Diversification and volatility of currency pairs

The financial market has a wave nature. The prices take the goal and strive for it, leaving behind smaller and larger impulses and corrections. Macroeconomic data, which flows to the market throughout the week, give strong impulses to the next currencies. We are used to the fact that all important data for the pound is published at 10: 30, US publishes about 14: 30, data for Australia are served at night, and for data from Japan we usually wait until the last moment because they are "tentative".

Be sure to read:

Macroeconomic data

Consider one trading week and the fact that we analyze daily data - it is a fairly reliable analysis without noise. They rarely find macroeconomic data "substantiation" in the technical analysis carried out on the intraday chart, because "Rip" they will be an anomaly for the typical course of the price at such a low interval.

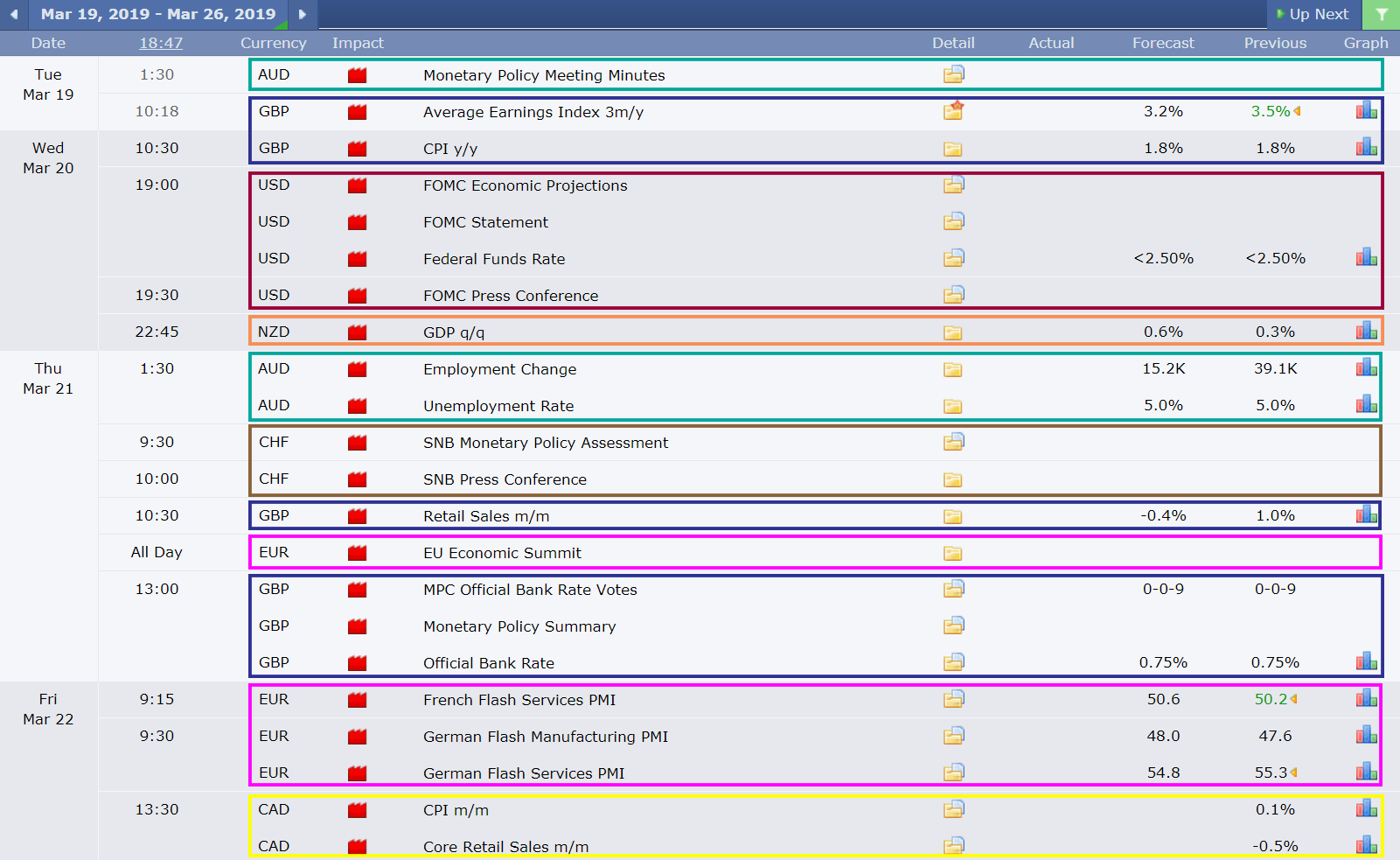

Above, we can see macroeconomic data with the highest impact on the markets. Data for particular currencies are given on different days and at different times. Therefore, opening a long position eg on AUDUSD and EURUSD pairs, in theory, we simply double the short position on the US dollar. Maybe it is "on paper", but in practice Australia and the Euro zone are two different economies. In our established example, we see that after the evening data for USD, on Wednesday, just after midnight on the following day, very important data from the Australian market are published. It may turn out that having both pairs in the portfolio, we will have a completely different result on Thursday evening on each of the above transactions.

Correlation

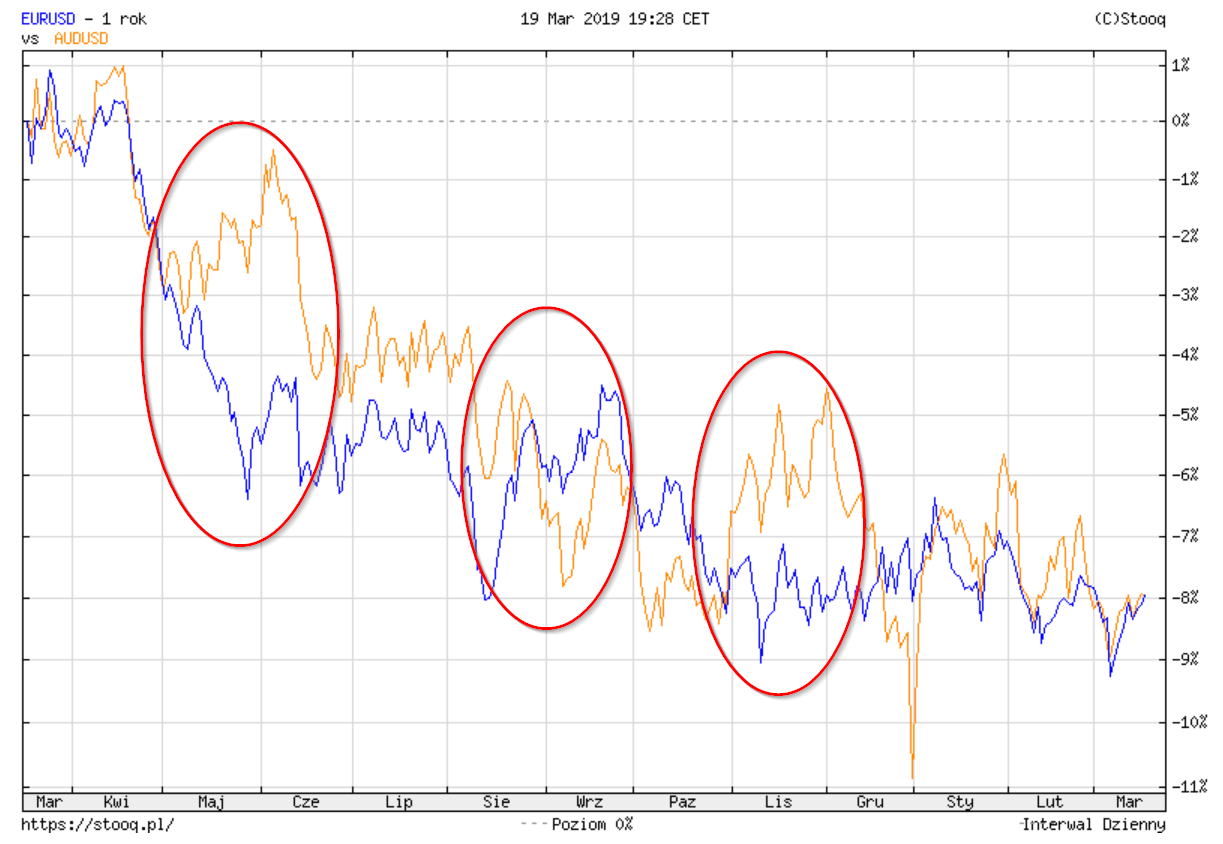

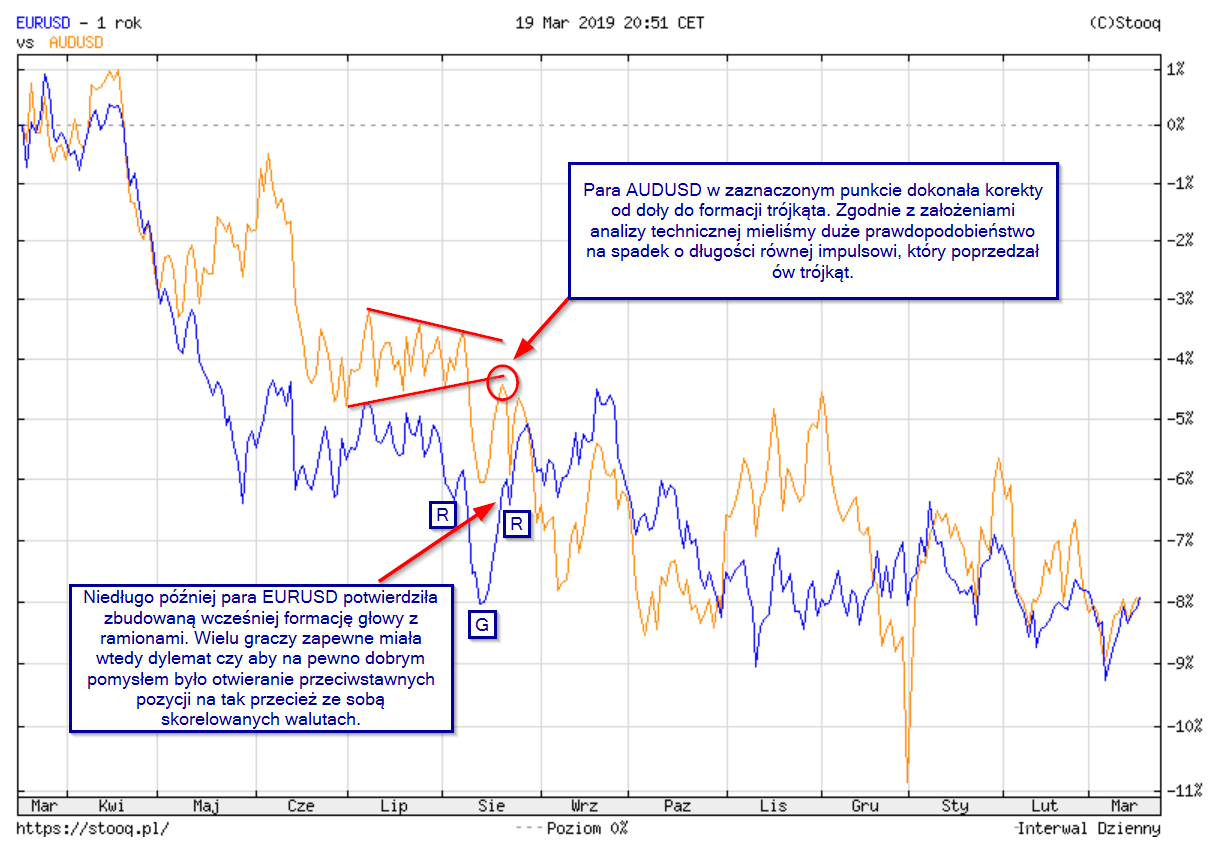

As in the example below, although in fact both currency pairs have been in a strong downward trend during the last year, thanks to the use of technical analysis, it was possible to take opposite decisions and achieve profit in both markets by simultaneously buying and selling US dollar against the euro and the Australian dollar.

Be sure to read: Diversification of funds between brokers

Forex diversification

Below we see a table of correlation of markets. For example, we omit the technical analysis and open three virtual positions, three long and three short. We will therefore have currency pairs in 6's portfolio. For each of them, we set the same stop lossa and take profit level at the 100 pips level. We omit spread and swap for the purposes of this example. So we have 50% chance of success in each transaction. Going further, we have exactly 2% chance that all our positions will achieve profit or loss assuming market randomness and randomness of inputs.

If we approach it in such a way that engaging in these 6 pairs consumes all our capital - we have a 2% chance of bankruptcy. When we use technical analysis to select instruments, our chances in each trade will increase slightly, but still. The main conclusion from the above thought experiment is that by diversifying your capital into many different items, we are less exposed to the risk of financial loss. We also save time, which is an important and often overlooked component of the market game. When we only have one position, it may turn out that after a few days we will lose some capital and time, which cannot be "made up". Very often this is the beginning of frustration that leads to decisions dictated by emotions, and these are the worst adviser to an investor.

Check it out: Index of fear as a barometer of investors' mood

It should be added here that the correlation is also variable over time and subject to trends. These, in turn, can be analyzed in the same way as the charts of individual couples. We come to this point to the so-called data meta-analysis, which I will allow myself to omit at this stage.

Above I presented one of many examples that can be observed in the markets. It proves the thesis that the correlation changes over time and can be used with good results to its advantage.

I encourage you to study the issues raised here. I encourage you to think "in spite of everything". Since most of us are wrong, we need to rebuild our thinking about the markets. Look for a different perspective and submit your analysis to the stern judgment. It is worth learning to mislead yourself. "What would I do if I wanted to scare someone like me"? It is worth to do an experiment with a game based on a fixed position size but without a stop loss, including diversification and low leverage. On the markets you can either actively manage positions or treat them zero-one. It is worth creating an image of the market that makes it easier for us to make decisions and which is not widely known and noticed by the rest of the players.

I hope that paying attention to the diversification aspect, even within the currency markets alone, will allow you to look at markets from a broader perspective. Remember that hard data from specific economies are "moving" markets and this data is different for each currency. It is worth realizing this and using it in your investment strategies.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)