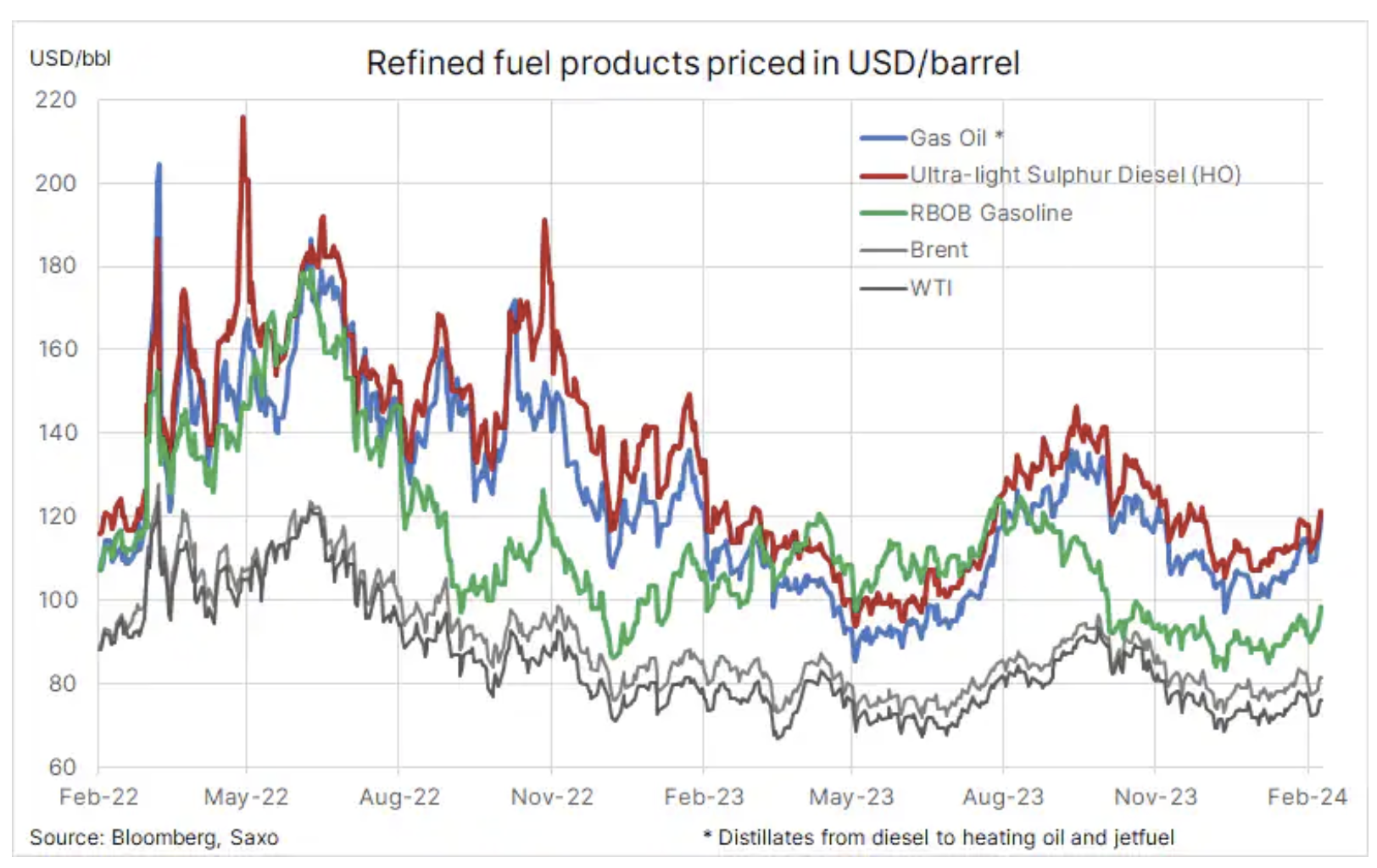

The increase in prices of refined products drives up oil prices

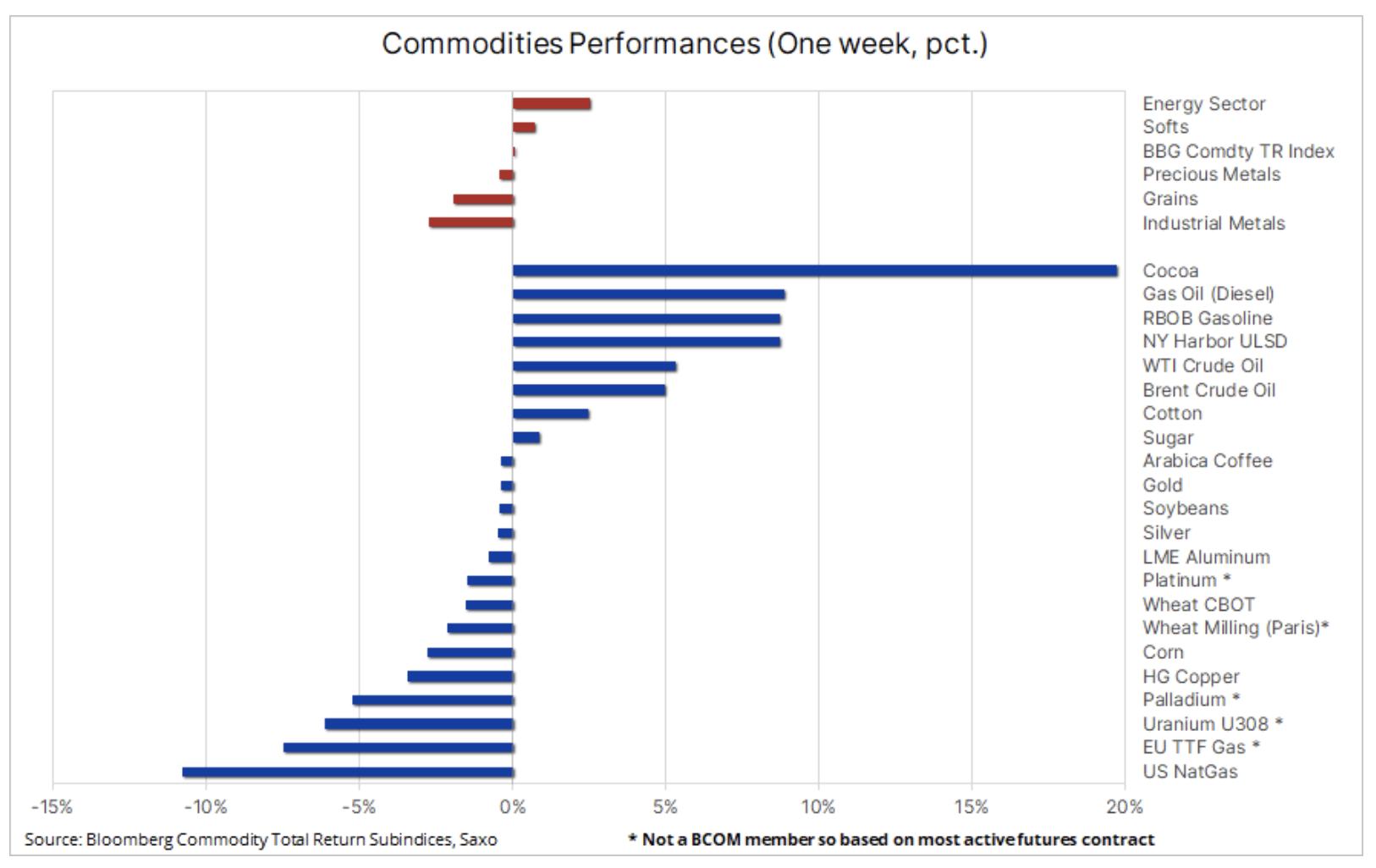

The commodities sector remains range-bound, with the Bloomberg Commodity Index remaining in a tight 3,5% range since mid-December. During this period, strong increases in soft goods and energy prices offset losses in industrial metals and grain. Markets have struggled to find direction and China's latest attempt to prop up its struggling economy has had limited impact. At the same time, hopes for a ceasefire in the Gaza Strip remain low, which increases concerns about stability in the Middle East, where Iranian-backed rebels remain very active throughout the region - primarily in the Red Sea, where attacks on merchant ships continue. Recent events have also supported increases in refined product prices, with diesel and gasoline among the best performing futures markets last week.

Moreover, the prospect of a March interest rate cut by the US Federal Reserve has de facto ceased to exist as US economic data continue to surprise on the upside, forcing the market to change its approach to the timing, pace and size of future rate cuts.

Overall, the Bloomberg Commodity Total Return (BCOMTR) index, which monitors a basket of 24 major commodity futures divided into energy, metals and agricultural products, remained almost unchanged on a weekly basis and on an annual basis decreased by approximately 1,5%. Apart from cocoa, which continued its parabolic rise, strong gains were also seen in the refined products market as fuel cargoes bypass the Red Sea, extending sea shipments of millions of barrels and reducing near-term availability.

Natural gas under pressure from large stocks and mild winter

At the bottom of the table are: natural gas futures in the United States and Europe, under constant pressure from mild winters and high production. U.S. natural gas hit its lowest price since September 2020 this week, with the Henry Hub gas contract falling below $2 per MMBtu as warmer temperatures reduce heating demand while slowing the rate of inventory release. The latest weekly inventory change report showed a decline of just 75 billion cubic feet, much less than the five-year average for the same period of 193 billion cubic feet. In Europe, the benchmark TTF contract fell 7% to EUR 27/MWh ($8,53/MMBtu) on weakening winter heating demand, high wind production and moderate industrial gas consumption.

Rebound in the oil market supported by rising prices of refined products and the situation in the Middle East

Oil prices continue to fluctuate, remaining broadly range-bound, with the greatest contribution to direction from alternating demand concerns, which are dragging prices down, and support from the as-yet-unexistent and limited risk of supply disruptions in the Middle East and OPEC actions to support higher prices. The combination of these factors over the past few months has created a difficult trading environment in which directional guidance by speculative traders has repeatedly failed, forcing them to regularly adjust both long and short positions, thereby generating moves that are not necessarily supported by fundamentals.

From a general perspective, we maintain the view that Brent and WTI oil prices in Q80 are likely to remain within the range - around USD 75 and USD XNUMX per barrel respectively - but the risk of disruptions, OPEC+ production cuts, shrinking supply in the refined products market and upcoming interest rate cuts may make the risk/reward ratio slightly will increase. While crude oil remains rangebound, the fuel products market is showing some strength and crack spreads continue to expand. This is particularly true for diesel prices, supported by the fact that global stock levels have fallen below seasonal averages. Supplies of distillates, including diesel, jet fuel and heating oil, have been disrupted by reduced supplies from Russia as a result of Ukrainian attacks on Russian refining infrastructure and Houthi attacks on merchant ships in the Red Sea and the Gulf of Aden.

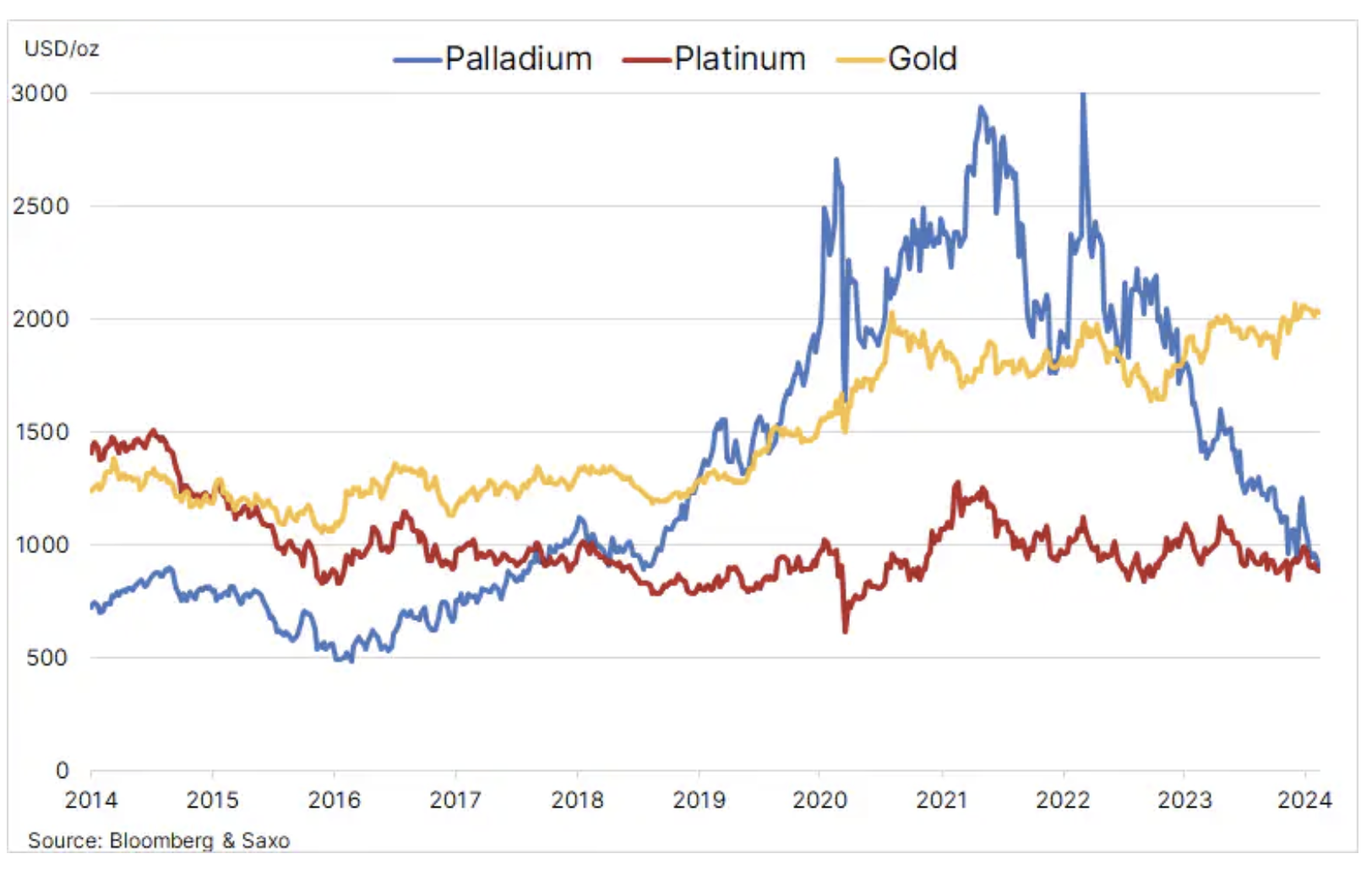

The price of platinum briefly exceeds the price of palladium for the first time in five years

Palladium price, which has fallen 44% over the past year, hit an August 2018 low of $880 last week, with sluggish demand fueling further speculative selling by hedge funds. Despite a significant decline last year, price increases in 2018-2022 have led the automotive sector to replace palladium in car catalytic converters with cheaper platinum. The spread of electric cars, reducing demand for diesel vehicles, has further worsened the prospects for the metal, along with other metals mined primarily in South Africa and Russia, limiting producers' ability to reduce palladium production despite prices falling below cost.

Simultaneously platinum price over the last twelve months, it has fallen by approximately 5% and, in addition to the above-mentioned support from the automotive industry, the use of this metal in the production of jewelry, as an investment metal via exchange-traded funds (ETFs) and in other industries has also contributed to the strengthening. These factors helped, but did not prevent, platinum from reaching a record discount to gold of around $1 per ounce. Overall, the price difference between the two platinum group metals has fallen to zero for the first time in five years.

Gold in an impasse between physical demand and "paper" sales

We maintain an optimistic forecast for gold i silver, but for now, both metals are likely to remain range-bound until we have a better understanding of the timing, pace, and extent of future U.S. interest rate cuts. Until the first cut, the market may be a bit too optimistic, increasing expectations regarding a rate cut to levels that expose prices to a correction. In this context, the near-term direction of gold and silver prices will continue to be dictated by incoming economic data and their impact on the dollar, yields, as well as expectations of interest rate cuts.

The combination of Fed caution and recent strong economic data has seen the short-term interest rate market move from pricing in more than six 25-basis-point U.S. rate cuts this year to fewer than five, with expectations for the first cut at the March 20 meeting falling below 20 %. All this highlights how volatile markets can be in the run-up to changes in monetary policy.

The fact that gold fell "only" by about 2,5% year-over-year despite a stronger dollar, rising bond yields and reduced expectations for a rate cut was likely the result of geopolitical concerns related to tensions in the Middle East and, above all, continued strong demand for physical gold from central banks and the Chinese middle class trying to protect their fortunes as a result of the housing crisis and some of the world's worst stock market performances, as well as a weakening yuan. Moreover, the market has coped with so-called "paper" selling: ETF outflows amounted to 60 tonnes year-on-day, and hedge funds sold almost 200 tonnes on the futures market last month.

As you can see in the chart below, the gold market increasingly appears to be stagnating, with physical demand from central banks and retail demand in China and India, as well as concerns about the situation in the Middle East, ensuring a soft bottom around 2 USD. A break above $000 seems difficult to achieve until we get a better idea of the timing, pace and extent of upcoming US interest rate cuts. The fact that both gold and silver rebounded after a wave of algorithmic selling in response to Thursday's better-than-expected US unemployment claims data suggests that underlying market demand remains strong.

Further parabolic increase in cocoa prices due to shortages among chocolate producers

Cocoa futures continued their parabolic rally last week, gaining as much as 20%, up 44% year-over-year. The March futures contract traded at nearly $6 a tonne on Friday, well above the previous high of $000 a tonne set in 1977. The continued strengthening was the result of a worse-than-expected deficit in 5-000 - the third in a row - due to unfavorable conditions in West Africa, the main production region of this commodity, caused by a) unfavorable intense dry winds, probably related to the El Niño phenomenon, and b ) pests and plant diseases because farmers have problems with access to expensive pesticides and fertilizers.

Shipments from cocoa farmers to Ivory Coast ports have so far fallen by 40% compared to last year. The mid-season harvest after March also appears at risk, raising concerns about the availability of cocoa to meet already agreed sales commitments, potentially putting major chocolate producers in a difficult position and forcing them to enter the futures market to secure supplies.

While this increase in cocoa prices is unlikely to be felt by consumers buying chocolate hearts for Valentine's Day and bunnies and eggs for Easter this year, its impact will become felt later this year and next year as cocoa costs typically pass on to consumers after 6 months. -12 months. However, as sugar prices rise, we should expect higher chocolate prices and perhaps another round of so-called shrinkflation, in which manufacturers reduce the weight of their products to give the impression that prices have remained unchanged.

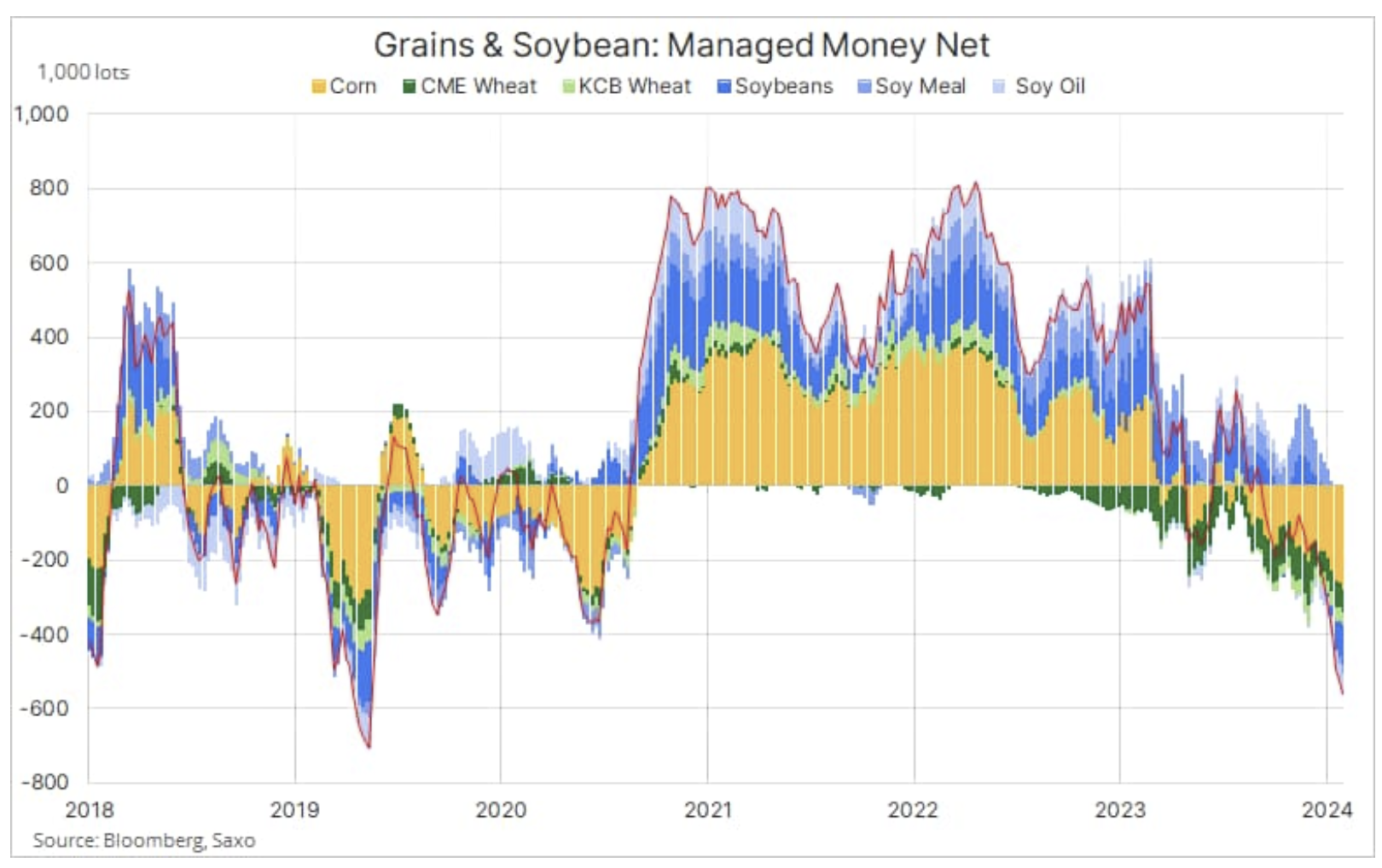

Large supply and speculative sales are dragging down the grain sector

The grain sector continued to decline, with the Bloomberg Spot Grain Price Index, which tracks the performance of six near-expiration grain and oilseed contracts, falling to a three-year low as tight supply and speculative selling continue to weigh on prices. After that sector lost 1,6% last week, the year-over-year loss widened to 19%, with wheat and corn recording the biggest sales.

That came after monthly data from the U.S. Department of Agriculture showed a rise in ending stocks in the United States, while raising questions about U.S. wheat exports as Russia slashes prices to get rid of last year's record harvest. Additionally, the report also found that concerns about negative weather impacts on soybean and corn production in South America were unfounded.

The latest Commitment of Traders report, covering the week ending January 30, showed continued selling pressure from hedge funds, with net short positioning in the grain and soybean sector reaching 563 contracts, marking the strongest belief in a price decline since May 000 ., while the nominal value of net short positions in corn and soybeans exceeded USD 2019 billion.

The uranium rally slows down after the publication of the results of the largest producers

As we highlighted in our last analysis, uranium market has been one of its best performers over the past year, with the spot price rising to a 100-year high above $XNUMX per pound as the sector undergoes a strong recovery after years of stagnation. Acceptance of nuclear energy is growing around the world, with major economies turning to nuclear power as part of their ecological transition.

However, after the publication of quarterly results and production forecasts for 2024 by Kazatomprom i Cameco Corp., the world's leading producers, last week the spot price of uranium and shares of mining companies were hit by long-awaited profit taking. The recently announced reduction in production by Kazatomprom has already been taken into account in valuations, limiting the potential for further price increases for this company. At the same time, Cameco's stock fell after fourth-quarter adjusted earnings per share fell short of analyst estimates and its 2024 outlook remained in line with consensus. Cameco has locked in a significant portion of its future sales at low fixed prices, which means that a higher spot uranium price would be negative for the company in the short term, particularly in the event of a reduction in production forcing the company to meet its sales commitments by entering the spot market at higher prices.

In the short term, price action may face selling risks from an army of recent nuclear converts disappointed with the market's inability to continue its straight-line rally. As we have already highlighted, the emergence and growing popularity of investment vehicles offering the storage of physical uranium on behalf of investors has also contributed to the current tight supply in the market, thereby supporting the spot price as well as the stock market performance of mining companies, reactor designers and fuel producers. Flows relating to these investment instruments will continue to contribute to price formation, both rising and, as has been the case recently, falling.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-300x200.jpg?v=1715055656)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)