How to invest in Uranus? Shares of mining companies, ETF [Guide]

Movie Oppenheimer became one of the cinema hits. The aforementioned production is set in the times of World War II and tells the story of the creation of the Manhattan project. The United States was the first country in the world to start producing nuclear weapons. The dropping of the bombs on Hiroshima and Nagasaki contributed to the end of the Pacific War. However, the development of nuclear energy research was not limited to its military application. The second half of the XNUMXth century saw a dynamic development of nuclear energy. Currently, 10% of electricity is produced in nuclear power plants. In Europe, the country that has developed nuclear energy very strongly is France. The country supplies most of its energy needs with nuclear power plants. The disasters in Chernobyl and Fukushima significantly cooled down the enthusiasm for the development of nuclear projects. However, that is slowly changing. Atom is one of the solutions that allows you to reduce CO2 emissions. Currently, SMR power plants are being tested, which will be small suppliers of nuclear electricity. The return of fashion for the development of nuclear energy. Can you make money on this? Theoretically, the increase in demand for nuclear energy should result in an increase in demand for uranium. Will this happen? In this article we will briefly answer the question how to invest in uranium. Contrary to appearances, there are many possibilities.

What is uranium?

Uranium is a heavy metal that is common on our planet. It occurs both in the form of ores and in many other places. Traces of uranium can be found in animals, plants and people. This element in its pure form has a silvery-white color with high density and hardness. It is a ductile and malleable metal and conducts electricity much better than steel copper (several times more efficient). It is also a very energetic element. Just mention that 1 gram of uranium corresponds to the energy value of 1,5 tons of coal. Not surprisingly, it doesn't take much uranium to power nuclear power plants.

We mentioned that uranium is extracted from uranium ores. It is mined using methods such as:

- open pit,

- deep,

- borehole.

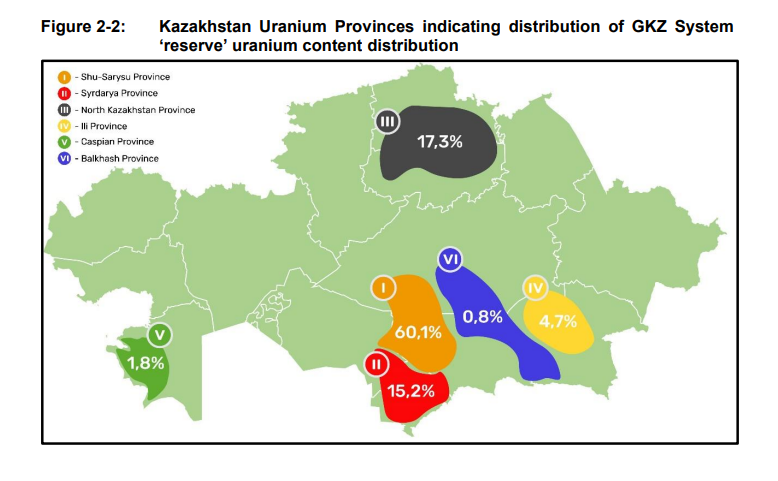

Kazakhstan is a real tycoon in supplying uranium to the world market. According to the data World Nuclear Association, this country accounted for 2021% of world production in 45. It is in second place Namibia with almost 12% market share. They round out the top five Canada (9,1%), Australia (8,7%) and Uzbekistan (7,2%). Together, these 5 countries account for 82% of global production. As you can see, Kazakhstan is crucial for the uranium market. In the event of political instability in this country, there may be a sharp decline in the supply of uranium on world markets.

Uranium in its pure form is not suitable for use in nuclear power plants. It is needed for this isotope U235. It is he who is used in nuclear power plants or in propelling submarines or aircraft carriers with such a drive. It is from uranium that clean nuclear energy is produced.

Of course, uranium has other uses as well. These include determining the age of rocks (thanks to the isotope U238). The ageing of the rocks is possible, with the decay period of this isotope being about 4,5 billion years. So it is suitable for determining the passage of time. In addition, uranium is also used militarily for the production of nuclear weapons and the creation of so-called depleted uranium projectiles. It is also used in chemical analysis and photography.

Uranium is a very important element, but it must be handled with extreme caution. We saw how destructive a nuclear power plant can be in Chernobyl and Fukushima. After the explosion in Japan, uranium prices dropped, which made mining unprofitable because the costs were higher than the price of the raw material. This increased the risk of imbalance in the market for this element in the following years.

Does uranium have a future?

It is estimated that by 2050 the demand for electricity will double. Electric cars, photovoltaic panels and wind farms are becoming more popular. Uranium will still be needed for nuclear energy and nuclear weapons. You don't have to worry about lack of demand in the coming years. However, is the supply not “suppress” price? We will find out about this in the coming years.

Uranium does not seem to be a very popular raw material, but a dozen or so years ago there was a large speculative bubble on this market. It was caused by a number of one-off factors that accumulated in a very short period. Between 2005 and 2007, the Cigar Lake Mine in Sasketchewan was flooded and the Ranger Mine was destroyed by a cyclone. As a result, there was a decrease in supply. At the same time, the market received news that China and India intend to invest significantly in the development of nuclear power plants. Investors began to expect high demand for uranium with a simultaneous decline in supply. Uranium rate exploded.

However, in the following years the situation normalized. It turned out that there was ample global production capacity and expected demand was much weaker than expected. As a result, there was strong downward pressure on prices.

The fall in prices further deepened the crisis of 2007-2008. However, immediately afterward, the price of uranium began to rise due to rumors of large purchases made by China. The price increase was stopped by the Fukushima disaster that took place in 2011. This triggered a wave of nuclear power plant shutdowns in many countries. One of the most famous are Germany. Once a powerhouse on the nuclear power plant market, since April 2023 there is no operating unit of this type.

Currently, nuclear energy is making a comeback. China is leading the way, with a strong focus on this type of energy in its mix. According to forecasts, by 2050 the share of nuclear energy in the global energy mix will be approximately 9%. Thus, demand for uranium is expected to increase. How to make money on it?

How to invest in uranium?

If you are wondering how to invest in uranium, surprisingly there are quite a lot of possibilities. The most popular of them include:

- shares of uranium mining companies,

- uranium ETFs,

- uranium derivatives.

Each method has its advantages and disadvantages. Later in the article, we will present both the strengths and weaknesses of individual investments.

Shares of uranium mining companies

You can invest in uranium through companies that extract this element. It is worth adding that many companies treat the uranium market as a side business. For this reason, many companies sell other raw materials in addition to uranium.

Kazatomprom

It is a Kazakh company whose shares can be purchased e.g. on the Frankfurt Stock Exchange. As you can easily guess, this is a company that operates in Kazakhstan. The main area of activity is the south of this country. This is due to the fact that it is there that the largest mines are located, which account for over 70% of production in Kazakhstan.

Uranium reserves. Source: Kazatomprom

Kazatomprom is engaged in the exploration, extraction, processing and sale of uranium. The recipients of the products are countries that have developed nuclear energy. In addition to uranium, the company also mines and sells other raw materials. These include beryllium, titanium and niobium. The company also has side activities. These include transport services, radiation monitoring and engineering consulting offers.

Cameco Corporation

It is a Canadian company that mines, processes and sells uranium. Cameco Co. has assets including in Canada, the United States and Kazakhstan. One of the most important projects is Cigar Lake. It is a mine with a very high raw material content. According to data prepared by the company, the mine has a U3O8 index of 17,2%. This means a deposit of very good quality. For comparison, Kay Lake's other mine had a rate of 6,7%. During its investor presentation, the company mentioned the structural mismatch between the demand for uranium (constantly growing) and the supply of uranium (decrease in production). As a result, according to the company, an increase in uranium prices can be expected. Currently, the company generates approximately 1,8 billion Canadian dollars (CAD). Net profit last year was approximately C$89 million. As you can see in the chart below, the company has significantly increased in value in recent years.

Cameco Corp. stock chart, MN interval. Source: TradingView

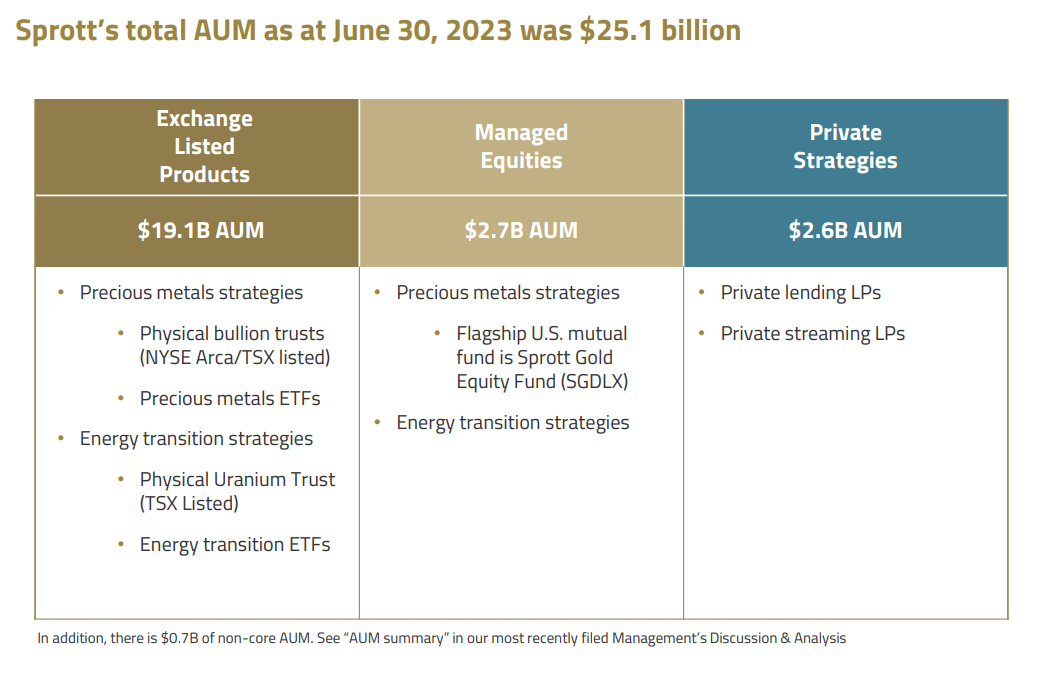

Sprott Inc.

It is not a uranium mining company, but an asset management company. As you can see in the table below, Sprott Inc. has over $25 billion in assets under management. The company focuses on ETP, i.e. products that can be traded on the stock exchange (e.g. ETFs, ETC, ETN). At the end of June 2023, the total number of assets accumulated in these products amounted to USD 19,1 billion. It is worth noting that the company also offers its own funds investing in gold and energy resources. The company is the beneficiary of the inflow of funds to the uranium and precious metals market. So it could be an interesting way to invest in this sector indirectly.

Source: Sprott

Investing in companies can be a good idea, as long as the investor is able to identify the best companies operating in this industry. The problem, however, is whether the investor really has sufficient competences to estimate future changes in uranium prices. Mining companies have high fixed costs. This means that falling uranium prices mean that costs will not quickly adjust to shrinking revenues. As a result, such companies may experience periods of temporary operating losses. On the other hand, an increase in the price of uranium may result in really high profits.

How to invest in uranium using an ETF

If the investor does not want to select companies from the uranium mining industry himself, he can use ETF for this market. When purchasing an ETF, the investor is buying "basket" companies, you have exposure to the sector while minimizing the risk of picking the wrong stock. The disadvantage of such a solution is “diluting the winners.” The portfolio includes both the best and the worst performing companies in the industry. However, this is the price for greater diversification.

Global X Uranium

One of the most interesting ETFs is Global X Uranium. It contains a representation of the quotations of the 46 largest companies that deal with the extraction and distribution of the element on international markets. ETF has relatively high commissions. The Total Fund Fee (TER) is currently 0,69% per annum. Despite the high fees, the fund raised $1,8 billion. It is worth noting that this is not a product for the long-term investor. The mentioned ETF was established in 2010. From now on, the average annual rate of return on this fund is -9,2%. Over the last 10 years, the CAGR% was -1,6%. Good times have happened in the last 3 years. During this period, the average annual profit was over 29%. The largest components of the index include:

- Cameco Corp - 24,1%

- Sprott Physical - 10,2%

- Nextgen Energy – 6,3%

- Kazatomprom – 5,8%

- Uranium Energy Corp – 4,6%

As you can see above, the ETF is very concentrated. The top 5 components of the index together account for 51% of the fund. For the index, it is crucial how the shares of Cameco and the product with exposure to the uranium market, i.e. Sprott Physical, will perform.

Global X Uranium ETF chart, D1 interval. Source: xStation, XTB.

HANetf Sprott Uranium Miners UCITS

It is a much smaller ETF but is also available to European investors. The assets under management of this ETF are small and amount to only €62 million. The fund is relatively expensive as its annual management costs are 0,85% (TER). The benchmark for the ETF is North Shore Sprott Uranium Miners. The ETF includes 42 companies. The largest components of the ETF are:

- Cameco Corp - 16,9%

- Kazatomprom – 13,5%

- Sprott Physical - 12,7%

- Nextgen Energy – 5,0%

- Paladin Energy - 4,9%

As with the previous ETF, this one is also quite concentrated. The fund's 5 largest components account for 53% of assets. In the case of this ETF, the most important thing is the behavior of Cameco, Kazatomprom and Sprott Physical prices.

VanEck Uranium and Nuclear Technologies UCITS ETF

The mentioned fund invests in companies mining uranium and in enterprises developing nuclear technologies. Purchasing such an ETF means betting on the further development of nuclear energy. The ETF is not very large, its assets under management are just over $12 million. The annual fund costs (TER) are 0,55%. The ETF consists of 25 companies, the most important components include:

- Cameco Corp - 16,4%

- BWX Technologies - 10,0%

- Uranium Energy Corp – 6,6%

- JGC Corp – 5,1%

- Jacobs Solutions – 5,0%

Uranium derivatives

Uranium does not match the popularity of gold, oil or copper. For this reason, interest in this asset is quite niche.

Uranium futures are traded on the CME exchange. However, they are not very popular. According to the specification, one contract is for 250 pounds of uranium. The futures contract is cash settled. Thus, the investor does not have to worry about having to deliver or receive a large amount of uranium. Given the scant interest in futures, it is certainly not surprising that there are no uranium options.

Investing in foreign stocks and ETFs may be a problem for investors who do not have this option with their broker. They may be the solution CFDs stocks or ETFs. Thanks to this, the investor can easily gain exposure to this sector. However, the disadvantage is that CFD is an expensive solution. This is due to the high costs of maintaining the position (swap points) and the often wider spread than on the stock exchange. For this reason, CFDs are more suitable for speculative trades than for building long-term positions in shares or ETFs.

Brokers offering ETFs, stocks and futures

How to invest in uranium? Each of the solutions mentioned above has its advantages and disadvantages. Of course, the simplest option is to buy these shares, but for people who want to diversify and balance their portfolio well, investing in whole ETFs will be a better choice. An increasing number of forex brokers have quite a wide range of stocks, ETFs and CFDs on stocks. For example on XTB we find over 300 ETFs today, a Saxo Bank almost 3000.

Uranium CFDs are virtually unheard of among popular broker offers, and futures contracts are a solution only for the very brave due to the high transaction value and very low liquidity.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

What affects the price of uranium?

As you can easily guess, the price of uranium is influenced by the ratio of demand to supply. Let's take a closer look at these issues.

The supply of uranium depends on the available resources and the production capacity of the mines. Mines are unable to increase their production capacity by leaps and bounds from month to month. Investments in new mines are needed. In the coming years, according to the available data, there will be an imbalance on the uranium market. This is due to the fact that during the slump in the years 2008-2022, the price of uranium was low, which discouraged investment. Thus, the supply of uranium was relatively constant. It is worth remembering, however, that an increase in uranium supply in the long term will be possible when the prices of this raw material are at a level that will encourage investment.

The demand will grow in the coming years. This will result from a large number of investments in countries aimed at developing nuclear energy. A great example is China, which intends to build over 20 new nuclear reactors. The climate policies of the EU and China will also support investments in nuclear energy. The slow move away from fossil fuels increases the demand for energy sources that ensure a constant supply of energy to the grid. The atom is such pure energy. The increase in the number of nuclear power plants will result in an increased demand for uranium. Even if new technologies are developed that reduce the need for uranium, it will take decades to implement such technology. This is approximately how long it will take from the project, through pilot implementations, to the dissemination of the solution on the market.

Advantages and disadvantages of investing in uranium

Uranium is a strategically important energy resource. Nuclear power plants would not work without it. Investing in this raw material has its advantages and disadvantages.

The advantages certainly include low correlation with the stock market. The demand for uranium is relatively constant. This is because the demand for electricity is relatively constant over the years. Of course, the demand for energy is growing by several percent annually, but the power of nuclear power plants is not so easy to scale.

The disadvantage of investing in uranium is that it is difficult to predict how the demand and supply for this raw material will develop in the coming years. As a result, it must be assumed that companies operating in this market behave rationally and are able to provide value to shareholders in the long term.

There are political risks. Given that 45% of the uranium supply comes from Kazakhstan, any disturbance in the supply chain from this country could have a significant impact on uranium prices.

Another risk is climatic aspects. Nuclear energy has been on the defensive for years. Many environmental organizations have reservations about methods of storing radioactive waste, which is difficult to dispose of.

Summation

To sum up, how to invest in uranium? Let's be honest, this is quite an exotic idea. But as the classic said: "money do not stink". Uranium is certainly one of the most important energy raw materials and the demand for it should increase in the coming years. You can invest in uranium using shares, ETFs, futures contracts and CFDs. Before making an investment decision, it is worth considering whether there are other, better investment opportunities.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in Uranus? Shares of mining companies, ETF [Guide] how to invest in uranium](https://forexclub.pl/wp-content/uploads/2023/09/jak-inwestowac-w-uran.jpg?v=1694089639)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![How to invest in Uranus? Shares of mining companies, ETF [Guide] Dagong Global Credit Rating Agency](https://forexclub.pl/wp-content/uploads/2023/09/Dagong-Global-Credit-Rating-Agency-102x65.jpg?v=1694088548)

![How to invest in Uranus? Shares of mining companies, ETF [Guide] monetary policy council, interest rates](https://forexclub.pl/wp-content/uploads/2020/06/rada-polityki-pienieznej-glapinski-102x65.jpg?v=1592378493)

Leave a Response