It's hot in Japan, but it's the US data that's in focus

It was still very hot in the Japanese market tonight. Investors are becoming more and more convinced that a long period of maintaining ultra-loose monetary policy Bank of Japan comes to an end. As a result, Japanese shares lose value and at the same time the yen strengthens. All this included a downward revision of Japan's GDP data for the third quarter of this year. The result is that the Tokyo stock exchange is having one of the worst weeks in recent months, and the USD/JPY rate, falling this week to 141,61 from 146,78 at the close of the previous Friday, will probably experience the biggest decline in five months.

USD/JPY daily chart. Source: Tickmill

The market is waiting for data from the US

A lot is happening in Japan, but these are not the events that are attracting investors' attention today. The highlight of Friday will be the publication November report on the American labor market. This will be the penultimate important report (the last one will be US inflation published next Tuesday) before the meeting scheduled for December 12-13 Fed and decisions made a day later by European Central Bank, Bank of England i Swiss National Bank, which will be the last important market event in 2023.

Analysts forecast that in November the unemployment rate in the US remained at 3,9%, employment in the non-agricultural sector increased by 180 and in the private sector by 153. In the context of inflation expectations and future Fed decisions, the wage data included in the same report will also be important. Annual hourly wage growth is expected to slow to 4% in November. with 4,1 percent in October. These data will be published at 14:30 p.m. Polish time.

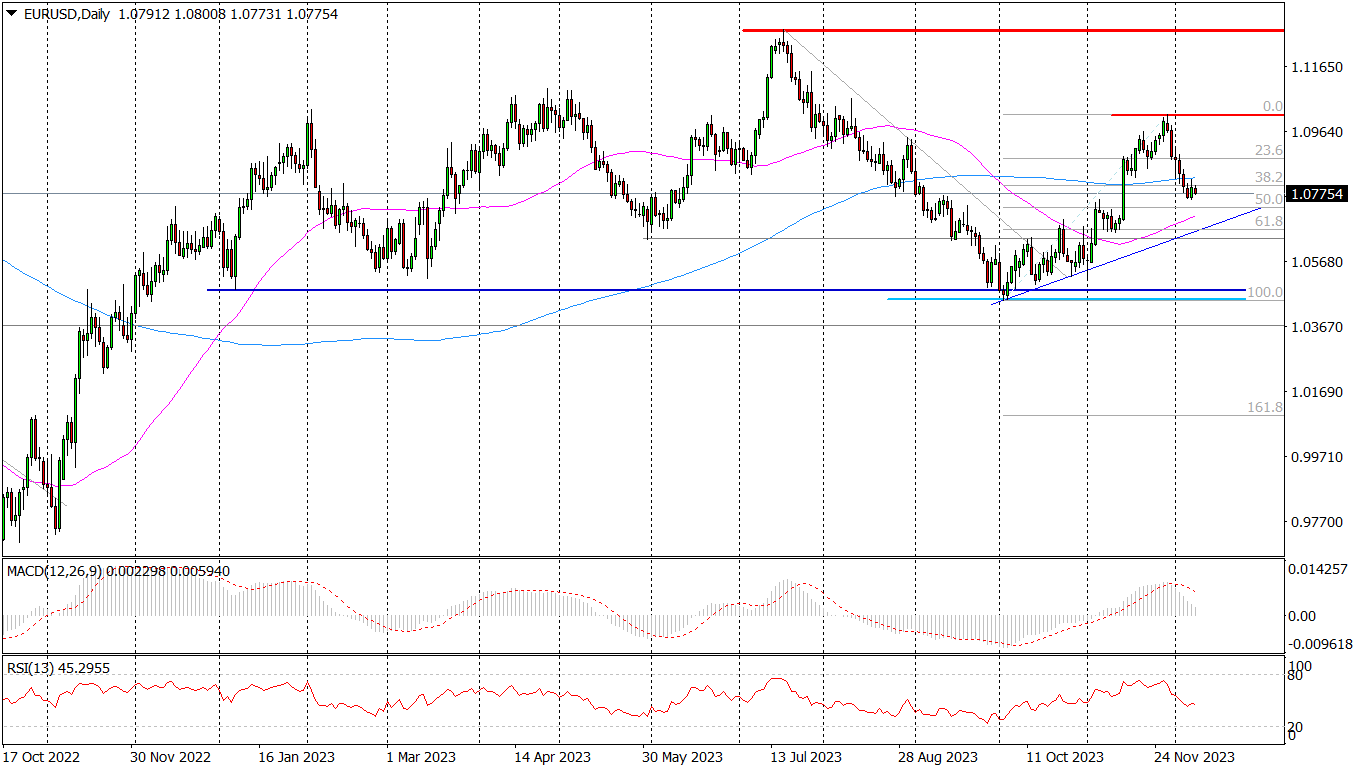

Daily chart EUR / USD. Source: Tickmill

The markets' interpretation of the described data has remained unchanged for months. The worse-than-expected data (but not very bad) will increase expectations for next year's Fed interest rate cuts, which should support risky assets while hurting the dollar. And vice versa. Better-than-expected data may provoke an escape from risky assets. Especially since the market has recently exaggerated expectations for quick interest rate cuts by the Fed, so before next week's meeting, investors may be afraid that Powell will brutally bring all the optimists down to earth on Wednesday.

US 500 daily chart (CFD on the S&P 500 index). Source: Tickmill

In addition to labor market data, a report from the University of Michigan will also be published today. The presented sentiment index is expected to increase to 62 points in December. with 61,3 points in November. These data should not have a major impact on market sentiment.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)