Covid-19 is constantly bothering the markets. A turn towards oil to soften the blow

In recent weeks, writing about current events in world markets has become a special challenge. Denmark, like many other countries, is currently in a state of partial isolation, while the number of victims of Covid-19 is steadily increasing, primarily in Europe, which is now the epicenter of the pandemic, but with a high probability soon in the United States.

Omnipresent quarantine

Governments have made the right decision to support work from home and avoid danger. The negative side is the huge cost of lost revenues and pressure on small businesses to stay on the market and pay their employees. Unemployment will rise dramatically in the coming weeks and months, signaling a temporary end of the period prosperity from the last decade.

Governments and central banks have already stepped into action, launching dozens of bazookas to support individuals and businesses. Perhaps we have already reached the peak of panic - it remains to be seen. At least on the stock exchanges we are already seeing some stabilization. For now, however, the strong dollar resulting from exceptionally strong demand and the collapse of the bond market, primarily corporate, is a symbol of further challenges ahead.

Crude oil is the biggest loser

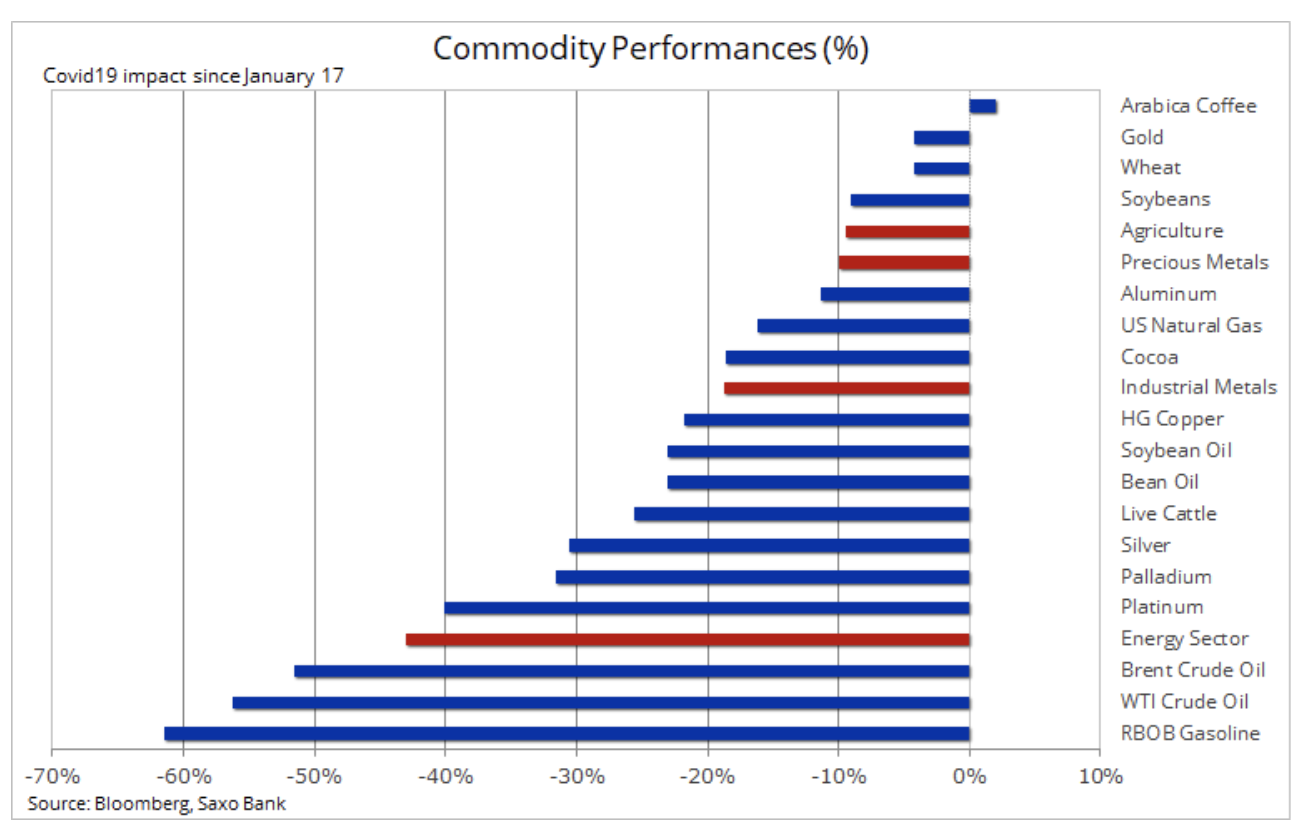

In the context of commodity markets, the table below presents the current losses in this sector incurred this year. It recorded the largest losses Petroleum, which binds the world economy and constitutes the primary source of income for many countries and regions. The extraordinary drop in global demand has created a gap between supply and demand of 5-10 million barrels per day.

As a result of Saudi Arabia's price war two weeks ago and a further decline in demand as more countries halt operations and close airline connections, this gap could increase by a further 5mbbl / day from April.

These events led to an unprecedented slump in the oil market: on Wednesday, the price of Brent crude oil for the first time since 2003 reached USD 25 / b. Compared to 2019, when the price averaged $ 65 / b, the net reduction in consumer-to-producer payments has now approached $ 3,5 billion per day.

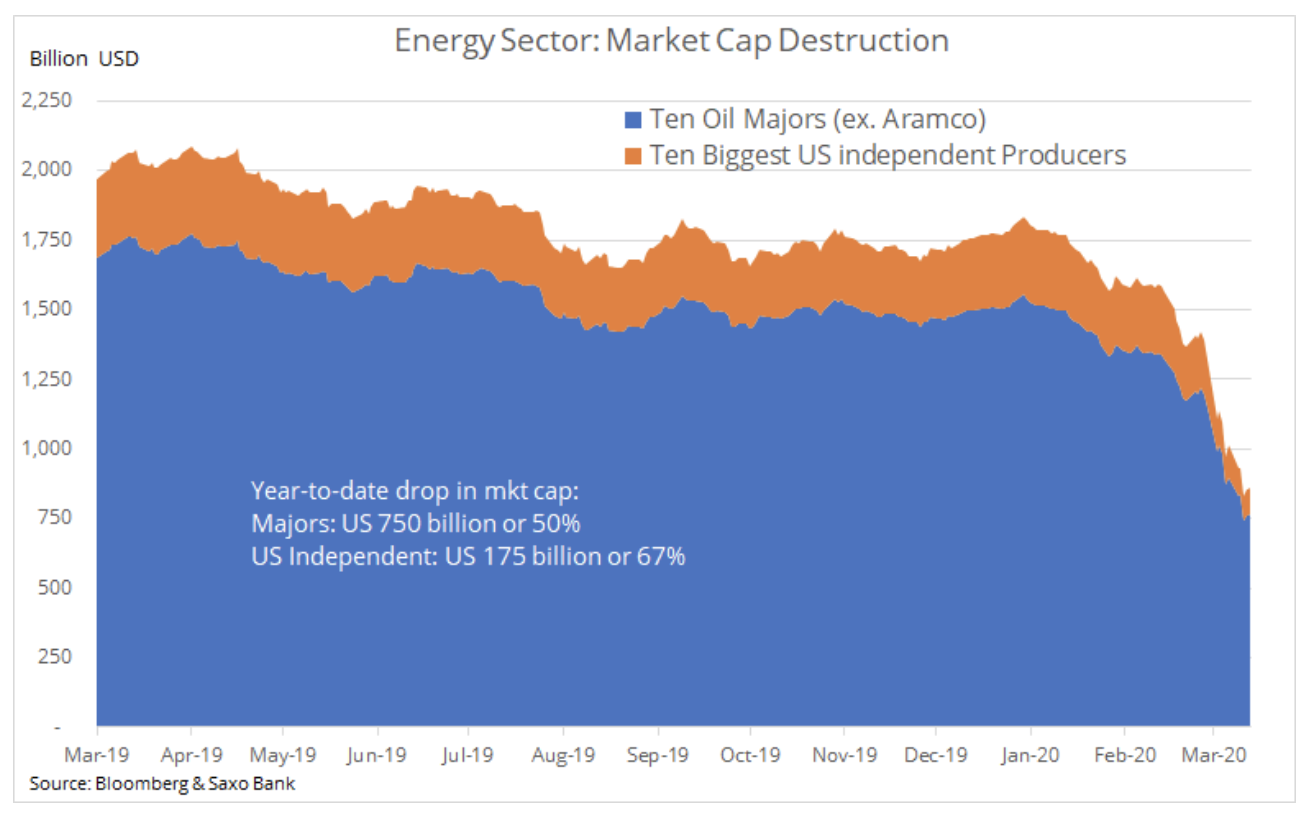

Energy companies recorded a significant drop in market capitalization in this period. While the price war is not losing its intensity, the focus is on the ability of heavily indebted manufacturing companies to stay afloat, especially in the United States, where as a result of borrowing more and less return on capital, many smaller producers face difficulties. Unless drastic measures are taken to reduce supply, it will be a race to the bottom. With such a daily increase in the amount of oil stored in just a few months, the tanks will fill, which will eventually force a decrease in production. However, this will mean huge costs and losses for everyone, including Russia and Saudi Arabia.

The race to the bottom could be slowed down by announcements of production cuts by the Railroad Commission of Texas, an agency that regulates the production of oil and natural gas in Texas, the third largest production area in the world. This agency is empowered to take appropriate action and order reductions, as was the case in 1973. Such a step would dramatically increase the chances of dialogue, and for Russia and Saudi Arabia to move away from the current war of words and prices.

For the benefit of the global economy and all of us - producers and consumers alike - in the next 12 months, we should try to avoid filling up the tankers, otherwise the price of oil will drop sharply. A 10% reduction in overall production would ensure that the oil market was able to avoid this scenario. Special times call for exceptional decisions.

Situation on the gold market

Inability gold to strengthen in recent weeks as the Covid-19 spread and economic uncertainty increased, it raised doubts about the role of this metal. In the short term, the challenge is constant demand for cash, dollar appreciation and increase in real yields as inflation expectations are shaken.

We maintain our positive forecast, recognizing some analogies with the situation during and after the global financial crisis in 2008-2009.

At that time, the final recovery did not start with gold, but with stocks of gold mining companies, and the stock market only recovered after another few months. Based on this, we closely monitor mining stocks through the Vaneck Major Gold Miners fund (ticker: GDX: arcx).

Gold saw a 15% markdown before finding support again at $ 1 / oz. This adjustment naturally raised doubts again as to whether the opinion about gold as a safe haven and diversification asset was justified. In our view, the long-term rationale for holding gold has at least strengthened as a result of recent events.

Many investors are considering silver after it fell to an eleven-year low of $ 11,65 / oz. Due to the fact that it is a lower liquid metal, like platinum and palladium, silver has fallen victim to the cash-chase last week. An additional downside potential is related to the coming recession due to the fact that 50% of silver is used in industry. Meanwhile, the ratio of gold to silver rose to a record 127 ounces of silver for one ounce of gold.

Norwegian Krone [NOK]

Like the Norwegian krone, silver has found itself at the center of the impact of factors that have shaken global markets in recent weeks. In the coming time, price movements in these very different markets should be a guide to the approach to risk among investors.

The agricultural sector has now overtaken precious metals as a sector that has recorded the best results among the raw materials since the outbreak of the pandemic. Last week, arabica coffee gained significantly as a result of supply chain disruptions. Wheat turned out to be another strong raw material in response to the increase in demand from panicked consumers filling pantries with bread, pasta and cakes. These events, along with signs of increased demand in China, strengthened flour demand from mills, as many people switched to home baking.

Finally, in the coming weeks and months, market attention will most likely focus on the catastrophic effects of a dramatic drop in demand for many key raw materials, from oil and industrial metals to some agricultural products. However, as the coronavirus spreads further, it is likely that the forecast supply will become a challenge, as mining companies and producers will begin to feel the consequences of staff shortages and supply chain breakdowns. The effects of lower fuel prices are felt in both agriculture and mining, as this means a decrease in investment. However, the potential risk for supply can cause many markets to find support faster than demand forecasts.

source: Ole Hansen, head of department of commodity markets strategy, Saxo Bank

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response