US stocks remain attractive, but it all comes down to inflation

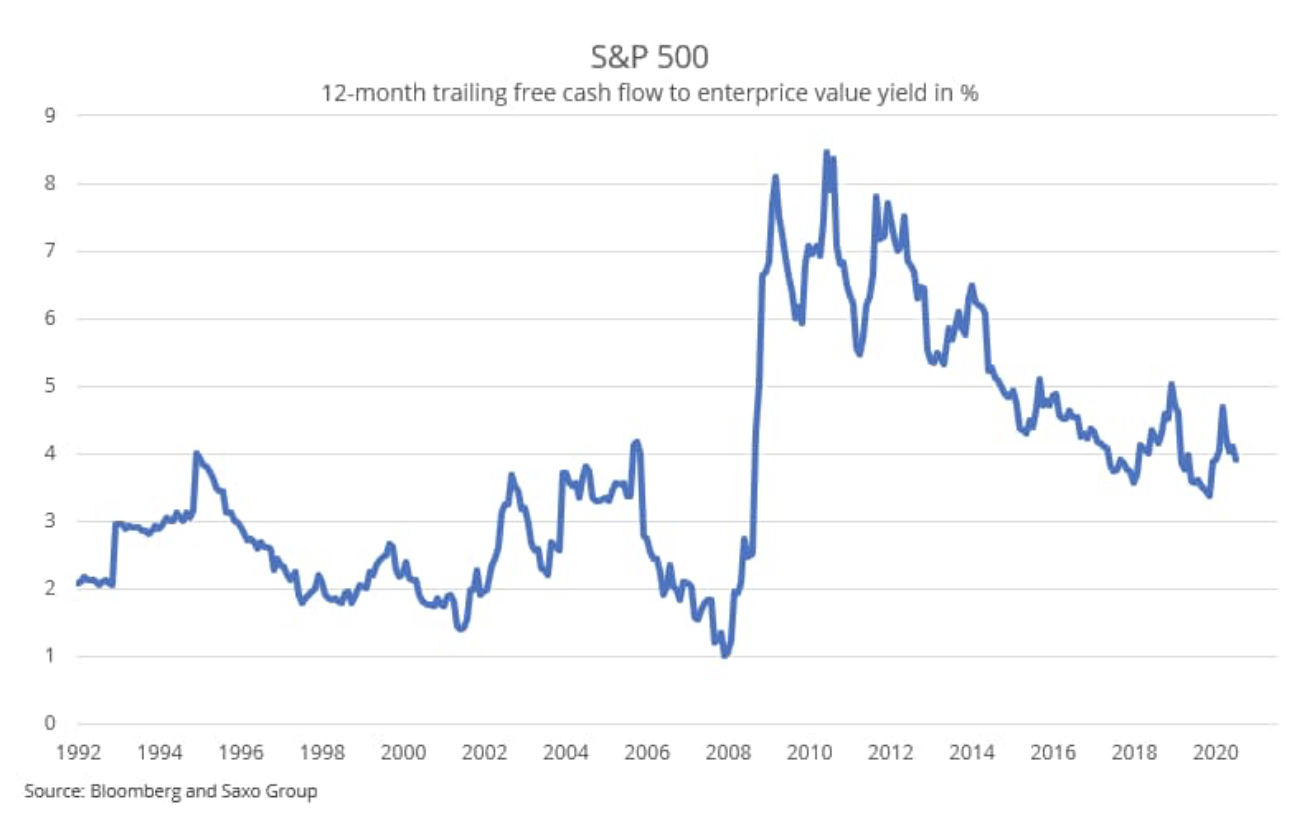

We wrote back in May about how much US stocks have become overburdened compared to European stocks. If we ignore the discussion of relative attractiveness, US stocks are not as expensive as they might seem. As of July this year, the 12-month free cash flow (FCF) to enterprise value return is 3,9% (the FCF rate for European equities is now 12,5%) compared to just 0,5 . 10% for US ten-year government bonds (0Y). Even assuming free cash flow growth of only 2-XNUMX%, expected future returns largely prefer equities over bonds. The latter, however, still play a role as a component to calibrate the portfolio to the desired risk profile.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

US stocks getting more and more expensive

If we compare the FCF S&P 500 rate of return with that of the US 10Y, two things will become clear. First, there are two distinct periods that are before and after Lehman Brothers filing for bankruptcy. Second, equities are probably one of the few options investors have left for a meaningful long-term return on investment, especially in a potentially inflationary environment. Before Lehman Brothers filed for bankruptcy, the equity market was dominated by finance, energy and other capital-intensive industries. This period is characterized by lower free cash flow growth and a persistently lower free cash flow return than that offered in US Treasury bonds.

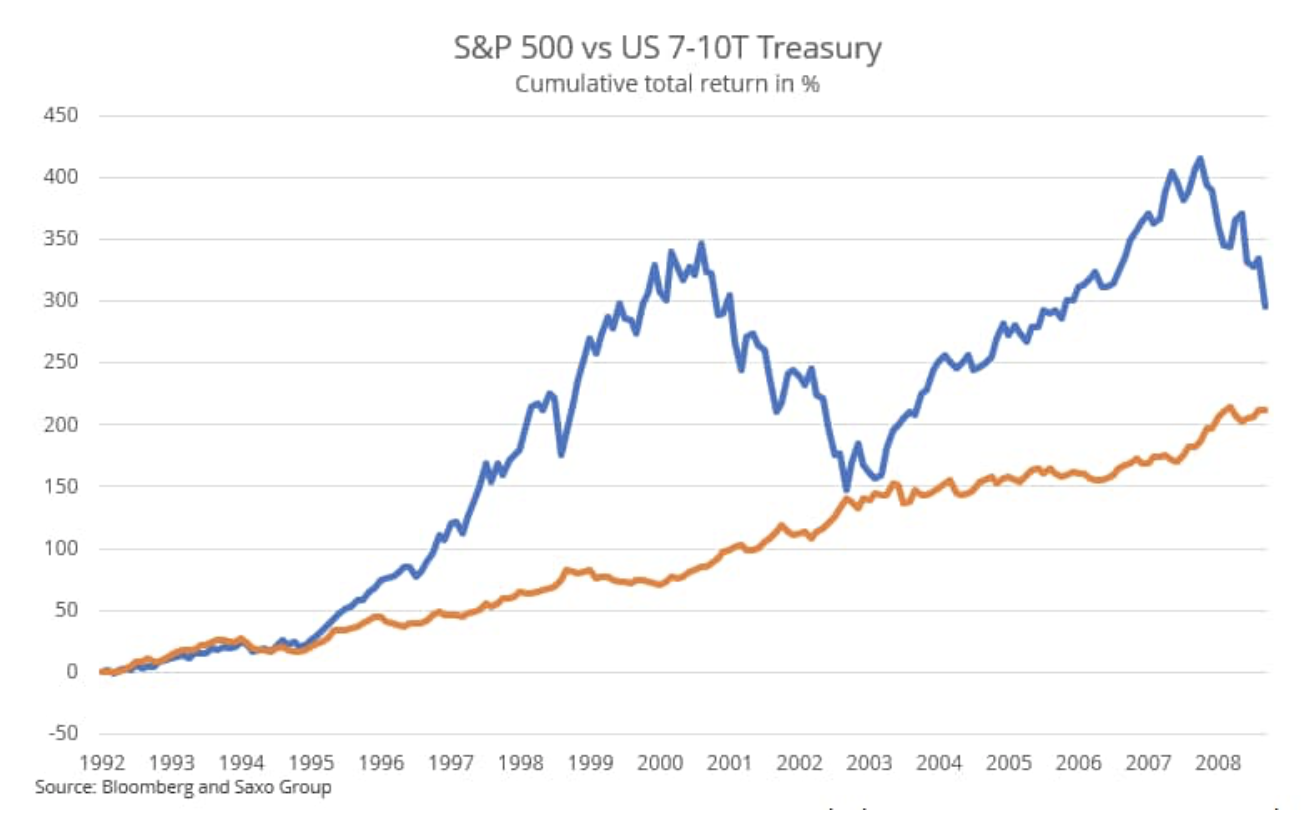

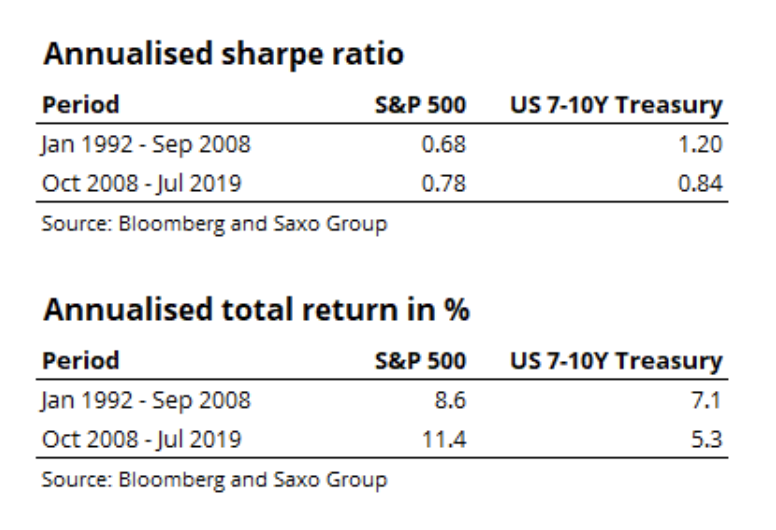

As you can see in the chart below, the S&P 500 outperformed 500-year US Treasuries, but with worse risk-adjusted statistics (see table below). During this period, the S&P 8,6 achieved an annualized return of 7,1% compared to XNUMX% annualized on US ten-year government bonds. Despite the natural problems with estimating expected returns on equities over the period, they managed to outperform government bonds, largely due to an increase in free cash flow.

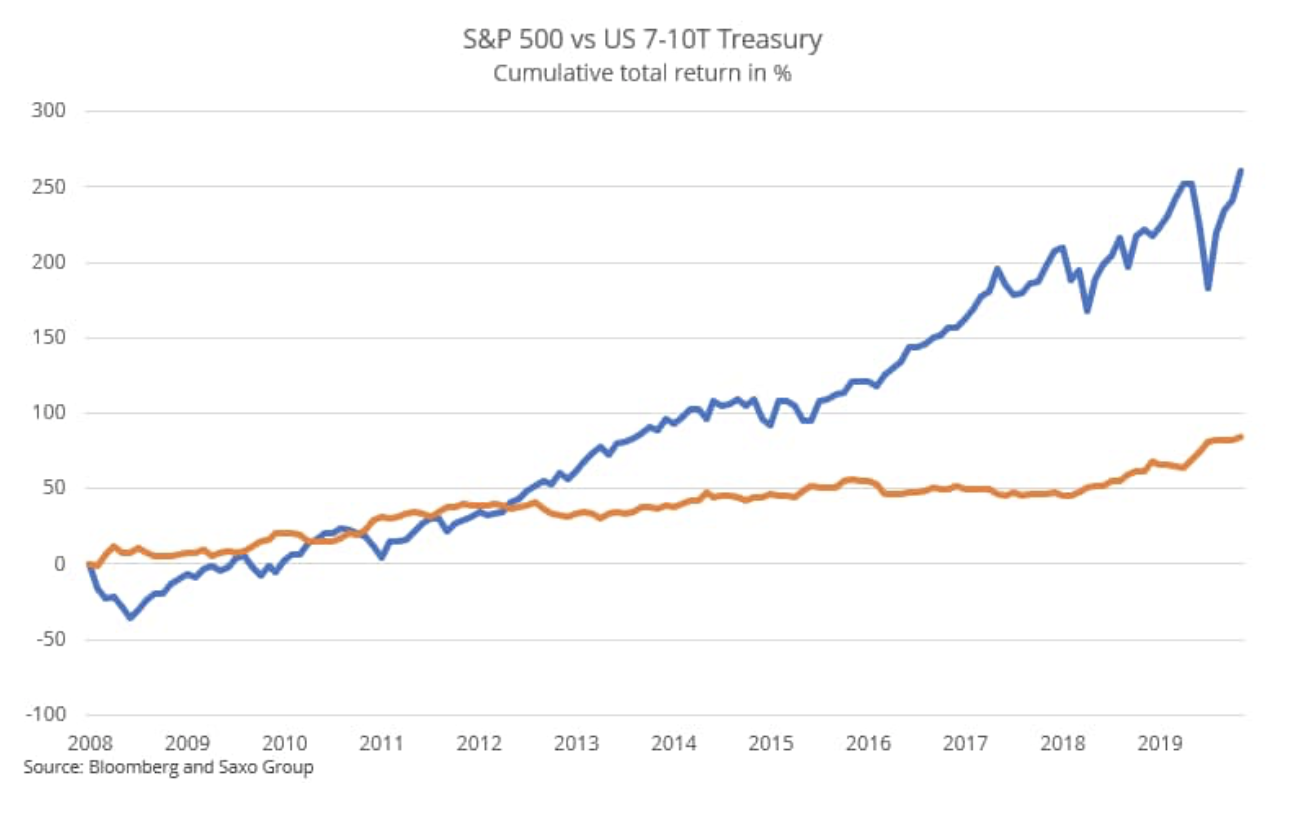

The post-bankruptcy period from Lehman Brothers is interesting for two reasons. First, the technological ecosystem (semiconductors, e-commerce, hardware, software, cloud, etc.) has become the dominant segment in stock market. Second, central banks kept lowering interest rates despite the temporary period for Fed in the years 2016-2019. Technology companies have lower capital expenditure requirements relative to revenue growth, and the digitization from low penetration has created a high growth environment for these companies with high operating margins and predictable cash flows.

As interest rates have fallen, the multiples of estimates for these types of companies have increased sharply, and with long USD exchange rates approaching zero, the multiplier effect is exponential. In addition, tech firms saw free cash flow growth beyond the growth rate in the pre-Lehman Brothers period, and the combination of these two factors created a post-bankruptcy period in which the S&P 500 achieved an annualized return of 11,4% compared with just 5,3% annualized for 10-year US Treasury bonds.

Is stocks the best option right now?

Despite this huge advantage, US stocks still look attractive compared to US Treasury bonds, but in relation to the stock itself compared to the pre-Lehman Brothers bankruptcy period. The critical assumption is that the Fed will keep interest rates at these very low levels for a very long time. This assumption will come under tremendous pressure should inflation return, but given our little understanding of forecasting inflation, it will be difficult to know when to change the way you think about stocks. Our advice to investors, however, is to closely monitor the US 10-year return and inflation expectations.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response