Will the Federal Reserve accelerate tapering?

Yesterday, Thanksgiving was celebrated in the United States. Therefore, trading on the US stock exchange was closed. The day before yesterday we got to know a large amount of macroeconomic data, including publications from the labor market. In the last six months, we have been looking particularly closely at the issue of unemployment and unemployment benefit claims. This is because Federal Reserve he pays particular attention (in the context of the pursued monetary policy) to employment. In today's article, we will analyze the chances of an acceleration announcement in December tapering (increase of limits) and the impact of these measures on inflation.

Recovery - a necessary condition

During the last two meetings, the Fed placed particular emphasis on economic recovery as a necessary condition to maintain the slowdown in the pace of asset purchases (tapering). The Council left the door open to stop the tapering if necessary (the ongoing slowdown), saying that the economy needed further fiscal stimulation.

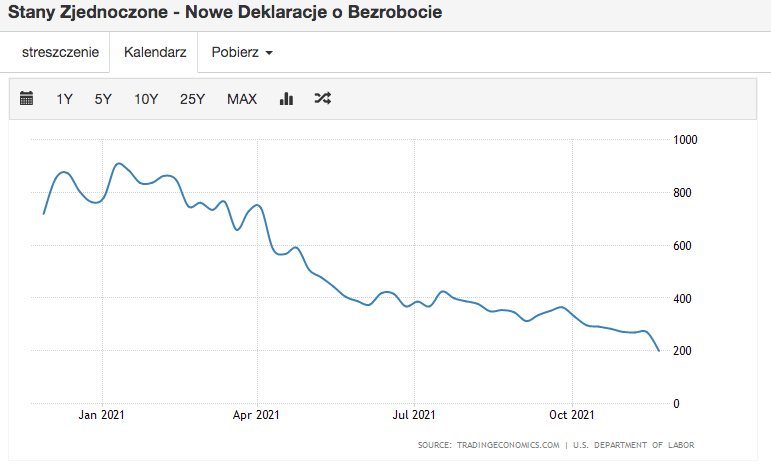

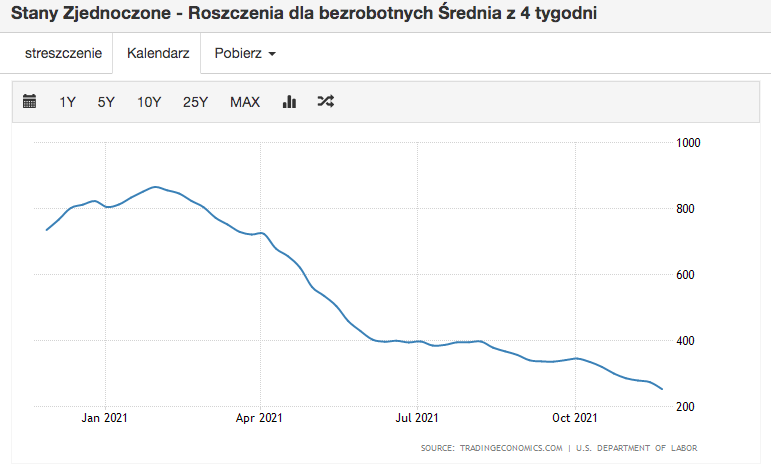

The labor market was one of the elements of the economy that suffered the most from the pandemic. Hence, so much pressure from the central bank to bring it back to a healthy condition. Without delving into the relationship between the labor market and the economy as a whole and the supply / demand processes it shapes, let us focus on the nominal values of employment. As shown in the two charts above (both have a yearly range), both the new unemployment declarations and unemployment claims (4-week average) are the lowest in the analyzed range (year). The labor market has practically returned to pre-pandemic levels. Therefore, it can be concluded that its structure is good enough for the tapering to be not only continued, but also intensified.

Another issue is the seasonality of this employment. Many analysts of investment banks indicate that statistically the pre-holiday period showed historically lower unemployment (and further on, benefits and applications). Will this be taken into account at the December reserve meeting? I think it might be. Powell has been overly cautious in recent quarters. Therefore, I am more in favor of the scenario in which he indicates that a significant improvement in the labor market has occurred, but it should be watched during the next readings.

High inflation is a prerequisite for recovery

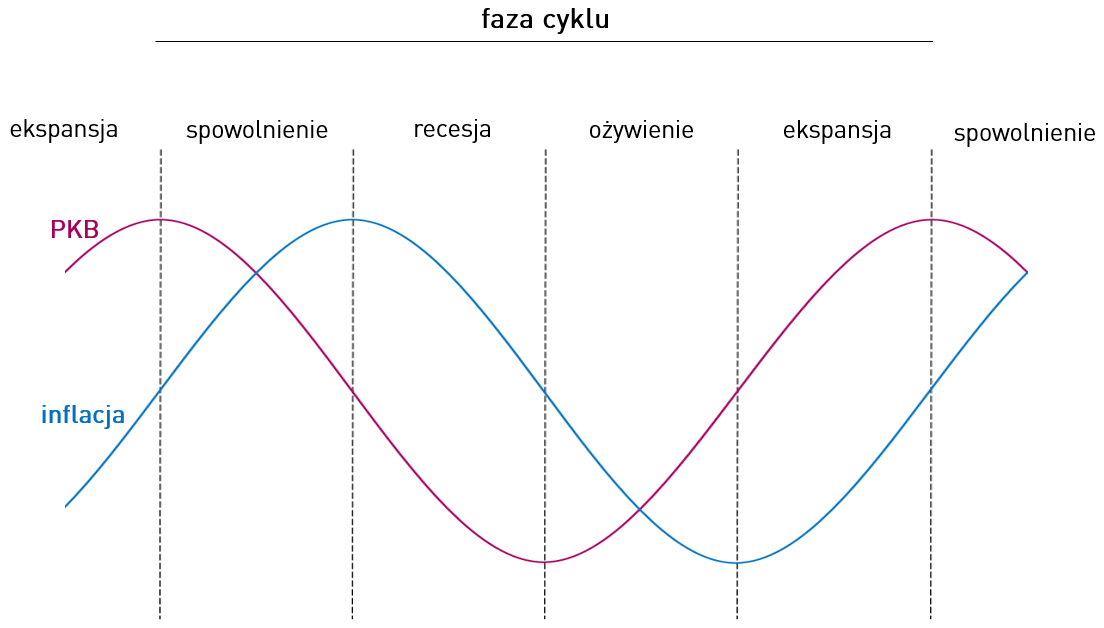

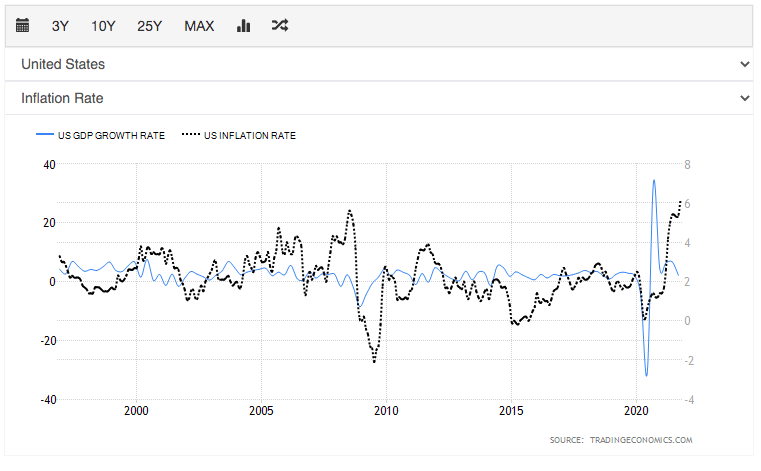

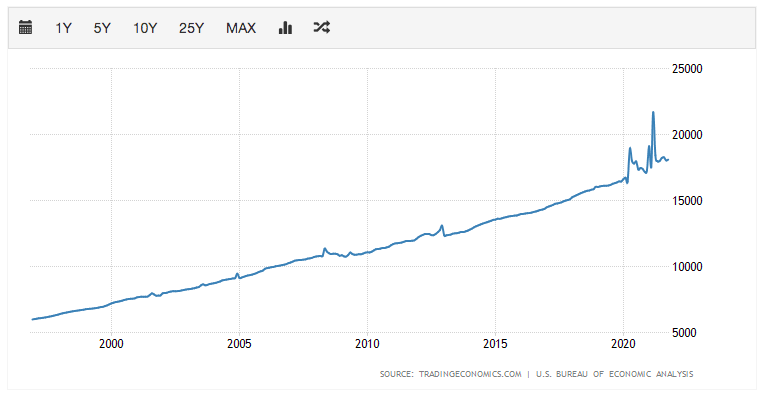

Looking at inflation and economic growth purely as a model and technically, let's try to determine where (in what phase of the cycle) we are now. To make the analysis a bit easier, we will consider two graphs. The first model, the second "real", in which we compare inflation to the rate of economic growth in the United States.

Looking only at models, we can still say that we are still in a phase between a slowdown and a recession. We are not behind us inflation peak, it can be said that a high rate of price increase is still present in the economy. Dynamics readings for Q3 in the US show a downward trend. So what kind of recovery are we talking about?

Answering this question, it must be said that the effects of the changes introduced in the monetary policy are postponed. Of course, you have to take into account the short-term factors that may mask the above-mentioned effects to some extent (as in the case of the PLN, which is after two abundant increases, and is currently depreciating more and more in relation to the USD and EUR).

Distorted inflation-GDP relationship

In the above paragraph, we compared the real market to a model economic situation pattern. At first glance, everything is correct. We have a pattern that fits into the slowdown / recession phase. I would like everything to be so trivial that we match one pattern to the pattern and we are able to determine where (economically) we are now. The problem is that the course of each crisis until the pandemic crisis was very similar. The "crisis generator" was either the financial market or the real economy. However, the Covid crisis is completely different. In the first case, we usually observed a collapse in demand, which resulted in reductions in employment and wages, along with a decline in real household incomes.

Without analyzing the excessive number of indicators, we can see that personal disposable income not only did not stop during the covid crisis (not to mention a steady decline), but also recorded significant increases. This is explained by the huge reprint, the allowance anomaly and numerous fiscal measures. Never before on such a scale and in such a short time has so much USD been printed as in the times of 2020. Despite closing and rationing the supply by enterprises, the demand side has not depleted (due to the large, available money resources), but has been put off in time, what we are now observing (via inflation readings).

Will the tapering be accelerated?

Summarizing the above, there is a good chance that by the end of this year the tapering will be accelerated. We still observe strong consumer demand, and we have the Santa Claus Rally and pre-Christmas shopping ahead of us. It is true that we will not know the readings from this period until January. However, following the fact that the covid crisis was a strong slowdown, delaying the demand in time, the FED has a lot of room to postpone increases in time, and to neutralize the loose monetary policy with tapering. With such high inflation readings, which, due to the pre-holiday season, will not show signs of stagnation / slowdown, there is a good chance that the Federal Reserve will boost the tapering by buying even fewer bonds from the market.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response