British parliamentary elections and their impact on the pound [12 December]

The parliamentary elections in Great Britain planned for December 12 are coming soon. The pound sterling markets react spontaneously to any information regarding this historic event. This is because early elections will be crucial for further relations with the European Union, but will also determine the further direction of UK economic policy. Both the party led by Boris Johnson and Jeremy Corbyn want to expand fiscal policy by increasing investment levels, lowering taxes, and changing the structural role of the UK in the global economy. Both groups are in favor of loose budget policy and stimulating the economy.

What impact will the election results have on the "cable"?

Positive variant

The victory of the Conservative Party is a potential signal to strengthen the pound. This variant means the UK's exit from the European Union at the end of January 2020 year. According to the latest polls, it is Boris Johnson's party that has the chance to get the largest number of seats in the House of Commons since the party was ruled by Margaret Thatcher. If the Conservatives win the elections, this will mean the likelihood of divorce from the EU while maintaining UK-EU cooperation. Analysts expect that with the above scheme, the currency pair will head north to reach 1,35. Last GBP / USD was seen in this area in May 2018 year. The current layout on the chart is very much in line with the above scenario. After reaching the hole, in September this year below 1,20, the course moved towards the 200-periodic moving average, which determined the resistance on the weekly chart. From October 2019 the "cable" has been in 200-pip consolidation, which looks like a flag. According to the assumptions of technical analysis, after breaking resistance on 1,30, the quotations should be at least 800 pips higher (movement measured since the last, strong upward impulse from 1,22), which gives the 1,38 level. It is still below the fair value of GBP / USD, which has been estimated at 1,45 by analysts. Remember, however, that there is still some time until the election and it seems doubtful that traders would be willing to trade currency above 1.30 until then. At most, the market can make a false break and again push the price into consolidation.

Chart GBP / USD, W1 interval. Source: xNUMX XTB xStation

However, one should consider the scenario in which the Labor Party will gain the upper hand. The consequence of the Labor victory in the December elections will be potential contract negotiations, guaranteeing milder ones conditions for Great Britain to leave the Community or even to hold a new referendum on Brexitu. The above scenario should also have a positive impact on the exchange rate of pairs with sterling.

Negative option

The main risk factor for the strengthening of the pound is the unexpected development of events on the British political scene. This situation can occur when we come to power Tory along with the Brexit Party, headed by Nigel Farage. This scenario is the high probability of UK's uncontrolled exit from the Community, and this has negative effects on sterling. Leaving the consolidation down and closing the daily candle below 1,28 opens the way to a return to the September minima.

This also applies to the pattern in which no majority will be elected and parliamentary work will be suspended. BoE (Bank of England), also called "Guardian of the British pound" he announced clearly that in Due to the protracted exit from the EU, interest rate cuts will be possible to stimulate investment processes.

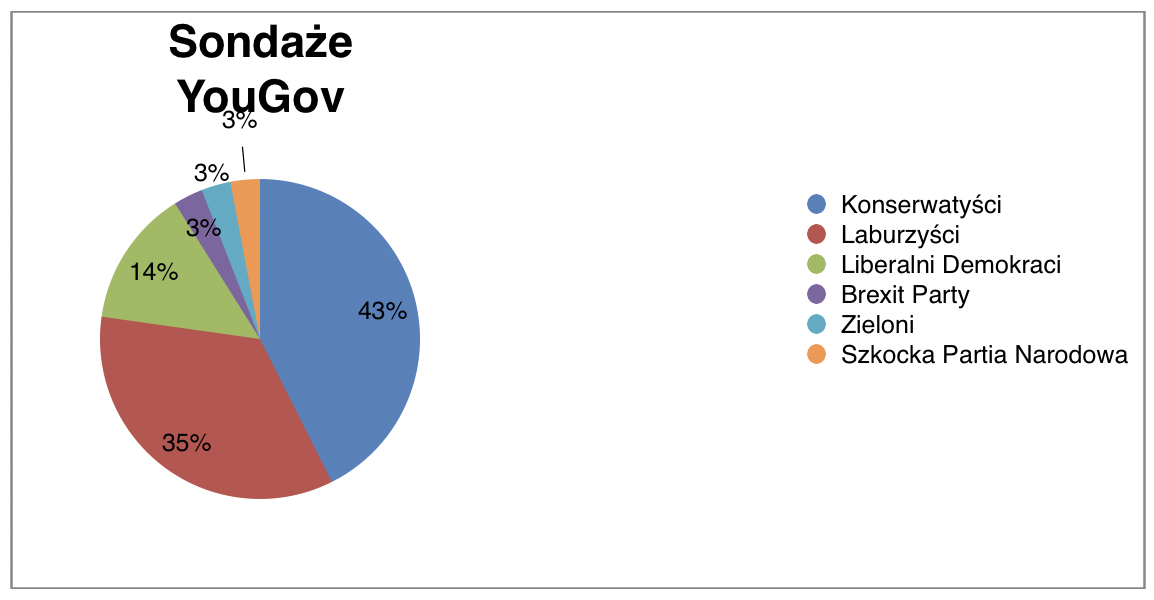

YouGov polls

Research conducted by YouGov shows that the most likely scenario is the Tories' victory in parliament and the acquisition of independent power (currency appreciation). Another is a coalition of Conservatives from the Brexit Party (pound depreciation). The third possible scenario is suspension of parliament's work and conducting a new plebiscite, which will negatively affect the GBP exchange rate. According to polls, the unlikely least likely is Labor's victory. It is estimated that a coalition with the Liberal Democrats or the Scottish National Party is more likely, which should not weigh the British currency in the medium term.

Source yougov.co.uk

The YouGov poll was awaited by the market because it accurately predicted the loss of majority of Theresa May's government in elections in 2017.

For now investors remain skeptical about the pound and, looking at market reaction, do not take into account Boris Johnson's defeat at all. The market hedges itself mainly against a possible decline in the pound value in options.

Summation

The pound still remains sensitive to surveys and each publication of new results causes variation in sterling pairs. There is another pre-election debate ahead of us at BBC 6 on December 2019, which will be attended by Tories and Labor. The former lead in polls and have an average of 14-17 percent. advantages over others. We will get to know the election results on December 12, at 23: 00. At the end of the year, the first meeting of the Bank of England (19 December 2019) and the final date of Brexit (January 2020) are planned.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![British parliamentary elections and their impact on the pound [12 December] UK parliamentary elections](https://forexclub.pl/wp-content/uploads/2019/12/wybory-parlamentarne-w-wielkiej-brytanii.jpg?v=1575277397)

![British parliamentary elections and their impact on the pound [12 December] lmax turnover](https://forexclub.pl/wp-content/uploads/2019/11/lmax-obroty-102x65.jpg?v=1574939745)

![British parliamentary elections and their impact on the pound [12 December] fed cryptocurrency](https://forexclub.pl/wp-content/uploads/2019/11/fed-kryptowaluta-102x65.jpg?v=1575025227)

Leave a Response