What can we expect on the currency market in 2020?

Forex 2020: Last year was another exciting year for currency traders.

being US-China trade conflict have dominated the headlines of most newspapers over the past year. Although the first part of the agreement was finally agreed in December and is to be signed in January 2020, the road to the final agreement remains long and burdensome. The uncertainty associated with global trade, combined with generally weaker macroeconomic data that emerged later, was one of the main reasons why most major central banks in the world have adopted such an accommodative policy approach last year.

The Federal Reserve began a sharp turnaround in US policy, lowering interest rates three times last year. European Central Bank he followed suit in September, while resuming his large-scale quantitative easing program. Central banks in Australia and New Zealand aggressively softened policy, and many others from the "Group of Ten" (G10) either suggested the possibility of cuts, or argued that high interest rates would remain out of reach in the near term. Notable exceptions are Norges Bank (Norwegian Central Bank) and riksbank (Swedish National Bank), which raised rates last year.

The Brexit saga is still going on longer than expected, as parliamentarians cannot agree on the content of the deal. The date of leaving the Community was delayed more than once, and twice, from March 31 to October 31, and then again until the end of January 2020. The decisive victory of the Conservative Party in the December parliamentary elections, however, guarantees that Great Britain will eventually leave the European Union in an orderly manner end of month.

Be sure to read: 31 January 2020 of the year Britain is saying goodbye to the European Union

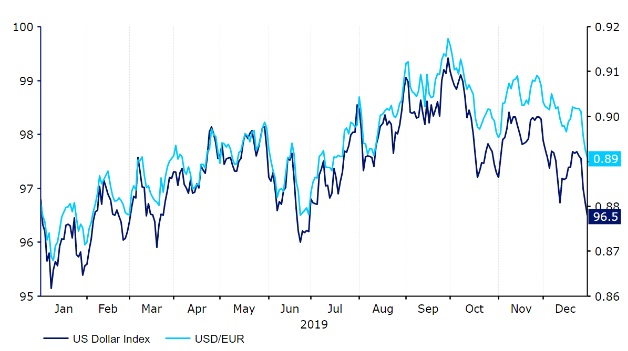

In the case of emerging market currencies, escaping the risks of trade war contributed to an unstable year, although eventually emerging markets currency indices closed at the point where they began 2019. The dollar itself actually ended the list slightly above the level from which it started the series of increases, despite the aforementioned cuts from Federal Reserve and uncertainty about the trade war.

US Dollar Index, Source: tradingeconomics.com

Forex 2020: What awaits currency markets in the next 12 months?

The Federal Reserve will remain passive in the near future

At the FOMC meeting in December, Federal Reserve Chairman Jerome Powell made it clear that interest rates were unlikely to change in the near term. Powell said the bank would have to see a "sustained" spike in inflation to justify an increase in rates. On the one hand, positive trade signals and solid macroeconomic data from the US suggest that further cuts by the Fed will not be justified, and on the other - with the inflation rate preferred by the Fed below 2%, there is also no need to raise interest rates in the near future . Therefore, it can be expected that the Fed will keep the current rates at least until the first half of 2020. Only after this period, it will be possible to determine the impact of the recent cuts before the Reserve decides to set a new direction for monetary policy.

The ECB is in no hurry to relax again in 2020

The era of Mario Draghi at the European Central Bank ended in Octoberand former head of the IMF Christine Lagarde gave her first press conference as the new president in December. Unlike Draghi's relatively harsh and slow tone, Lagarde started quite optimistically, stating that there were signs of a slowdown in production decline in the euro area.

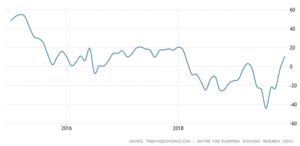

According to experts, there are reasons to be optimistic about the outlook for the eurozone in 2020. PMI indicators stabilized, especially the service index, which was above 52,4, suggesting improved consumer sentiment. Recent data on sentiment from Germany have also improved, and the ZEW economic sentiment index has returned to the highest level since the beginning of 2018.

ZEW Index, Source: tradingeconomics.com

The improvement in macro data from the eurozone, awaited by the market, may mean that the ECB will maintain a stable policy in the coming year. Stable interest rates of both central banks, combined with the improvement expected in the growth of the euro area, should support the listing of the main EUR / USD pair in 2020.

The end of the US-China trade conflict

In December, investors finally had good news from the US-China trade front, and President Trump signed the first part of the agreement with China, which was initially concluded in October. China has agreed to purchase an additional $ 200 billion of US goods over the next two years under the agreement, with the US giving up additional tariffs and withdrawing previous ones.

Also watch: Top 10 Forex, Indexes, Metals for 2020 year [VIDEO]

Despite recent progress, there is still a long way to go before a final agreement can be reached. Chinese officials seem less enthusiastic about the "first phase of the agreement" than President Trump. Nevertheless, the market expects that a final agreement will be reached in the coming months, which should support emerging market currencies this year, especially in Asia.

Britain will eventually leave the EU

Boris Johnson's revised agreement to withdraw from Brexit eventually passed through the House of Commons, ensuring that Britain will leave the European Union by the end of January. The key this year will be whether full agreement can be reached in time to the end of the transition period, or whether it will be necessary to extend it beyond 31 January 2020. Boris Johnson took a firm position on the transition period, and the Tories announced in their manifest that they will not try to extend this period. However, political analysts generally believe that a year is not enough time to formalize a full agreement. If everything is formally "completed", the relief associated with Brexit will be replaced by concerns about future relations with the European Union.

US presidential election

Donald Trump's attempt to win the second term is likely to dominate the headlines for most of the next 12 months. Financial markets are often well during the election year. Trump is said to be considering a fiscal hike called "2.0 tax cuts," which could boost his popularity and raise the valuation of major Wall Street stock indices before the November election. Many investors have priced Trump's re-election, so only the Democrats' victory can surprise the markets. Bookmakers have about 50% probability of re-election Trump, and his closest rivals Joe Biden and Bernie Sanders are slightly lower in the ranking. The election result may depend on the final result in several states, given the particular American electoral system. This makes it difficult to predict the final results of the November elections and its impact on the currency market.

An opportunity for emerging market currencies.

The above factors should generally support emerging market currencies in 2020. Low global interest rates, the likely end of the US-China trade war and reducing the risk of uncontrolled Brexit should, according to analysts, improve risk appetite and lead to a moderate reversal of capital from safe harbors.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Who will win the US elections? [Video comment] Who will win the US elections](https://forexclub.pl/wp-content/uploads/2020/10/Kto-wygra-wybory-w-USA-300x200.jpg?v=1603704365)

Leave a Response