The crisis is hanging in the air. Flash crash on the yen, the Chinese economy slows down

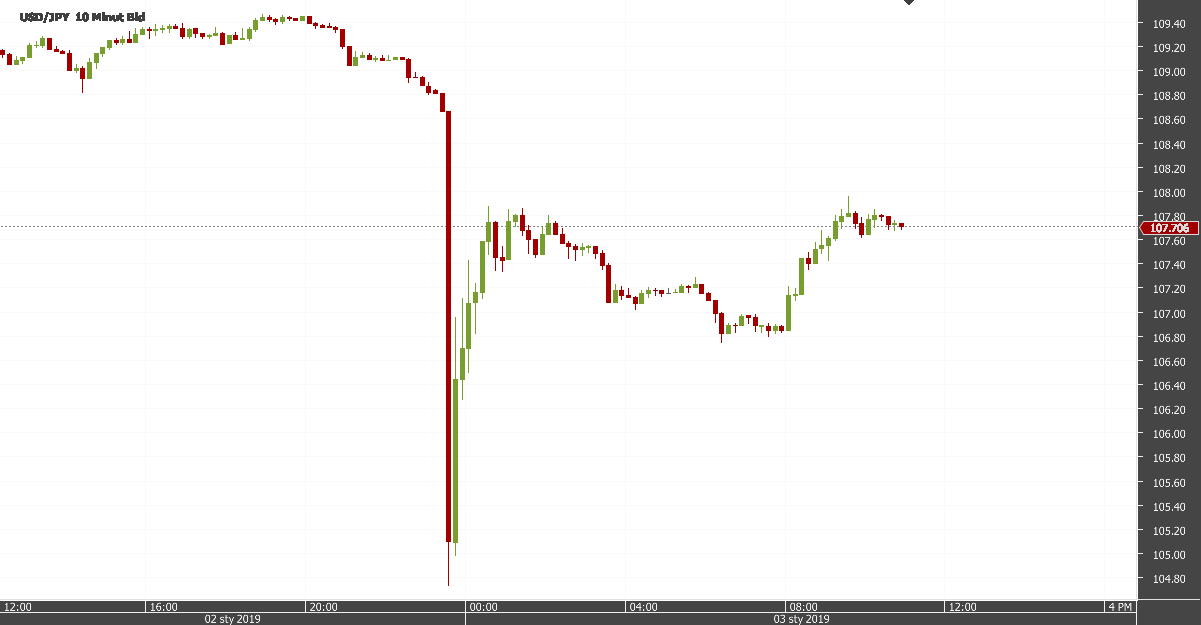

Yesterday evening, the traders delivered a lot of excitement. Movement on 400.0 pips with USD / JPY pair does not happen very often. Especially at night, in less than 10 minutes, and on the day when the Japanese are off work :-). Yes, there was no doubt about it Flash Crash. Now we are left to ask the question "why?" and "when / will there be another?".

Flash Crash phenomenon it is defined as a sudden, drastic collapse of the exchange rate of a financial instrument on the stock exchange.

USD / JPY technically

From August 2018, the rate moved in a fairly wide channel of the sideways trend with a range of less than 500.0 pips. The price was at its upper limit still in the second half of December, but a downward trend towards the lower band was already visible. But who would have guessed that it would be so decided? Relatively low liquidity from which the market has not woken up after the holiday season has certainly proved to be helpful in this case. It can also be assumed that traders playing "for consolidation" had their Stop Losses set at the level of 108.10. So all you had to do was try to "get" to that limit.

Is there a chance for a repeat in the near future? Yes. You can see with what precision the rate reacted to reaching the local low at 104.60. This is a temptation for speculators to "pull" the course to a critical level again as soon as the right opportunity presents itself.

China's economy is limping

Its condition affects the entire global situation - it does not need to be explained to anyone. Thus, it is easy to understand how negative the news is that the Chinese economy is slowing down the most in 25 years. This has a negative impact on all currencies that are dependent on the local economic situation (including the Australian dollar and the correlated New Zealand dollar). Thus, the market turned to the Japanese yen. And what's important - it's also bad for Japan, which has been fighting for years to weaken its currency to help domestic exports.

Apart from the yen, the emotions are also delivered by Apple - the company with the largest capitalization in the US. The downward revision of revenues, for the first time in many years, results in a decline in the share price of almost 8% in post-session trading. The statement reads that China and the slowdown in its market are to blame. It is worth adding, however, that the stocks have already dropped by more than 30% from the peak in just 3 months and have fallen back to their July 2017 level. It turns out that the trade war between the US and China does not help anyone - despite Donald Trump's theory that despite the conflict, the United States is able to continue dynamic development.

The situation in Poland

Real estate prices are going crazy, the unemployment rate is record low, and the sale of new cars in 2018 year broke records several times. Sounds great, right? Practice shows that the real estate market can not grow indefinitely. Favorable conditions for leasing new, more expensive vehicles have just gone away. There are also lacking hands to work, because the Ukrainian immigrant more often thinks about going further west. Effect? Slowdown primarily in the production sector.

The European PMI index for the industry is declining. A value below 50.0 means recession in the sector according to the definition. And this is the situation observed in December 2018 in the Czech Republic (49,7), France (49,7), Italy (49,2), Poland (47,6) and Turkey (44,2). The Eurozone average is 51,4. This could prove to be a sufficient brake on the European economy, especially if we take into account the fact that current production is met by orders placed in previous months.

PMI index (Purchasing Managers Index) - leading indicator; created on the basis of answers to anonymous questionnaires addressed to company managers, where questions concern orders, employment, payments, inventory and prices.

Krach is not fear

Will we enter a global recession? This is still nothing, but the symptoms of such a scenario are getting more and more. Do you have to be afraid of a crash? It depends on the perspective. Some will say that it is unethical, but from a practical point of view, the crises and crises for the speculator are the best times. It is the strong stock market bess that is the fuel for high volatility in all markets.

Hence the concept of "long" and "short" - Stock market rallies are long and slow, while declines are usually quick and sharp.

The crisis is good - it sounds terrible, but the trader is making money on volatility. The obstacles can be occasional spreads, price gaps and overloaded servers on the broker's side. That is why it is worth being prepared and ensuring proper diversification by dividing your capital into 2-3 reliable brokers.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response