Gold up, oil down in a world struggling with Covid-19

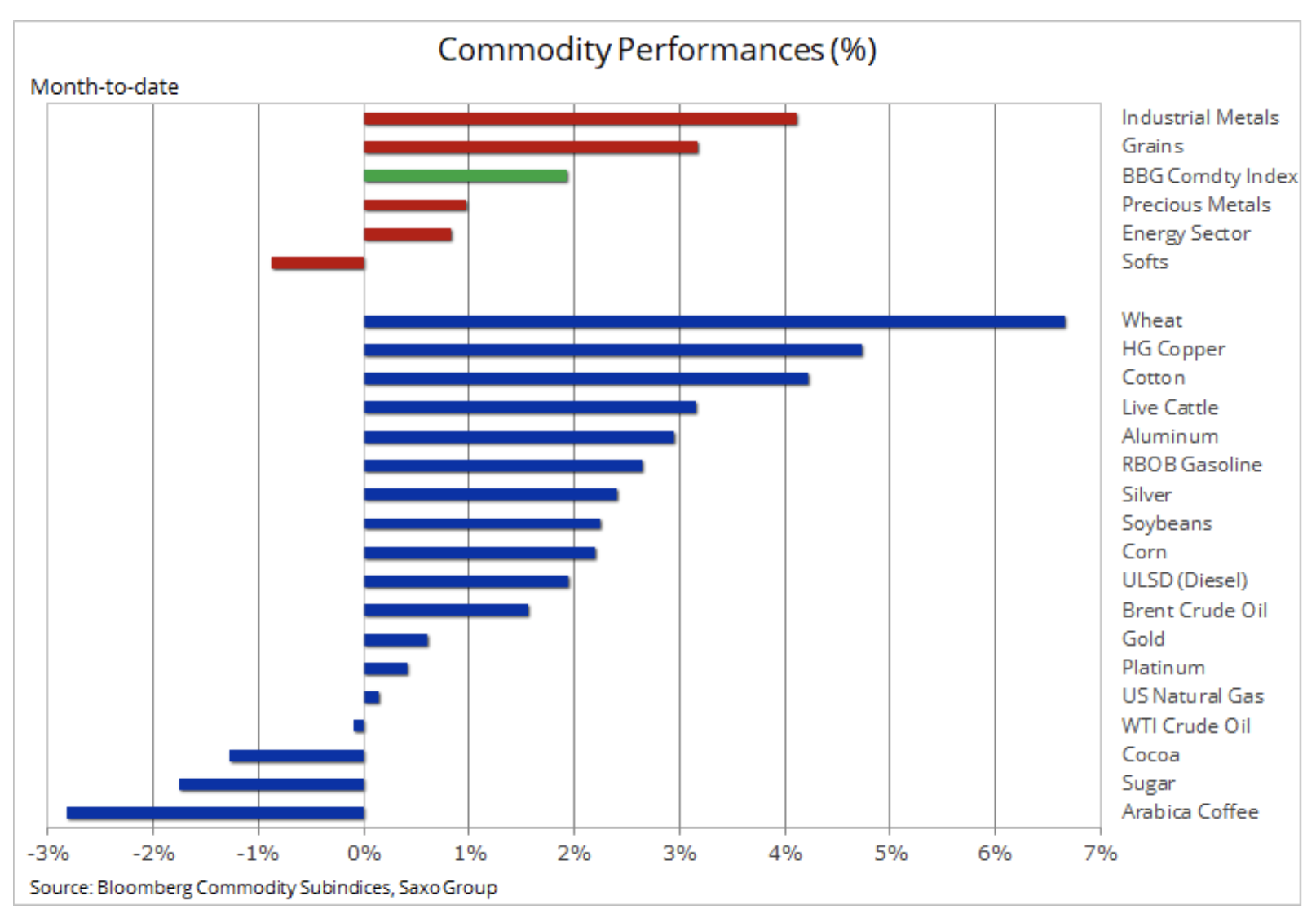

Last week, the index monitoring the results of key raw materials recorded a maximum of four months; industrial metals and grains, in particular wheat and copper, gained the most. Gold has made a small but very significant upward move to its highest level since 2011, exceeding USD 1 / oz. However, the Bloomberg Commodity Index, based on a basket of key raw materials broken down into energy, metals and agricultural products, lost value before the weekend because the market was nervous about the increase in the number of coronavirus infections worldwide.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

In the United States, where the three states that are the largest fuel consumers are seeing a dramatic increase in incidence, real-time indicators suggest a change in consumer behavior again. In Europe, we are beginning to see signs of acceleration in new cases, led by countries such as Portugal and Bulgaria, where tourism is expected to increase over the next two months.

HOW TO BUY GOLD [GUIDE]

Up to this month, risk appetite was associated with an eight-day government-backed buying spree for Chinese shares and the latest record highs on the technology-based Nasdaq 100 index. Considering that margin debt for Chinese speculators reached levels recently recorded in 2014-2015, when the CSI 300 index doubled its value, after which it fell by 40%, the government and state media decided to step in with actions and warnings to limit the wave of purchase transactions.

Traders in the segment cereals waited for the publication of World Agriculture Demand & Supply (WASDE) by the US Department of Agriculture on Friday to confirm that the recent 10% gains in corn and wheat markets are sustained. Short coverage has been a major factor, and maize demand has strengthened the recent decline in acreage in the United States. The Chicago-listed wheat futures contract hit its highest price in more than two months after the latest harvest estimates in major exporting countries such as Argentina, France and Russia raised concerns about global supply levels.

Gold

The spot price finally managed to break above USD 1 / oz, thus achieving what was not achieved on two previous occasions, most recently in 800. At the same time, silver broke the resistance at the level of USD 2012 / oz, which paved the way for higher prices. This breaking may signal the prolongation of the gold movement towards the record peak of 18,40 at the level of 2011 1 USD / oz, while silver has so far set resistance at 920 USD / oz before the next level, i.e. 19 USD / oz.

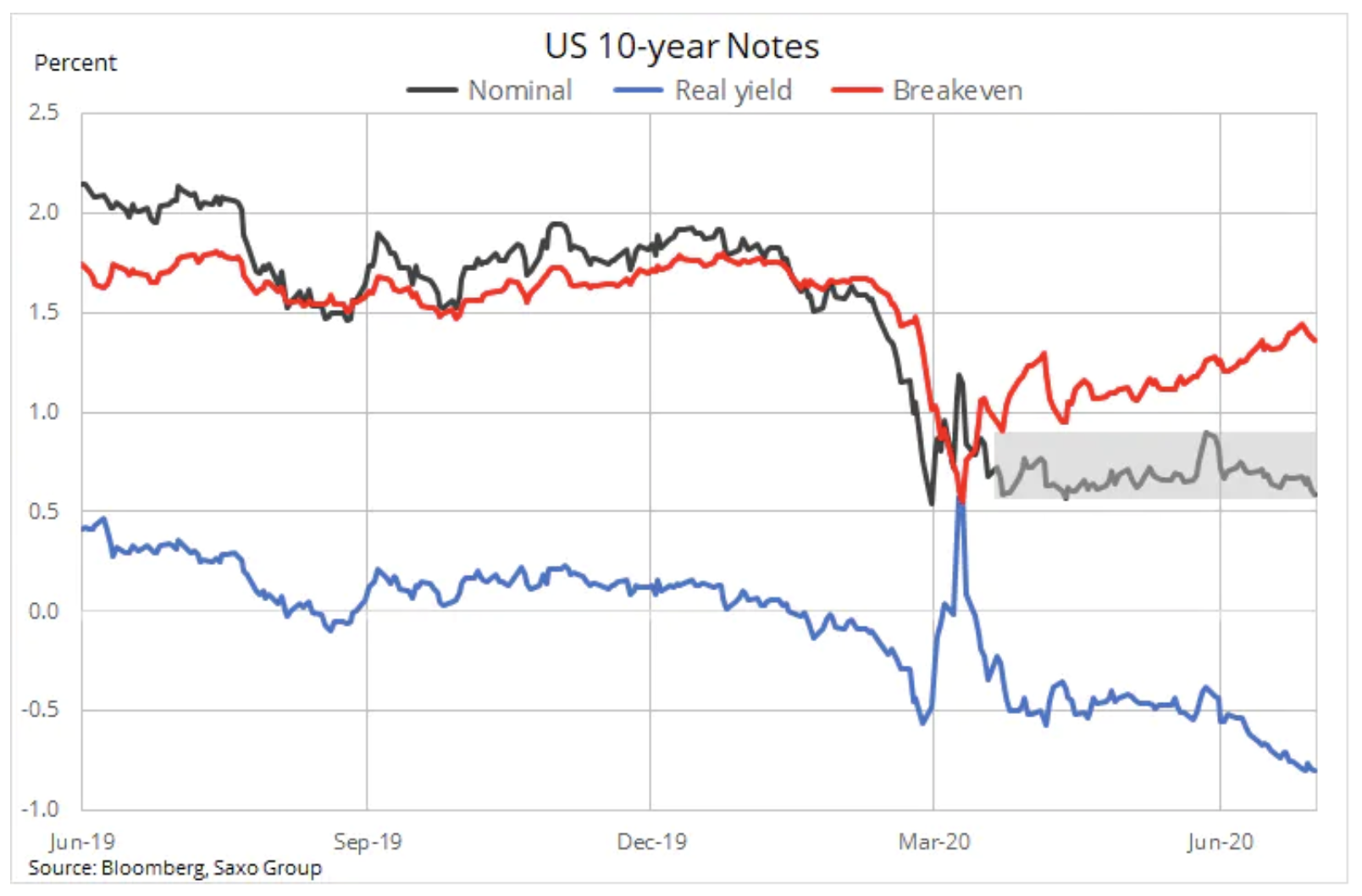

Apart from the concerns about the virus, another important phenomenon supporting recent growth was the latest changes in US bond yields. While the nominal yield of ten-year debentures remains within a relatively narrow range, yields above the break-even point, representing the inflation rate, went up, causing real yields to fall to the current level of -0,8%. These phenomena illustrate what the US market would look like when controlling the yield curve under the inflation scenario.

Factors that we believe will continue to support precious metals in the coming months include an increase in inflation expectations leading to a decline in real yields combined with the potential for dollar depreciation. Add to this the increase in political tensions both in the US alone before the November election and in relations with China.

Gold is heading towards the fifth consecutive weekly profit, and in the short term its ability to generate additional momentum above USD 1 / oz is crucial. A drop below this level may mean the risk of another correction, but in general our positive forecast has not changed, and the next key level will be the record high from 800, i.e. USD 2011 / oz - this view is shared by Goldman Sachs, indicating that over the next 1 months, the price of gold may reach USD 921.

The rise in the price of gold and industrial metals should continue to support relative strengthening silver. The current price of silver versus gold, i.e. 97 ounces of silver to one ounce of gold, is the highest in history and on this basis we predict that further strengthening of gold will lead to a decrease in the ratio of gold to silver, initially towards 90 points.

Petroleum

Both clothing WTI as well as Brent oil depreciated after several unsuccessful attempts to overcome resistance at 41 USD / b and 44 USD / b respectively in recent weeks. Oil reserves in the United States are still at an almost record level, and the market is now concerned that the rise in coronavirus infection in Texas, California and Florida, the three states that are the largest fuel consumers, may hinder the recent recovery in demand. Fears about supply have been exacerbated by the news that, war-torn Libya has signaled the possibility of resuming oil exports. In recent months, production has been almost zero compared to December production of 1,1 million barrels per day.

HOW TO BUY CRUDE OIL [GUIDE]

In the latest report on the oil market, the International Energy Agency (IEA) was optimistic given the recent recovery in demand and the subsequent successful OPEC + efforts to reduce supply. However, this forecast was negatively affected by the recent increase in Covid-19 incidence, putting into question expectations about the transformation of the oil market from a significant surplus in the first half to a deficit in the second half. As a result, the IEA ended the report with a warning that the large, and in some countries rapidly growing, number of Covid-19 cases is a signal that the pandemic has not been controlled and the risk for market forecasts is almost certainly downward.

Although last week's range for Brent oil was almost the narrowest since September last year, recent events confirm our forecast for Q35: Brent crude will most likely remain within USD 45-XNUMX.

Copper

An impressive price increase copper HG by 45% from the March minimum level this metal almost reached its peak in January at 2,886 USD / lb. A particularly significant aspect of the increase in copper prices is the fact that it has reached levels recently recorded just before China's official admission that they have a coronavirus problem. Since then, global economic growth has fallen and unemployment has risen sharply.

However, copper managed to strengthen due to three phenomena. The pandemic has contributed to increased demand expectations for infrastructure projects, in particular in China. Confirmation, however, we will only get in the form of an increase in the ratings of construction companies. The second aspect was the wave of speculative buy transactions, not only on the New York or London Stock Exchanges, but also in China, due to the above mentioned increase in risk appetite. However, the most significant impact was the reduction of supply from Chile, the largest copper exporter in the world, after thousands of miners got infected with coronavirus.

Although copper exhibits a significant growth rate, we are increasingly skeptical about the ability of this metal to further strengthen. RSI, at the highest level since November 2016, seems to strive to drop to around 2,75-2,65 USD / lb. In the short term, the next move will depend on the behavior of speculative investors, further risk appetite and the supply situation from Chile.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Typical signs of an impending crisis. It will be interesting in a few months.