Weekly Commodity Market Review: Gold and Silver in Focus

The commodities sector started March with strong gains and the best weekly results since October. While obesity drugs and artificial intelligence continue to attract attention in the stock market, this week in commodity markets was all about precious metals, especially gold, which was heading for its biggest two-week gain since July, hitting record highs. This was influenced by a weakening dollar and lower Treasury yields after the chairmanship of the Board of Governors Federal Reserve Powell said the central bank was close to having the certainty needed to ease policy, suggesting rate cuts would begin this year.

As mentioned, these comments weakened the dollar significantly and risk appetite increased significantly. This applies, among others, to the Japanese yen, which, in addition to Powell's dovish announcements, received an impulse in the form of strong wage growth, increasing the chances that Bank of Japan will finally exit the world's last negative interest rate regime and raise interest rates, perhaps as early as this month. A strengthening trend USDJPY has broken down and may begin to reverse as speculators reduce exposure to one of the most favored short positions of the past three years.

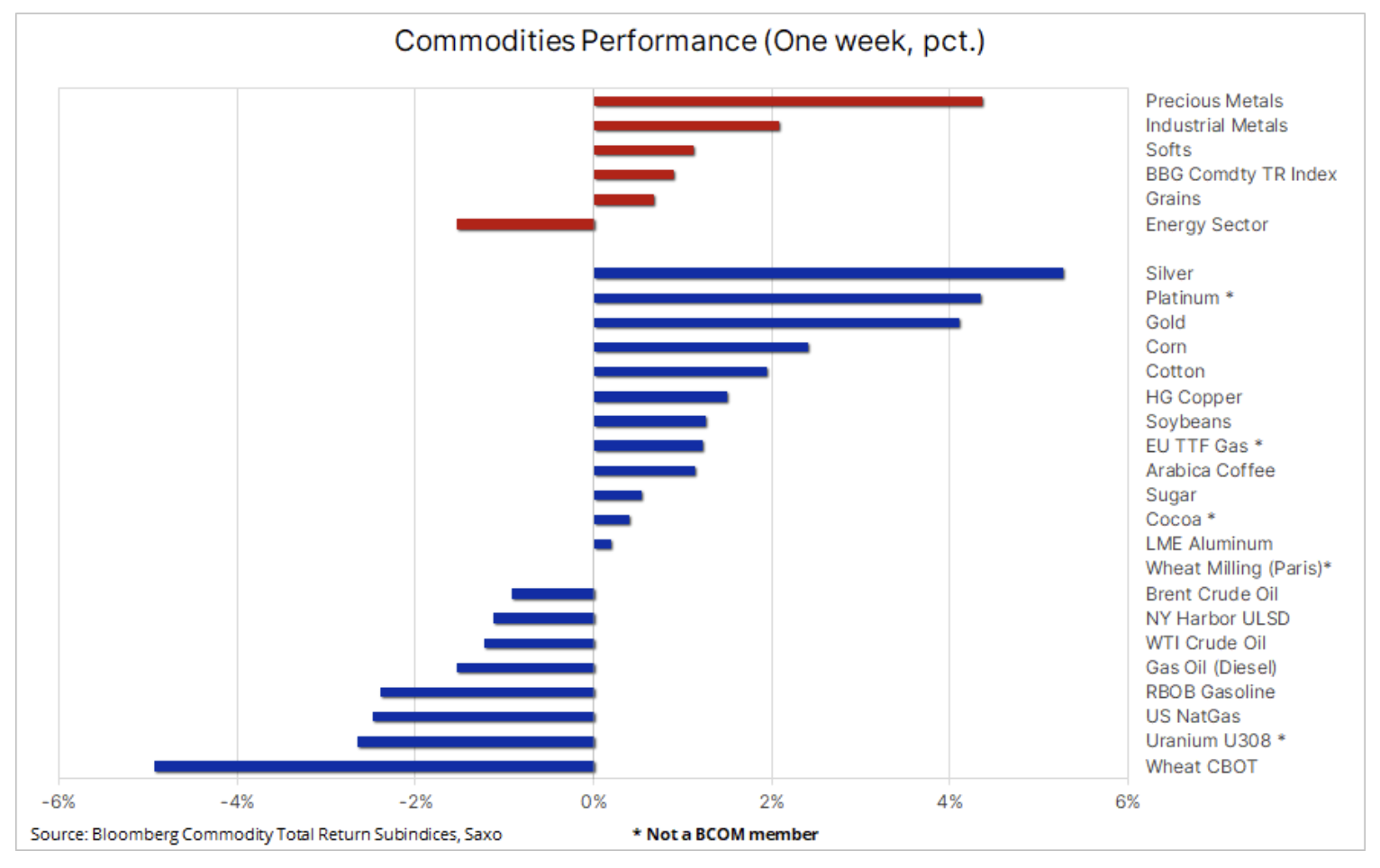

As the table below shows, all sectors except energy traded higher during the week, and strong gains make the prospect of the Bloomberg Commodity Total Return Index returning to positive territory within a year realistic. Despite everyone focusing on gold, silver was the best performer of all commodities, benefiting from the support of rising gold and copper prices, as well as a weakening dollar.

The Bloomberg Softs Index remains the best-performing sector this year, despite emerging signs of profit-taking. This is particularly true for cocoa, which has experienced rapid growth in the face of a significant decline in supply from West Africa, resulting in purchasing pressure from producers closing short positions taken to hedge their exposure. On the other hand, coffee and cotton recorded a boom. Arabica coffee futures benefited from rising Robusta coffee futures, which hit new highs on growing concerns about tighter supplies from Vietnam and Indonesia, two of the world's three biggest producers.

Consolidation of gold prices after a record series

In our last weekly update, we mentioned that the gold market showed signs of strength last month, seeing a flattening trend even as U.S. Treasury yields rose after positive U.S. data earlier this month further delayed the expected timing of the first U.S. interest rate cut , as well as the scale of subsequent ones. At the end of February, gold behaved like a spring, pulling upwards despite the counterweight of yields, but held back by concerns about further data. However, after the core PCE deflator in the US was in line with expectations, followed by a weaker ISM industrial reading, buyers switched to cautious mode and rushed to gold, which further strengthened it after breaking the key resistance level between USD 2075 and USD 2088, which has now stood the level of support.

At the end of last year, we forecast that gold could reach $2300 in 2024, so while recent results are in line with our overall predictions, we were surprised by the timing of the new record high. Given the need to reduce interest rates to attract investors ETF back towards gold, we urged patience regarding the timing of the next rally. Without any participation from ETF investors, who sold 9 tonnes last week, the rally was mainly driven by underinvested hedge funds forced to return to the market after breaking several key resistance levels.

For several months, the underlying support has been provided by central banks, some of which have been buying gold to reduce their exposure to the dollar, as well as continued strong demand from retail investors in Asia, in particular in China, where the weakness of the stock market and falling real estate prices are forcing the class average to invest elsewhere. Additionally, we believe that heightened geopolitical tensions around the world have reduced the appetite for short selling, essentially strengthening current gold buying opportunities on dips.

Without a significant increase in demand from ETF investors to take over from hedge funds that will soon achieve their desired level of exposure, gold may plateau followed by a tense period as recently established long positions may reduce exposure. Overall, we're keeping our prediction at $2300, with technically realistic results likely to be even higher at around $2500.

Top silver performance supported by gold and copper

Silver was the best-performing stock last week. The semi-industrial metal, in addition to the tailwind from gold trends, has received additional impetus from other industrial metals, especially copper, which has recorded its highest closing performance this year amid ongoing supply concerns and demand optimism in China in the coming months. months, especially if the government of this country announces support for sectors requiring intensive inputs of this metal, especially the real estate and infrastructure sectors. While gold has reached a new record high, silver has not yet sent a strong technical signal. An increase of another +26% is needed to overcome the key resistance at USD 5.

Copper, which has traded in a relatively narrow range of $2022 to $3,50 since mid-4,00, is showing signs of strengthening amid a weakening dollar, tight supply and demand optimism in China. The weekly chart indicates a breakout, but requires a break through the $4 threshold to be confirmed.

Wheat futures fall to three-and-a-half-year low

Two years ago, Chicago wheat futures hit a record high of $1363 a bushel after major exporter Russia attacked another major supplier, Ukraine, putting about 30% of global wheat exports into question. This week, the CBOT wheat futures contract fell to $528 per bushel, the lowest level since August 2020. The grain joins soybeans and corn, which have fallen to their lowest levels since 2020 in recent weeks. While soft commodities such as cocoa, coffee and cotton remain depressed due to weather-related supply concerns, the grains sector is suffering continued losses after a successful 2023/24 season boosted global supply and with it competition for export orders.

Competition is a major factor in wheat's current weakness, as wheat prices in the U.S. and Europe are depressed by lower wheat prices from Russia. In addition, production in Australia is expected to increase, while wetter weather will boost yields in the US. Nevertheless, the U.S. Department of Agriculture is expected to make slight cuts to its forecasts for U.S. and global wheat stocks in its monthly report, expected on Friday.

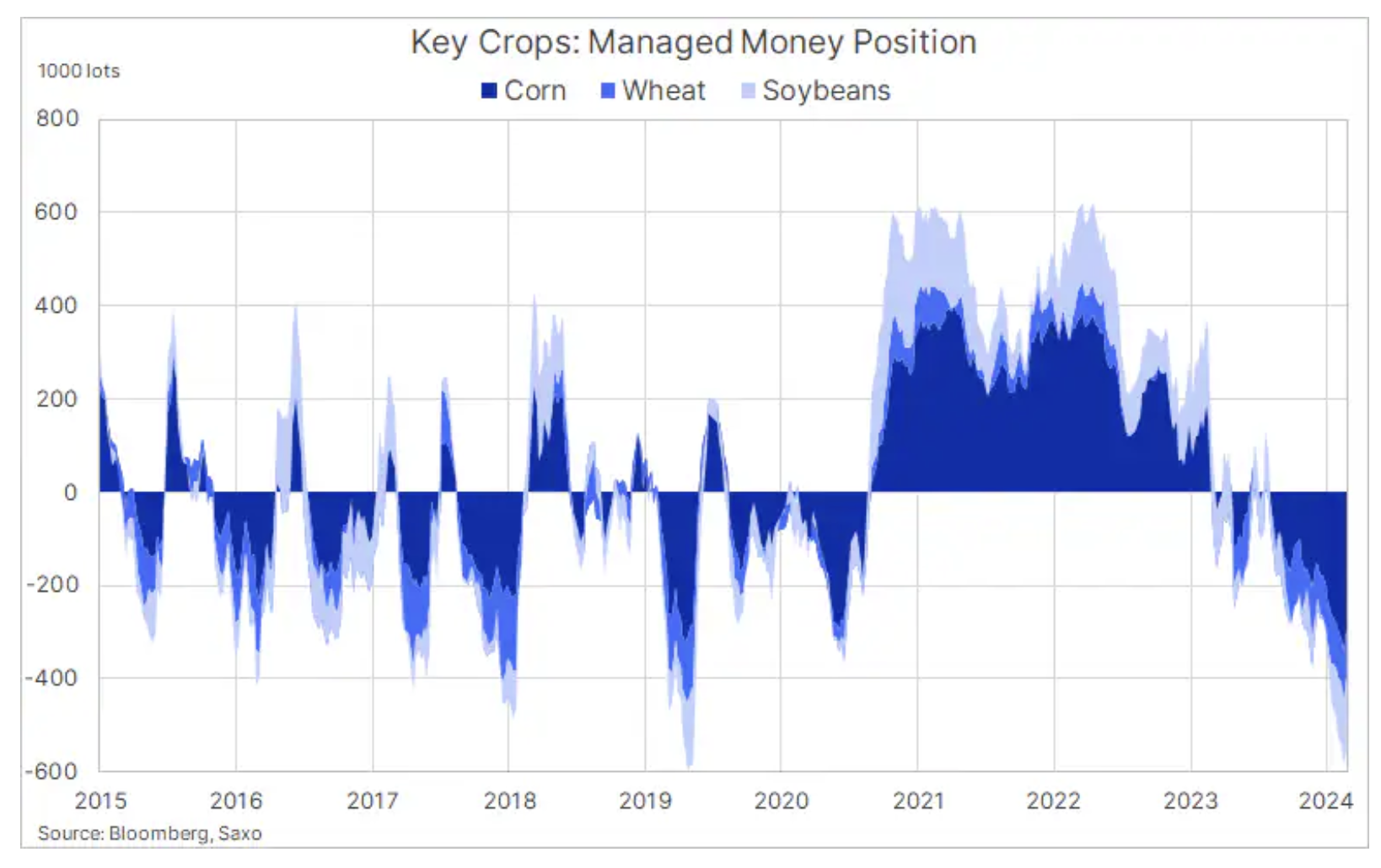

Speculators have responded to months of continued weakness in the grain sector by continuing to increase short positions, which recently led to record short positions, mainly in corn and soybeans. However, the number of net short positions in wheat has gradually decreased in recent weeks. However, as the Northern Hemisphere planting season approaches, attention will shift from old stocks to new production prospects, with the added bonus of increased weather-related variability.

Oil still at the same level

Lack of dynamics on the market oil confirms our view that Brent and WTI are likely to remain in this range for an extended period of time. This forecast gained further confirmation last week when WTI prices fell after several failed attempts to break above USD 80, while Brent has yet to face the key resistance level around USD 85. Overall, we see risk of a breakout to the upside due to unrest in the Middle East and prolonged production cuts OPEC+.

The biggest near-term challenge may be the risk of selling from hedge funds reducing their exposure as part of profit-taking in response to crude oil's current problems with a breakout, especially after net long positions in Brent and WTI futures reached a four-month high level of 430 contracts (000 million barrels).

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)