Forex lever: Do you need high leverage? [Column]

The FOREX lever is something the currency market has always been associated with. It has always attracted investors, especially those with smaller capital. According to many, it was thanks to her that the traders were given the opportunity to achieve high rates of return in a short time. The effect was often different, but this, of course, did not exclude the original assumption.

In any case, the siphon is like the emblem on the FX / CFD market flag. But is high leverage something you can not live without? Or maybe you just do not want changes, even though they will not affect you at all?

Forex leverage - necessity or possibility?

The mechanism in the form of leverage in our assumption is to enable us to invest much more than the one we have on the account. For what? To be able to achieve a theoretically higher profit with lower volatility. Forex is very often mistakenly identified with a market with a huge amplitude of exchange rate fluctuations. Of course, if we measure the scale of price change in points, it will turn out that it really is. But in terms of percentage of currency, at least the most liquid ones, are one of the most stable instruments.

With little capital, you can actually say that we are doomed to higher leverage. But let's be honest - 500 zlotys is not the amount that we can roll up the world or change our social status, right? It is more of a hobby speculation, art for the sake of art, a game that is often associated with the inability to rationally manage capital, which in turn teaches us only to take excessive risks.

However, there are strategies (arbitration, carry trading, news trading) where high leverage is their foundation, which allows you to optimize your results. It is also an opportunity to deposit a much smaller amount of funds on the investment account and leave a sufficiently large reserve in the bank. But you have to admit - there are more gamblers in Forex than consistent investors with a clear plan of action. And probably this was the assumption that ESMA came from, while leaving a wicket in the form of a "professional client".

What leverage do you use?

Now, looking at the platform and recent transactions, calculate what leverage you really use in practice. I made similar calculations myself. The results are presented below.

I currently have 31 800 on my account.

My last transaction was the position on 0,5 lot on a GBP / USD pair.

My biggest transaction in the last two weeks was 0,9 lot, also on GBP / USD.

In the case of the last transaction, the real leverage was 1:8.

In the case of the largest transaction, the real leverage was 1:14.

As you can see, I still had a lot of supplies, both to the currently valid limits and the upcoming ones. For statistical purposes, I encourage you to share your calculations in the commentary under the article.

A "gift" from ESMA

Whenever restrictions are introduced, a wave of dissatisfaction appears. Nothing strange. In the end, we feel that someone is attacking our freedom. And yet we know exactly what we need and what we can afford (that's why many drivers treat speed limits only as loose suggestions).

Lewar himself was never risky. It only gives us more possibilities. Risk always appears when a tool with considerable opportunities hits inexperienced hands. The problem is, however, to treat everyone equally, at least at the beginning.

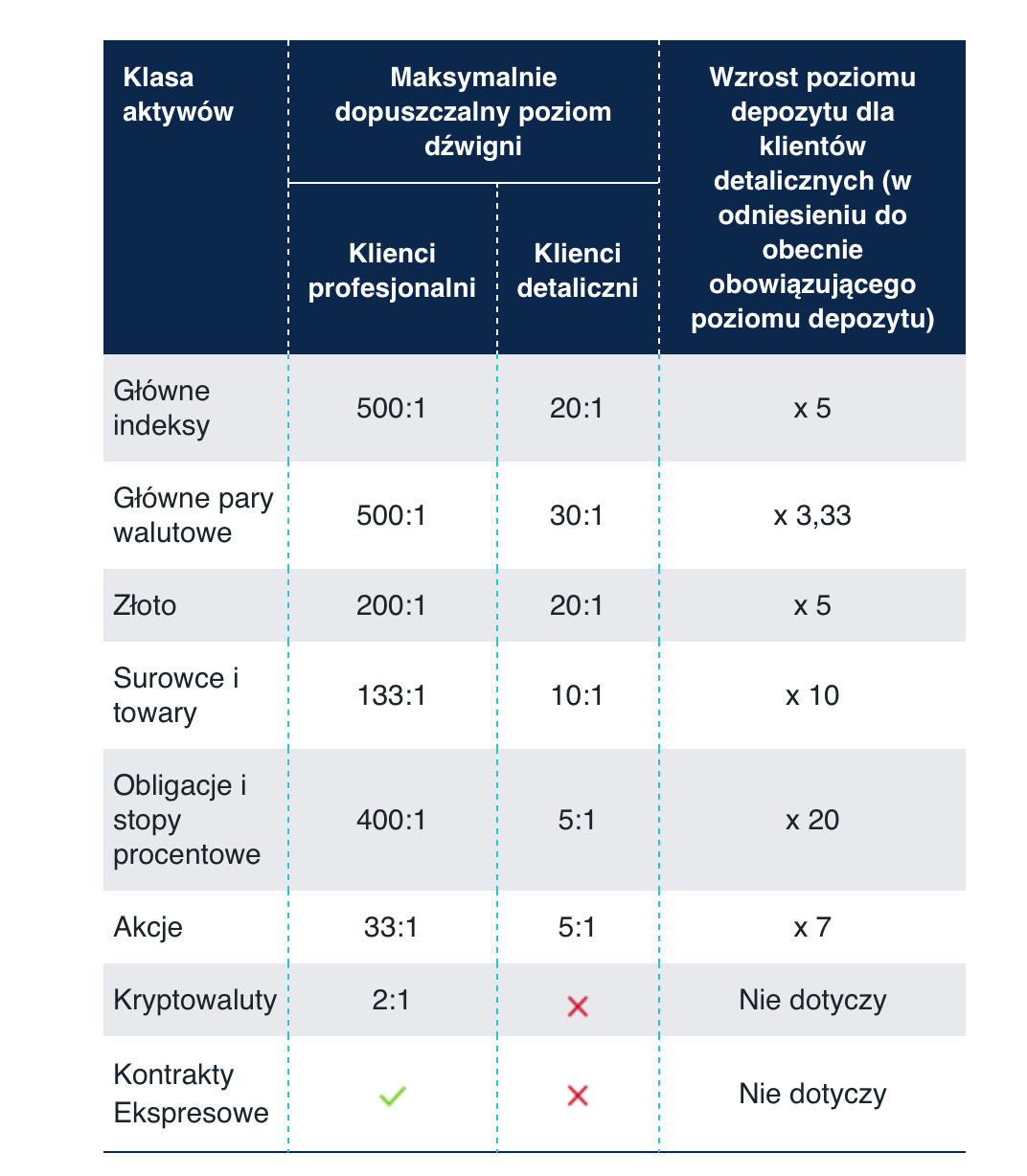

The table below sent by one of the brokers presents legible changes in leverage.

The point of reference are the maximum values offered as of today, i.e. taking into account the KNF guidelines for leveraging max. 1: 100, which applies to Polish residents from July 2016. These guidelines do not include professional clients (read: Become a professional client with the 1 left: 500?).

If your specialization is Forex, you can say that the changes are not dramatic. Worse with less popular markets. You can also regret the closing of the door to cryptocurrencies, because whatever it is, it is a market that will certainly develop very dynamically, and being unable to apply for the "pro" status, we will be left to watch it from the side.

Forex will be unprofitable?

I met with the opinion of a trader who said that after changes in the EU regulations, Forex will cease to be profitable and he will change to the stock market. Was not this the purpose of the originators of the restrictions introduced? Officially, it was about increasing the security of trade and the capital of individual traders. But will the changes that come into effect make currency trading go past the target?

Let's look at the facts.

Variability. The volatility is higher on the stock market. In the case of KGHM's shares, exchange rate changes in June this year they were able to hesitate in one session even up to 6%. On the eurodollar market in the same period reached 1,9%. Only consider leverage. Actions? 1: 1. Forex trading? 1: 30. So the maximum variability that we can use is 1,9% x 30 = 57%. This is 9,5 times the greater profit potential (losses as well) with the involvement of all capital.

Short sale. The argument can not be beaten. Short sales are on the FX / CFD market. Lack of any restrictions, based on the concept of boom or bear market. Actions? Well, while the bull market is going on, no matter what we buy, there is a good chance that we will earn. When the belly comes in most cases, we will vegetate, waiting for the day when we can finally buy some shares.

Volume. The regulated market has the advantage that we actually see what the real turnover in the market is. Just what, if it is, for example, in the case of the WSE, saying gently, poorly? There is not even the slightest sense of comparing the turnover of the Polish Stock Exchange with the currency market.

Transaction costs. At the moment, fees from most Forex brokers remain stable. But sporadically, one can observe a curious situation, where the brokers covered by ESMA decide to lower the commissions in order to stop existing customers, afraid of their outflow outside the EU. So in effect, we are losing leverage, but also the fees are reduced. Let us now refer to the stock market. For many years, Polish brokerage houses have been maintaining commissions at a similar level in the area of 0,3% on the value of the transaction. In the case of Forex brokers, it is usually 0,0020%. Even taking into account leverage, which ultimately affects the increase in the value of the transaction, it is still a decidedly lower commission rate.

Trading hours. Are you working from 9 to 17? Actions - You are doomed to place orders during working hours. Forex - you can adjust the strategy and trading hours to your mode of the day.

Transaction platforms. The opportunities offered by the platforms offered by Forex brokers are space in comparison to the Polish stock market. Speed of operation, intuitiveness, analytical possibilities, operation of machines and non-standard solutions - this is a sea of possibilities to which we have access as standard, without additional fees and conditions. The complete opposite of what brokerage houses on the regulated market offer us.

One could mention further, but is not it enough to make an assessment? In the face of changes, is the stock market becoming more attractive than the Forex market? Evaluate yourself.

… If facts, then facts

It can not be said, however, that the introduced changes will be imperceptible for everyone.

There will certainly be several groups of victims:

- Retail traders with small capital. Unfortunately, the trade from 100-200 PLN will cease to be possible. And even if the brokers bring nano-flights or even smaller units, it will simply be a waste of time.

- Traders scalping high volume, with a narrow stop loss. It may be necessary to reduce the volume and, consequently, reduce profits.

- Traders using non-standard strategies based on higher leverage who do not have the chance to change their qualifications to a professional client.

- Traders trading in commodities, commodities and CFDs on bonds. In this case, we are talking about a significant reduction in leverage to the 1 levels: 10 and 1: 5 (increase of the required deposit 10- and 20-times).

All these groups will have to think about compromising or modifying their existing habits. In the name of "better protection". At least for now.

Summation

The upcoming changes are not the end of the currency market. Undoubtedly, some of its participants will feel the changes as negative. But will Forex become unprofitable or unattractive? No. It is still a market of great opportunities that can be put into practice. We should also remember that the changes introduced by ESMA are, in theory, temporary. The new guidelines will apply from August 1 this year. for the next 3 months. After this period, the regulator has the option to extend this period by another 3 months. Will he decide to take such a step? Time will tell.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex lever: Do you need high leverage? [Column] forex shift lever](https://forexclub.pl/wp-content/uploads/2018/06/Zrzut-ekranu-2018-06-19-o-10.51.30-1000x653.png)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)

![Forex lever: Do you need high leverage? [Column] Cryptocurrency market](https://forexclub.pl/wp-content/uploads/2018/06/Zdj%C4%99cie-ilustracyjne-mat.-pras.-102x65.jpg)

![Forex lever: Do you need high leverage? [Column] tradebeat xtb](https://forexclub.pl/wp-content/uploads/2018/06/tradebeat-xtb-102x65.jpg?v=1596198878)

3,33 times higher payment for fx is not a tragedy. The problem may be when some beginner trader who is deeply convinced in his colorful indicators and finds that there is nothing to wait for and you have to play with the flight. If you do not have your own capital, you will make yourself a leftist by means of payday loans, lose everything, and the bailiff will become a frequent visitor. Security is the key 🙂

Exactly. It is also worth noting that in the case of the majority of aware traders, it will not be necessary to pay a deposit 3 more than once because the trader has so far rarely used the lever in 100%. Usually it is a lot less. So the only thing that will change in this case is the increase in the commitment of funds that we already have on the broker's account. However, this will not translate into our profits or the risk we take. Of course, assuming that we do not currently exceed the real leverage at the 1 level: 30 and we will keep the volume at the same level.

Another interesting thing for me is the protection against a negative account. I may be wrong, but I heard that it will only apply to amateurs, so I do not know if there will be a bizarre situation in which real amateurs in pursuit of a lever will pretend to be a pro, and real professionals will become "amateurs" for additional safety.

Theoretically, it could be that way. But in practice it looks a bit different. Negative balance protection will be mandatory, but for the "retail". It will not be obligatory for the "pro", but most brokers have already announced that they will also offer them this protection. Just to increase the competitiveness of your offers and stop the migration to brokers from outside the EU :-).

I have been trading for several years but to be honest I have not really said anything about these ESMA regulations. if someone wisely manages the deposit and does not drive sharply after the band, 1:30 is even more than enough.

Рычаг дает возможность больше заработать, но и в то же время потерять при неосторожности. Так что высокий rychag для бывалых тредеров и тех кто хочет заработать при больших рисках