Tickmill

STP

PLN 100

FCA (UK), CySEC (Cyprus)

Forex, Metals, Indices, Oil, Stock CFDs, Futures (Thematic), Cryptocurrencies

Retail client - 1: 30

Experienced customer - 1:100

Professional client - 1: 500

market variable

from 0,0 pips

0.01 lot

$4,5 for 1 lot with Forex Club - Tickmill UK (MT5)

$4,75 for 1 lot with Forex Club - Tickmill EU

YES

100% up to £85 - Tickmill UK

100% up to EUR 20 - Tickmill EU

MetaTrader 4, MetaTrader 5

YES

iOS, Android

VIP offer, One Click Trader, Autochartist, competitions for traders

- very low commissions

- FCA and CySEC regulations

- very good execution of orders

- a relatively small number of instruments

Tickmill it's global Forex broker, present on the market since 2014. The company is headquartered in London and is regulated by the Financial Conduct Authority (license number 71270), Cyprus Securities and Exchange Commission (CySEC - license number CIF 278/15) and Financial Services Authority (FSA license number SD008). In addition, it complies with the European MiFID directives, introduced on November 1, 2007 and is notified by the Polish Financial Supervision Authority.

A transparent offer based on very attractive transaction costs in the STP model is addressed to traders who value simplicity and reliability at very low commissions and spreads.

DISCOUNT -10% WITHOUT TIME LIMIT

(applies to Tickmill UK & MT5)

Additional features of the offer:

- Fixed commission rebates -10% (applies to Tickmill UK and PLN accounts on the MT5 platform) – details

- Fixed commission rebates -5% (applies to Tickmill EU - registration required from THIS link)

- The order fulfillment model: STP,

- The lowest commissions on the market Forex retail,

- Account in PLN, EUR, USD and GBP currency,

- Possibility to change the categorization to a professional client (leverage 1: 500),

- A bank account at a Polish bank,

- Min. 0.01 lot transaction volume,

- Spreads from 0,0 pips,

- DAX 0,7 pips (no commission),

- Protection against negative account balance,

- No dealing desk,

- Average duration of the order: 0,3 seconds,

- Trading tools: One Click Trading, VPS, Autochartist,

- About 600 instruments with the most favorable trading conditions,

- Deposits and withdrawals made by DotPay,

- Possible any type of trade: news trading, EA, scalping, HFT.

Having a real account in the Forex Club group you will receive:

- 10% commission lower - Details

- You will get a set of tools to help you trade - Forex Club Tools

- You will receive a program for settlements with the tax office - Tax program

- You will get a discount on all programming services.

Commission discount -10% applies to Tickmill UK on MT5

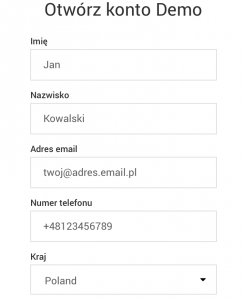

DEMO account

It only takes a minute to start trading on your DEMO Tickmill account. To do this, complete the short form REGISTRATION FORM (select Tickmill UK)and then select the account parameters. After a while, login details and a link to download the transaction platform will be sent to the e-mail address provided.

Tickmill's demo account is unlimited in time. The account will be active all the time - all you need to do is use it (logging in, concluding transactions). You can open any number of demo accounts using the same contact details.

Two yearsTypes of demo accounts:

- Classic,

- RAW.

Commission discount -10% valid on Tickmill UK on MT5

Commission discount -5% valid in Tickmill EU

REAL Account

Individual clients

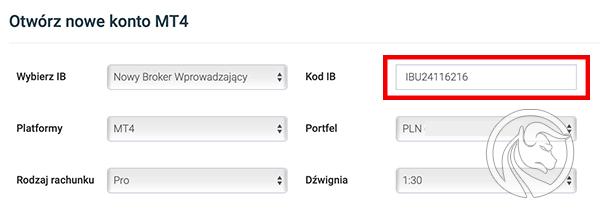

- Go to the site Tickmill UK and click on the tab Open an account - REGISTRATION (please select Tickmill UK). If you want to take advantage of the offer Tickmill EU, please select This link.

- A prerequisite to get additional benefits (including commission rebate) is to go to the form via the link above.

- Confirm your e-mail address, and then log in to the Customer Area using your e-mail address and password of your choice.

- Prepare two documents - 1) a scan of an ID card on both sides or a passport and 2) a driving license, bill or bank statement not older than 3 months, which will confirm the address you provided in the form.

- After verifying the documents in the Customer Area, you can set up a selected investment account.

- When opening an account, make sure you select an option "New Introducing Broker", IB code have: IBU24116216

- The next step is to make a deposit.

- If you have doubts about whether the bill was correctly assigned to the Forex Club group contact contact us for verification.

Commission discount -10% applies to Tickmill UK on MT5

Commission discount -5% applies to Tickmill EU

You can assign it to the Forex Club group and get access to all the benefits offered. Write to us - CONTACT.

Institutional clients

People interested in creating a company account please earlier contact.

Risk Information

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks involved in trading Contracts for Difference (CFDs) and if in doubt, consult an independent adviser.

Professional customer at Tickmill

Tickmill allows you to change the client's classification from retail to professional. In order to apply for a change of categorization, two of the three conditions described below must be met.

Conditions for changing classification:

- Conducting transactions with a value of the PLN equivalent of at least EUR 50 each, in the number of at least 000 transactions per quarter in the last 10 quarters;

- The value of the investment portfolio held exceeds the equivalent of EUR 500 (or the equivalent in another currency);

- Professional experience for at least one year in the financial sector in a position requiring knowledge regarding transactions in financial instruments or brokerage services.

PROFESSIONAL CUSTOMER - PROCEDURE

A professional customer at Tickmill receives:

- The lever max. 1: 500,

- Protection against negative balance without limits,

- Access to all instruments offered and transaction conditions (spreads, commissions, platforms),

- Maintenance of deposit guarantees,

- The ability to return to the status of a retail customer at any time.

The procedure for changing the classification:

- You must log in to the Customer Area,

- You must complete an application for professional client status.

- Mark in the application that you meet the minimum 2 with 3 requirements. The broker may selectively ask for additional explanations.

- The broker will contact you after verification of the application.

Types of accounts

Tickmill UK

Tickmill UK offers three types of accounts. Each of them is based on the STP order execution model and offers the same number of instruments. The differences are visible in the method of calculating fees and their amounts.

| Account type | Classic | RAW |

| Model of execution | STP | |

| Min. Deposit | 100 PLN | |

| Type of fees | spread | Commission |

| Standard commission for 1 lot | - | 5$ |

| Forex Club commission* – applies to MT5 | - | 4,5$ |

| Forex Club commission discount* – applies to MT5 | - | -10% |

*The discount applies to RAW accounts on the MT5 platform. The discount rate is -10% for accounts in PLN. For other currencies the discount is -5% (commission $4,75 per 1 lot).

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. You should be aware of all the risks involved in trading Contracts for Difference (CFDs) and if in doubt, consult an independent adviser.

Tickmill EU

Tickmill EU is the twin equivalent of the Tickmill UK offer. The main difference is that the company is subject to Cypriot regulations (CySEC), access to CFD instruments on cryptocurrencies and a Forex Club commission discount of -5%.

| Account type | Classic | RAW |

| Model of execution | STP | |

| Min. Deposit | 100 PLN | |

| Type of fees | spread | Commission |

| Standard commission for 1 lot | - | 5$ |

| Forex Club commission | - | 4,75$ |

| Discount of the Forex Club commission | - | -5% |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with Tickmill EU Ltd. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money. You should be aware of all the risks associated with trading contracts for difference (CFDs) and if in doubt seek advice from an independent advisor.

Protection against overdraft

The broker protects its clients against the need to repay their debt if it occurs. In the event that the trader's account balance goes below zero (an overdraft), the broker will not require its repayment. Negative balance protection applies to any type of account, and the balance is reset to zero within the next few days from its occurrence.

Commission policy

Tickmill was guided by this thought when preparing its offer for traders "the simpler and clearer the better". Based on this idea, a commission policy for real accounts was developed.

Classic account

On the account, the only cost that the trader incurs is the spread. Its value includes the broker remuneration. Thanks to this, novice investors have no problem with estimating the transaction cost before concluding a transaction. Classic spreads start from 0d 1.6 pips. The quotes on the real account are the same as the prices presented on the DEMO account, so in order to check the level of spreads it is best to follow the offer on the test account.

RAW bill

The spread on the RAW account assumes market values and depends on the current liquidity and volatility of the instrument. Tickmill's remuneration is a commission added separately to the transaction and its monetary value results from the volume of the position.

Spread on both of these accounts takes very low market values, which result from the liquidity and volatility of the instrument at a given time.

Commission discount for ForexClub.pl clients

- Commission discount -10% is permanent and applies to RAW accounts in PLN on the MT5 platform in Tickmill UK. For accounts in other currencies the discount is -5%.

- If you want to trade in Tickmill EU (Cyprus) commission discount is -5% and you should take advantage of it from THIS link. The discount is also permanent.

- The only condition is to create an account through the Forex Club.

- The discount applies only to RAW accounts kept in PLN.

- The discount applies to all Club Members, regardless of the deposit and turnover.

- The discount can be combined with other promotions organized by Tickmill.

- The discount applies only to currency pairs and precious metals.

- In the case of Tickmill UK a preferential commission rate applies immediately. No additional activation is required. In case of Tickmill EU, to activate the discount, after registration, please: contact.

- The discount is included in the commission paid at the time of the transaction.

CFD instruments

Regardless of the type of account, on CFD instruments the cost is always fully included in the transaction spread. To find out what the spreads for individual instruments are, the best option is to create a demo account (quotes identical to those on a real account) or use the subpage below.

Spread on the DAX index is just 0,7 pips and no additional commission is charged.

You can assign it to the Forex Club group and get access to all the benefits offered. Write to us - CONTACT.

Promotions and competitions organized by Tickmill

Trader of the month - $ 1000 every month

A cyclical competition in which the best trader of the month is selected. But before you say "it's not for me" - learn the rules! The victory is determined not only by the rate of return, but also by the ability to manage capital and risk (the ratio of profit to losses is assessed, among others). The trader of the month is selected by a 3-person jury assessing the overall trading. But that's not all - the trader has to give a special interview in which he presents his approach to trading, so that it can be an inspiration for other traders.

The most important conditions:

- Each real customer automatically participates in the competition. Registration is not required.

- The minimum deposit that qualifies the participant is 500 $.

- The competition runs from the first day to the last day of each month.

- The condition for receiving the prize is to provide an interview for Tickmill.

- The prize of 1000 $ is awarded to two people selected by the jury.

- Only customers can participate in the competition Tickmill SC (Seychelles).

Payment and withdrawal of funds

The funds management operations are available from the Customer Area level. Tickmill offers 5 deposit and withdrawal methods.

The methods are:

- traditional bank transfer (Polish and British),

- credit / debit card,

- Skrill

- Neteller,

- express DotPay transfer.

Payments

Tickmill offers to make a transfer to a bank account in Poland and Great Britain. Express transfers via the website are also available DotPay - transactions are carried out immediately. Transactions of payments and withdrawals to a bank account in Poland are free of any fees from Tickmill and its bank. Transfers are posted within one business day.

In the case of using the option of a bank transfer to a British bank (SWIFT transfer), Tickmill reimburses the costs of the transfer for transactions larger than 5 000 USD (just send a confirmation of the transfer), if such costs occurred. The maximum refund amount for bank charges is 100 USD.

When using alternative methods, the payment costs, if they occur, are not covered.

EVERYTHING ABOUT PAYMENTS FOREIGN BROKER

Withdrawals

The withdrawal of funds is ordered in the Customer Area after logging in. It is important to remember the principle that requires that the deposit be paid out using the same method that was paid in. Profits can be withdrawn by bank transfer or one of the alternative methods (eg Skrill).

Tickmill covers all transaction costs related to the withdrawal of funds.

Financial instruments

Tickmill offers about 600 financial instruments that can be traded. Their number is the same regardless of the type of account selected. In the case of currency pairs, the only noticeable difference is the method of calculating the fees (the spread itself or the market spread + commission).

| Type of instrument | Number of instruments |

| Currency pairs | 62 |

| Precious metals | 2 |

| Stock indices | 14 |

| Energy carriers | 2 |

| treasuries | 4 |

| Cryptocurrencies - only available in Tickmill EU* | 8 |

| Futures contracts (thematic) | 10 |

| CFD per share | 500+ |

*Commission discount for Forex Club clients in Tickmill EU is -5%. The discount at TIckmill UK is -10% for RAW accounts on MT5.

Platforms

Available platforms:

- Tickmill MetaTrader 4

- Tickmill MetaTrader 5,

- Tickmill Webtrader MT4 / 5.

Mobile platforms:

- Tickmill Trader iOS,

- Tickmill Trader Android,

Tickmill Meta Trader 4

MetaTrader 4 is without a doubt the most famous trading platform among Forex traders. The software, which debuted in 2004, has become a world bestseller, and its popularity is due to its intuitiveness, reliability and high level of security. A wide range of configuration and personalization options combined with a huge amount of tools in the form of indicators, overlays and automatic strategies makes trading on MT4 a pure pleasure.

- Tickmill UK - MT4 for Windows

- Tickmill UK - MT4 for MAC

- Tickmill UK - MT4 for Android

- Tickmill UK - MT4 for iOS

Tickmill MetaTrader 5

The successor to MT4, MetaTrader 5 is a technologically advanced platform designed specifically for trading Forex and CFDs. It combines advanced order execution capabilities and the MQL5 language to implement the most ambitious trading ideas, making it one of the most advanced platforms for creating and testing robots, scripts and strategies.

- Tickmill UK - MT5 for Windows

- Tickmill UK - MT5 for MAC

- Tickmill UK - MT5 for Android

- Tickmill UK - MT5 for iOS

A set of tools for our clients:

Tickmill Webtrader MT4 / 5

It is an alternative version of the MetaTrader 4/5 desktop platform. Its biggest advantage is the ability to run on any computer without the need to install additional software (except a web browser). Webtrader offers users real-time charts with basic analytical tools. It is also an opportunity to efficiently conclude transactions and manage the position, thanks the ability to add and edit orders from the graph and level.

Advantages of Tickmill Webtrader MT4 / 5:

- on-line trading platform,

- cooperation with all known browsers,

- one-click trade,

- speed and reliability of operation,

- basic analytical tools,

- real-time charting.

Go to Tickmill Webtrader MT4 / 5:

- Tickmill WEB - Sign in

Note:

Logging in to the investment account using the Tickmill Webtrader MT4 / 5 platform takes place using the same data as on stationary MT4 and MT5 platforms.

Tickmill Trading Tools

Autochartist Tickmill

It is an invaluable service supporting the trader in performing analyzes, in particular technical analysis. Thanks to advanced algorithms, it is able to analyze a huge amount of data at one time and find interesting traders on the chart and key levels. Autochartist is an on-line service and comes in the form of a plug-in for the MetaTrader 4 platform. This tool will primarily facilitate your analyst's work, save time and allow you to look at many markets at the same time.

Tickmill clients with a real account receive access to the site completely free. In the case of demo accounts, access is also possible, but with 5-secular delay.

Autochartist functions:

- Forecasts in graphic form,

- Personalization of searching for instruments and formations,

- Analysis of volatility,

- Sound alarms about the occurrence of the formation,

- The ability to run directly on MT4,

- Detection of the Fibonacci formation,

- Automatic drawing of the technical analysis form on the chart,

- Market news and macroeconomic comments,

- Statistics on the effectiveness of the formation of the last 6 months.

VIDEO GUIDE AUTOCHARTIST

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)