The Bank of Norway, the most hawkish bank in the near future?

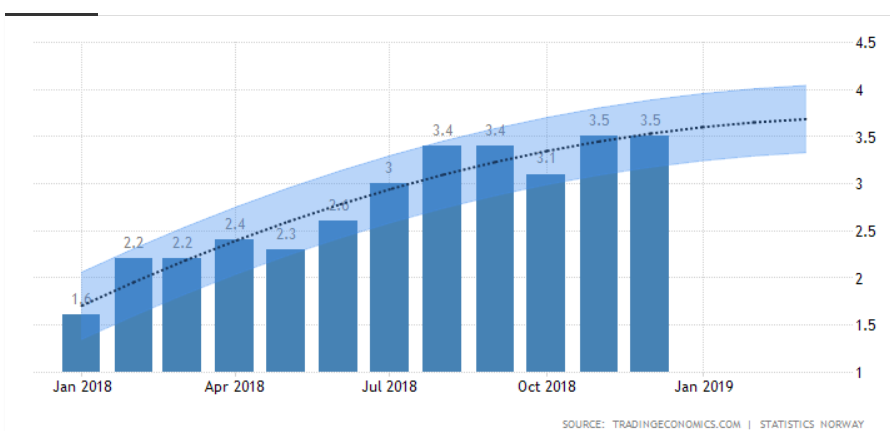

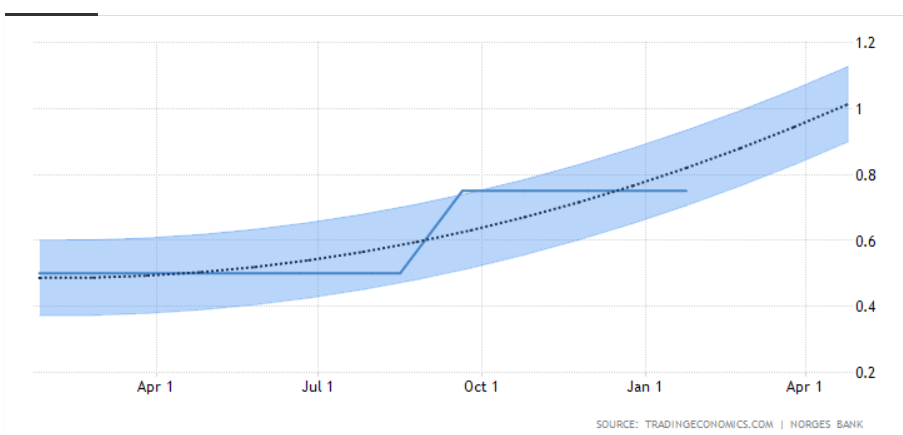

The Bank of Norway may be the only central bank in the developed countries group that will decide to raise interest rates in the first quarter of this year or even in the first half of the year. After today's decision on interest rates, little was expected, namely that Norges Bank will keep the main interest rate at 0,75 percent. It is worth recalling that the NB has been lowering the level of rates in the last cycle systematically since May 2011 year from the level 2,25 percent. to 0,5 percent in March XUMUM year. Only in September 2016 the central bank raised the interest rate to the current 2018 percentage.

After the last decision, the central bank decided that inflation is slightly higher than the original level, repeating forecasts of gradual interest rate increases.

The Norwegian bank thus confirmed that the next raise should take place in March. The head of NB Oystein Olsen said at a press conference that overall, new information indicates that the forecasts for future monetary policy have not changed much since the December meeting.

Therefore, the gradual tightening of monetary policy by the Bank of Norway may be sufficient to allow the Norwegian krone strengthened in relation to other major currencies in the coming quarters, especially if NB is the only hawk.

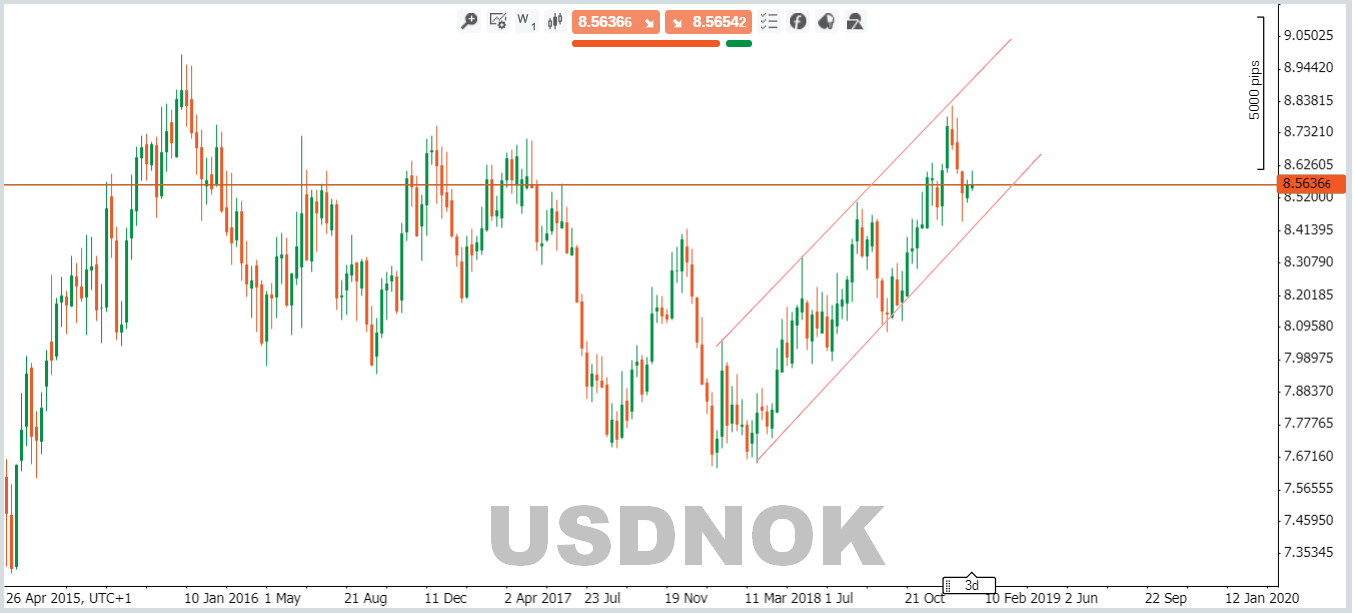

From the point of view of analyzing the pair of USDNOK, the mid-term exchange rate stays in the growth channel, which upper limit is a quite significant barrier to supply. It affects the market along with the last local vertices. Nevertheless, in order for the NOK to strengthen here, it would first have to overcome the line taken after the last holes.

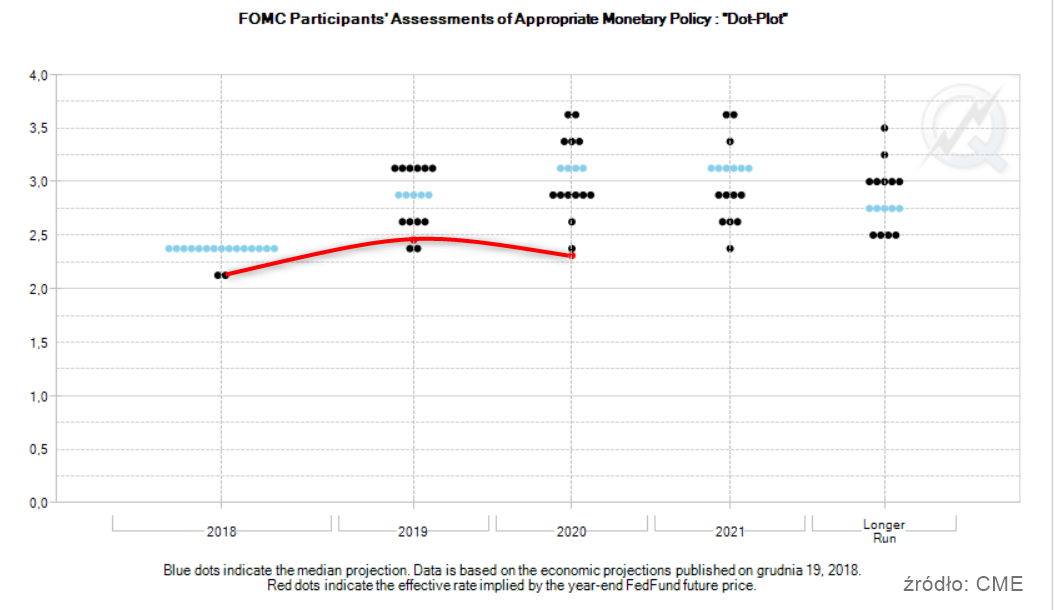

To complement the subject of monetary policy and the USDNOK pair below, also market expectations regarding further FED policy based on Federal Fund interest rate forward contracts.

The above chart shows that the interest rate market is considering further interest rate hike by the Fed this year, and then pricing the chances of cuts already in the 2020 year.

Daniel Kostecki

Chief Analyst Conotoxia Ltd.

The above commentary is not a recommendation within the meaning of the Regulation of the Minister of Finance of 19 October 2005. It has been prepared for information purposes and should not constitute a basis for making investment decisions. Neither the author of the study nor Conotoxia Ltd. are responsible for investment decisions taken on the basis of the information contained in this comment. Copying or reproduction of this document without the written consent of Conotoxia Ltd. is prohibited.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response