How and why to diversify your investment portfolio?

Even at the earliest stages of investing, it is important to remember that we are building a portfolio that will be with us throughout our lives. Of course, novice investors often start their investment life by testing the conditions by purchasing shares of one or two companies with which they are somehow related or to which they have sentiment. However, this is rarely the path to long-term success, and a diversified core portfolio is an important first rule for pursuing more stable, long-term success.

Big risk: owning just a few shares

By investing in just a few companies, our entire portfolio depends on their performance. And although we can always see what happened in the past, no one can predict what the future of a given company will look like. Imagine that in the late 90s you built a portfolio that included Kodak, Blockbuster, and Nokia after all three companies had made spectacular profits for years. By the second decade of the XNUMXst century at the latest, all three companies were in decline, leaving investors with virtually nothing. Worse still, investors who have selected particular stocks often feel married to a given position in the hope that prices will return to highs, and are unable to decide to exit it for fear of a situation in which they would suffer a loss in the wrong moment. moment only to see stock prices rise again. This is the definition of "the tendency to regret a decision."

The solution is diversification

Diversification is the first tool investors should consider to avoid risking their portfolio where a single event could jeopardize their savings and to prevent them from being caught in the crossfire of emotions that cloud their decision-making. diversification spreads investments across sectors, countries and industries to reduce portfolio risk while maintaining exposure to potential market growth over time.

In a diversified portfolio, a given financial event may be negative for some investments but positive for others. Best of all, the broad exposure to the market comes with much lower behavioral risk than selecting individual stocks. Knowing that historically, with a more diversified approach, the stock market has always bounced back over a sufficiently long time horizon, even if individual companies have failed to do so, gives you confidence.

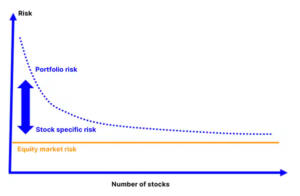

This concept is illustrated in the chart above. As you can see, with a small number of shares, the share-specific risk in the portfolio is high, but it decreases as the number of added shares increases and approaches the level of general stock market risk, i.e. the risk associated with owning shares of all listed companies in the world.

Turbocharging: asset allocation

As you can see in the chart above, the effect of adding shares reduces the risk of portfolio volatility the more the more shares we add. If we wanted to diversify our portfolio even further and thus lower the risk to the portfolio, we could also add other asset classes such as debentures, which historically are not typically closely correlated to stocks over the long term - 2022 was a notable exception!

How to start diversifying your portfolio today?

If you choose the security of your savings over your emotional relationship with your investments, we have good news for you: diversifying your portfolio has never been easier than it is today. This is due to two reasons:

- Transaction costs have dropped significantly (see new, extremely low Saxo commissions)

- The extensive exchange-traded funds (ETF) market offers a wide range of effective diversification opportunities.

Diversifying your stock portfolio using single stocks

If you want to diversify your portfolio, you need at least ten stocks from unrelated sectors. For inspiration, we've highlighted the two largest companies in each major sector in the United States and Europe in the table below.

Diversification of stock portfolio through ETFs

If you're aiming for a fully diversified portfolio, the best and most cost-effective way is to choose a global equity ETF. Simply put, basic ETFs are funds that include a number of shares, but which can be traded like stocks. The most popular ETFs track the major stock indexes. In Europe, the largest fund providing exposure to global equities is:

World shares: iShares Core MSCI World UCITS ETF

- Ticker Saxo: IWDA:xams

- Includes: 1 shares from 500 developed markets

- Total assets: USD 72 billion

- Dividends are not paid, but reinvested in the fund in a tax-efficient manner

- Annual costs are 0,2%

Add bonds to your portfolio for greater diversification

If you want to diversify your portfolio even further, a relatively easy way is to invest in a global bond ETF. In Europe, the largest fund providing exposure to global bonds is:

Global bonds: iShares Core Global Aggregate Bond UCITS ETF

- Ticker Saxo: AGGH:xams

- Includes: approximately 14 bonds in key developed markets, including treasury, corporate and mortgage-backed bonds

- Total assets: USD 8,9 billion

- Dividends are not paid, but reinvested in the fund in a tax-efficient manner

- Annual costs are 0,1%

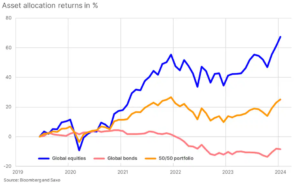

Below is a comparison of the performance (in USD) of a stock ETF, a bond ETF, and a portfolio with 50% of each fund. Even though the best results are generated by stock ETFs, a portfolio with a 50/50 distribution is less volatile. Bonds have had a bad run recently due to the historic rise in interest rates, but if over the next five years equities underperformed but interest rates remained fairly stable, diversifying into bonds would improve the overall outcome.

The point of diversification is that you should avoid taking unnecessary risks with a particular company and achieve the highest possible returns on your savings without unnecessary stress.

About the Author

Peter potter - director of equity markets strategy in Saxo Bank. Develops investment strategies and analyzes of the stock market as well as individual companies, using statistical methods and models. Garnry creates Alpha Picks for Saxo Bank, a monthly magazine in which the most attractive companies in the US, Europe and Asia are selected. It also contributes to Saxo Bank's quarterly and annual forecasts "Shocking forecasts". He regularly gives comments on television, including CNBC and Bloomberg TV.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)