Gas leading general strengthening in commodity markets in 2022

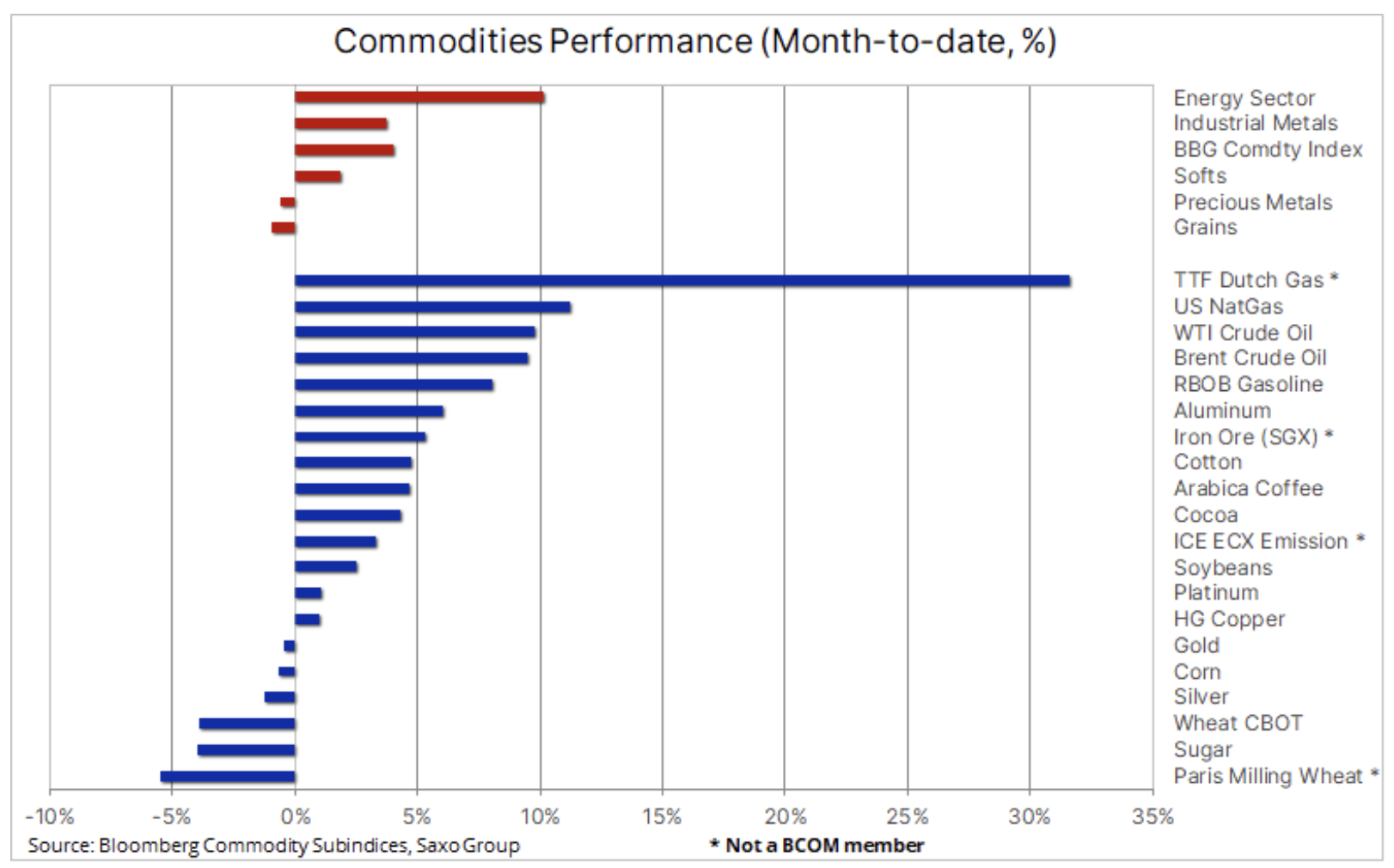

Commodities extended their strong start to the year last week: the Bloomberg commodity index this month saw an increase of 4,1%, while the SP GSCI index, heavily contributed by the energy sector, gained around 5%. The energy sector remains in the spotlight this year as lower-than-expected supply pushed up oil prices by almost 10%, while what is happening in the natural gas market in both the US and Europe is best described by the term 'extreme rollercoaster ".

In the macroeconomic context, the commodities sector received additional support from a weaker dollar and lower bond yields after data showed that in December, US consumer prices, as expected, reached their highest level in forty years (7%). In contrast, China saw a decline in the CPI, which, combined with weak credit data, has strengthened the chances of the Chinese government accelerating the pace of some of the 102 key projects included in the 2021-2025 development plan. Many of these areas will need industrial metals to some extent as they relate energy security, affordable housing, infrastructure development and logistics.

About the Author

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Ole Hansen, head of department of commodity market strategy, Saxo Bank. Djoined a group Saxo Bank in 2008. Focuses on providing strategies and analyzes of global commodity markets identified by foundations, market sentiment and technical development. Hansen is the author of the weekly update of the situation on the goods market and also provides customers with opinions on trading goods under the #SaxoStrats brand. He regularly cooperates with both television and printed media, including CNBC, Bloomberg, Reuters, Wall Street Journal, Financial Times and Telegraph.

Industrial metals

The industrial metals sector reached its three-month high on the prospect of a sharp decline in inventories, supply disruptions and the aforementioned possibility of a Chinese fiscal stimulus increasing the potential for re-strengthening. Nickel has taken the lead, hitting the highest price in a decade amid fears that Indonesia, the world's largest supplier of nickel, is taxing raw nickel exports to focus on expanding more profitable refining domestically. Such a move from Indonesia, combined with strong demand for electric vehicle battery production, could result in a significant supply deficit in 2022. After many months of a sideways trend, copper has finally signaled a breakout, a move above the former resistance area, and now support at the level of $ 4,47-50 was driven by the prospect of rising demand due to electrification, scarcity of supply and signals that China is tightening its policy to support the slowing economy, thus offsetting the latest macroeconomic risks, in particular related to the crisis in the Chinese real estate sector .

Agricultural sector

In the agricultural sector, the start of the year was mixed: markets for constrained commodities such as coffee, cotton and soybeans increased, while wheat prices continued to decline. It gained momentum after the US Department of Agriculture raised its forecast for global inventories and after the International Grains Council predicted record world production for the coming 2022-2023 season. Adverse weather conditions in Brazil continue to negatively affect the supply of coffee and, more recently, soybean supplies, although rainfall is now expected in the growing areas, which could improve this situation.

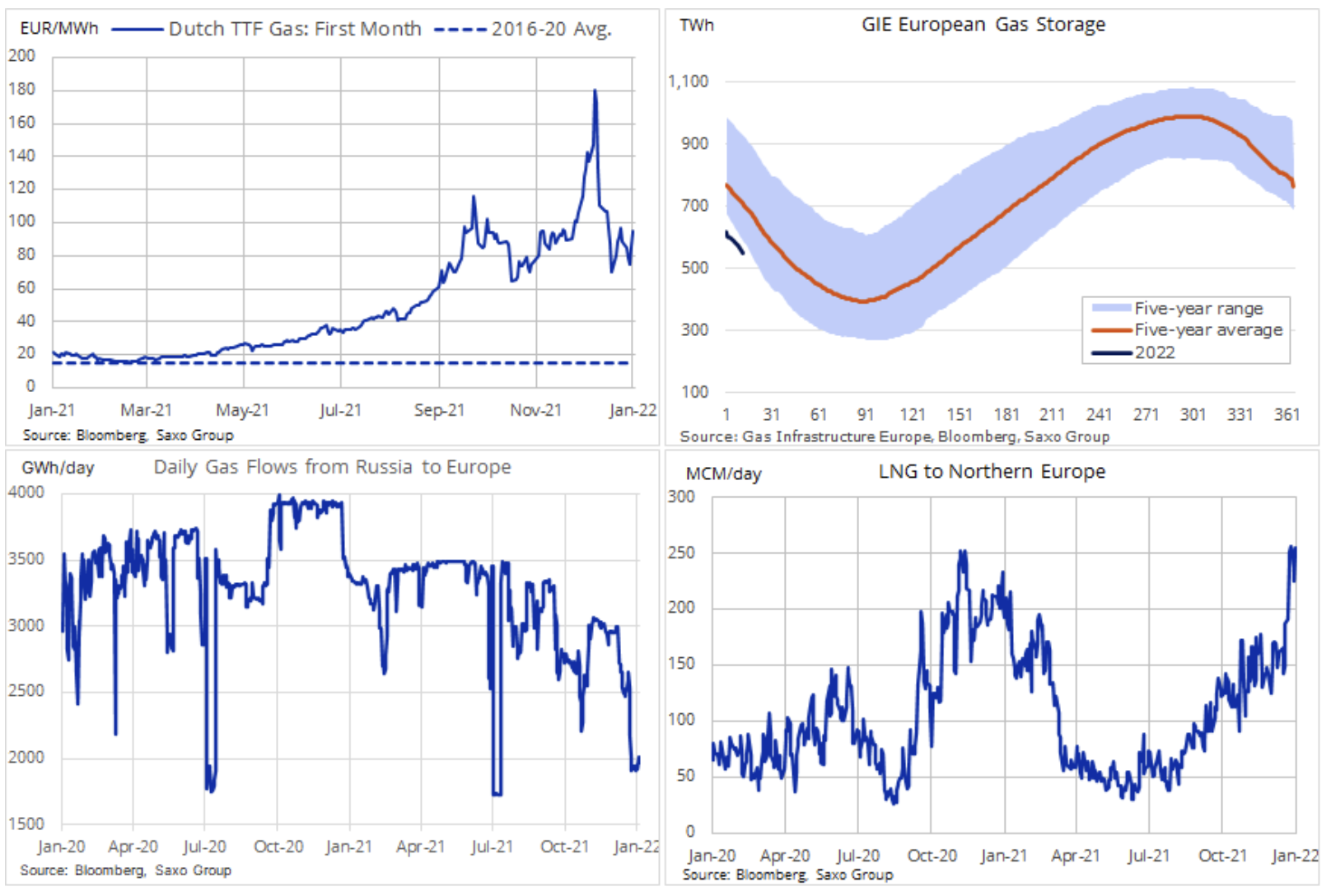

Another week was also the rollercoaster on world gas markets. US natural gas futures for the first month on Wednesday rose as much as 14% to a six-week high in response to the freezing weather, then fell 12% the next day on the outlook for a warming and after weekly inventory use turned out to be as predicted. To this should be added the recent increase in LNG supplies to Europe and the previously safe US market has become much more exposed to international events, which contributed to the largest weekly growth since November.

Meanwhile, in Europe, the energy crisis continues and despite an armada of ships with increased LNG supplies, gas prices remain at a breakneck, and for some even unattainable, levels. The aforementioned arrival of LNG-carrying vessels and the mild January weather so far have reduced the risk of power cuts and depletion of gas stocks, but uncertainty about the Nord Stream 2 pipeline and Russia's intentions towards Ukraine continues to cause sudden jumps and high volatility. On Thursday, the price of the Dutch benchmark TTF gas futures briefly fell below EUR 70 / MWh in response to the aforementioned mild weather and heavy foreign LNG shipments, followed by a sharp upwards of over EUR 90 / MWh after talks between Russia and the United States has failed to alleviate fears of military intervention in Ukraine, a country through which about a third of Russian gas flows on its way to Europe.

Petroleum

Clothing continues the month-long rally, and although the jump in early January was the result of temporary concerns about a supply disruption in Libya and Kazakhstan, larger and more worrying phenomena became apparent at the same time. In addition to the fact that the increasingly common omicron variant has a much smaller negative impact on global consumption, price support this month was also influenced by signals that several countries in the OPEC + group are struggling to increase production to agreed levels.

We have seen exceptional compliance in this group over the past few months as monthly production increases of 400 barrels per day have not been achieved, due in particular to problems in Nigeria and Angola. However, a recent SP Global Platts manufacturing survey in December found 000 out of 14 members, including Russia, had not met their targets. According to this study, 18 members were producing 18 million barrels a day in December, or about 37,72 million barrels below their combined quota.

An increasing discrepancy between oil quotas OPEC + and actual production is already being felt in the market, and the prices of the nearest expiry futures contracts for both WTI and Brent crude oil rose more than the future contract prices. Such a difference, i.e. The deportation between the first and second Brent crude oil futures rose from a low of 20 cents a barrel in early December, as omicron concerns triggered a sharp correction to the current level of 70 cents a barrel.

Global oil demand is not expected to peak in the near term, putting even more pressure on production reserves, which are shrinking every month, thus increasing the risk of even higher prices. This confirms our long-term positive opinion on the oil market, as it faces many years of potential underinvestment - major players are redirecting some of their already reduced capital expenditures to low-carbon energy production. The timing of the next upward move depends on Brent's short-term ability to close above $ 85,50 / b, i.e. a 61,8% retracement from the 2012-2020 mark-down line, followed by a break above the double top of $ 86,75 . However, the chart below shows more and more the need for a consolidation period, and maybe even a correction. With such strong foundations, only a greater than expected increase in infections with the omicron variant and stronger production may cause a sharp drop in the price.

Gold

Gold increased and thus almost recovered the losses incurred in the first days of this month, when rising yields on US bonds caused some weakening. Gold's ability to withstand a 0,3% spike in ten-year real US bond yields at the start of the year may have come as a surprise to some - but not to us, given our emphasis on gold's relatively low price relative to real yields that have been going upwards since the beginning of the year. July last year. After this divergence disappeared, gold gained additional support last week from a weaker dollar, not only against the JPY when there was a shift in risk approach, but also against the key EUR / USD pair, which managed to break resistance below 1,1400 after how the CPI reading in the United States reached the highest level in several decades.

Several aggressive comments from Fed members, led by Vice President nominee Lael Brainard, who said she was open to March's rate hike, had limited impact on gold, the most sensitive to interest rates and the dollar of all commodities. This underlines our view that the gold market has already fully priced in further increases in US interest rates, starting from March this year, and in a situation where the bond market is torn between a rise in bond yields under the influence of the Fed and the growing risk of an economic slowdown favorable to bonds, we see that in the case of gold, the risk-reward ratio becomes much more balanced.

Silver's recent strong performance has weakened in response to profit-taking late in the week in the industrial metals market. For silver to shine and move higher towards resistance in the $ 23,90 area, it must first break above $ 23,41, a 50% retracement of the November-December markdown. Gold, meanwhile, has re-established some support in the $ 1 region ahead of key $ 800 support. A break above the $ 1-777 area could hit $ 1, followed by a November peak of $ 830.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response