Geopolitical risk and peak interest rate speculation

Return on the Bloomberg Commodity Markets Overall Return Index (Bloomberg Commodity Total Return) was almost 1% in September, a month that highlighted the difference between the energy (excluding natural gas) and industrial metals sectors on the one hand, and the grains and precious metals sectors on the other. In September, we learned two key pieces of information that ultimately set the tone for all markets. The first concerned the decision of Saudi Arabia and Russia to extend unilateral production cuts until the end of the year, which contributed to a sharp increase in energy prices. The US Federal Reserve then issued a message about "higher rates for a longer period of time".

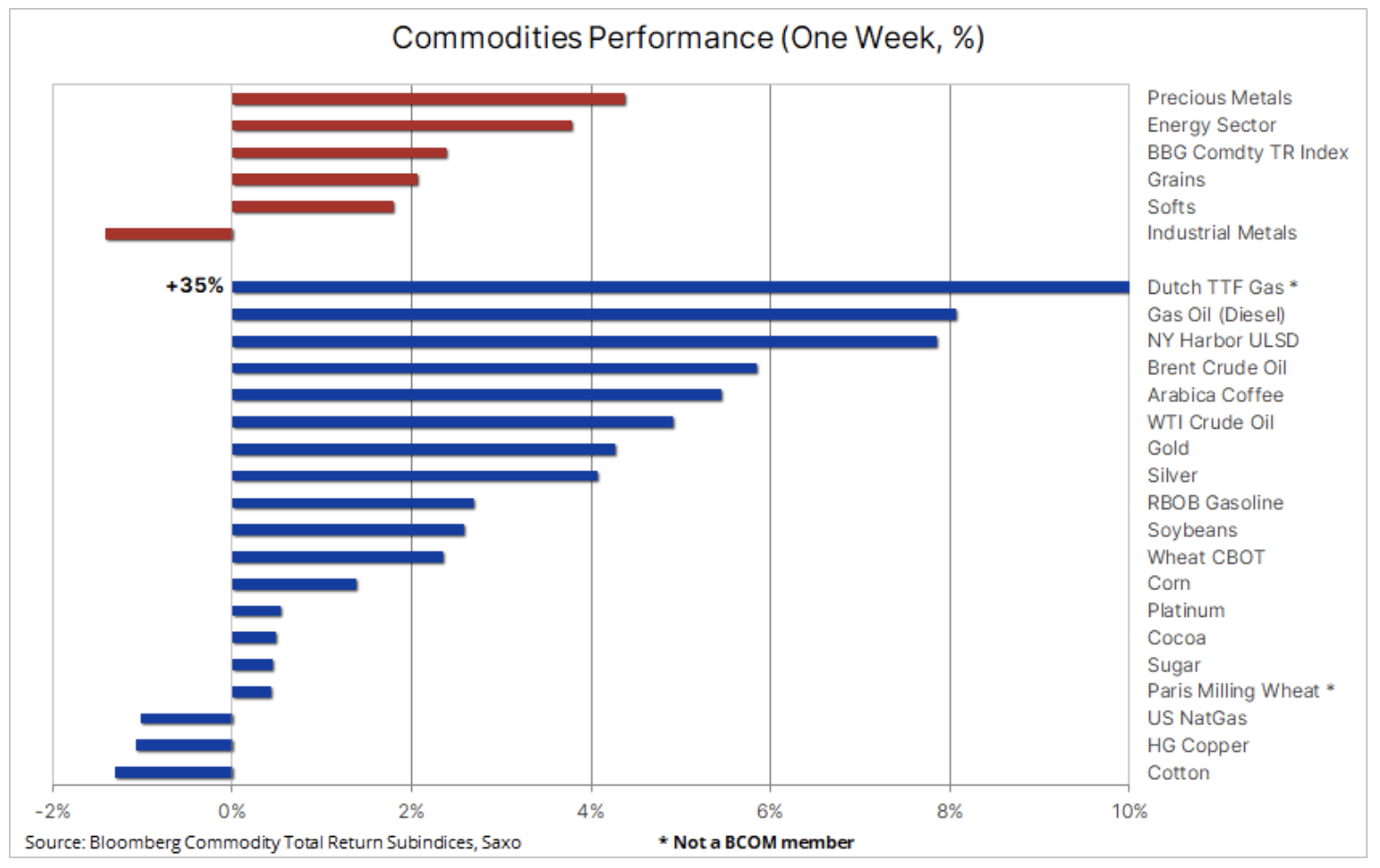

Prices of most key commodities reversed and rose sharply last week as the tragic events in Israel raised concerns about stability in the region, supporting the energy sector, including the dynamic rise in gas prices in Europe. After weeks of weakness, the precious metals sector saw strong growth, supported by demand for hedging investments in the Middle East and comments from several members of the U.S. Federal Reserve that the recent rise in Treasury yields reduced the need for additional rate increases. With peak interest rates approaching and despite a stronger-than-expected US inflation reading in September, gold managed to break above key resistance.

Additionally, the grain sector rose for a second straight week after the U.S. government revised down this year's U.S. soybean and corn harvest, which led to a decline in global inventories. Overall, all three key crops continue to trend down due to significant levels of global supplies, including: from South America. Combined with the recent strengthening of the dollar, this has caused the competitiveness of U.S. exporters to deteriorate, forcing them to lower prices to levels that would ultimately appeal to foreign buyers.

Overall, the Bloomberg Commodity Total Return (BCOMTR), which monitors a basket of 24 most important commodity futures contracts, increased by 2,4%, maintaining the upward trend that started in June. The largest increases were recorded by four diesel and crude oil futures contracts, while the absolute exception was the EU gas futures contract (not included in BCOMTR), which increased by as much as 35% to a seven-month high. At the same time, gold recorded its best week in seven months thanks to a situation in which speculative investors were forced to cover recently opened short positions and thanks to upward momentum attracting new buyers.

On the other hand, HG copper was one of only three raw materials that fell last week under pressure from rising inventories in LME-monitored warehouses to two-year highs and, as a result, deteriorating sentiment among delegates at the LME's annual meeting in London amid concerns about the global economic growth. Add to this the at best uneven recovery in China and the short-term outlook remains bleak, but downside risks are mitigated by an overwhelmingly positive long-term outlook.

The war risk premium drives up oil and fuel prices

After recent aggressive declines across the energy sector amid a sharp rise in bond yields and a strong dollar fueling demand concerns, there has been a sharp reversal as a result of the Hamas attack on Israel and subsequent counterattacks on the Gaza Strip. There is no doubt that a prolonged war between Israel and Hamas could destabilize the situation in the Middle East and, at worst, reduce global supply after Iran's foreign minister warned that Tehran-backed militants could open a new front.

Moreover, the IEA in its monthly report on the oil market stated that the recent retreat oil from around USD 100 per barrel showed that prices had risen to levels that could result in a decline in demand, while OPEC maintained its projections for a record deficit this quarter, amounting to 3 million barrels per day. At the same time, EIA reported that U.S. crude production hit a record 13,2 million barrels per day and inventories showed the largest weekly gain since February, with refineries operating at their slowest pace since January due to seasonal maintenance.

While the macroeconomic outlook remains bleak and demand shows signs of weakening, particularly in the United States, where implied four-week average gasoline demand shows a steady decline, the prospect of geopolitical supply disruptions and further OPEC+ production cuts will provide support to prices in the coming weeks .

Saudi Arabia and its Middle Eastern neighbors, who have fought so hard to support oil prices while sacrificing revenues in the process, are unlikely to accept significantly lower prices. Therefore, we believe that support for WTI and Brent crude oil will be found, or perhaps already has been found, before the level of USD 80. Barring any geopolitical disruptions, upside potential now appears equally limited, while a bearish bulge in the US yield curve continues to raise stagflation concerns; Taking this into account, the price of Brent crude oil may stabilize again in the range of $85 to $95, which we would describe as "ideal" for now - not too low for producers and not too high for consumers.

After correcting by almost 15% in early October, renewed tensions in the Middle East and concerns about supply disruptions caused Brent crude to strengthen towards $90. It is almost impossible to make any forecasts for the coming weeks, but it can be noted that producers from the Gulf Cooperation Council, led by Saudi Arabia, have very large production reserves, which may be released if the worst-case scenario materializes - if such a decision is made .

Gas prices in the EU are going up due to concerns about winter supply

European futures contract on gas TTF saw its biggest increase since last summer as war in the Middle East led to Egypt disrupting supplies from Israel and Finland suspects a gas pipeline leak in the Baltic Sea was the result of sabotage, fueling concerns about the security of Europe's energy infrastructure ahead of peak winter demand. Let us recall that last year there were explosions in the Nord Stream gas pipeline from Russia to Germany; So far, it has not been determined who is responsible for this.

However, the 35% increase, which at one point pushed the price to a high of EUR 56 per MWh for the first time since February, began after Israel ordered Chevron to halt production at the Tamar gas field. This facility delivers gas via pipeline to Egypt, where some of it is then converted into LNG and shipped to Europe. While the supply disruption is likely to be temporary, it highlights Europe's growing dependence on gas imports from countries other than Russia. Despite the very strong strengthening seen last week, the current price still shows relatively little change compared to EUR 160/MWh in the same period last year, proving that the market is much better prepared for the coming winter as storage facilities across the region are close to being full , and demand fell by over 15% as the recession and high energy prices hurt many energy-intensive industries.

Improved gold fundamentals just after deterioration in the mood of speculative investors

Gold posted its biggest weekly gain in seven months due to demand for hedging investments in response to the tragic events in the Middle East, as well as comments from Federal Reserve members preparing the market for a scenario of peak interest rates. Before rebounding, gold saw a decline of as much as +$130 to near key support above $1. As a result of this weakness, hedge funds maintained a net short position before the rebound that followed the Hamas attacks on Israel.

The latest decline culminated in another surprisingly strong U.S. jobs report, which supported the narrative of longer rates for an extended period of time and pushed U.S. Treasury yields at the long end of the curve to new multi-year highs. Since then, however, yields have begun to decline again as a result of the tragic events in the Middle East and comments from several Fed members who emphasized that rising bond yields reduce the need for further rate increases by the FOMC. Both of these events forced hedge funds to return from their recently created net short position to a net long position.

In our recently published QXNUMX forecast, titled “Bonds. Let's buy bonds", we argue that real interest rates are too positive, which will negatively impact sectors and consumers in need of refinancing. With spending likely to slow down and the U.S. fiscal cycle shifting from headwind to headwind, the world may actually hit peak interest rates, offering a once-in-XNUMX-year opportunity to go long bonds. In relation to bonds, we further noted that the risk of stagflation and a 'higher rates for longer' scenario, driven by inflation expectations and most recently driven by higher energy prices, could pose a threat to the timing of our bond call forecast. However, the economic slowdown, with the delayed effects of the last cycle of interest rate increases, will force central banks to cut rates, lowering the short end of the US yield curve, and as the effects of this situation deepen, the long end of the curve will also fall, reflecting the need for lower or even negative long-term real interest rates.

Despite yields rising again following a stronger-than-expected US inflation reading in September, the gold market appears to be refocused on support, particularly given the prospect of rising yields - in line with last week's Fed comments - reducing the risk of further interest rate increases . In our latest analysis precious metals market, we take a closer look at these and other recent events contributing to improved sentiment.

Gold continued to rise on Friday after an impressive week in which there was no attempt to close the ten-dollar gap below USD 1 that opened on Monday. After breaking back above $844, the next major resistance level will be the two-hundred-day moving average near $1, followed by the recent high near $900.

Cereal prices are rising, but the downward trend continues

The US grain and soybean sector, primarily falling wheat prices, received a small boost after the US Department of Agriculture (USDA) in its monthly report set the soybean harvest at 4,104 billion bushels, which is 42 million bushels less than forecast in September and 30 million bushels less below average analyst estimates. The price spike that followed the publication of this report also contributed to higher prices wheat and corn after falling to their lowest levels in three years and 3 months, respectively, last month. The price of the December wheat contract fell by a third compared to the same period last year, while corn lost 33% and soybeans just 29%. Prices for these three key crops were negatively impacted by the summer harvest, which turned out to be better than initially feared, and a stronger dollar made exports from other producers more competitive, particularly in the case of Brazil and Argentina in the context of corn, and Russia and Europe in the context of wheat.

Once the Northern Hemisphere harvest is complete and the results are known, the market will focus on South America and Asia, especially given the prospect of La Niña causing drought in Australia, a major wheat producer, while supporting production in South America as La Niña usually provides plenty of rain.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![STI 30 – Singapore Stock Exchange – Does a great country also mean a great index? [Guide] singapore stock exchange sti 30 singapore](https://forexclub.pl/wp-content/uploads/2024/05/singapurska-gielda-sti-30-singapur-184x120.jpg?v=1715232642)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-300x200.jpg?v=1715055656)

Leave a Response