Guaranteed Stop Loss at CMC Markets. Too beautiful to be true?

On February 18, 2018, the CMC Markets broker introduced the so-called Guaranteed Stop Loss (GSL). Is this the moment when we can forget about slippages in Stop Loss execution and the risk of price gaps? Sounds nice. But hearing about any "Guarantees" on the Forex market, usually a red lamp lights up. Let's look at whether in this case it is the right response.

Be sure to read: Stop Loss - Everything You Need To Know About Defensive Orders

Guaranteed Stop Loss - a novelty on the market?

Apparently, everything has already been in the world. Guaranteed SL orders were offered almost a decade ago by the British GFT broker, which was famous for its access to a wide range CFD instruments. The trading took place on the DealBook 360 platform, which was popular at the time. XTB (available only on the Basic account) or EasyMarkets (available in the entire offer).

It's just that the devil is in the details, and more precisely in the regulations. In the past, any type of "guarantee" was dependent on additional factors and conditions. But the world is moving forward and traders are becoming more and more demanding. So what's the case with CMC Markets?

GSL on the CMC platform

Guaranteed Stop Loss, marked with the abbreviation GSL (like some new Mercedes model 🙂), is absolute in CMC. This means that even if it burns or collapses - our SL will be realized on the spot. Price or weekend gaps? No problem. Macroeconomic data releases, and maybe another one SNB intervention? You do not have to worry.

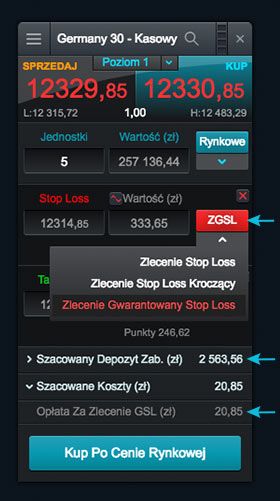

To use the stop loss guarantee, simply select the appropriate option on the platform.

Of course, nothing is for free. GSL is an extra paid option. But it must be admitted that the conditions are fair. The cost of GSL is not scary. In the case of EUR / USD, it is equivalent to 1.0 pip. Considering that the spread on this pair during the day hovers around 0,7 pips, in combination with the GSL, we still get a good offer. And yet there is a chance that we will "save" on SL slippage.

| Instrument | Fee for GSL |

| EUR / USD | 10 $ for 1 lot |

| GBP / USD | 15 $ for 1 lot |

| EUR / GBP | 20 £ for 1 lot |

| Germany 30 (DAX) | 1,5 € per unit |

| US30 (Dow Jones) | 1,5 $ per unit |

| Gold | 0,3 $ per unit |

| Brent oil | 0,02 $ per unit |

Restrictions and Conditions

CMC Markets, however, stipulates that, depending on market conditions, the GSL request may be temporarily unavailable and may change the fee for its activation.

But what happens when we reach TP, close the position manually, or decide that we want to give up the already activated GSL option? You'd think our 1.0 extra pip would be lost. None of these things! The fee is charged only when our order finishes with the execution of the (G) SL. Otherwise, the additional "commission" will be returned. Fairly.

Additional conditions:

- GSL orders may be submitted only during market hours for a given instrument,

- outside of market hours, GSL can only be modified from the current price,

- a certain minimum distance is required to set the GSL (dependent on the instrument),

- GSL is available on most (but not all) instruments.

More details on SL guaranteed orders can be found on the broker's website HERE.

A decent alternative to protection against debit?

Over the last year, many brokers have decided to introduce the so-called protection against negative balances on the account (check out: List of Brokers). On the one hand, some regulators have begun to require it (and it is not known whether they will introduce such an obligation in the entire EU), and on the other hand, traders who fear the repetition of the 15 January 2015. However, CMC Markets is one of those companies that did not take such a step. Only can GSL be a viable alternative to this protection? In our opinion, in practice, it may even be a better solution.

Debit protection is primarily needed for people who:

- they make excessive use of the lever on the bill,

- they do not use Stop Loss orders.

There is also a third option - extreme situations. It's just that even if our broker guarantees protection against overdraft, in the event of huge market traffic, the result will be wiping all our capital on the account. In other words, we are protected against indebtedness, but not against excessive loss. Guaranteed Stop Loss, even a distant one, is able to save even a part of our capital. Regardless of the conditions.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Building a risk management plan - How to do it? [Guide] risk management](https://forexclub.pl/wp-content/uploads/2021/12/zarzadzanie-ryzykiem-300x200.jpg?v=1639495023)

![Automatic Stop Loss on MetaTrader 5 - how to do it? [Video] auto-stop-loss-mt](https://forexclub.pl/wp-content/uploads/2021/11/auto-stop-loss-mt-300x200.jpg?v=1637831541)