Will the S&P 500 end 2023 at new highs?

S&P500, the main index of the New York Stock Exchange, is already close to making up for losses caused by the sell-off of technology shares in 2022. This was due to many unfavorable factors, both on the local US market and among general macroeconomic trends around the world.

The poor results on the stock exchange last year were due to the continuing effect of the Covid-19 pandemic, turmoil on the real estate market in China, lower than expected economic growth in that country, and even problems of banks serving technology companies. However, all this seems to be behind us. Here we will give the floor to experts who predict increases and new highs in the S&P500 index and the stocks and ETFs related to it, such as iShares Core S&P 500 UCITS ETF. We will also look at the main growth factors and potential risks for the capital market that may block the path to the highs.

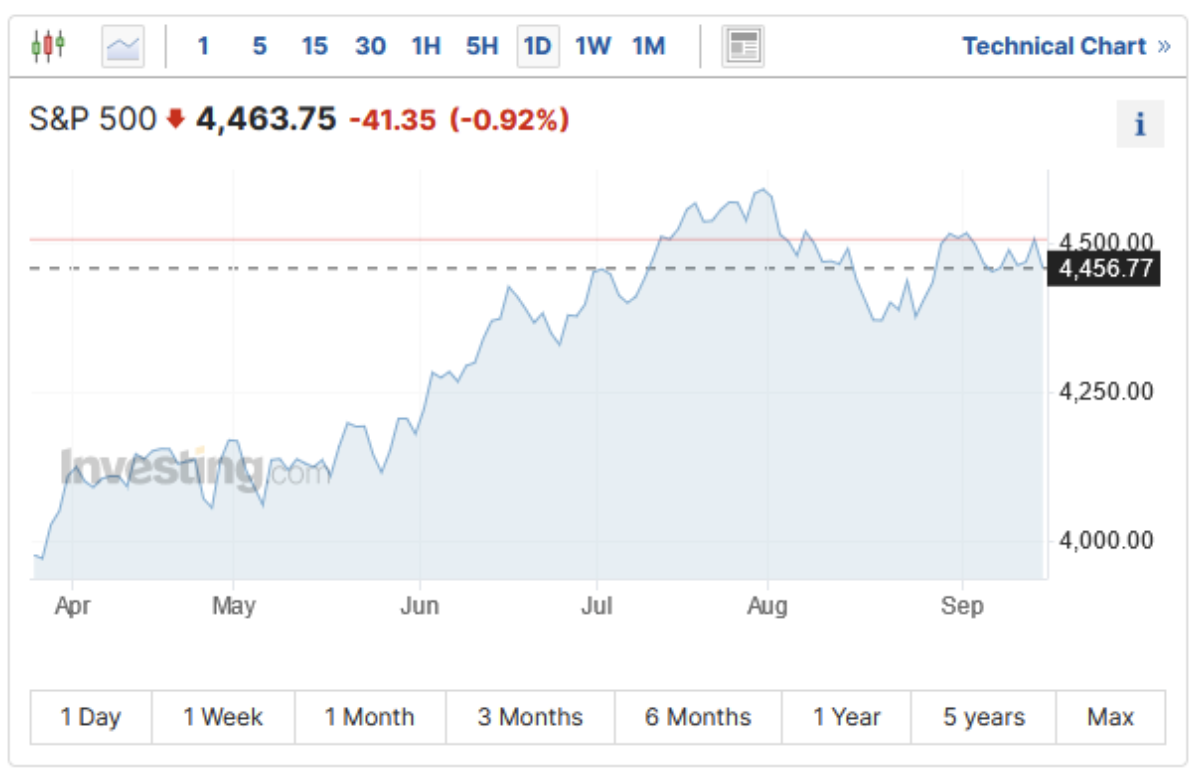

S&P500 index increases in recent months. Source: Investing.com.

The potential of the S&P 500: Expert opinion

What do experts think about the growth potential of the S&P500 index? Maxim Manturov, Director of Investment Advisory at we, has an opinion on this matter Freedom Finance Europe. According to Manturov: “It is quite possible that the S&P500 index will end 2023 above its peak achieved as a result of the post-Covid boom in technology companies. Nevertheless, there are many factors that can influence the capital market, including interest rates, inflation, geopolitics and global markets.

Uncertainty over interest rates can put pressure on bond rates while causing stock prices to fall. Inflation is also a problem, as it can weaken corporate profits and reduce consumer spending.

Regardless of these risk elements, there are positive factors in 2023 that should support the stock market. The US economy is expected to continue to grow and corporate profits are expected to remain high. Additionally, the Fed is expected to exercise restraint in raising interest rates if falling inflation continues, which could prevent a sharp sell-off in stocks.

Jerome Powell's statement during the Jackson Hole Symposium indicated the central bank's willingness to continue raising rates to balance inflation and direct it towards the inflation target, but Powell also indicated that he would base his decision on the upcoming data on inflation and the broader economy. “In addition, August 29 JOLTS data indicated that job openings fell more than expected to 8,83 million – a two-year low – providing timely evidence that the labor market is slowing, steering the Fed's fourth-quarter policy in a dovish direction.”

JOLTS data: Number of job openings in the United States, indicating the health of the economy. Source: Business Insider.

Experts from leading investment banks interviewed have a similar opinion on this matter. Marko Kolanovic z JP Morgan, who is the company's chief economic expert, claims that the US stock market should drift towards highs by the end of this year. According to him, the economic data may not be perfect, but they are sufficient to provide an impulse for an increase in the stock market. This analyst points to other factors that allow investors to sleep at night. This is intended to be a gradual cessation of the trade war between China and the United States, as well as an end to problems with the adoption of the budget by Congress, which will calm the macroeconomic situation in the country. He also claims that while economic growth will not be very dynamic, it should reach "mid to high" single digits. Of course, there is no guarantee that such large increases will actually occur. According to this analyst, there is about a 25% chance that the market will achieve a weaker result.

Main growth factors and threats for the S&P500

The chart above clearly shows that the condition of the American economy is good. The number of job offers is also almost at the maximum level and has long since rebounded from the bad period of the pandemic on the labor market. The number of jobs is one of the best predictors on the basis of which we can assess the financial condition of enterprises, and excellent results indicate high company profits. Interestingly, this may even trigger the effect of wage pressure, slightly increasing enterprises' expenditure on wages, but this effect will be rather long-term and should not be reflected in current results. However, economic growth in the European Union and Asia will also support the S&P500, increasing profits from sales outside the US, presented in quarterly and annual reports. Normalizing inflation, supported by effective policy, will also be an important factor FED and kept in check by the central bank. In contrast, an increase in the value of the dollar should provide additional benefits to importers in the United States, increasing profits in constant currency.

Despite these favorable trends, there are also threats that may cause declines in the stock market at the end of this year. This includes declining demand among consumers, whose limited spending will hurt companies' profits. The increased attractiveness of US bonds may encourage some large institutional investors to transfer funds to these state instruments. However, potential problems in China will affect the entire economy. Nevertheless, the growth of the main index of the Shanghai Stock Exchange was even better than the results of the S&P500 this year, which is rather a reason for optimism.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response