Gold regains its luster and stays in the region of $2000 per ounce

The weather term "in March like in a pot" perfectly reflects the reality on global financial markets this year. The crisis in the banking sector has led to a radical change in investor sentiment. The high level of risk aversion made the search for "safe havens" the dominant trend. In addition to treasury bonds recording strong increases, gold and bitcoin became the beneficiary of the prevailing sentiment.

Gold is approaching highs

Investors many times gold treat with a pinch of salt, recalling its advantages only during the appearance of the "black swan" or the deterioration of the economic situation on the stock markets. The past two weeks have been no different, as the banking crisis and rising risk highlighted the benefits of having gold in your portfolio. This metal works great as a portfolio diversification element, protecting it from excessive drops at the time of a market collapse.

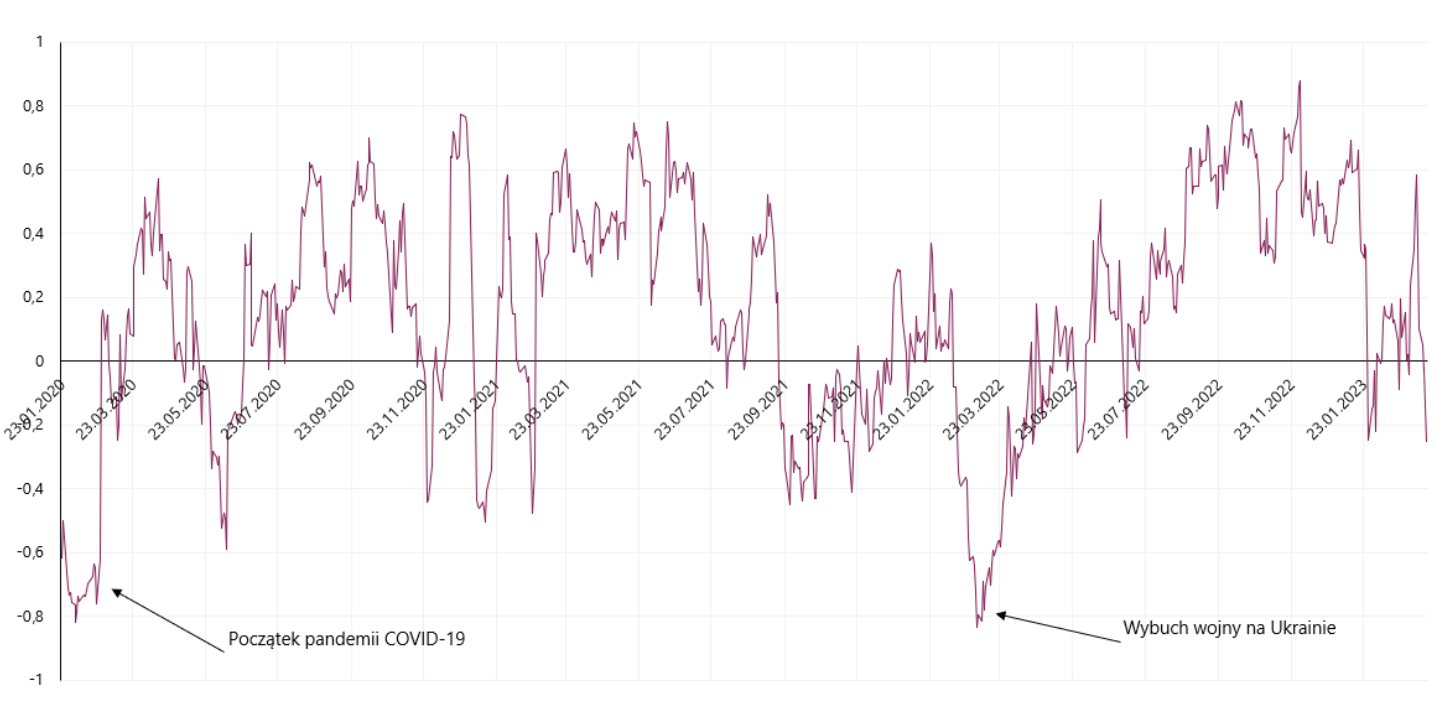

The correlation of gold with the stock market changes over time, and taking into account the period from the beginning of 2020, this coefficient reaches a value of 0.16. Most of the time, the 14-session correlation coefficient points to a similar trend in gold and stock prices. However, when extraordinary events occur, this situation changes, and the correlation coefficient takes on strongly negative values. We faced such a phenomenon with the appearance of the first reports of the coronavirus pandemic in 2020 or after the outbreak of war in Ukraine. A similar trend can be observed in recent days. On March 8, the indicator showed a positive relationship (0.58) between stocks and gold, while after the announcement of Silicon Valley Bank's problems, there was a clear reversal and once again a negative correlation appeared.

14-session correlation between gold and the S&P 500 index. Source: own study based on Stooq.pl data

Gold increased by about 10% over several sessions, approaching the psychological barrier of 2000 USD/oz (March 20.03.2023, 2020, this level was breached). Last week's events show the value of including gold in investment portfolios. The recent price move pushed the precious metal close to record highs (August 2075.11 peak is $XNUMX/oz).

Technical overbought as well as significant resistance in the zone between 2000-2050 USD/oz mean that a market correction should not be ruled out in the short term, which may be a good opportunity to enter the market for late investors. On the other hand, there is a risk that gold will set a triple top scenario, and the further direction will largely depend on the development of events in the global economy and the effects of actions related to saving the situation in the banking sector.

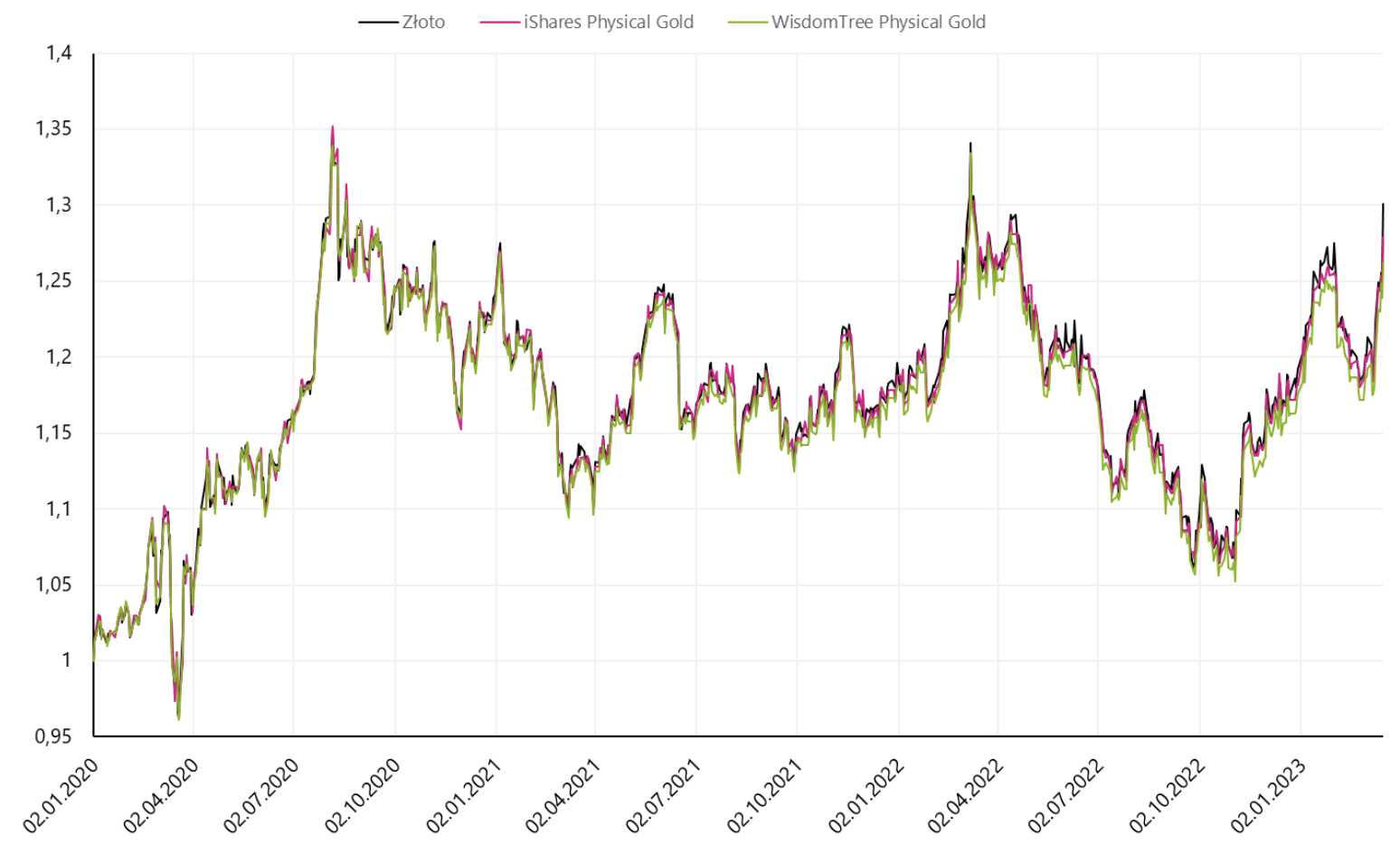

The high price of gold makes it a real challenge for the average investor to buy physical gold. The value of a coin containing an ounce of gold is nearly PLN 10, which somehow makes this investment a considerable expense. If we do not have sufficient funds, financial instruments come to our aid, especially ETP. Within this group, you can find products whose task is to imitate gold prices with relatively low management costs. The effectiveness in mapping gold prices is reflected in the quotations WisdomTree Physical Gold or iShares Physical Gold ETC. The value of one participation title is only the equivalent of several dozen zlotys, which makes this investment much more affordable.

WisdomTree Physical Gold and iShares Physical Gold quotes against gold prices. Source: own study based on data Stooq.pl

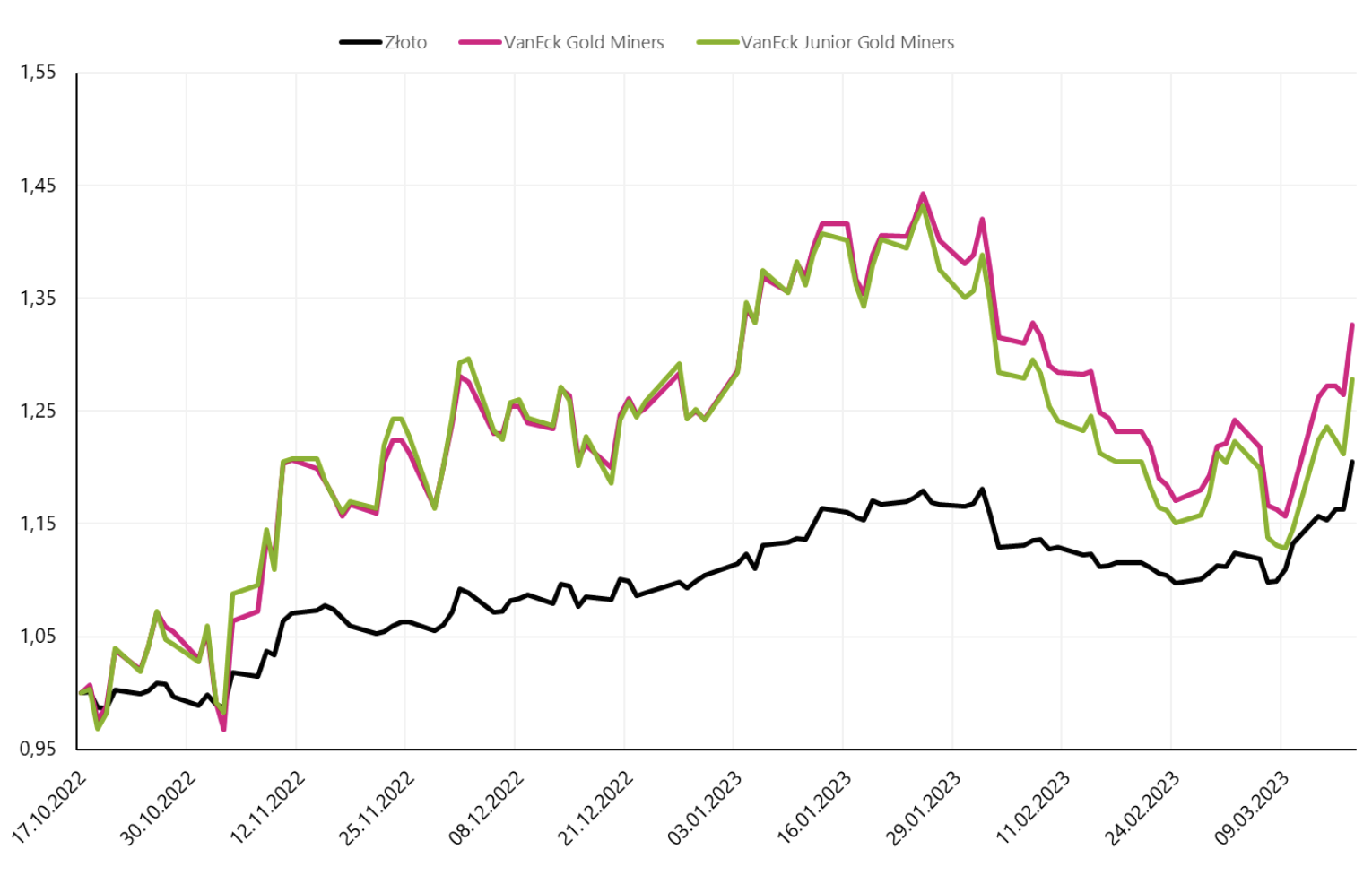

Those who are more risk-averse can gain exposure to the bullion by investing in gold mining companies. The share prices of these issuers are characterized by greater volatility, and the rates of return in the short term can be up to 2 times higher/lower, as shown by the quotations from the last 5 months. As with investing in physical gold, exposure can be gained through available ETFs such as VanEck Gold Miners ETF or VanEck Junior Gold Miners ETF.

VanEck Gold Miners ETF and VanEck Junior Gold Miners against gold prices. Source: own study based on Stooq.pl data

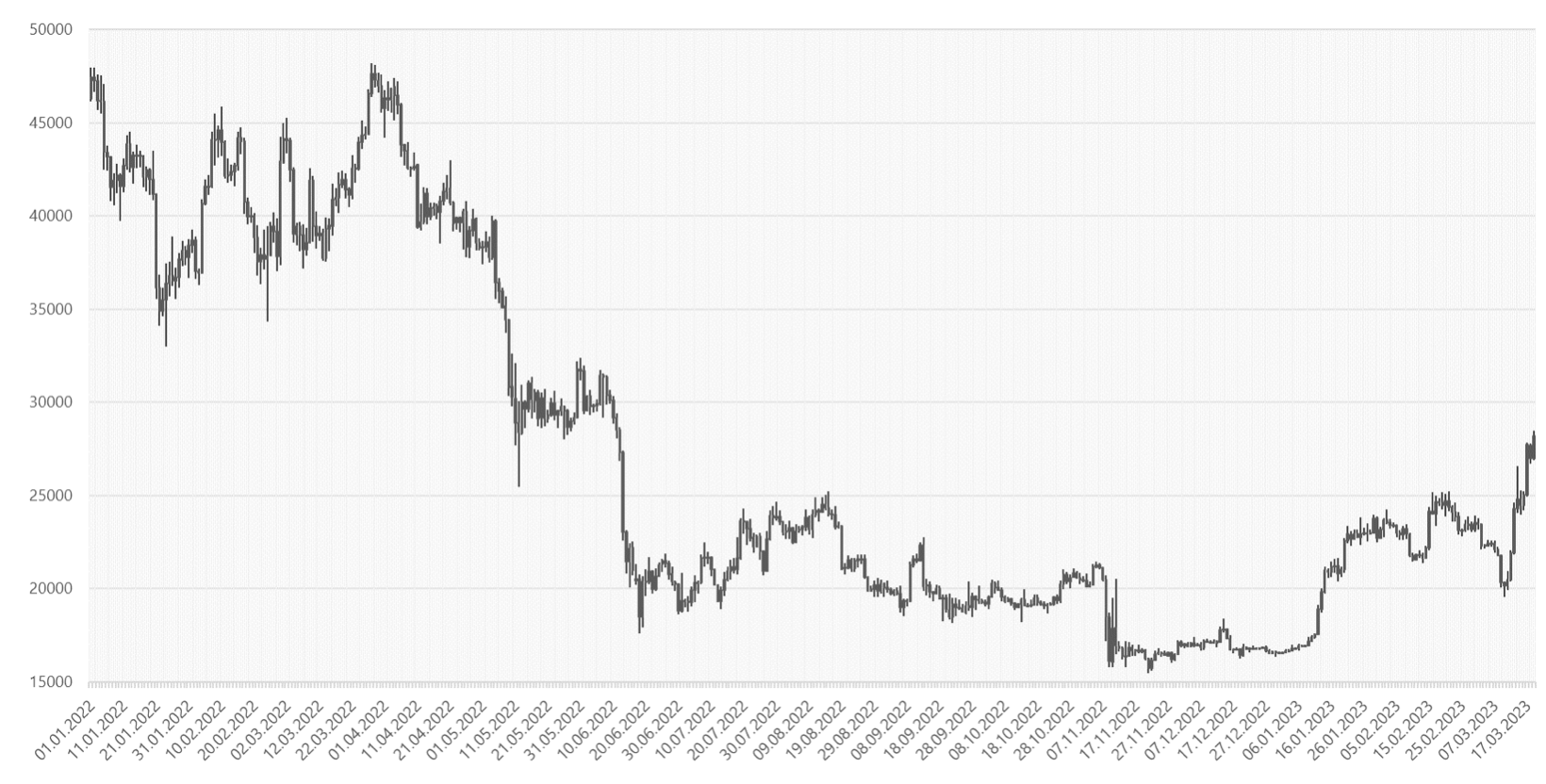

Bitcoin a recipe for losing credibility

Heavily battered by many previous negative events, the cryptocurrency market has recently been reliving its glory days. For many market participants, the development of the situation over the past few sessions may be very surprising. The deterioration of sentiment on global stock exchanges usually also led to a sale of cryptocurrencies. It was different this time, and one of the reasons seems to be the source of the current tension in global markets. The upsetting situation in the banking sector and the loss of confidence in the key sector and standard money contributed to the relocation of capital to the cryptocurrency market. Bitcoin in a very short time it increased by nearly 50%, highlighting the strength of the movement. The cryptocurrency reached its highest level since June last year, breaking significant technical resistance.

Bitcoin quotes. Source: own study based on Stooq.pl data

Currently, it seems too early to predict the durability of bitcoin's rebound, however, undoubtedly the latest move indicates that it is back in the favor of investors. The policy of central banks will be of great importance for the market prospects. Hope has been aroused among investors that the cycle of interest rate hikes and balance sheet reductions is coming to an end, the first symptoms of which appeared in the decisive actions of the Federal Reserve and other central banks (rescue programs + additional swap lines).

Summation

The emergence of problems in the global banking sector translated into an increase in risk aversion. Investors actively began to look for assets that would effectively protect their capital during market turmoil. Given the decline in trust in standard money and the banking system, gold and bitcoin turned out to be the best choices in recent days. So far, the growth impulse is short-term, and its translation into the longer perspective will depend primarily on further developments in the global economy. However, the situation shows that in addition to standard solutions such as stocks and bonds, it is also worth considering alternative investments in your portfolio, such as gold or cryptocurrencies.

Author Peter Langner, Investment Advisor, WealthSeed

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response