Sugar boom, stabilization on the market of agricultural raw materials

For many months, food prices have been one of the hot topics discussed by many people. The record prices of vegetable oils and grain products are mainly the aftermath of the outbreak of the war in Ukraine.

The situation on the wholesale markets of agricultural raw materials is stabilizing, as evidenced by the 12th consecutive decline of the FFPI (The FAO Food Price Index) to the levels last recorded in 2021. Among the sub-indices, the sugar market is in the opposite trend, the highest level for many years.

Sugar market

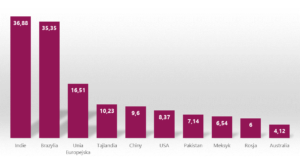

World sugar production is shaping up at the level of approx. 180 million tons. The main global producers are two countries, ie India and Brazil, where on average about 35 million tons of sugar are produced.

W. 1 The most important sugar producers in the world (million tonnes). Source: own study based on Statista data

The 10 largest manufacturers in the world account for approx. 80% of global production. This group includes, among others: European Union countries, Thailand, China, USA and Pakistan. In recent years, we have seen a situation where sugar consumption has been close to the volumes produced, and stocks have remained relatively constant. The year 2023 was supposed to be relatively calm, but the events of recent weeks show that the market was under pressureand prices soared to their highest levels in many years.

Prices are at their peaks as a result of supply concerns

In recent days, increased price pressure has been observed on the sugar market. The price of raw sugar surpassed $24/lb, its highest level in more than 10 years. Even greater increases took place on the white sugar market, which translated into a significant increase in the premium (difference in price between white and raw sugar).

The dynamic growth on the sugar market observed in recent weeks is the result of several factors. One of the elements that pushed the price of raw material to new highs this year is the approaching expiry date of contracts (next Friday) in May. The high number of short positions and the inability to physically settle contracts causes the need to close the "shorts"which affects the price of sugar.

In addition, the rally is driven by issues related to the supply of raw material. India, one of the largest exporters of sugar in the world, has introduced restrictions on the shipment of goods outside the country. China also announced a reduction in the sugar supply forecast for the current season to 9 million tonnes. The situation is also not good in Pakistan, Thailand and European countries.

All hope was placed in Brazil, but the recent above-average rains in the region do not inspire optimism. Moreover, the next period may also be associated with high uncertainty. The area of sugar cane and beet cultivation may decrease, among others due to due to Thai farmers planting more cassava, and a reduction in crops in France as a result of the ban on the use of neonicotinoid pesticides.

The combination of the above-mentioned circumstances makes it possible that the upward trend will continue and sugar prices will approach the maximum levels recorded at the beginning of the previous decade.

Investment opportunities

The growing range of financial instruments available to the average investor also creates the opportunity to benefit from changes in sugar prices. One of the investment products that allow exposure to sugar market there are ETFs, among which you can find WisdomTree Sugar.

W. 3 WisdomTree Sugar Quotes against sugar prices. Source: own study based on data from Boerse Frankfurt, Investing.com

Quotes of the presented ETF well reflect the trend prevailing on the sugar market. Differences in commodity prices are primarily due to currency issues. Since the beginning of the year, the instrument has achieved an above-average rate of return, growing by over 25%.

Summation

Agricultural raw materials are a segment of the investment market that is not very popular among global investors. Market specifics largely dependent on meteorological factors makes forecasts subject to a large dose of uncertainty. A certain kind of unpredictability often creates investment opportunities and allows you to achieve above-average rates of return in the short term.

A great example is the behavior of sugar prices over the last few weeks. Reaching the highest price levels for over 10 years is an important signal that this market segment can be interesting and sometimes it is worth taking a closer look at it. Certainly, there will be a lot going on in the sugar market in the coming weeks, and developments will show whether the recent price breakout will continue.

Source: Piotr Langner, WealthSeed Investment Advisor

Disclaimer

This document is only informative material for use by the recipient. It should not be understood as an advisory material or as a basis for making investment decisions. Nor should it be understood as an investment recommendation. All opinions and forecasts presented in this study are only the expression of the author's opinion on the date of publication and are subject to change without notice. The author is not responsible for any investment decisions made on the basis of this study. Historical investment results do not guarantee that similar results will be achieved in the future.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response