First signs of improvement in key commodity sectors

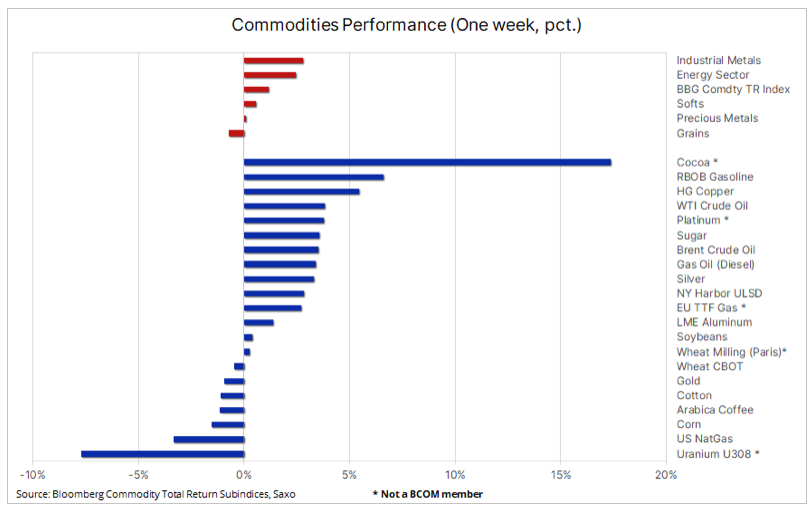

The commodity sector recorded its third consecutive weekly gain, and although precious metals and the so-called soft products, we have seen strengthening across the board over the last few weeks, with two notable exceptions being wheat and uranium. The Bloomberg Commodity Total Return Index, which tracks a basket of 24 major commodity futures spread evenly among energy, metals and agricultural products, hit a three-month high, raising questions about whether the year-long consolidation phase is coming to an end.

WTI and Brent crude oil hit four-month highs after the IEA completely revised its supply and demand forecast for 2024, showing a deficit amid an expected prolonged period of OPEC+ production cuts. Gold, supported by silver, remains resilient, holding on to most of its recent strong gains despite a strengthening dollar and a rise in yields following better-than-expected CPI and PPI readings this week. Based on this data, the market concluded that the US Federal Reserve would adopt a cautious stance and wait for more evidence of a decline in inflation towards its 2% target. As a result, expectations of a 25 bp interest rate cut in June dropped to 75% compared to 95% at the beginning of the week.

Meanwhile, copper and copper mining companies attracted the market's attention after the green metal king hit an eleven-month high after rising 6%, supported by the already tight supply in the market, which may deteriorate further due to the prospect of Chinese smelters reducing production. The price of iron ore (down 30% year-on-date) has fallen below USD 100 per tonne as the real estate crisis in China continues to reduce demand for steel. The long-term upside potential for uranium remains unchanged despite the recent wave of stop-loss sell orders among investors who went on a buying spree in January.

In the agricultural sector, cocoa hit a new record high of $7 per tonne, more than tripling the five-year average price. The price of the New York Stock Exchange-listed futures contract is up 700% year-over-year as there is no sign of improvement in the under-production situation in West Africa. Meanwhile, hedge funds continue to hold near-record short positions in the grain sector, primarily corn and soybeans, a risky approach ahead of the Northern Hemisphere planting and cropping season where weather will be a key factor.

Copper and copper mining companies benefit from restrictions on Chinese smelters

Copper and shares of copper mining companies rose last week, with HG copper exceeding USD 4 per pound and the price of copper quoted on the London Metal Exchange rising above USD 8 per tonne, reaching an 700-month high, while exchange-traded funds following the share prices of mining companies recorded an increase of over 11%. The price of the metal has risen steadily over the past month, supported by a weakening dollar, optimism about demand in China after the New Year celebrations, and a significant reduction in mine supply in 6, which further reduced supply in the market. A number of mining companies have announced production cuts due to factors including rising input costs, deteriorating ore grades, increasing regulatory costs and weather-related disruptions.

The latest price rise has been fueled by Chinese steel mills reaching an unprecedented agreement to jointly cut production of refined metals to deal with shortages of the raw material. In China, the world's largest copper-producing country, smelters fought for tight supply by cutting processing fees, leading to a downward trend and cutting processing and refining fees to almost zero.

In addition, the ongoing green transformation is increasing demand from traditional sectors such as housing and the construction industry. The expected start of the U.S. interest rate cut cycle later this year could prompt companies that depleted inventories last year to reduce financing costs to replenish their inventories. We maintain our long-standing constructive view on copper, and with copper mining companies also showing signs of recovery, a new record high in the second half of the year appears possible.

The Global X Copper Miners UCITS exchange-traded fund tracks the performance of 37 copper-focused mining companies such as Antofagasta, Ivanhoe, Lundin Mining, Southern Copper and Zijin Mining Group. From a geographical perspective, exposure is mainly to Canada (37%), followed by the United States (10%) and Australia (10%). ETF grows by 8% year-on-year and 12% year-on-year.

Stabilization in the lithium sector due to production cuts

Lithium, a key ingredient in lithium-ion batteries, is showing signs of stabilizing after manufacturers, responding to an 80% price drop last year, began cutting production, potentially by as much as a third, according to analysts. Over the past month, we have seen similar initiatives from U.S. natural gas producers, who have made temporary cuts to support prices and reduce excess inventories, now exceeding the five-year average by more than 37%. In the case of both raw materials, these events confirm the old adage that the best cure for low prices is low prices, because they lead to reduced production and, in the case of some raw materials, stimulate demand.

While the lithium spot price has stabilized, it is worth noting that China's 99,5% lithium carbonate benchmark is up 21% this year, potentially signaling improving fundamentals. Meanwhile, the Solactive Global Lithium Index, which tracks the performance of the 40 largest and most liquid lithium-related companies, showed a decline of approximately 11% over the same period. The index includes well-known companies such as Albemarle Corp, TDK Corp and Pilbara Minerals, some of which have fallen due to intense short selling by hedge funds, but after the first signs of improvement in sentiment these short positions became at risk, making the entire sector could see further gains if the recent recovery continues.

Crude oil hits four-month high after IEA report correction

In our mid-week market review oil we highlighted that the recent lack of price catalyst has pushed the four-week moving average price range for WTI and Brent crude oil prices to a ten-year low. Nevertheless, crude oil has seen consistent but slow growth since December, when Houthi attacks on ships in the Red Sea raised geopolitical temperatures while contributing to a squeeze on market supply as a result of the prolonged transport by sea of millions of barrels of crude oil and fuel products.

However, since then, Ukrainian drone attacks on Russian refineries have occurred, which is estimated to reduce the efficiency of these refineries in 2024 by 300. barrels per day, as well as a major change in the IEA forecast for 2024 to a deficit, contributed to the increase in WTI and Brent oil prices. In its latest Oil Market Report (OMR) for March, the International Energy Agency (IEA) increased its forecast for global oil demand to 1,3 million barrels per day, while changing the balance for the year from a surplus to a deficit based on o the assumption that OPEC+ will maintain current production cuts until the end of 2024.

Before the IEA's forecast revision, oil prices fell after the U.S. Energy Information Administration EIA) raised its US oil production forecast from 13,19 million barrels per day in 2025 to a record 13,65 million barrels per day, while OPEC in its latest monthly report said supply cuts have stalled as Iraq in the second month it produced about 200. barrels per day above its limit.

Brent crude oil has broken through the previous resistance level in the area of USD 85 per barrel, but the lack of further buy orders before the weekend potentially indicates that the price will remain within the range, although with little upside potential. Based on Fibonacci retracements, the next key resistance is at $88 per barrel.

Gold benefits from the strengthening of copper and silver

Gold continues to show great resilience, losing less than $40 so far of the $170 it has gained over the past two weeks. This took place in a week that saw the release of better-than-expected inflation data in the United States, from CPI to PPI, which may delay the start of the cycle of cuts in American interest rates. The data helped push U.S. Treasury yields higher, while the dollar posted its first weekly gain in four weeks. However, the counterweight to these events was the mentioned strengthening of copper, contributing to the growth supporting gold silver prices.

Substantial support for gold has been provided for many months by central banks, some of which have been buying gold to reduce their exposure to the dollar, as well as continued strong demand from retail investors in Asia, especially in China, where the bear market in the stock market and falling real estate prices force the middle class to look for other solutions. In the short term, some of this demand may slow down as investors become accustomed to new, higher prices, but with increasing geopolitical tensions reducing the appetite for short selling, we believe the current case for buying gold on dips has only been strengthened.

Without participation from ETF investors, who remain net sellers, the recent rally has been driven largely by underinvested hedge funds returning to long positions after clearing several key resistance levels. In the week ending March 5, when the price of gold rose 4,8%, money managers such as hedge funds and CTAs purchased 63. futures contracts (195 tonnes), the largest weekly gain since June 2019, and with the buying wave extended into another period, this group of traders now have an elevated position that needs to be protected, which may be another reason why gold is not was able to fall in response to the increase in yields and the strengthening of the dollar this week.

While we are surprised by the timing of the recent rally to record levels despite the prospect of a delayed start to the US interest rate cycle, we maintain our $2 target, with technical conditions potentially pointing to an even higher level near $300. In the short term, the risk of a deeper correction to USD 2, i.e. the maximum from December 500, cannot be ruled out. In the meantime, silver needs to settle in the $2-135 area, from where it can make a fresh attempt to reach the April 4 highs around $24.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

Leave a Response