculates volatility for all options at any given time to expiration. Of course, only those options that meet the preconditions are taken into account. The options on EURO STOXX 50 are one of the most liquid options contracts available on the Eurex platform. For this reason, basing the VSTOXX on this index is a good approximation of market expectations for volatility.

READ ALSO: How to trade the Euro Stoxx 50 Index? [Guide]

The VSTOXX model was jointly developed by Goldman Sachs and Deutsche Börse. Volatility index-based derivative products are a great solution for market participants who want to use it to speculate and hedge their portfolio.

How is the European Index of Volatility constructed?

The most important thing is to understand how the input data is taken to calculate the index.

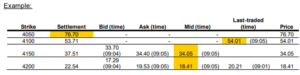

First, options with a price lower than 0,5 points are rejected. This is because such options have a marginal share in options trading. Then, option prices are taken to calculate the index. Depending on the trading on options, different types of prices are taken. Among them are:

- market price

- mid price between bid and ask

- settlement price

The mid price quote is only available if the following conditions are met:

- bid and ask prices are quoted

- both bid and ask are greater than 0,1 points

There are also further conditions to be met. Among them is the maximum level of the bid-ask spread, which depends on the market condition.

During the normal functioning of the bid-ask market, the value of the bid-ask spread is up to 8% of the bid quotation, including the minimum value of 1,2 points and the maximum value of 18 points. During a period of high volatility, the spread may increase to 16% with a minimum of 2,4 points and a maximum of 16 points.

If two or more options have a middle price of 0,5 points, only the option that is closer to the ATM level is included in the calculation.

As already mentioned, the most recent price is calculated for the index calculation: market price, middle price and the price resulting from the model. If the middle price and the market price have the same calculation date, the market value is always used in the index calculation.

The index calculation itself is complicated, but you don't have to know the formula by heart. It is much more important to understand how to read the index and how derivatives on VSTOXX can be used.

VSTOXX Futures

You can trade options and futures on the VSTOXX index on the stock exchange. For VSTOXX futures, the multiplier is € 100. This means that it is a derivative with a very small nominal value. The STOXX value is currently 29 points which means the face value is € 2900.

It is worth noting that futures contracts are very sensitive to changes in market sentiment. In the period of market panic, the VSTOXX index grows significantly, which allows players to increase the index to achieve spectacular rates of return. However, most of the time the short volatility strategy looks much better, as the value of the index is systematically decreasing.

How to read an index signal

VSTOXX has the same interpretation as VIX. The higher the readings of this indicator, the greater the price volatility in the market. This may mean that a market turning point is approaching and therefore investors should look for a place to close short positions or open long positions in the stock market.

Another important piece of information indicated by VSTOXX is also the value of implied volatility and its impact on the option price. Periods of high volatility mean options are expensive (both calls and puts). In such a situation, you should avoid buying options, but rather expose them or create spreads (bull, bear).

Use of derivatives on VSTOXX

Equity market participants may use derivatives on VSTOXX for speculative and hedging purposes. Futures and options on the volatility index are a great speculative instrument because they are very sensitive to changes in market sentiment. If the speculator takes a position at the right moment, he will be able to make a very high profit. VSTOXX may increase several times in periods of sharp sell-offs.

The use of derivatives on the volatility index is also used to hedge positions. Most often he takes a long position on VSTOXX futures contracts to insure the portfolio against market corrections. This is an expensive strategy as the volatility index loses its value during periods of market highs and sideways. For this reason, the “short volatility” strategy is much more popular in such periods.

CFD on VSTOXX

Retail traders also have the option to invest in the VSTOXX index through CFDs. The European volatility index is very rarely found in the offers of Forex brokers, but it is offered by, for example, the Polish Brokerage House X-Trade Brokers SA. The leverage on this CFD is 1:5.

| Broker |  |

| End | Poland |

| VSTOXX symbol | VSTOXX |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

| Min. Lot value | Price * EUR 100 |

| Commission | - |

| Platform | xStation |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

VSTOXX is the European equivalent of the American VIX. The European implied volatility index uses the data of most available options on the EURO STOXX 50 to calculate its value. VSTOXX can be used to either speculate, hedge positions or decide to buy or write options on the EURO STOXX index.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![VSTOXX - the European equivalent of the American VIX [Guide] Vstoxx index](https://forexclub.pl/wp-content/uploads/2022/10/Index-vstoxx.jpg?v=1666609979)

![VIX Index [Fear Index] - in search of market volatility [Video] vix fear index](https://forexclub.pl/wp-content/uploads/2021/12/vix-index-strachu-300x200.jpg?v=1638525622)

![VSTOXX - the European equivalent of the American VIX [Guide] kryptowaluty](https://forexclub.pl/wp-content/uploads/2022/06/kryptowaluty-raport-102x65.jpg?v=1655457227)

![VSTOXX - the European equivalent of the American VIX [Guide] a week in the markets, What will count this week](https://forexclub.pl/wp-content/uploads/2019/07/macd-forex-102x65.jpg)

Leave a Response