+ 1675.29% profit in the second round of the TMS Brokers competition

The high volatility of financial instruments allows for achieving high rates of return and fierce competition in the educational competition TMS Brokers. However, we must not forget that although the game is played on virtual resources, the conditions are real and the world is facing the impending crisis.

Over the weekend in the United States, the number of people infected with the COVID-19 virus exceeded 35. In Poland, this number is about 700 infected, but this is due to, among others from a small number of tests carried out. According to specialists, we are still ahead of the main wave of cases. The European epicenter of the coronavirus is in Italy - that's where the number is approaching 60 It is currently a country where almost 5,5 died people. At present, isolation is the most effective form of fighting a pandemic.

Be sure to read: Summary of the second round of the TMS competition

The Fed takes steps

The third week of the educational competition has started, and the volatility in the markets has been boosted by Federal Reserve. The institution has introduced unlimited asset purchases - new support measures for the economy. Interest rate cuts in the long run may have results, but the economy and Wall Street need support now, hence the next, so sudden decision. This action is a nod to American companies.

Less volatility

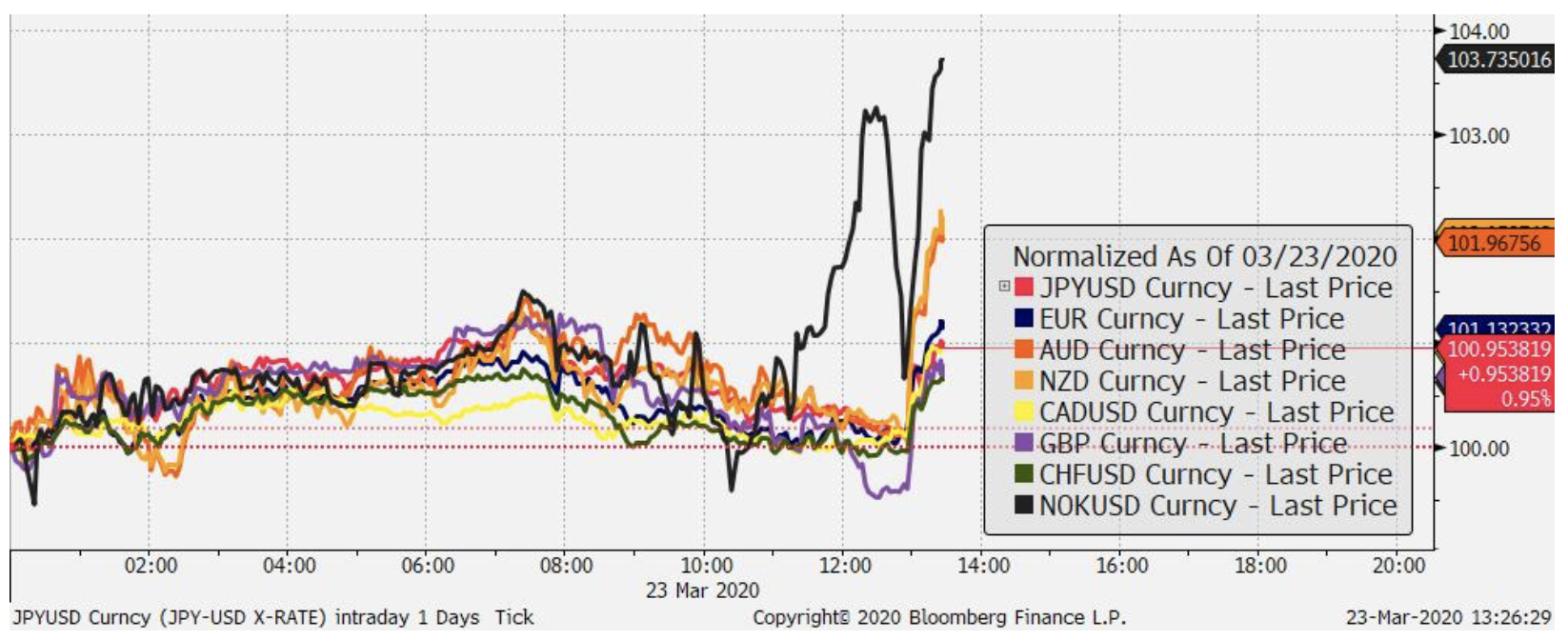

Last week started like the current one - increased intervention of central banks. The Fed lowered the reserve requirement ratio, the native NBP introduced the QE program for the first time and reduced the cost of money by 50 bp. Thus, the Polish zloty is the weakest for years against the euro, dollar and franc. Last week was a period of escape from risk and discount on the raw materials market - mainly energy. WTI oil it got cheaper to $ 20.5 per barrel. It has not been so cheap for 17 years. The capital flow was heading towards US dollar. On the main currency pair we saw the rate 1.0640, i.e. the level last seen in April 2017. In the following days, the ECB took the floor. Head of the Lagarde bank decided to increase the asset purchase program to EUR 750 billion by the end of 2020 in order to provide comprehensive support for the economy.

In the second round of the competition Stock indices lost and broke further local support. The DAX - the German index - breached the 8000 point barrier, but quickly turned back and is currently above this level. The US stock market benchmarks were losing mainly on the last day of the week.

Second round leader

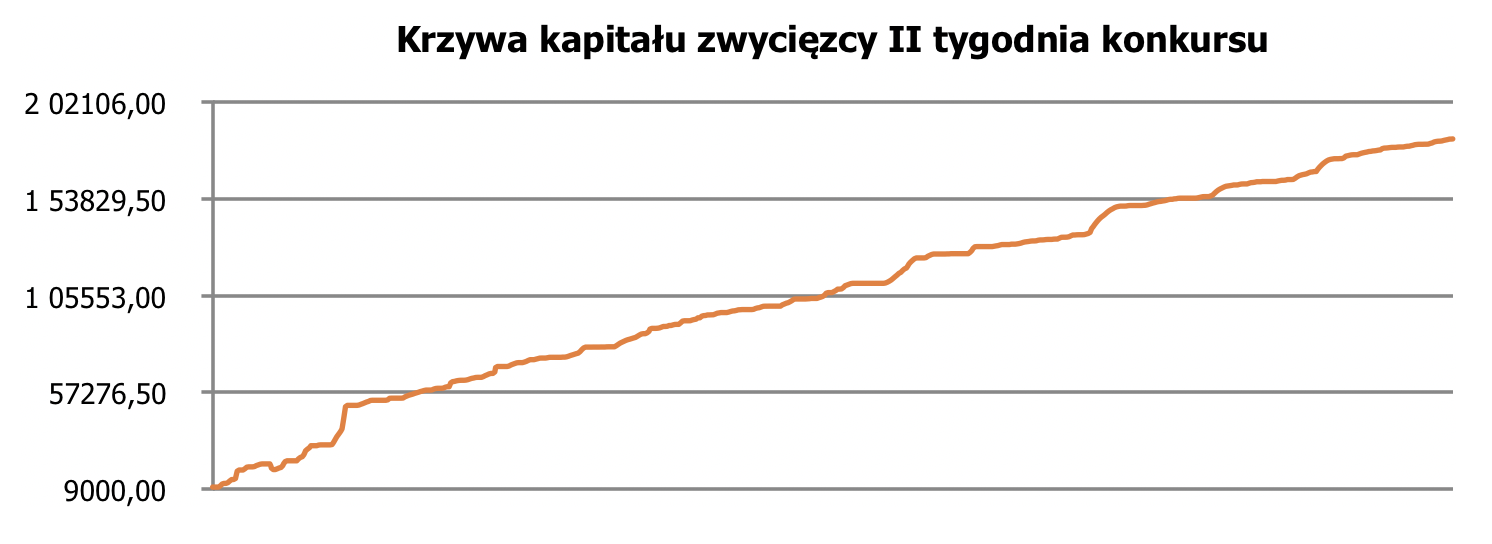

The second week of the competition again brought high rates of return. Leader with a result of +1675.29 percent, completely outclassing the rest. The second player in the weekly classification achieved a result of 733.65 percent. This result is more than half worse. The winner of the second round concluded over 5 transactions within 3300 trading days - which means - that his involvement in competition trading was huge, or simply his automatic strategy was extremely effective. The capital curve shows that there are no major capital drops in this portfolio. After analyzing the invoice, it can be seen that there were only 8 lossy positions, and the largest of them was just above EUR 340. The leader was mainly among US, European and Asian stock indices. He sporadically concluded transactions on EURUSD or WTI oil.

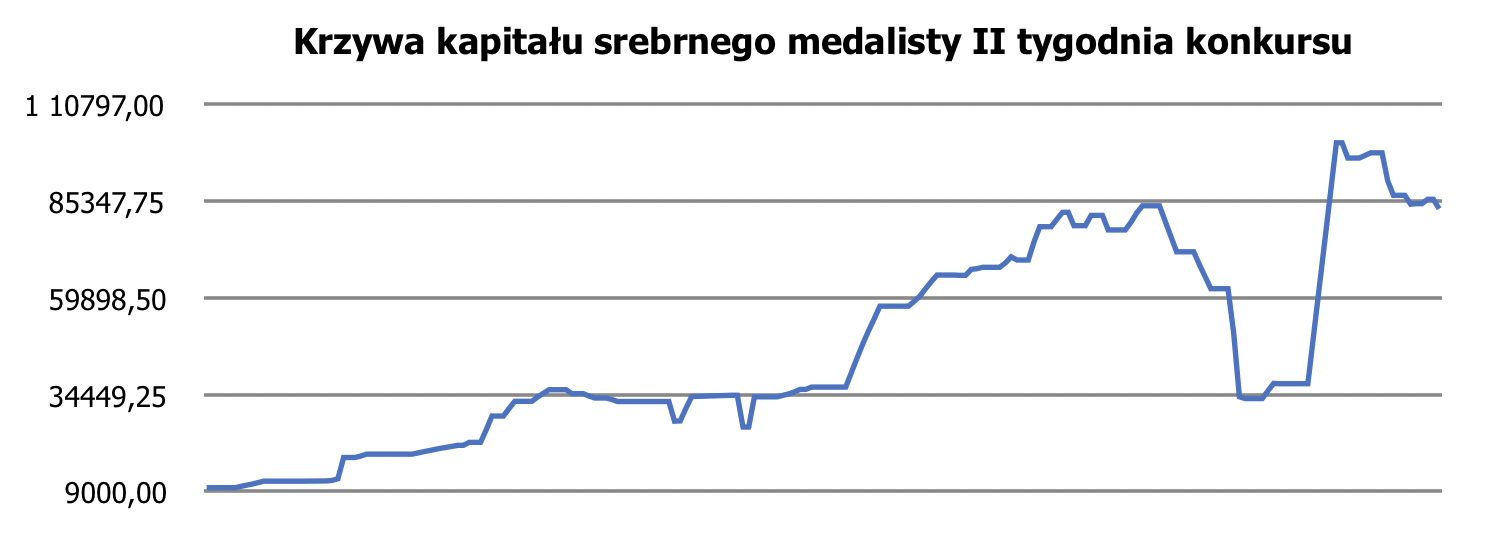

Second runner is a trader who won such a good place with the proverbial "throw on the tape". The player focused only on the German DAX index. He concluded 107 transactions. He did not use Stop Loss defensive orders or those that make a profit - Take Profit. In the middle of the week, several unsuccessful positions on DE30 caused his capital curve to fall dramatically. A day later, long positions on the same instrument allowed him to make up for earlier losses more than once.

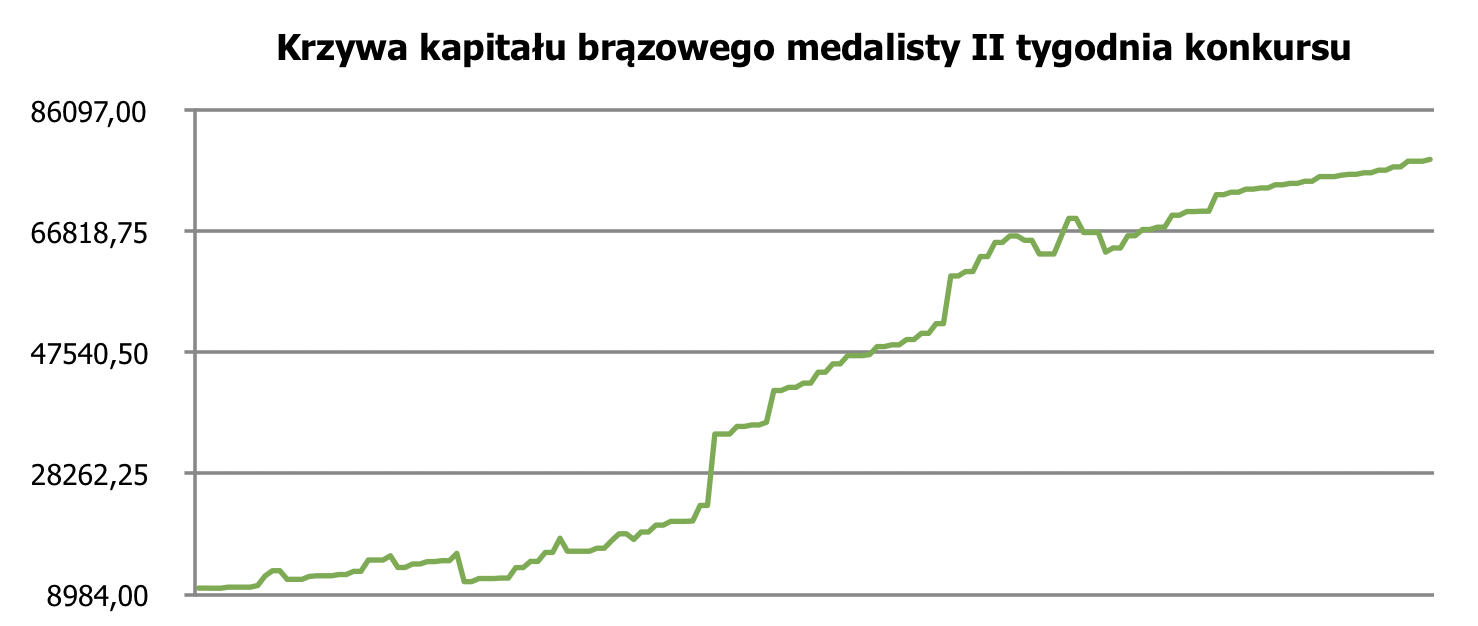

The bronze medalist is the player who was the only one of the three to set Stop Loss and Take Profit orders. Such trading habits bode well for the future. Someone who trades responsibly in competition conditions will treat his hard-earned money in real investing equally responsibly. The investor has concluded over 70 transactions, choosing instruments such as: DE30, US30, WTI oil and Gold. I must admit that it was the player's strategy that resembled the one that least differs from the real market realities.

We have small castling in the general classification. The leader after the first week (Czorcik) in the second round was out of the first 50 points. So he fell to 7th place. We see that the use of "points for commands" among the best traders is still small.

Exploiting this opportunity it can even determine a win. The current leader - Zibi - is a trader who, despite not winning any of the rounds, shows faithfulness to strategy and skills. You can see that it is consistent in action. In the first round he won the 6th place, in the second week he was out of the first 10. The examples of players show that winning one week does not necessarily mean a full victory, and oscillating around a good 15-10 place in each round can finally bring better results. Therefore, we appeal to all those who had unsatisfactory results in the first rounds: fight to the end because the market is unpredictable. And to all those who did not want to join the party because they were afraid that it was too late - we remind you: each week is a new chance for victory! Good luck!

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response