Calm before the storm. Investors are looking at the MPC and FOMC

Wednesday morning is marked by a slight appreciation of the zloty against the main currencies, caused by the expectation of the forecasted today an increase in interest rates in Poland. The fluctuations, however, are not large and you can easily treat them as proverbial "Calm before the storm". In fact, before the storm that may be caused by two central banks on the currency market: Polish and American.

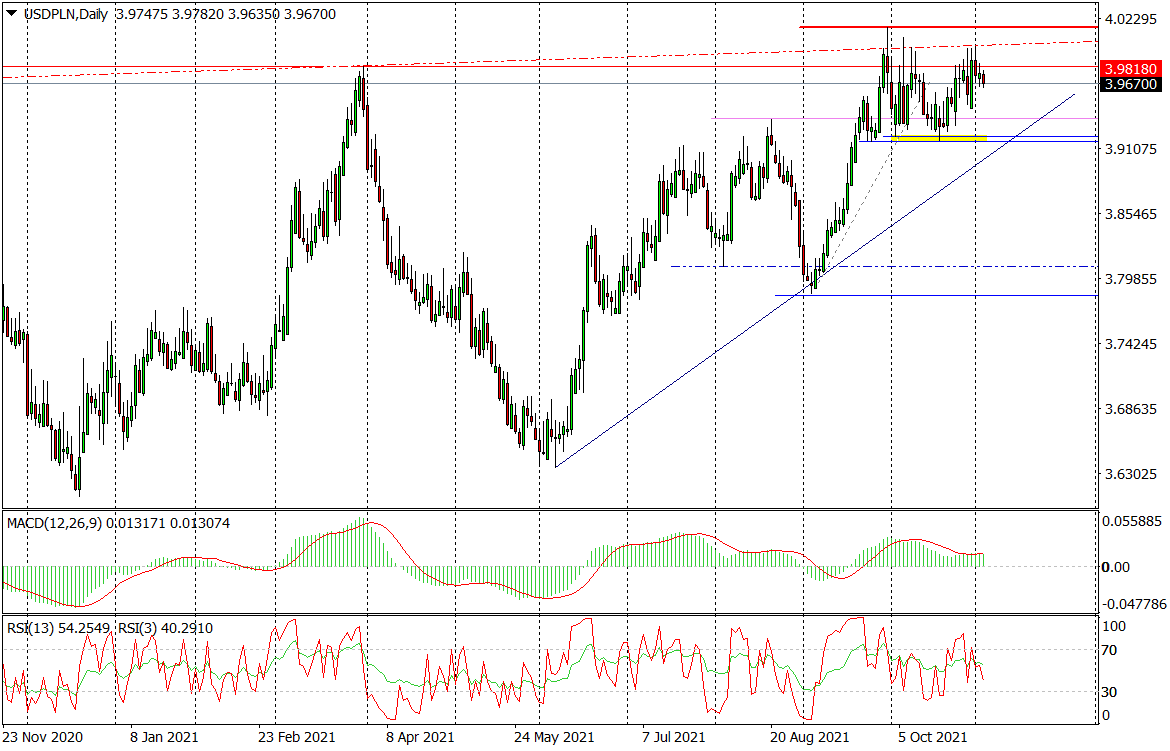

In the morning the EUR / PLN exchange rate fell by PLN 1 to PLN 4,5965, and the USD / PLN rate by PLN 1,1 to PLN 3,9670. What will be interesting on the market today only before the zloty.

EUR / PLN daily chart, D1. Source: Tickmill

USD / PLN daily chart, D1. Source: Tickmill

Looking forward to the MPC and the FOMC

Today, the attention of the domestic FX market will be mainly focused on two events. Meeting of the Monetary Policy Council (MPC) and the accompanying press conference of the president National Bank of Poland (NBP) Adam Glapiński and the American session Federal Committee on Open Market Operations (FOMC) and the accompanying conference of Fed Chairman Jerome Powell. Both in Poland and in the USA, decisions will be made on monetary policy. The former will have a direct impact on the quotes zloty, the second - indirect. In both cases, these are the most important events not only of this week, but also of the month.

What will he do MPC? Nobody knows that. The market is very divided as to how and if at all, the Council will respond to the highest inflation in 20 years in Poland. A cautiously assumed increase in interest rates in Poland by 25 basis points (bp) after they were unexpectedly increased by 40 bp in October. It is realistically assumed that they will increase by 50 bp. Others see even a 75bp hike, but there are also those who assume no change or a 100bp move and a return of interest rates to pre-pandemic levels.

The futures market is more decisive here and is pricing in a 75bp rate hike, expecting at the same time their rapid increases in the coming months and finally an increase in the main rate from 0,5%. currently to the level of 2,75 percent. in the summer of 2022.

From the point of view of the zloty, an interest rate hike by at least 50 bp is a necessary condition for it not to weaken further and perhaps to strengthen slightly. But this will not be the only factor that investors will pay attention to. The new macroeconomic projections, which will be included in the Council's communiqué, will also count. It will be important whether the Council will announce the beginning of the rate hikes cycle. And finally, what will be said at the press conference at 16:00 pm by President Adam Glapiński, who believed in September that rate hikes in Poland would be a "school mistake".

PLN dependent not only on the MPC decision

The fate of the zloty depends not only on the results of the MPC meeting, but also on the reaction of global markets to the FOMC meeting. Investors will know its results at 19:00 Polish time, and a press conference of the Fed president will start half an hour later. The base scenario is an announcement tapering, that is, the slow decline in asset purchases by the Fed with a scenario of their expiration by the middle of next year. The faster this process is going and the more “hawkish” Powell speaks, the stronger the dollar will be, and consequently the pressure on the sale of the zloty will increase.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response