Wheat - How to invest in wheat? [Guide]

There is no doubt that once typical agricultural products such as wheat, soybean or corn, did not arouse much interest among investors. But times are changing. arrives brokers, and thus the instruments that are available to invest for the average trader. Trade in agricultural instruments can be very interesting and, more importantly, thanks to quite large amplitude of exchange rate fluctuations it can also bring satisfactory rates of return.

An interesting instrument classified as agricultural products is wheat, which is characterized by high volatility. How to invest in wheat? In this article, we'll tell you a little more about it.

Wheat - basic information

Wheat has been cultivated for about ten thousand years. Only barley is grown for longer, and more often corn and rice. It belongs to the panicle family. She liked fertile and fertile soils rich in humus and calcium. There is also a shortage of wheat in the temperate zones where it occurs most often. Therefore, it is grown mainly in Europe and throughout the Americas. Much of the crop is also found in Asia, where the wheat comes from (China, but also Punjab in India). It is also an important component of the agricultural economy in Australia, in some Maghreb countries and Asia Minor, where the soil is distinguished by a high degree of fertility, despite the prevailing dry climate.

Wheat growing is also possible in areas with short vegetation periods. The so-called spring wheat, which is cold-resistant but gives low yields. Wheat is also used to produce basic food products such as pasta. It is also used in other industries, e.g. biofuels.

The largest producers

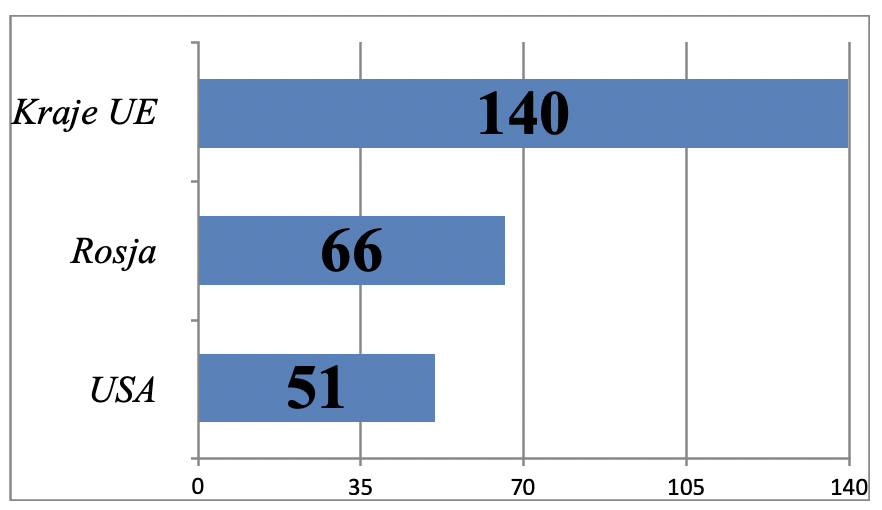

Comparing wheat to other agricultural products and directly with other types of cereals, it is characterized by the largest number of varieties. Individual species differ from each other, e.g. protein content. In previous years (2017/2018) the largest producers were EU countries, Russia, the USA and China.

Main wheat producers in 2017/2018 (in million tonnes). Source: Agricultural Weekly

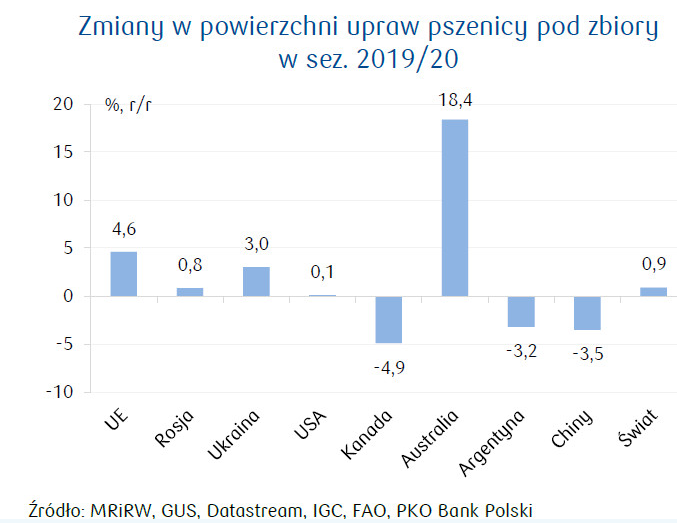

However, for the 2019/2020 season, a certain change in tendency can be seen in relation to the crop area under harvest. While EU countries still maintain a high rate, the percentage of China and the United States has decreased. It is also worth noting the huge increase in Australia. It is also interesting that the price of wheat is very influenced by the weather.

The price of wheat

Wheat is listed on the American commodity exchange CME Group - CBOT (Chicago Board of Trade) since the 70's. Most of the time, the price fluctuates in the range of $ 200-600 per contract. The unit by which we measure the amount of wheat is the bushel.

Bushel - unit for wheat; 1 bushel is about 27,216 kilograms.

The highest recorded price for wheat contracts was around USD 1349 in February 2008.

Graph of wheat contracts listed on the CBOT since 1970, interval MN1. Source: Trading View

Wheat - how to invest

There are several ways to invest in wheat. In our considerations, however, we will omit the option to buy agricultural land and focus only on "virtual" variants :-).

Wheat options

It is an instrument that gives the buyer the right to perform a specific operation. The conditions for the option are specified by the exchange. Most often they expire after a month, and the value of one option is 5000 bushels.

We have both buy and sell options, of which we can be exhibitors (put option) and buyers (call option). Leverage is available on these instruments. By design, the options are quite similar to the futures market with the difference that here we still have to pay the so-called option premium. It is worth noting that there is no obligation to exercise the option. For example, if the course goes in the opposite direction to our scenario, we do not need to activate the option and then the only cost we incur is the cost of the bonus. The advantage is the fact that the risk in the case of call options we already know at the beginning, and the profit is theoretically unlimited.

Futures contracts

Futures contracts are standardized, i.e. they have a uniform specification on a given exchange. As in the case of options, they also expire every month, and one contract is for 5000 bushels. We place the position on the centralized, open market, where the broker is only an intermediary between two parties to the transaction. In practice, this requires the involvement of large resources. If there is no other party to the transaction willing to buy back the contract from us, the position is closed at expiry at a predetermined price. The leverage for wheat contracts is 1:10, however, due to its specificity, this market is intended primarily for experienced investors.

CFDs

The most popular and easiest way to invest in agricultural products. CFD contract imitates the movement of the underlying, which in our case is the price of wheat (usually resulting from the futures rate). We do not physically purchase wheat itself or the right to supply it in the future, we only speculate on its rate as to future valuation. CFDs do not have an expiration date and we can usually keep them open as long as our deposit allows us. However, there are swap or rollover points (depending on the offer). The wheat leverage for most Forex brokers is 1:10. CFDs are a non-standardized instrument, which means that their specifications, symbols and even quotation times may differ between individual brokers. Before investing, be sure to read the specifications of this financial instrument.

How to Buy Wheat - Brokers offering Wheat CFDs

Below is a list of selected brokers offering the best conditions for trading on wheat (CFD).

| Broker |  |

||

| End | Poland | Australia, Mauritius, Cyprus | Poland |

| Symbol of wheat | WHEAT | WHEAT | WHEAT.pro |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

200 USD | PLN 0 |

| Min. Lot value | price * 400 USD | - | price of 100 bushels * 50 USD |

| Commission | - | - | - |

| Platform | xStation | MT4/5, cTrader | MetaTrader 5 |

| - | |||

Summation

If we want to trade on agricultural commodities, including wheat, we have a whole range of options to choose from. Taking into account the specificities of the various instruments, investments with a long-term focus are rather recommended. The easiest way to invest in wheat for retail investors is through CFDs. It is here that we will find "simplified" trading conditions, devoid of possible expiry of contracts and liquidity gaps, with simultaneous fast execution of transactions, low volume and transaction fees.

Before entering the agricultural market, it is definitely worth starting with a demo account where you can check how our deposit behaves in relation to changes in the price of wheat at a certain volume.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![How to transfer shares to another brokerage office [Procedure description] how to transfer shares to another brokerage house](https://forexclub.pl/wp-content/uploads/2024/03/jak-przeniesc-akcje-do-innego-biura-maklerskiego-184x120.jpg?v=1709556924)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Wheat - How to invest in wheat? [Guide] wheat investing](https://forexclub.pl/wp-content/uploads/2020/07/pszenica-inwestowanie.jpg?v=1593507343)

![Will global warming help wheat? [Webinar] wheat raw materials webinar](https://forexclub.pl/wp-content/uploads/2024/03/pszenica-surowce-webinar-300x200.jpg?v=1711099347)

![Wheat - How to invest in wheat? [Guide]](https://forexclub.pl/wp-content/uploads/2020/06/swiat-surowcow-ksiazka-102x65.jpg?v=1593500317)

![Wheat - How to invest in wheat? [Guide] low interest rates](https://forexclub.pl/wp-content/uploads/2020/06/niskie-stopy-procentowe-102x65.jpg?v=1593501226)