InPost shares - is it worth investing in parcel lockers? [Guide]

At the end of January, the shares of InPost, a company known mainly for its offer of parcel machines, debuted on the Amsterdam market, which became a kind of phenomenon in Poland. The company's capitalization as of January 29 was € 9,9bn. This means a market valuation in excess of PLN 44 billion. This is more than the capitalization of such Polish companies as KGHM, PKN Orlen, PKO BP or CD Projekt. This means that the assets of Rafał Brzoska (CEO and founder) currently exceed PLN 5 billion.

The company has a very turbulent history and consists of the fate of Integer.pl and InPost. A company consisting of both the former Integer and InPost debuted on the Amsterdam Stock Exchange. Integer was established in 1999, and its founder was, among others, Rafał Brzoska. In 2006, the company entered the market of postal items under the name "InPost". The company needed capital for development, and consequently decided to debut on the WSE in 2007 as Integer. It collected over PLN 20 million from the market. Integer.pl has become a favorite of many investors. The fight with Poczta Polska, i.e. the famous badges stuck to the letter in order to circumvent the state monopoly, won both supporters and opponents of the company. At the same time, the won court service contracts made it possible to increase the scale of operations.

The company, believing in the bright future of e-commerce, developed both postal services, standard courier services and introduced the parcel locker service (2010). Parcel lockers were to revolutionize the last mile delivery market to the consumer. Waiting for a courier or making an appointment by phone was frustrating for online shoppers. Parcel lockers were to become an imperfect solution to facilitate the collection of small-size parcels. Instead of waiting at home or going to a parcel collection point, the customer was supposed to go to a nearby parcel locker and pick up the parcel. Business was highly capital intensive.

In 2015, the subsidiary of Integera debuted. At that time, InPost was an operator of parcel machines and offered postal services. The company raised PLN 120 million (the seller was Integer) to spend it on development (including parcel machines). Unfortunately, the InPost rate has been in a downward trend since its debut. The reason was the deteriorating financial results. The Capital Group (Integer and InPost) was under pressure. It lost the tender for the Universal Postal Operator with Poczta Polska and lost the contract for the delivery of court letters. The company was heavily indebted, which, combined with the loss of some revenues, heralded major financial problems for the company. The capital group needed additional capital.

The companies (InPost and Integer) were pulled from the stock exchange by the Advent fund, which spent about PLN 500 million on both companies. The "squeezing out" of minority shareholders left a bad taste for some Polish investors. Advent left Rafał Brzoska in the position, who still owns over 12% of the company's shares. The company restructured itself and focused on the development of parcel machines and the provision of courier services. The postal market has been "let go".

General information about the company

At the end of 2020, InPost had 12 parcel lockers and 254 million active users of the mobile application. The company offers delivery and fulfillment services for e-commerce sellers. They operate in the B5,7C (business-to-consumer), C2C (consumer-to-consumer) and C2B (e.g. parcel returns) offer. At the end of September 2, the company employed 2020 employees. The company's largest sorting plant is located in Wola Bykowska (near Łódź). In 3, about 186% of shipments passed through it. The second main sorting plant is located near Warsaw. The company also had 2019 parcel machines (APM), mainly on the Polish market. Foreign parcel lockers were set up in the United Kingdom and Italy.

The CEO (Chief Executive Officer) of the company is Rafał Brzoska, who is the founder of Integer and InPost. In turn, the financial director is Adam Aleksandrowicz, who performed similar functions, among others at American Heart of Poland SA, Bioton and AstraZeneca Russia.

InPost Shares - IPO

The debuting InPost is a Luxembourg company established in November 2020. Its main asset is the daughter company Integer.pl. The number of the company's shares is 500 million. The share issue was made only to institutional shareholders.

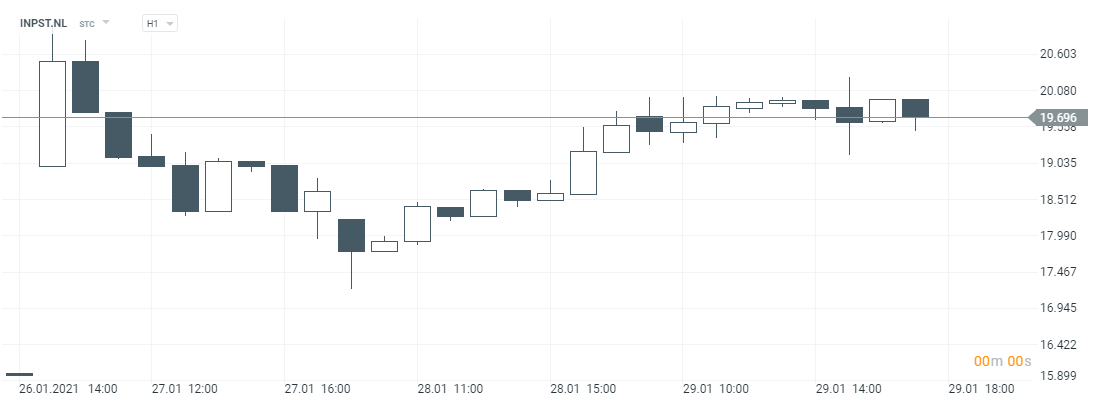

InPost stock chart, H1 interval. Source: xNUMX XTB.

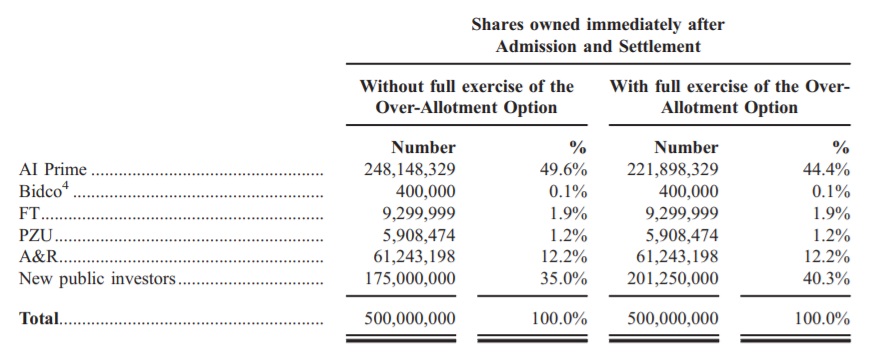

175 million existing shares were sold (35% of the total). The sellers were PZU Closed-End Non-Public Assets Fund BIS 2, the majority shareholder of AI Prime and Tempelton Strategic Emerging Markets Fund. As the shares are sold by the existing shareholders and the company does not issue new shares, the public offering will not result in capital injection. It is only a "profit harvest" by existing shareholders. Institutional investors acquired the entire issue for € 16 each. Which resulted in the total capitalization of the company at the level of € 8 billion. The debut took place on the Amsterdam Stock Exchange. One of the buyers is BlackRock and the Singapore-based GIC fund. After its debut, AI Prime will continue to be the main shareholder in the company with shares well over 40%. The company's shareholding structure will be as follows:

Source: company's prospectus

How to buy InPost shares

Rafał Brzoska (CEO and founder) owns a 12,2% stake in the company through A&R. After the company's debut, InPost shares can be traded through platforms that provide access to the Dutch market. This group includes, among others XTB or Saxo Bank.

| Broker |  |

|

| End | Poland | Denmark |

| Number of exchanges on offer | 16 exchanges | 37 exchanges |

| Number of shares in the offer | approx. 3500 - shares approx. 2000 - CFDs on stocks |

19 - shares 8 - CFDs on stocks |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFDs on ETFs |

3000 - ETF 675 - ETF CFDs |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

E-commerce and retail market

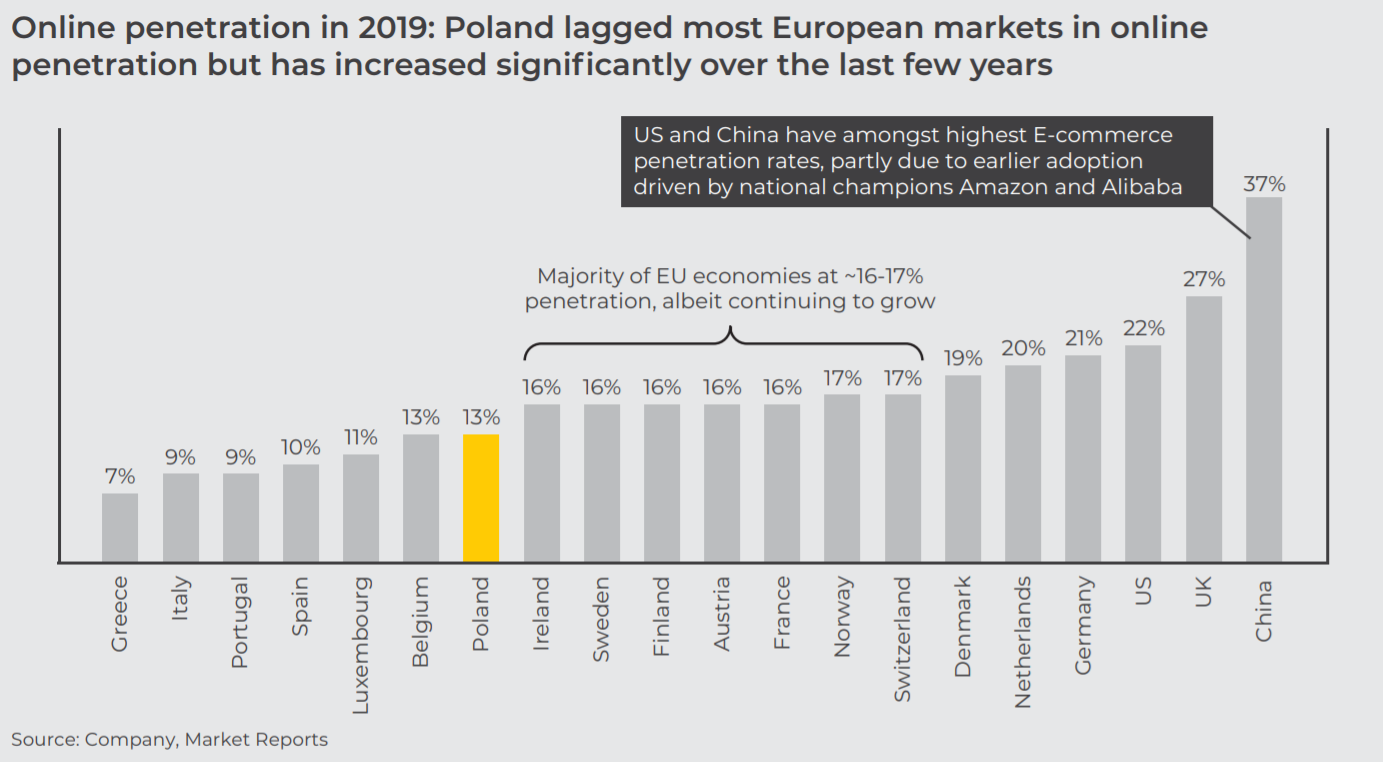

Polish retail trade grew between 2015 and 2019 at a rate of around 7% per year. The rapid growth was helped by the good economic situation, lowering interest rates, rising real wages and increased social transfers by the government. However, it should be remembered that most of the sales are carried out "stationary" (about 87% of the market). Retail sales in Poland are much less penetrated by e-commerce than in countries such as the United Kingdom, the United States or China.

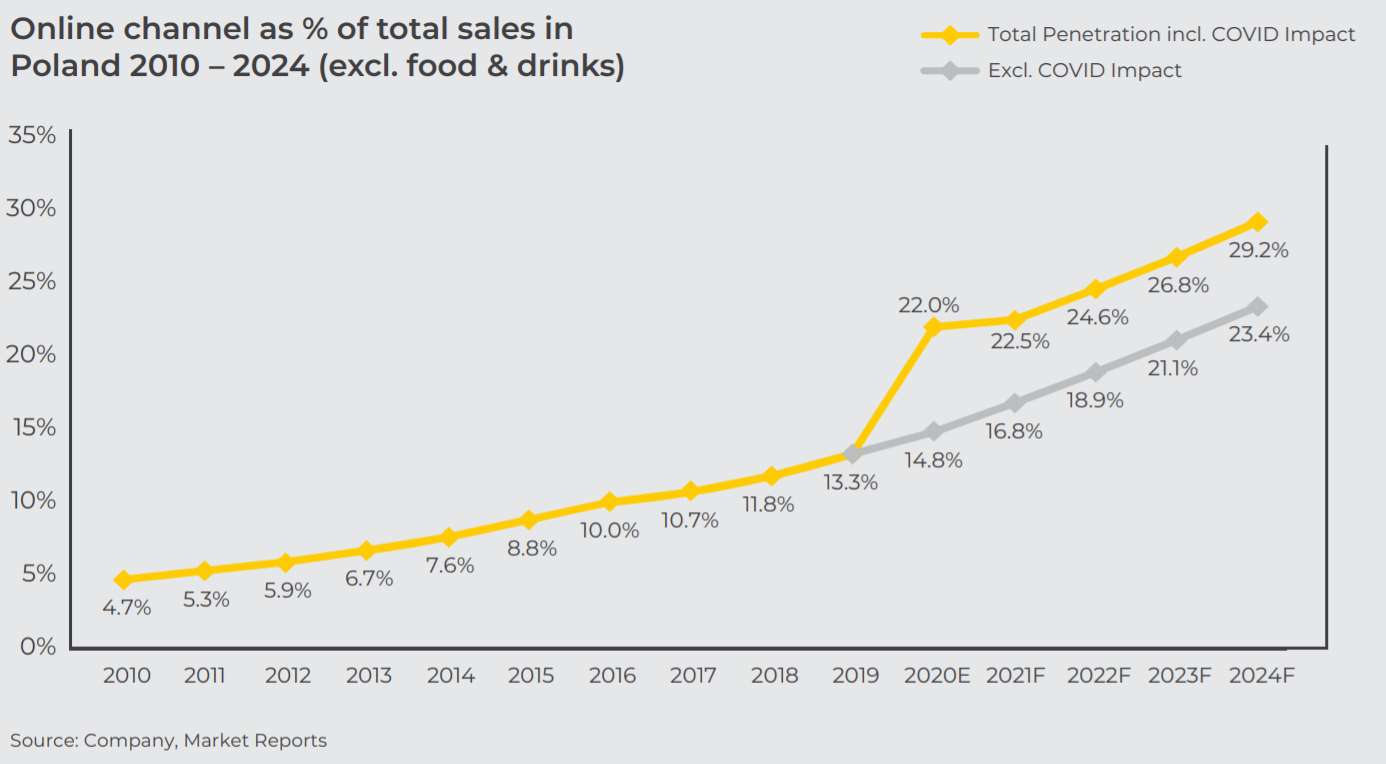

For this reason, a significant increase in online sales should be expected in the next dozen or so years. It is worth mentioning that the online sales market in 2015-2019 grew in Poland by about 16% annually, much faster than in France (11% annually), Germany (9%) or Spain (13%). The Polish e-commerce market, excluding the sale of food and beverages, is worth approximately PLN 57 billion (an 8-fold increase over a decade). According to the company's estimates, in 2024 the market will be worth PLN 95 billion.

Allegro dominates the Polish e-commerce market, which is a marketplace connecting 12,3 million active buyers and 117 sellers. As a result, the average number of transactions on this platform is around 000 million per month. There are also foreign marketplaces (Amazon, AliExpress, Olx). At the same time, companies specializing in individual industries (e.g. eObuwie, Answear, Zalando, Vinted) are developing dynamically.

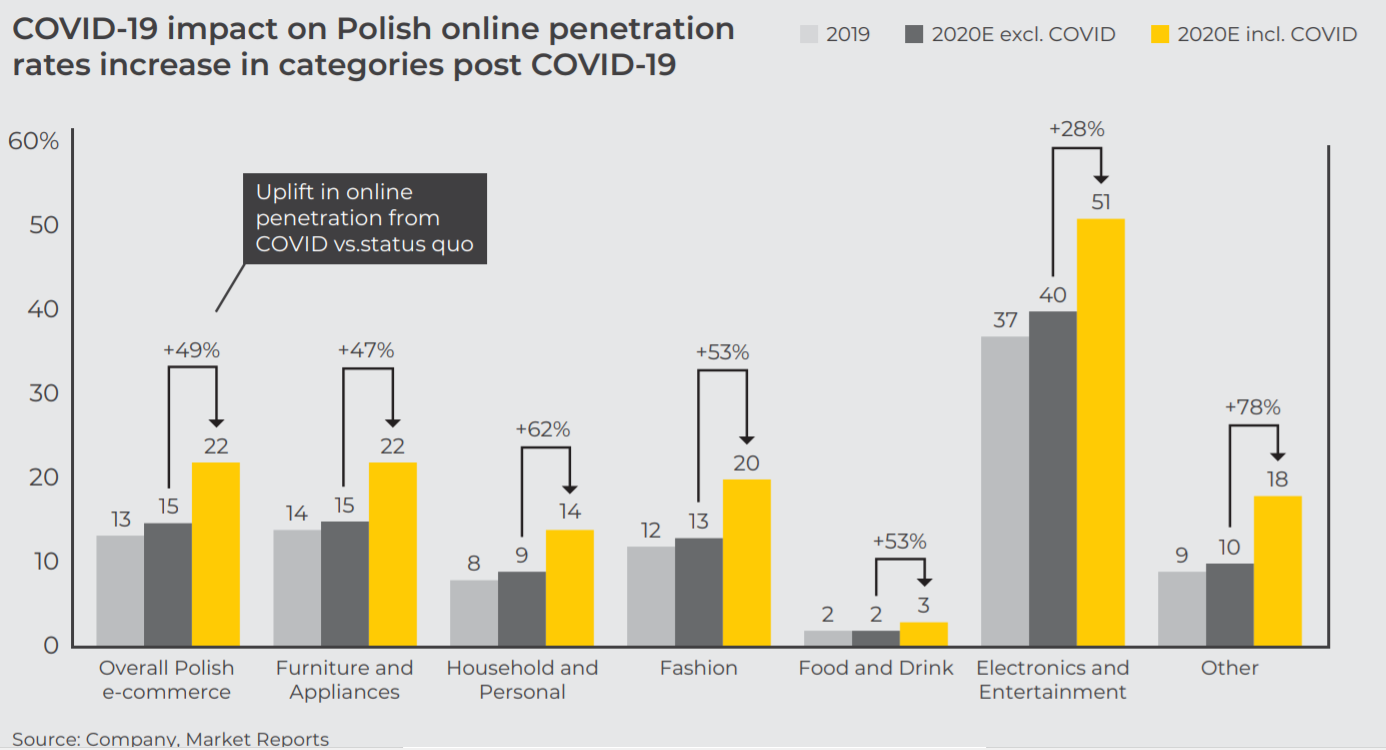

Customers are slowly getting used to online shopping. The reasons are often a wider range of products, competitive prices, and better logistics and returns policy. It is also worth mentioning the influence of smartphones. Currently, 65% of visits to online retailers' websites are made via mobile devices. In terms of value, around 33% of online purchases are made via mobile devices. Covid-19 has significantly accelerated the maturation of the e-commerce market.

Source: company presentation

Trade restrictions have led to a significant increase in the scale of online purchases. This applied to most of the trade segments. However, it can be seen that online grocery trading is still in its early stages of development.

Source: company's prospectus

The company's success depends largely on the development of the e-commerce market. In Poland, the penetration of e-commerce into retail (excluding food and drink) was 13% in 2019. According to the company's forecasts, in 2024 it is to reach the level of 29%.

Due to the limited size of the Polish market, expansion on foreign markets (first of all, European) is necessary. A few years ago, the expansion on the foreign market was not fully successful. In 2017, the company withdrew from operations in the Czech Republic, France, Canada, Slovakia, Hungary and Brazil.

There is a risk that expansion in foreign markets will be slower than in Poland. It should be remembered that the recognition of the Inpost brand outside Poland is very poor. Large investment and marketing expenditure will be required to build consumer confidence.

Poland - supply market and competitors

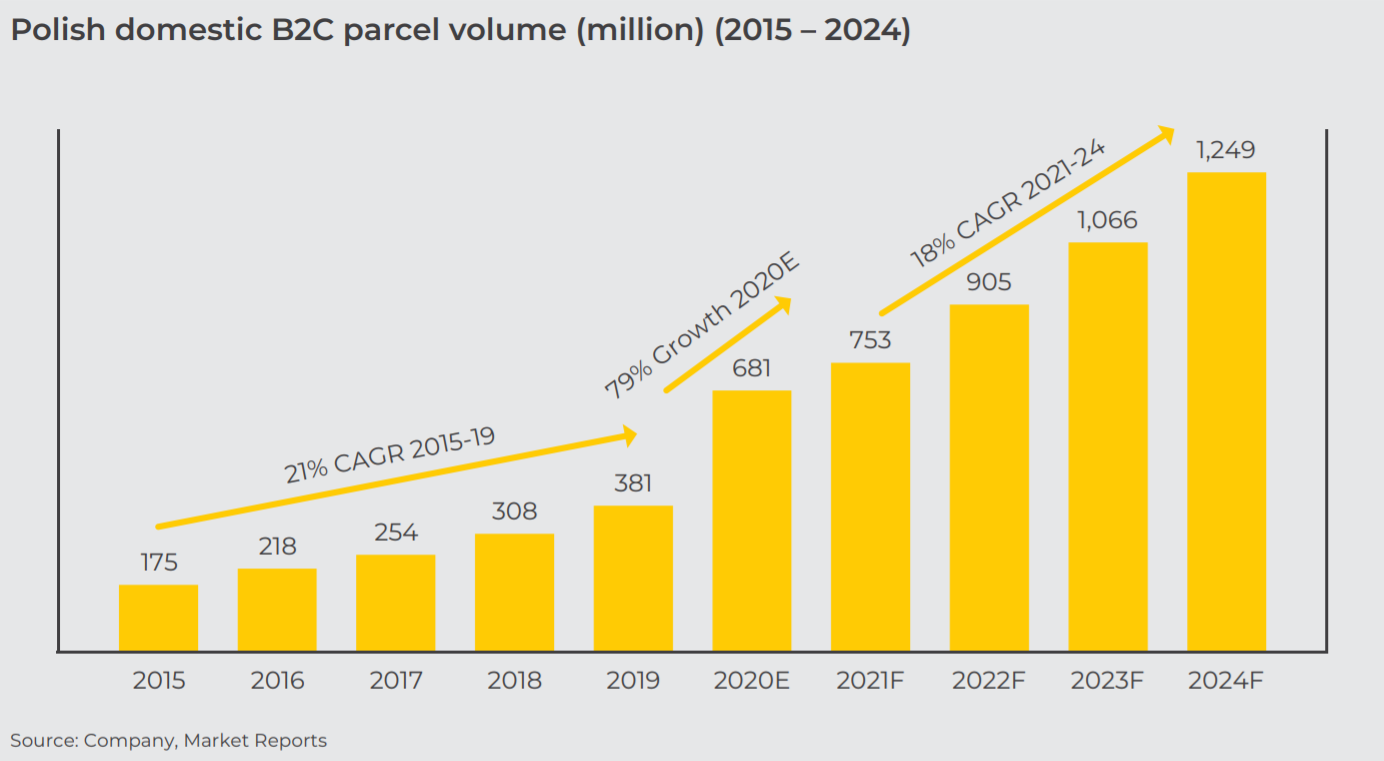

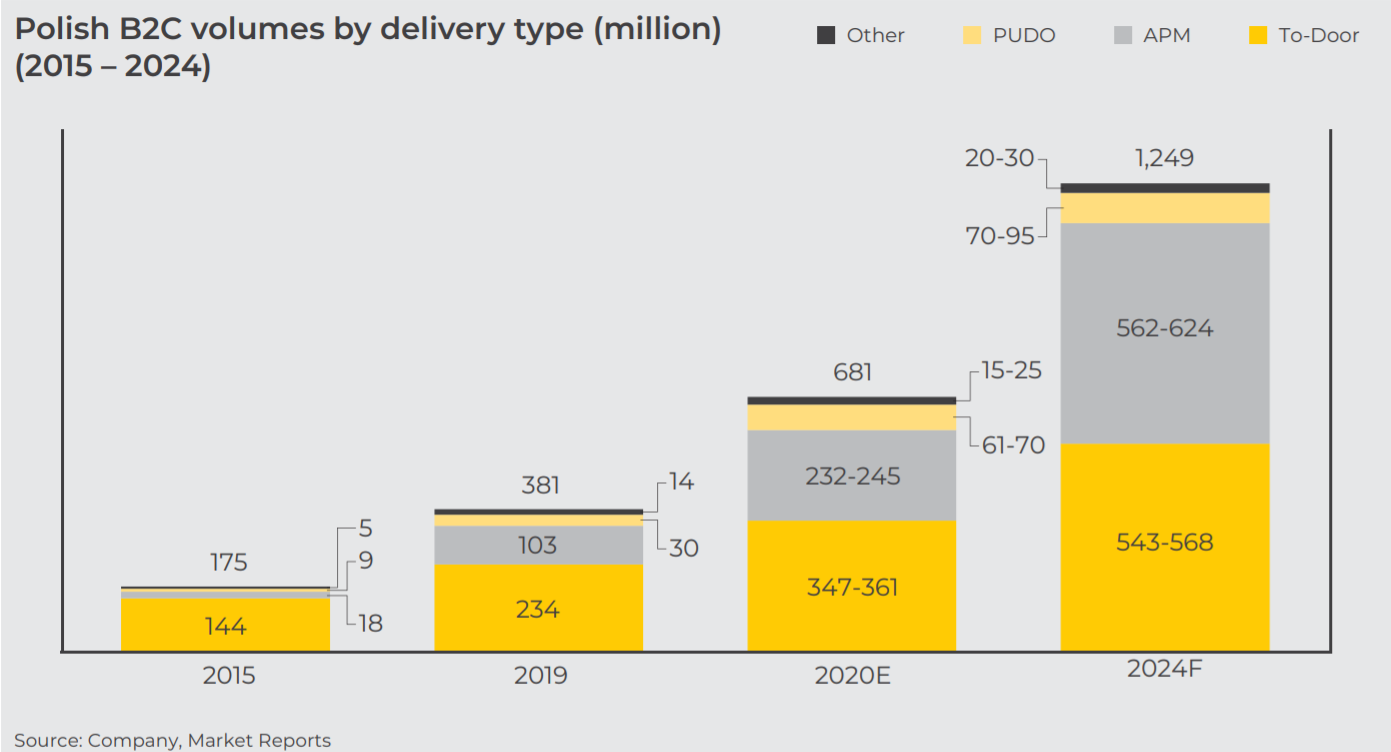

The Polish B2C (Business-to-consumer) market has significantly accelerated during the COVID-19 pandemic. In terms of volume, the market will grow by approximately 79% annually to 681 million units (domestic). This is much faster than in previous years. The high base effect in 2020 will mean that in the coming years the market will probably grow more slowly than in the period before the pandemic.

Source: company's prospectus

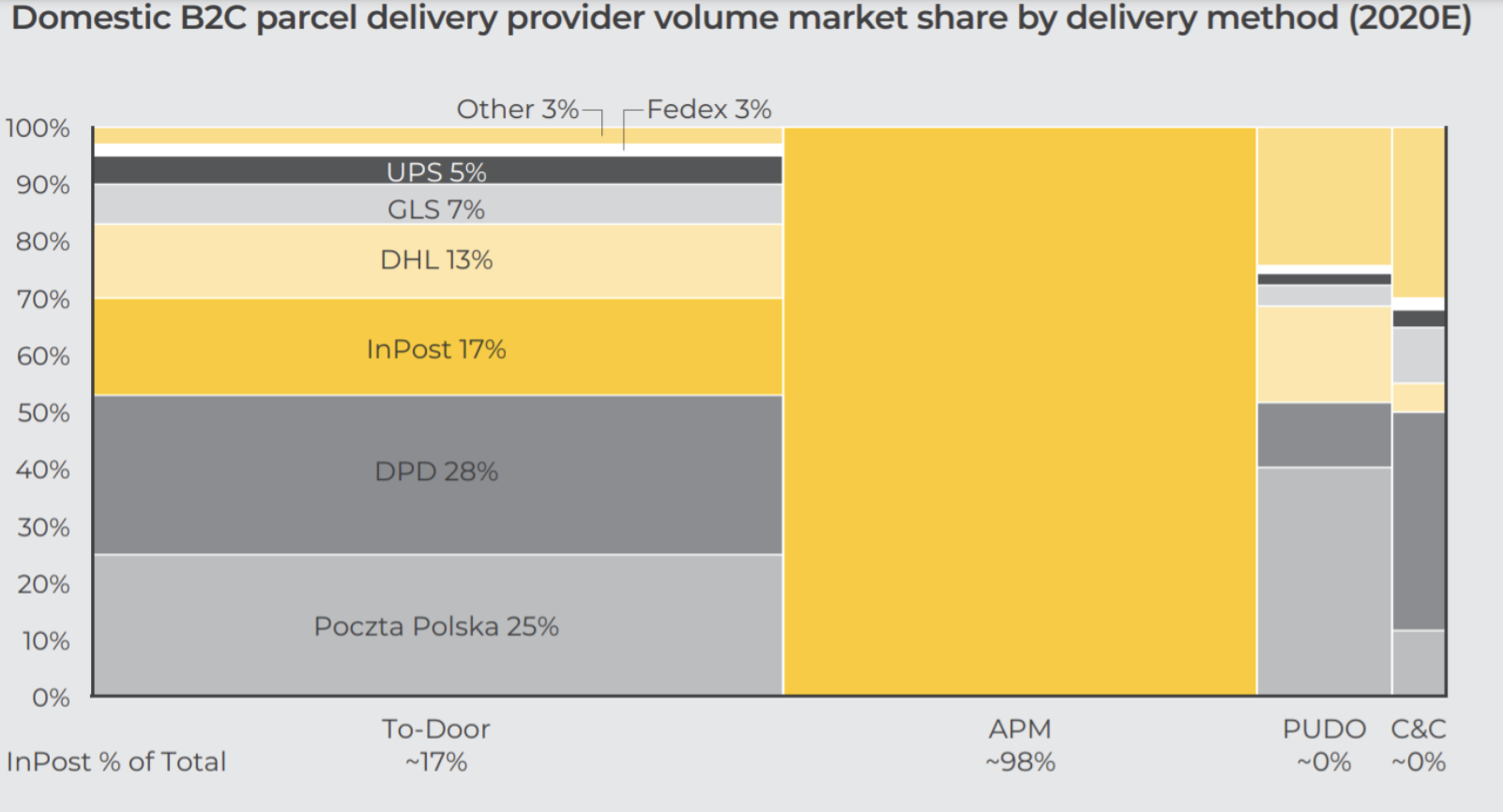

The market is dominated by deliveries of parcels "to the door". However, over the past 5 years, the use of parcel machines as a way to deliver a package to the consumer has increased significantly. Along with the density of the network of parcel machines, there is a chance for an increase in the share of parcel machines in the "mix" of deliveries.

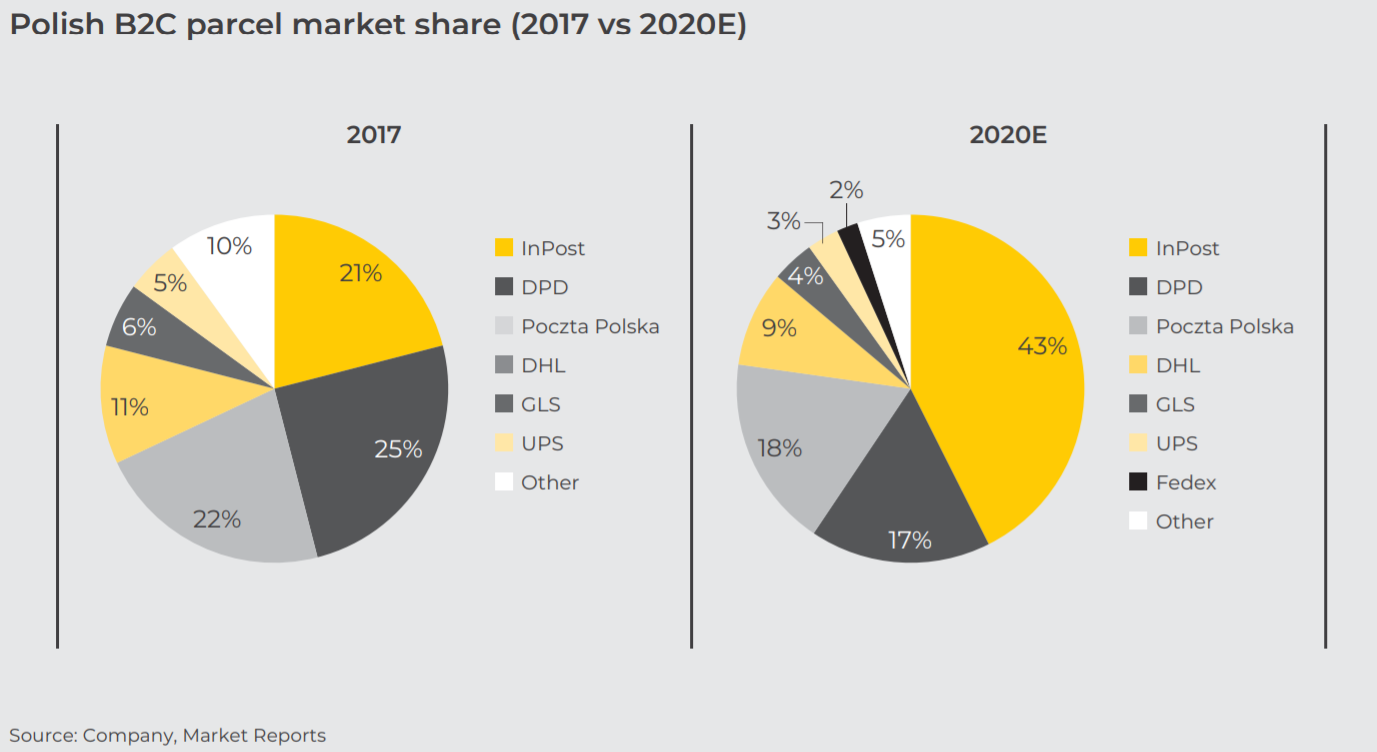

The Polish logistics market is very concentrated. Seven entities play a dominant role (InPost, Poczta Polska, DHL, UPS, FedEx, DPD and GLS). The Brzoski company does not compete on all markets. It focuses on the parcel machines market (pioneer) and courier deliveries in the B2C segment. A significant increase in the share of parcel machines on the B2C market and cooperation with Allegro were among the main reasons for the significant increase in market share by InPost.

InPost's position on the market of "traditional" courier services is much weaker. This segment is dominated by the state-owned Poczta Polska and DPD.

Source: company's prospectus

Parcel lockers are an interesting solution for both sellers and buyers. Sellers can offer lower shipping costs, which helps to convince people to make a deal. For some buyers, the benefits are twofold. First of all, he gets a parcel at a lower cost and obtains flexibility when collecting the parcel (parcel lockers operate 24/7).

InPost can offer lower parcel delivery costs due to operational savings (mainly last mile costs). The company reports that the delivery of more than 70 packages to a parcel locker may be cheaper by half than delivery to the door.

InPost and the foreign market

The e-commerce market abroad is much more developed than in Poland. For this reason, the online sales market itself will grow slower than in Poland.

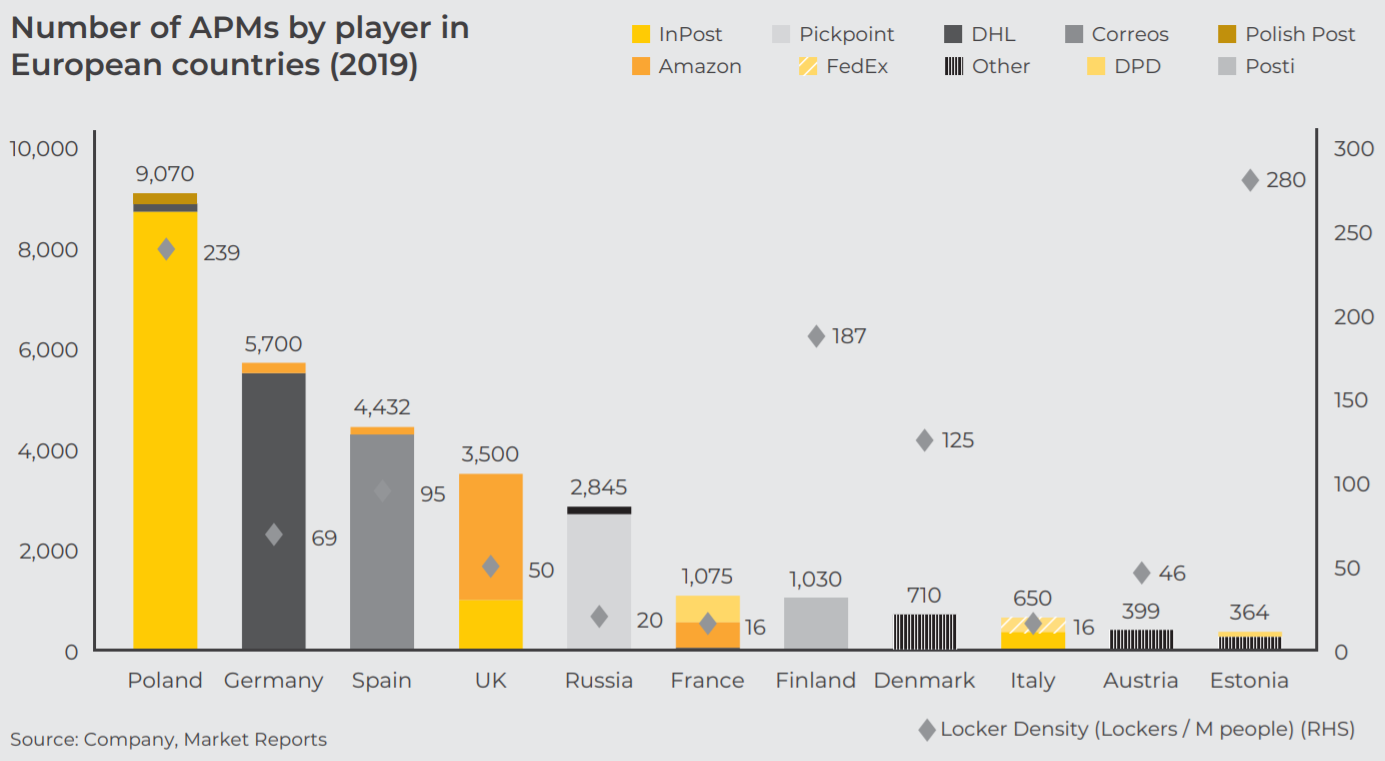

InPost on the foreign market will focus on the development of the parcel machines market. The company does not operate in a vacuum, so there is competition in the foreign market. It is strongest in Germany (DHL), Spain (Correos) and the United Kingdom (Amazon). The aforementioned markets will start to have a lower density of parcel machines than Poland. This gives the potential for the development of a network of parcel machines outside Poland.

The company's financial results

| Integer Group | 2017 | 2018 | 2019 | 9M 2019 | 9M 2020 |

| revenues | PLN 482,5 million | PLN 726,2 million | PLN 1 million | PLN 832,5 million | PLN 1 million |

| Operational profit | PLN -65,2 million | PLN -36,7 million | PLN 128,6 million | PLN 82,7 million | PLN 392,7 million |

| Operating margin | -13,5% | -5,1% | 10,4% | 9,9% | 23,6% |

| Net profit | PLN -109,6 million | PLN 0,3 million | PLN 54 million | PLN -14,8 million | PLN 208,7 million |

| OCF * | PLN -43,8 million | PLN -18,9 million | PLN 292,8 million | PLN 190,6 million | PLN 516,5 million |

| CAPEX | PLN 153,9 million | PLN 135,7 million | PLN 319,7 million | PLN 215,4 million | PLN 393 million |

| FCF ** | PLN -197,7 million | PLN -154,6 million | PLN -26,9 million | PLN -24,8 million | PLN 123,5 million |

Source: own study based on the company's prospectus; * OCF - cash flows from operating activities, ** FCF = OCF - CAPEX

The development of the e-commerce market and the good reception of parcel machines by customers resulted in a significant increase in the company's revenues. At the same time, the improvement in operational efficiency had a positive impact on the profitability of the business. It is worth adding that there is seasonality in this business. The company's revenues follow the dynamics of e-commerce. For the e-commerce market, the highest turnover is recorded in the last quarter of the year. In Q2019 32,5, the company generated 2019% of annual revenues for the entire 38,3. In the previous year, Q2018 was responsible for XNUMX% of the total revenues generated in XNUMX.

It is worth breaking down the generated revenues into individual segments. Revenues generated by the parcel machines segment dominate. In the first 9 months of 2020, the company generated PLN 1 million of revenues from parcel machines (183% of total sales). The segment's revenues increased by 70,96% during the year. The reason for the increase was the increase in the volume of parcels, which on the one hand was driven by the growth of the e-commerce market, and on the other hand, the greater willingness of customers to use non-contact parcel collection. The gross margin on sales improved from 131,5% to 54%.

| paczkomaty | 2017 | 2018 | 2019 | 9M 2019 | 9M 2020 |

| revenues | 245,9 | 393,8 | 776,4 | 511,1 | 1 183,2 |

| Gross profit | 110,1 | 205,3 | 418,9 | 277,3 | 688,2 |

| Gross margin | 45% | 52% | 54% | 54% | 58% |

The second key segment was classic courier services, which accounted for 26,74% of total sales (PLN 445,9 million). The increase was much smaller and amounted to 51,76% during the year. In this segment, the increase was due to both the increased volume and the signing of contracts with large clients such as Vinted (a marketplace with second-hand clothes) and the LPP clothing group. The sharp increase in revenues helped to operate the operating leverage, which led to an increase in gross margin on sales (lowering the unit cost of delivery of a package). It is worth noting that courier services are much less profitable than the parcel machines segment.

| Service courier | 2017 | 2018 | 2019 | 9M 2019 | 9M 2020 |

| revenues | 187,4 | 290,6 | 420,1 | 293,8 | 445,9 |

| Gross profit | 13,4 | 42,5 | 106,6 | 73,5 | 141,9 |

| Gross margin | 7% | 15% | 25% | 25% | 32% |

The company estimates that in 2020 it spent about PLN 500 million on CAPEX. In the near future, the company expects capital expenditures at the level of PLN 600-625 million. In the medium term, CAPEX expenses should amount to 5-10% of revenues. Along with the maturation of the parcel machines base, the capital expenditure should approach 5% of sales. This will be the result of a lower development of parcel machines and an increase in revenues per box.

Infrastructure expenses will mainly concern the foreign market. Currently, the company has 1 parcel machines outside Poland (as at the end of 134). Initially, the company plans to add 2020 - 1 parcel machines annually. Then the expansion is to accelerate to 200 - 1 parcel machines per year. In the medium term, the number of parcel machines is to reach the level of 400 - 2.

The infrastructure maintenance expenses are estimated at PLN 25 million in 2020. In the medium term, this type of expenditure will amount to between PLN 25 and 30 million. In the long term, the costs of maintaining parcel machines will range from 0,5% -1% of revenues. The average "life time" of a parcel locker was estimated by the company at 15-20 years.

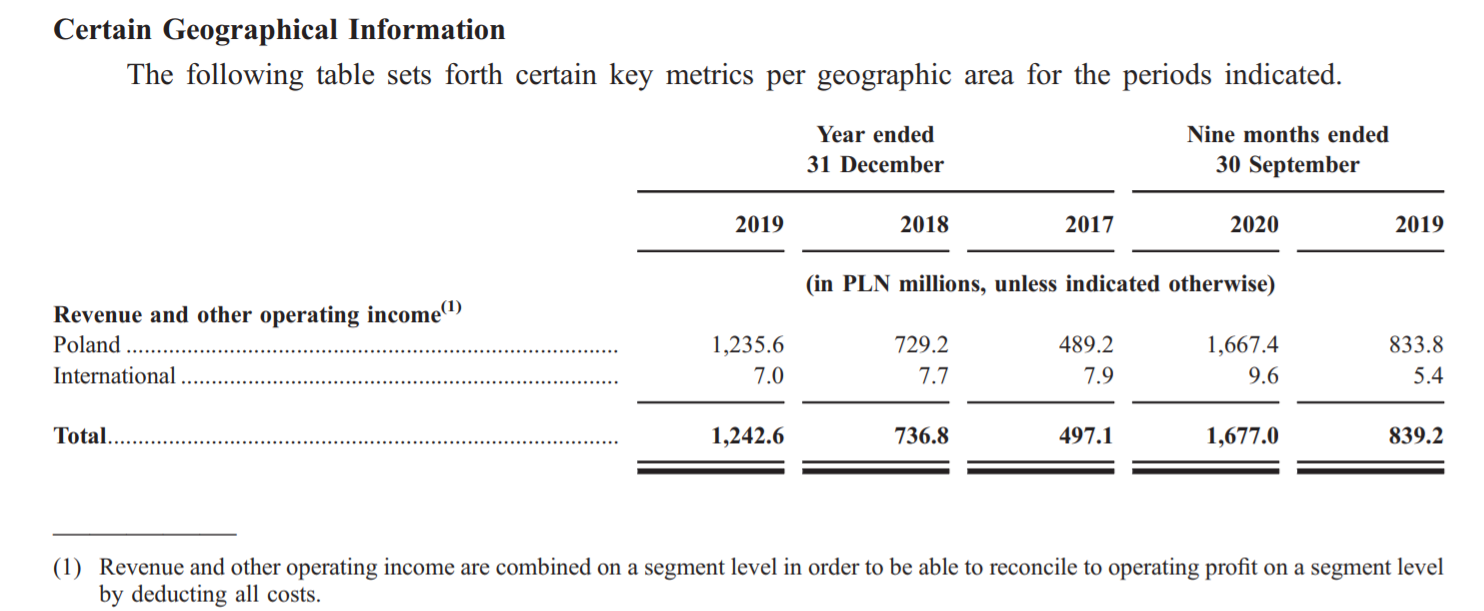

The company is geographically poorly diversified. In 2020, the company generated approximately PLN 13 million in revenues from foreign markets. The company intends to generate revenues of PLN 60-80 million in the near future. The break-even point on the foreign market is planned for mid-2022 (EBITDA).

Source: Company prospectus

The largest category of expenses is external services, the largest share of which are couriers who set up their own business and cooperate with InPost, and seasonal workers in sorting plants. Thanks to this move, the company "optimizes" employment costs. External services in 9 months of 2020 amounted to approximately PLN 836 million (increase by 71,2% y / y). It is worth noting that the increase in costs was 30 percentage points lower than the increase in sales. The operational leverage helped (eg more parcels for loading, better "utility" parcel machines). This helped the company improve its operating margin. Payroll costs in the first three quarters of 2020 amounted to PLN 131,6 million. This confirms the thesis that employees are "pushed" into their own business.

Company balance sheet structure

At the end of 2019, the company had PLN 1,57 billion in assets. Over 60% of them (less than PLN 1 billion) are fixed assets (buildings, parcel lockers, etc.). Due to its activities, the company does not have significant inventories (PLN 2,2 million). Receivables did not exceed PLN 216 million. The company had PLN 613 million of long-term debt and several million short-term debt. At the end of December 2019, loans to AI Prime Bidco (a company controlled by the Advent fund) remained outstanding. The interest rate on the debt was 1M EURIBOR + 6,25% -6,5% margin. In 2019, loans from mBank and PKO BP (PLN 39,7 million in total) were repaid with an interest rate of 1-month EURIBOR + 2,5% margin.

The company's operational data

The company could boast of 310 million parcels delivered in 2020 (a year earlier it was 144 million parcels). Approximately 61 million were delivered to the customer's door (40 million shipments a year earlier). The current dynamic increase in shipments is the result of COVID-19 and the transition of a large part of the trade to e-commerce. InPost is the beneficiary of the increased volume of shipments.

Source: prospectus

Two things contributed to the success of parcel machines on the Polish market. Firstly, it resulted from very poor experiences with courier services (contact with the courier, parcel collection) and the willingness of customers to collect parcels themselves. As a result, parcel lockers were created, which gave flexibility to collect the parcel (at a time convenient for the client) with a reduction in last mile costs (delivering parcels to parcel machines, not to the client's door). The company also offers access to the shipment status from the application level (also remotely opening the locker). The "InPost Mobile" application is to be implemented in the UK in 2021.

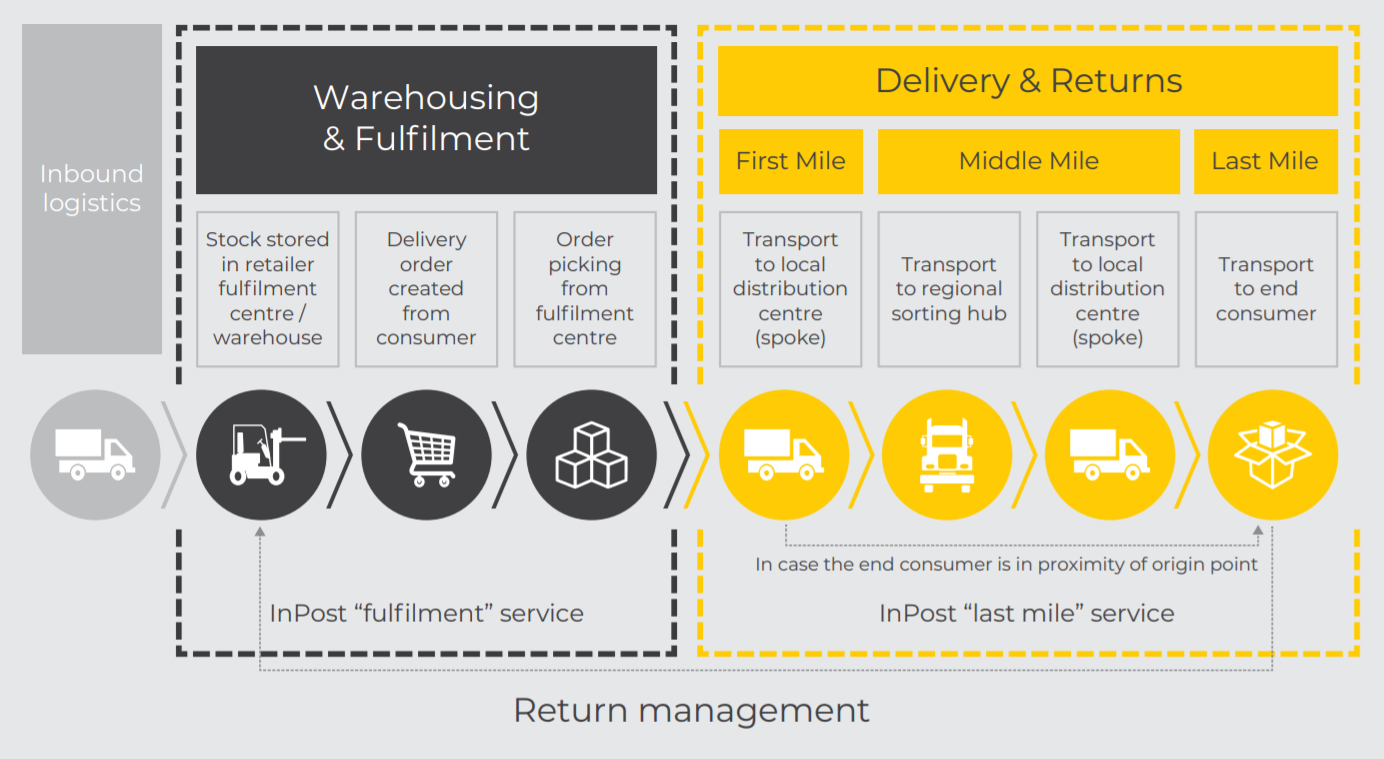

The company also offers fulfillment services for sellers. It is a one-stop-shop solution that offers storage, preparation and shipping to the customer. At the same time, he deals with the management of customer returns.

Most of the revenue is generated from payments from vendors for delivering products to the customer's door or to parcel lockers (APM).

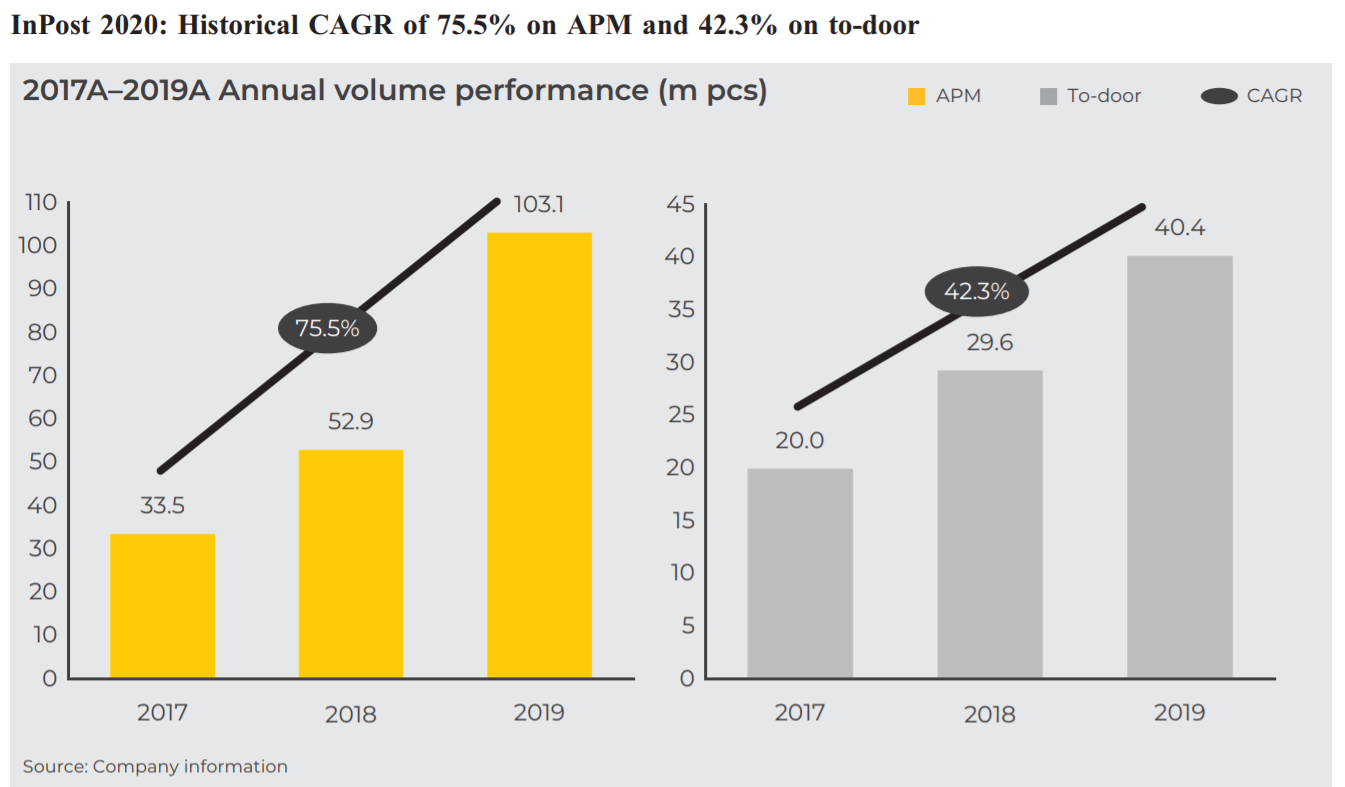

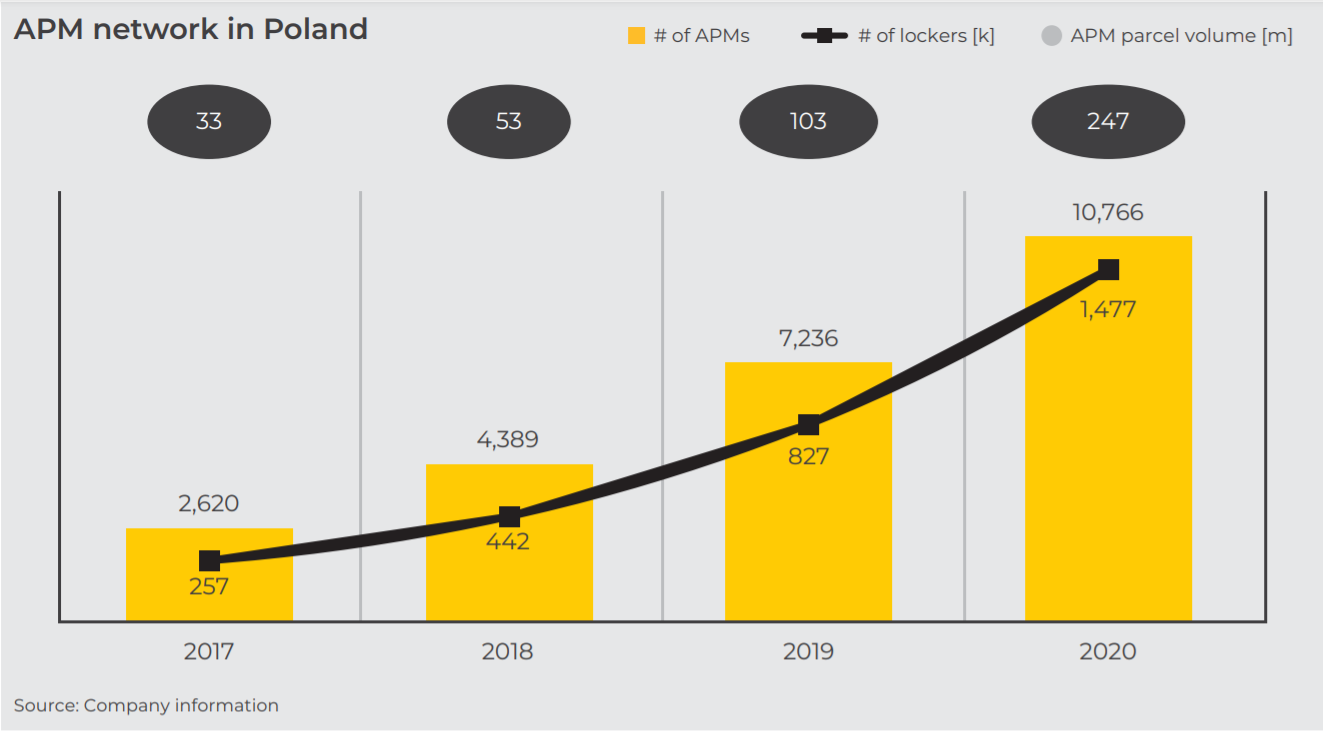

Between 2017 and 2020, the number of parcels delivered using parcel machines (APM) increased from 33,5 million to 247,2 million. Along with the increase in the scale of operations, the company had to expand the number of collection points. At the end of January 2017, the company had 2 parcel lockers (182 boxes). At the end of 150, Integer (a subsidiary of InPost) had 728 APMs in Poland (2020 boxes).

The company reports that the cost of 1 new parcel locker location is PLN 71. PLN in 2019 (PLN 109 thousand in 2017). New parcel lockers usually have 130 lockers. The cost of expanding old parcel machines (by 30-41 boxes) costs from PLN 13 to PLN 16. According to the data provided by the company, the payback time on investment in a parcel locker (2019 cohort) is approximately 13 months.

The expansion of parcel machines depends on the utilization rate. A 100% utilization rate means that a given cache had 1 package on each working day. The indicator may exceed 100% if there were, for example, two packages from one shipment in one locker. The company treats the parcel locker as "mature" if it can boast a utilization rate of 72%. At the end of September 2020, Integer had an utilization rate of 80%. For parcel machines operating in 2019, the ratio was 85%, which gave the gross profit on sales at APM of PLN 123. It is worth mentioning that the annual cost of maintaining a parcel locker is PLN 000 per year. As a rule, the parcel locker reaches "maturity" two years after installation.

Customers and relations with Allegro

It should be remembered that the company's main customer is Allegro, which in 9 months of 2020 was responsible for 26,2% of revenues (Allegro Smart service!). At the same time, sellers on the Allegro platform generated an additional 20,7% of the company's revenues. This is a significant concentration of customers, which may hit the company if Allegro creates a similar service. The next 10 largest clients accounted for only 7,5% of the company's revenues.

Check it out: Allegro on the stock exchange - How to buy shares? [Guide]

The company distinguishes the following types of clients:

- "Telesales", i.e. sellers generating revenues up to 2000 per month,

- Medium and small sellers - up to PLN 5000 per month,

- Large sellers - up to PLN 20 per month,

- Key clients - up to PLN 50 per month,

- Strategic sellers - over PLN 50 per month.

Customers are assigned to particular categories every 6 months. For the company, the most important clients are those generating revenue over PLN 5000 per month. This is due to the greater stability of sellers (and therefore a more stable "source of shipments") and lower risk of write-offs of receivables. At the same time, the company is trying to expand the base of sellers, because InPost's business should 'grow' along with the customers. The larger the database of sellers, the greater the likelihood of establishing contracts "with the winner". The company signs contracts with sellers generating over PLN 5000 monthly income. Agreements are usually signed for several years with a one-month notice period. The shipping cost depends on the choice of the delivery model (parcel locker or delivery to the customer) as well as the weight and size of the shipment. It is worth noting that in the first 9 months of 2020, the average cost of delivery to a parcel locker was PLN 7,34, and to the customer's door was PLN 10,60. Compared to the previous year, the cost of delivery to the parcel locker increased by 1%, while the increase to the customer's door was 5-6%.

For smaller sellers, there is a subscription model (12-24 months) or a "pay-as-you-go" model.

The company offers its clients deferred payment, which is from 14 to 90 days. As a result, the company runs the risk of writing off some receivables (no collection). On the other hand, flexible payment methods allow you to increase the number of customers. The company uses payment monitoring and customer credit assessments to minimize the risk of significant write-offs.

The company is also trying to sign strategic cooperation agreements with the largest players on the e-commerce market. InPost has contracts with, among others, AliExpress and Allegro.

Contract signed with Allegro

In September 2020, InPost signed a 7-year contract with Allegro for the provision of parcel locker services for "Allegro Smart!". Many Allegro users joined the "Allegro Smart!" Program. At the end of the second quarter of 2020, the number of program users was 2,1 million. The agreement also specifies the minimum number of packages handled during the partnership. Corrections in the volume of parcels depend on the development of the e-commerce market and the dynamics of parcels by InPost parcel lockers as part of the Allegro Smart! Service. The commitments last 4,5 years with the possibility of extension by Allegro for another 2,5 years. The contract also covers shipping costs. During the first 2 years, shipping costs (for Allegro and sellers on the platform) cannot increase without Allegro's consent. After this period, prices are indexed by the inflation rate specified in the contract. At the same time, the contract contains provisions specifying the conditions that InPost must meet in cooperation with other contractors. Additionally, Allegro had the pre-emptive right to InPost, but did not use it.

The contract covers two parties. First, InPost has a partnership with the main client for the next few years. As a result, it is easier for the company to plan capital expenditure to scale the business. On the other hand, Allegro can develop the Smart! without fear of the prices of courier services on the part of the parcel locker operator.

Company forecasts

The company assumes that in the medium term, the average price for the delivery service to the parcel locker will slightly increase. As a result of foreign expansion and an improvement in the "utilization rate", revenues are to grow between 20% and 25% in the medium term.

In the case of "traditional" courier services, the company expects revenues from this segment to increase between 15% and 20% in the medium term. Therefore, Inpost expects parcel lockers (APM) to be the main growth factor. As a result, the share of "to-door" revenues will decrease in the coming years.

Is it worth buying InPost shares

During the period of increased deliveries, InPost showed that the company can achieve a satisfactory operating margin. At the same time, the quick "maturation" of parcel machines allows you to effectively scale your business. The company does not operate in a vacuum, so expect significant competition in the coming years. Allegro, AliExpress, Orlen and Poczta Polska want to enter the parcel locker market in Poland. What counts for the customer is the ease of pickup and delivery reliability. A secondary matter for the final recipient is whether he will pick up from the InPost or DPD parcel locker. At the same time, be aware that this is not an ideal solution for the customer. It is just less onerous than waiting for a "late" courier at home. If effective logistics develops in Poland (delivery "to the door" on the same day) and, in addition, is timely, the long-term sense of the existence of parcel machines will be questionable in large cities. In such a situation, price competition will be necessary, which will hit the profitability of the business. The question whether customers will prefer to save a few zlotys by spending their time on reaching the parcel locker will remain an open question. It is worth remembering that customers are very sensitive to changes in pricing policy, as demonstrated by the Chinese Hive Box (with over 180 "parcel machines" in 000 cities). The suspension of the free storage of deliveries in vaults in 110 resulted in customer dissatisfaction and calls for a boycott of the company's services.

On the other hand, parcel lockers in smaller towns can still be a useful supplement to courier services. E-commerce in smaller towns is growing faster due to a lower saturation of online shopping than in larger cities.

The investor should remember that one of the risks is the possibility of terminating the lease agreements for parcel lockers. In this case, Inpost will have to move a parcel locker, which may affect customer traffic (worse location).

A necessity for the company is to thicken the network of parcel machines in order to improve its offer for customers. Increasing the scale of operation will require an increase in the number of parcel machines. This in turn is a very capital intensive endeavor. The Company may not generate expected cash flows from operating activities that will be able to cover the necessary capital expenditure (CAPEX). As a result, the company will be forced to incur debt (which in the current low interest rate environment may not be a bad idea) or raise capital (using attractive valuations). For now, InPost intends to pay the shareholder several dozen million zlotys in the form of dividends. The company mentioned in the prospectus that it agreed to pay PLN 40 million in dividends to the main shareholder (companies controlled by the Advent fund) for the 2019 profit.

A separate issue is the company's valuation, which exceeds PLN 44 billion. The company is developing dynamically, but it seems that the current valuation already includes the development in the coming years. With revenues that in 2020 will probably amount to around PLN 2,5 billion, this gives a multiplier of several times the revenues. This is a valuation similar to that of many tech companies. For now, InPost is not a tech company, but it certainly benefits from online trading. For this reason, InPost can be considered a growth company. InPost has a significant share on the Polish market, therefore, we should expect a growth rate of several percent per year. For this reason, foreign expansion is of key importance, as it will allow it to grow faster than the growth rate of the e-commerce market in Poland. Without success in the overseas market, the current valuation will be difficult to defend.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![InPost shares - is it worth investing in parcel lockers? [Guide] how to buy inpost shares](https://forexclub.pl/wp-content/uploads/2021/02/jak-kupic-akcje-inpost.jpg?v=1612085356)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![InPost shares - is it worth investing in parcel lockers? [Guide] US inflation](https://forexclub.pl/wp-content/uploads/2021/02/ukryta-inflacja-saxo-bank-102x65.jpg?v=1611923453)

![InPost shares - is it worth investing in parcel lockers? [Guide] GameStop or GameOver](https://forexclub.pl/wp-content/uploads/2021/02/GameStop-czy-GameOver-102x65.jpg)

Leave a Response