China's Dagong Ratings Agency - Former scams are hiccuping

Most of you know the names of companies such as: S&P Global, Moody's or Fitch. These three agencies have approximately 90% of the rating market and control most of the market in the United States and the European Union. What's more, most companies that issue debt in euros or dollars need the opinion of a credible rating agency. It is these companies that assess the ability of companies to repay their liabilities. China is known to have “an economy with Chinese characteristics”. The rating agency market also has its own "Chinese characteristics". And, among other things, you will read about it in this article, where we will take it to the workshop Dagong Global Credit Rating Agency. The history of this company is interesting because the company went from heaven to hell to be saved by the government. We invite you to read!

Chinese characteristics of the rating market

With the development of the capital market in China, there was a need for professional credit rating agencies. It was in this environment that it was created Dagong Global Credit Rating Agency, which started operating in 1994. This was done after receiving approval from the People's Bank of China and the State Economic and Trade Commission.

A major step in the history of this agency was the internationalization of the rating market in China. Then, many Western rating agencies acquired shares in Chinese entities. Of course, traditionally, the Middle Kingdom has prohibited the acquisition of more than 49% of shares in Chinese companies. The reason for internationalization was simple, China needed to copy Western solutions related to ratings. No wonder. The Western capital market has developed over several generations. In turn, in China, the first generation that began its adventure with the capital market was just growing up. Thanks to investments by Western companies, global standards for conducting audits have been introduced. As a result, the quality of ratings improved significantly. Still, the market was less professional than the American one. Dagong has gained a solid position on the Chinese market. The prospects also seemed great as the Chinese economy was still growing strongly and Chinese companies needed capital to expand. At the same time, the professionalization of the capital market increased the demand for ratings.

Dagong - attempts at geographical expansion

When the rating market in China began to develop rapidly, some agencies were looking for a place to expand abroad. Dagong took a very ambitious path. The agency wanted to be an independent company that would build its popularity on its own developed audit standards. The Chinese agency tried to obtain the right to operate a rating in the United States, but in 2010 the NRSRO (Nationally Recognized Statistical Rating Organization) rejected the application. The reason for the refusal was that the American supervision could not carry out an inspection of the Chinese company (this was against Chinese law). CSRC (Chinese regulator) in 2009 announced that the American regulator PCAOB will not be able to carry out inspections in the territories of the People's Republic of China. In response, the Americans blocked Dagong's attempts to expand in the US.

The European regulator was much more lenient. ESMA (The European Securities and Market Authority) in 2013 granted Dagdong consent to operate in the European Union as a rating agency. It was the first Asian form to be registered with ESMA as a rating agency. Ultimately, Dagong was to facilitate the inflow of Chinese investment capital to the European Union. Chinese agencies were to assign ratings for bonds issued in dollars, euros and yuan.

The company had ambitious plans. She wanted to break into the markets of the United States and the European Union by storm. The reason for choosing these economic areas was that they are the most developed financial markets in the world. Thanks to this, gaining even 5% of market share would drastically increase the company's revenues.

Some people believed that Chinese rating agencies would bring some freshness to a stagnant market dominated by "big three". However, more and more observers believed that Dagong was fulfilling the expectations of the Chinese Communist Party rather than acting as an honest rating agency. Critics have mentioned that Dagong analyzes debt based on geopolitics and the interests of the Chinese government rather than creating impartial ratings.

However, very quickly ESMA began to conduct a 2-year investigation into Dagong Europe. It took place between 2013 and 2014. The reason was problems with meeting European regulations regarding the conduct of business by rating agencies. The investigation has not been made public.

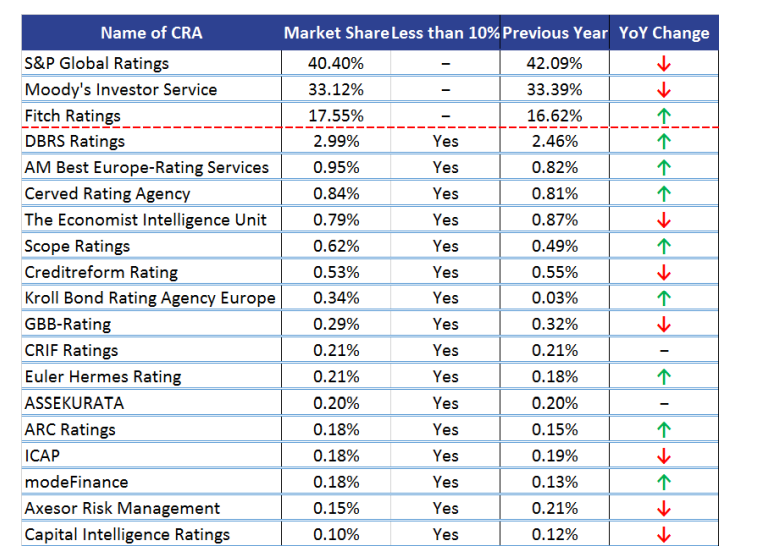

The activity of the Chinese on the European market was unexpectedly short. After 6 years, Dagong voluntarily withdrew from the European Union market. Currently, the European market is still controlled by the big three. Below is a fragment of the study Report on CRA Market Share Calculation, which was prepared by ESMA (European regulator) in 2020. As you can see, the market is still controlled by S&P, Moody's and Fitch:

Source: ESMA

Dagong - operation on the Chinese market

Dagong was a famous Chinese credit rating agency. It is not surprising then that she received a lot of orders on the domestic market. In China, the company had to compete with other entities for customers. Rating agencies competed on price and customer relations. The above-mentioned relations are to concern giving high ratings. For example, Dagong International gave the highest AAA rating to 156 entities in just one year.

It is worth remembering that the mass production of high ratings was not only caused by the specific activity of this one agency, but also by "Chinese characteristics" the entire market. You can also find flavors in the performance of Dagong activities. For example, Ministry of Railways debt was rated AAA (the highest), while China's government debt was rated AA+. So it came to a situation where a government agency had a higher rating than the entire country. Dagong explained that he uses completely different rating models for government debt and other entities, so AAA debt for the Ministry of Railways cannot be compared with AA+ government debt.

The ratings were determined in a very unusual way. For example Shoungang Group received the highest rating of AAA in accordance with the national standard and A in accordance with "international" standard developed by Dagong. Interestingly, the rating of A was more or less in line with that assigned at the time by "The Big Three".

Over time, it turned out that Dagong was using it "incentives" for companies. He gave his customers high ratings when they used "consulting services" offered by another part of the company. You could say that was it "decal" to Arthur Andersen's behavior from several years earlier. Of course, Andersen was an auditor, but unethical 'crosseling' was similar.

In 2018, regulators became interested in the company's activities. Chinese surveillance NAFMII (National Association of the Financial Market Institutional Investors) suspected the rating agency of not keeping the appropriate standards. Dagong was accused of a conflict of interest in the relationship agency-client and for making false statements. The regulators also thought that Dagong has very weak internal controls that would minimize the risk of unethical actions by employees. The investigation revealed that Dagong had poor rating models. What's worse, the agency itself began to falsify documents during the inspection of Chinese regulators. This was mentioned by the Chinese news site Caixin Global. At the same time, the agency, citing its sources, said that Dagong had a very weak, even unqualified senior staff. In August 2018, NAFMII and CSRC (China Securities Regulatory Commission) suspended Dagong's license for a year due to breach of core rating standards. In April 2019, the company officially became a state-owned company.

China's corporate bond market

The corporate bond market in China itself began to grow only in 2005. At that time, regulators allowed the issuance of corporate bonds by banks and other financial institutions. This provided fuel for the dynamic growth of this market. However, for this market to function properly, efficient rating agencies were necessary. Ultimately, the lack of oversight led to major corporate debt problems more than a decade later.

The problem Dagong and other Chinese agencies had was that they couldn't give lower ratings to domestic companies. According to an article by Caixin Global, more than 90% of domestic issuances were rated AA or higher. Given that developed markets do not have such a proportion of ratings, most likely the rating requirements were lowered so as not to offend the customer. This undermined the sense of assigning any debt ratings. Since most Chinese agencies acted on principle “it's great so what are you talking about”.

The mentioned rating agency participated in assigning ratings to corporate bonds of issuers with a very poor financial situation. It ended with spectacular insolvencies. In 2017, bond defaults amounted to RMB 26 billion and in mid-2018, they amounted to RMB 19,9 billion. Dishonest rating agencies certainly contributed to this. Of course, the corporate bond market did not collapse, but greater openness to Western companies was necessary. As a result, in 2019-2020, agencies such as Fitch and S&P were able to start operations in China itself. It should be noted that the problems in the corporate market were a valuable lesson for Chinese supervisors.

Dagong - ratings according to the party's wishes

Dagong has been a pro-government company since its inception. This means that the ratings were assigned in line with China's geopolitical expectations. As of 2019, the company became mostly state-controlled. As a result, some experts reacted very negatively to this event. Fears began that the ratings would be given by Dagong along party lines. Some investors began to fear impartiality and independence.

According to a 2021 article in the Journal of Financial Regulation, there was an opinion regarding Dagong. There were doubts about the actual operation of this rating agency. In 2010, the ratings assigned by the agency lowered the ratings of competitors or allies of the United States. At the same time, it awarded higher ratings to countries friendly to the Middle Kingdom or countries contesting Western supremacy.

For example, in 2011, Russia received a high rating from Dagong. The agency assigned an A rating with a stable outlook. It was the same level as the United States (sic). However, the United States had a negative rating outlook. In 2018, the US rating was downgraded to the agency from BBB+ and was lower than Botswana's (A-). It is worth noting that in 2011, Chinese debt had a Dagong rating of AAA, which is at the level of Switzerland or Denmark. In 2018 Australia, which has the highest rating awarded by the "big three" in China, has an AA+ rating, which is lower, the same as China's new rating. For comparison, Australia's debt to GDP is 42%, for comparison China's debt to GDP was 77%.

Summation

Dagong is one of the most important credit rating agencies in China. At the beginning of the second decade of the 6st century, the company wanted to conquer the American and European markets. However, the American market turned out to be closed to Dagong, while in Europe the company was unable to ensure sufficiently high rating standards. After 2018 years, Dagong withdrew from the European Union. Another blow to the company's reputation was an investigation by Chinese regulators in XNUMX. Dagong has been criticized for poor internal controls and uneducated staff. After a year, the agency was nationalized. This puts a question mark over the objectivity of the mentioned agency's activities. Anyone who is guided by the opinions expressed on the bond market by Dagong should remember that the company is state-owned and guided by geopolitical attitudes.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)