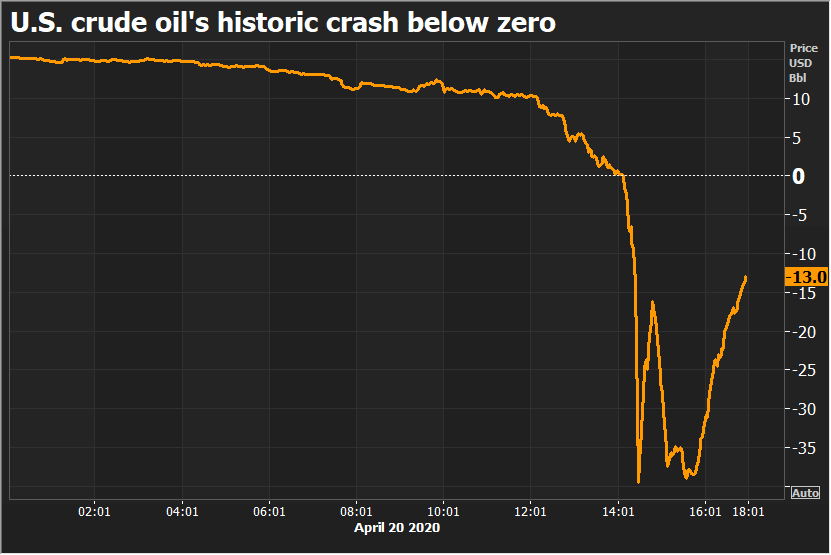

Oil price minus. Futures contracts lowest in history

Czy the price of oil can be negative? Until recently, no one would even be tempted to ask such a naive question. Meanwhile, it turns out that the answer is… yes.

Crude oil futures appeared in 1983. However, history is also happening now - before our eyes. On April 20 and April 21.04.2020, 37, the contract price is ... negative for the first time since the start of trading. The value of the May contract was at -XNUMX USD a barrel on Tuesday morning and is still falling. How is it possible that the price is negative? The devil is in the details and ... logistics.

Negative oil price. Source: Reuters

Crude oil futures contracts for May expire on April 21st. For the vast majority of investors, their purchase or sale is just numbers in the computer. But behind them are real barrels that someone buys and sells, then delivers, stores and markets. Of course, storage is a cost - the longer oil is stored, the more you have to pay for it. The storage cost increases with the amount of raw material on the market. These are the normal laws of supply and demand, and cheap oil has been flooding the market for months.

Brokers offering trading in crude oil - CHECK THE SETUP

Where does so much oil on the market come from?

There are several reasons. The first is, of course, coronavirus and pandemic principles of social isolation. Most planes do not fly, ship traffic froze, there are also fewer cars on the roads. And all over the world, so the supply of oil is definitely greater than the demand for it.

The second reason is the price war fueled for a long time through Saudi Arabia and Russiawhich - despite the drop in demand - did not agree to limitations in production, which not only caused a significant drop in prices, but also a gigantic oversupply of raw material.

Analysts from S&P Global Platts say that in April the daily demand for crude oil was 29 million barrels lower than a year ago. This results in an oversupply of 9 million barrels per day.

The effect was that oil prices fell to the lowest in history. A dozen dollars per barrel was a gigantic investment opportunity for many, but enthusiasm turned out to be premature. Especially futures prices have fallen enormously.

Negative oil price - how is this possible?

The price of one barrel of WTI (West Texas Intermediate) oil, which was to be delivered to customers in May, fell to Monday at -37 USD (minus 37 USD). On Tuesday the falls deepen. How is it possible that the price of the finished and extracted product is negative? Contrary to appearances, it is simple. This is due to the storage cost described earlier. Oil is so cheap and there is so much that the costs of storage and transport outweigh its value, so many companies just pay extra for someone to pick it up from them.

So maybe it's worth just pouring it on tankers? It has long been done. In 2009, when the last financial crisis occurred, about 100 million barrels were accumulated on tankers. Today, 170 million tons are flooded and the space is slowly running out. Some countries are no longer present, others have exceeded the critical value of 60 percent. capabilities.

That is why many investors are getting rid of May contracts (they expire on April 21.04.2020, XNUMX). Some roll them up in June, others finish the investment at a loss. Regardless of the decision - the price of the contract in May is falling, because no one wants to accept oil deliveries in May and take risks in uncertain times.

OPEC + cuts mining or not?

Since the supply of oil has an impact on the price of oil, why will the OPEC + countries (an association of the largest oil producers) not limit production? Formally like that the decision was made this month. From 01.05.2020/10/XNUMX, daily production is expected to decrease by XNUMX million barrels and is to be continued in the following months.

However, according to commentators, the decision was made with too much restriction, and besides, the US intelligence recently stated that Saudi Arabia and Russia - despite the OPEC + findings - have definitely ... increased production in recent days and are pumping cheap oil onto the market. Whether this is true or a political game, there can be only one effect: the US wonders if and when it will impose tariffs on oil from other countries to protect its production.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Some brokers do not have liquidity for Buy orders. Massacre.

buy because it will not be cheaper !! haha, but a ride without a handle. they will write about it in books about economics ...

Traditionally, the wine lies in the east. I believe that this time Putin will get over the head.