Cryptoretirement: January 2024 is marked by selling facts

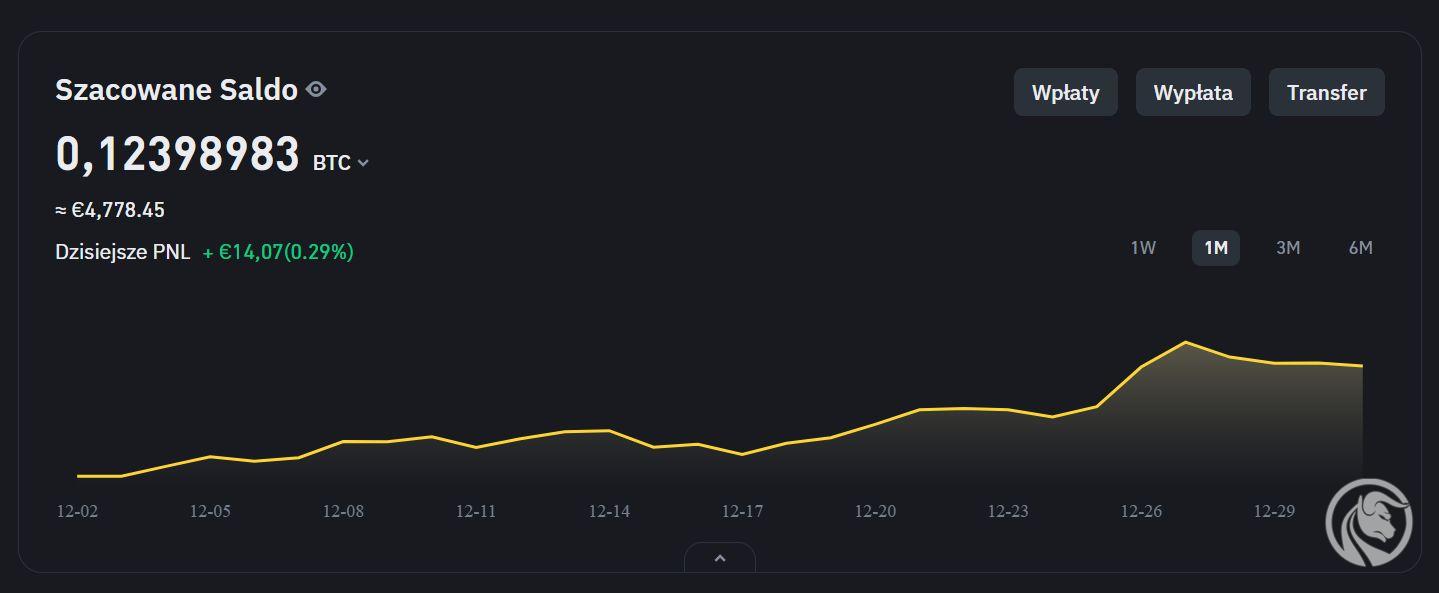

Bitcoin ETF approved, but contrary to the expectations of BTC price maximalists, its value did not increase at all. Investors implemented the second most common scenario: they sold facts. The price of all our cryptocurrencies dropped in January 2024, some even by more than 20%, but our retirement portfolio almost did not change in value, falling by only 0,78%. All thanks to the rewards from the issuance of new cryptocurrencies on the Binance exchange and staking rewards.

Check it out: Crypto-retirement: December 2023 - successful Saint's rally. Nicholas

Crypto-retirement rules of the Forex Club Portal:

- we invest on Binance Stock Market, which is not only the largest in the world, but also - so far - the most stable,

- every month we allocate an amount of EUR 60 (when we started it was the minimum deposit threshold at Binance),

- we want to invest approx. half of the funds in Bitcoin, as the "king of cryptocurrencies" and the indisputable flywheel of the entire market, but it is not a permanent rule,

- in addition to BTC, at the beginning we selected 3 other cryptocurrencies: LINK, ADA and BNB, in which we will invest,

- if it is possible, we deposit cryptocurrencies on "deposits" in Binance, recently also into the liquidity pool,

- every few months we decide whether the portfolio will include other cryptocurrencies, recently CRV, SAND, AXS, APE and GMT and BSW, we have completed investments in LINK and SOL,

- the investment horizon is at least 10 years.

In early January, we bought Binance Coin (BNB)

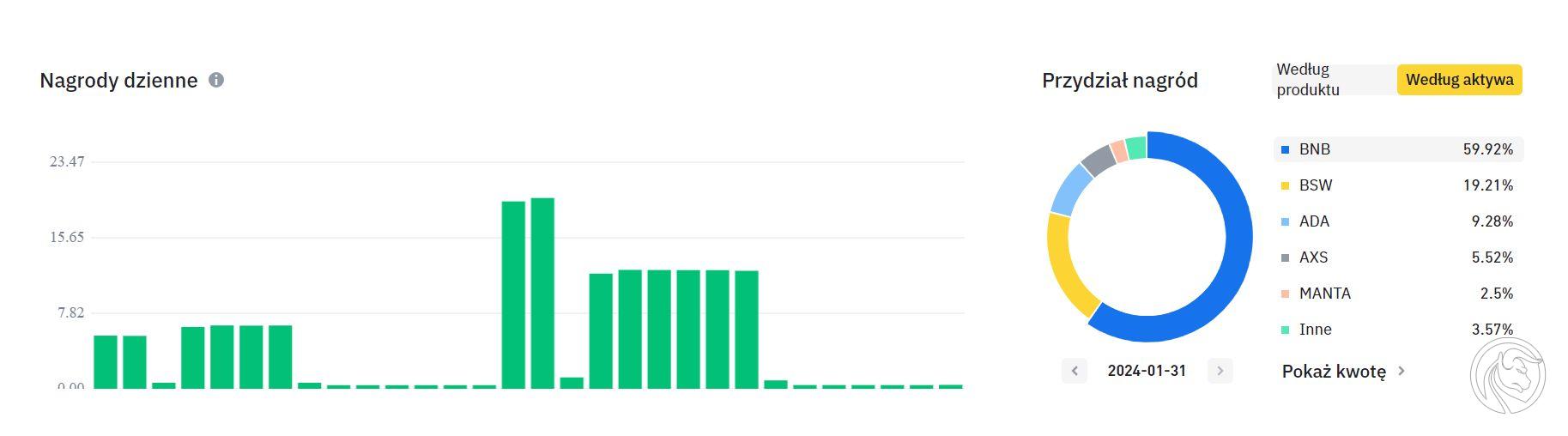

We bought Binance Coin a month ago. Mainly because we combined the BNB staking feature with a fixed interest rate Launchpool project, which allows you to receive new cryptocurrencies that are issued on the Binance exchange.

After purchasing for 60 euros, at the beginning of January 2024, our portfolio looked like this:

After the Bitcoin ETF was approved, the worst-case scenario came true: instead of an accelerating bull market, investors - especially short-term ones - started selling the facts, which caused the BTC price to fall. The entire market has traditionally followed the king of cryptocurrencies. And in this case, it's also textbook: altcoin prices have fallen much more dynamically.

The results of our cryptocurrencies in January 2024:

- Bitcoin (BTC) -7,16%

- Binance Coin (BNB) -9,50%

- Ape Coin (APE) -13,40%

- Cardano (ADA) -20,14%

- Axie Infinity (AXS) -23,58%

- Biswap (BSW) -25,81%

- Sandbox (SAND) -27,28%

- Green Metaverse Token (GMT) -28,25%

- Curve DAO Token (CRV) -29,95%

How come the value of our retirement crypto portfolio decreased by only -0,78%? This is due to two actions. The first is deposit interest rates, because from the beginning we place all cryptocurrencies on deposits on the Binance exchange. But the second one is more important: in January 2024, several new projects were launched and we received them from the promotional pool for the BNB we had. The drops had an initial value of PLN 100 to PLN 300. This translated into significant profits practically throughout the month:

This is how much we would have had if we had sold them on the debut day. However, we have decided that we will keep all new cryptocurrencies (including XAI, AI, MANTA, NFP) that we have received in recent weeks for a minimum of one year. Only after this period will we assess their potential, because there are sleeping giants among them that wake up slowly, but then can boast of gigantic price increases.

Thanks to this, at the beginning of February our portfolio looked like this:

We bought Binance Coin (BNB)

So we buy BNB again because we count on further launchpool projects in the waiting room, which affects not only the chance of finding the next "unicorn", but also the growing demand for BNB, which sooner or later always translates into the price of the token.

After buying BNB, our wallet looks like this:

Crypto Retirement: A Summary

Let us remind you: we deposited 48 times of EUR 60 each, i.e. we invested a total of EUR 2. On January 880, 1.02.2024, the account balance was EUR 4. In 673,20 months, our portfolio increased by EUR 47, or 1%.

Portfolio balance after 47 months: 4 673,20 euro (sum of payments: EUR 2880)

Loss in January: -0,78%

Profit after 47 months: + 62,26% (+ EUR 1 793,20)

Next summary in a month!

Learn more about selected cryptocurrencies:

- Bitcoin - all about the "king of cryptocurrencies"

- Link - a cryptocurrency that Intel has bet on

- ADA - a token created by scientists

- BNB - a token from the Binance exchange

- SAND - better than Minecraft because on blockchain and NFT

- SOL - still the cheapest blockchain platform on the market

- CRV - a platform for earning on stablecoins

- AXS - the gaming hit of recent years

- APE Coin - the cryptocurrency of the most famous NFT

- GMT - STEPN application - a new hit on the cryptocurrency market?

- BSW - 107% token stacking platform

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response