Goodman's Wave Theory as an alternative to Elliot's Wave Theory - Jim Poniat

Charles B. Goodman developed his proprietary wave theory, his own holistic approach to trading, and many other concepts during the 1940-1950s. Charlie, a farmer's son, was raised in EADS, Colorado. Every day, he went to the nearest broker office in Garden City, Kansas to watch the listing of listed companies. As Duane Archer (his last student) writes, Charles developed most of his theories in the bathtub. What's interesting about investing you can think of in it? I invite you to read.

Goodman's concept

The market is compared to a battlefield where there is a constant battle between buyers and sellers at different price levels. This is not an ideal reference, but you can compare each time chart as a different level of lethal combat. The market has relationships between all charts. The current price of currencies is a very important temporary truce.

- In the downward trend, the sellers strike, then the buyers repel the attack, followed by the sellers' blow again.

- In an upward trend, buyers strike first, sellers defend themselves, and then buyers strike again.

- In the sideways trend, the strength of the blows varies, neither side has the advantage. It should be mentioned here that the trend depends on both price volatility ( volatility) and from a given time frame.

The upward trend on one chart can be a sideways trend on another, and vice versa. All is the 1-2-3 matrix describing the diagram on the market blow-blow-defense. Goodman's Wave Theory (TFG) is built around the old concept - 50% rollback - correction and measurement of the next move. It is logical, transparent, objective and predictable.

Mand that Goodman's Wave Theory has several identical elements with Elliott's theory of waves, it differs in many respects. First of all, it's much easier in recognizing and predicting market changes, papplies 1-2-3 waves and with the 3-C principle, offers easy definition of levels Stop Loss and Take Profit.

What is swing?

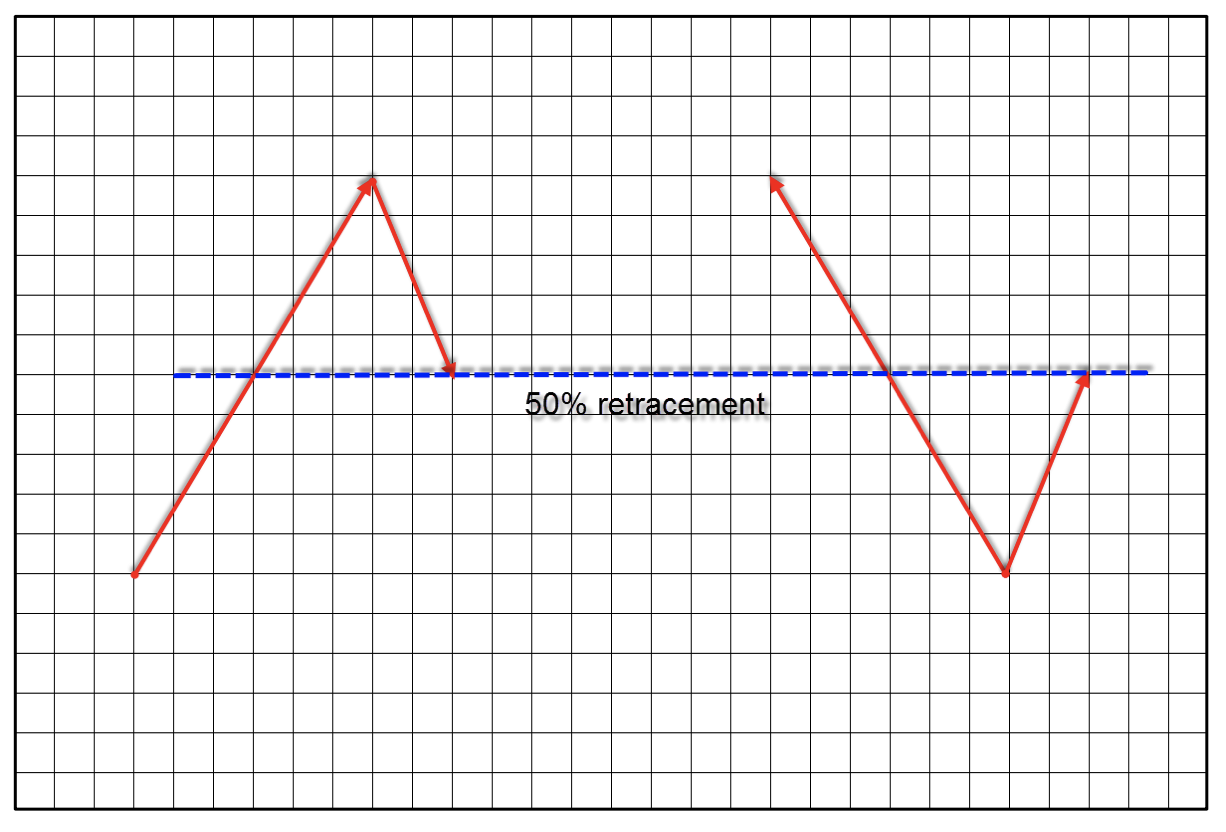

Swing is a rising or falling price change without a significant correction. The minimum change is 25% of the previous swing. If the price makes a change greater than 25%, then this move is a swing in itself, then the formation 1-2 is formed. The 50% rule says that the price will find support or resistance at the 50% level of the previous swing. retracement). This logic is very simple and easy to understand.

At 50% level, all buyers and sellers are connected. Half of the buyers and half of the sellers have a profit, half of the buyers and half of the sellers made losses. In this theory, swing is a price trend not less than 25% rollback. It starts with three foundations, i.e. propagation, intersection and 3-C.

TFG theory derives from four simple and clear concepts.

- Axiom 1-2-3;

- Principle of Propagation;

- Intersection Principle;

- 3-C principle.

These elements show how the Goodman Wave Theory differs from the Elliot Wave Theory. Let's start with the basics of Goodman's Wave Theory.

Axiom 1-2-3

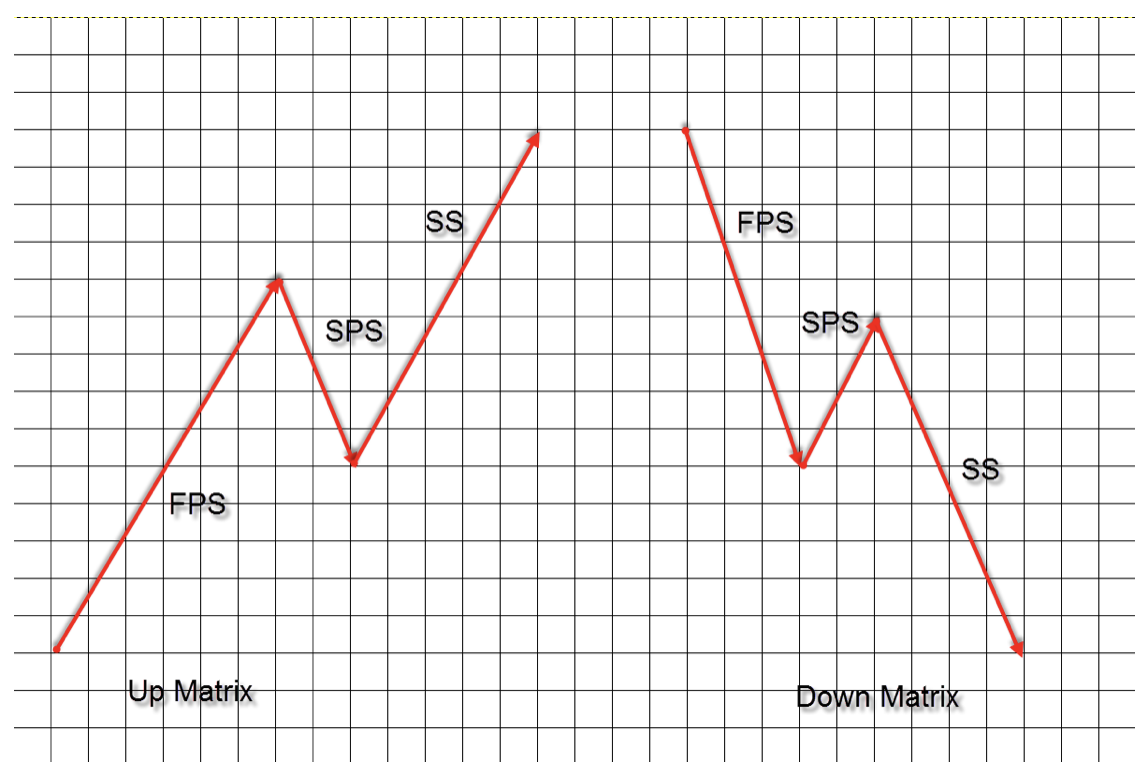

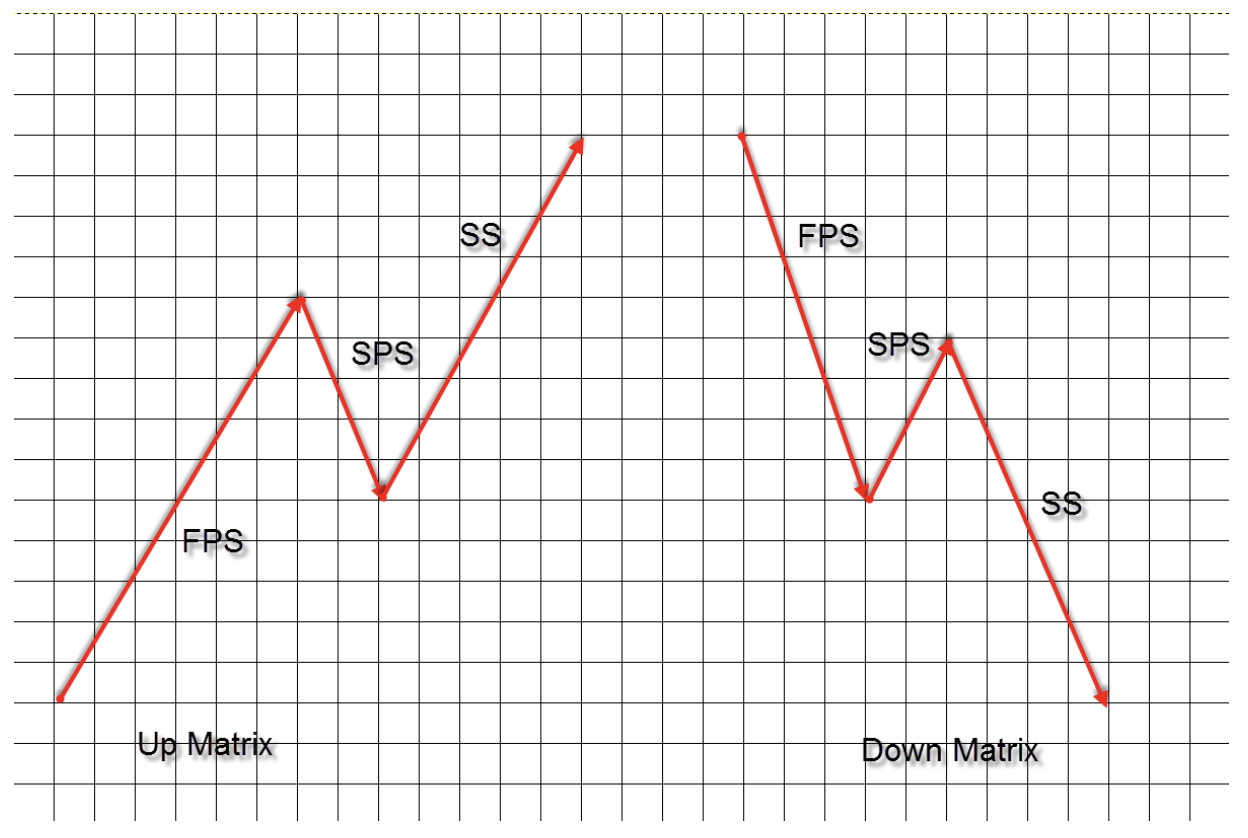

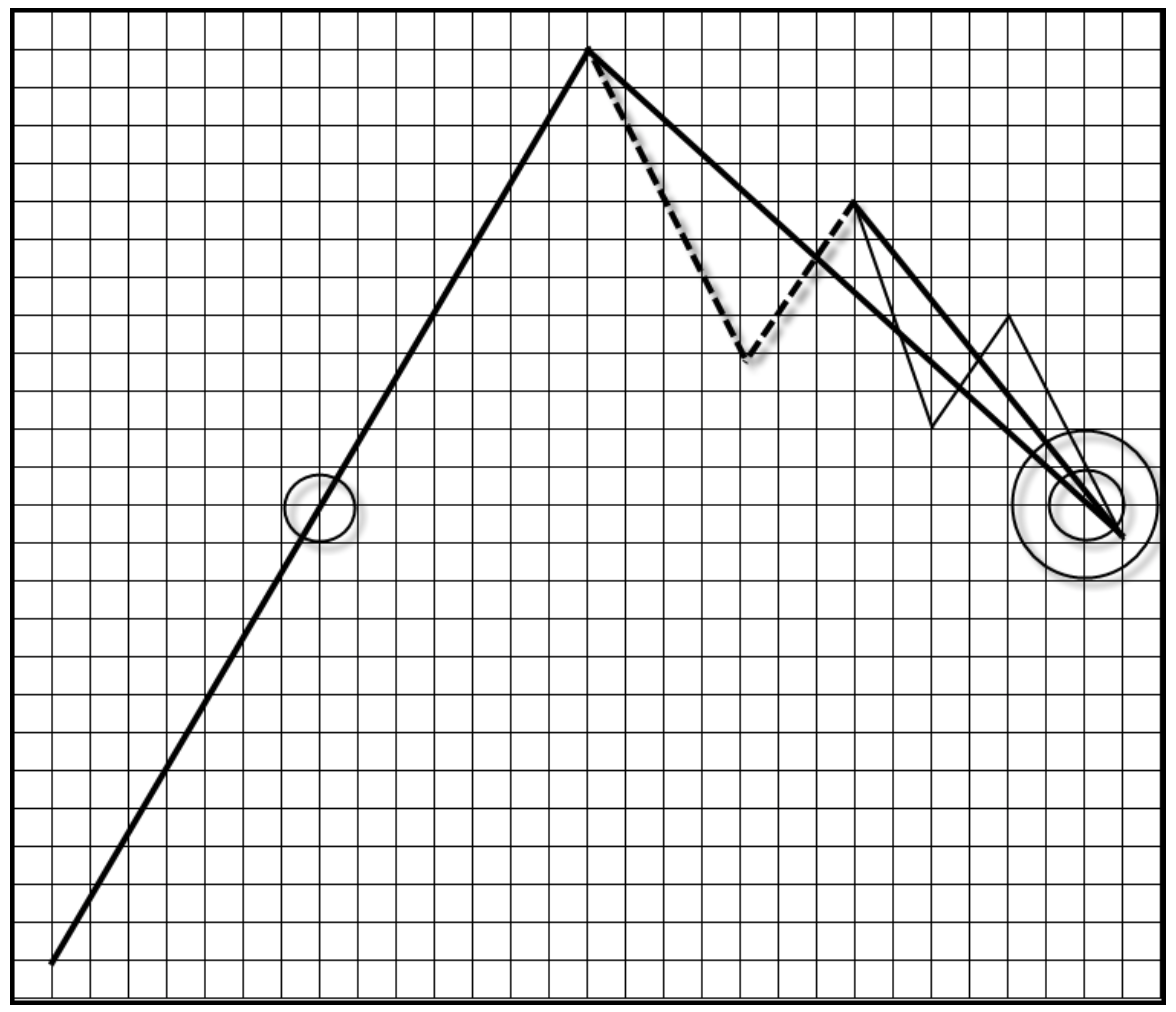

In Goodman's theory, everything is based on the formation of 1-2-3 - First Basic Swing - PPS First Primary Swing FPS) the primary direction (1), the next wave in the opposite direction (2) and the last wave in the same direction as the first wave (3).

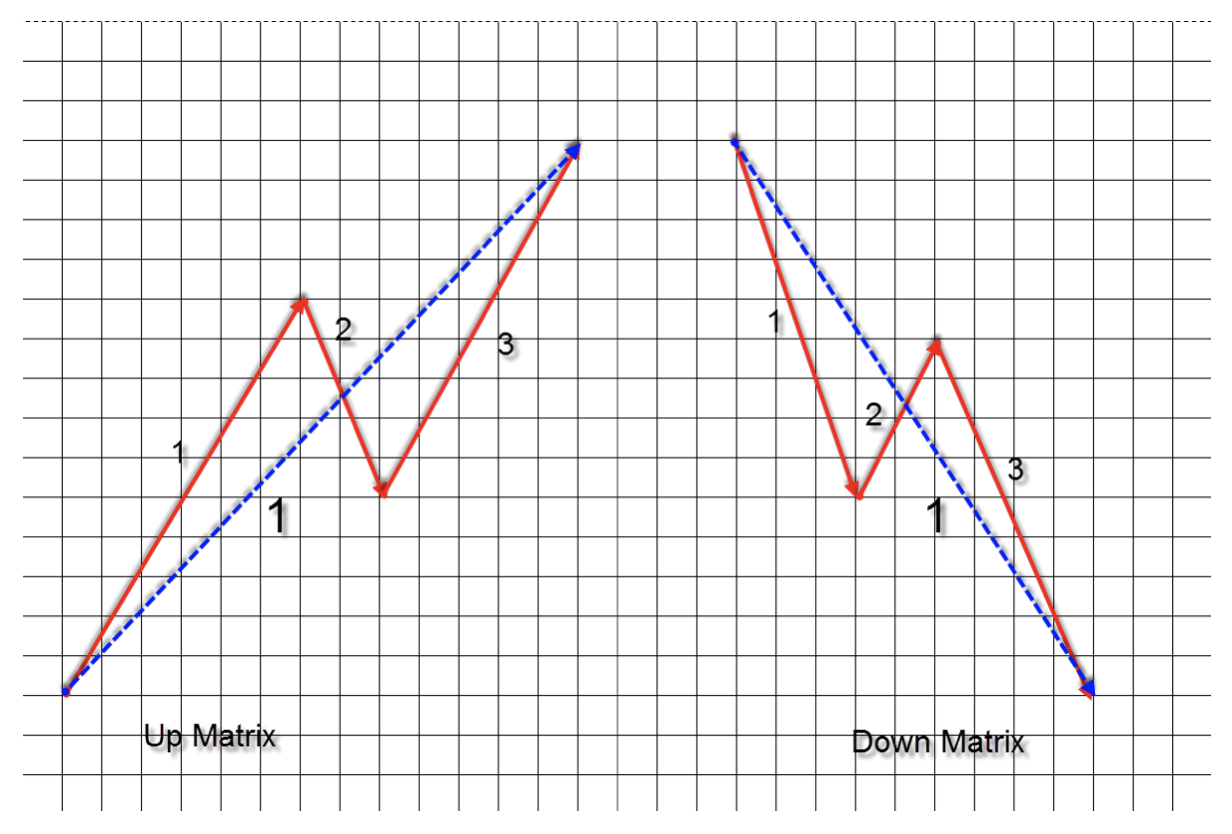

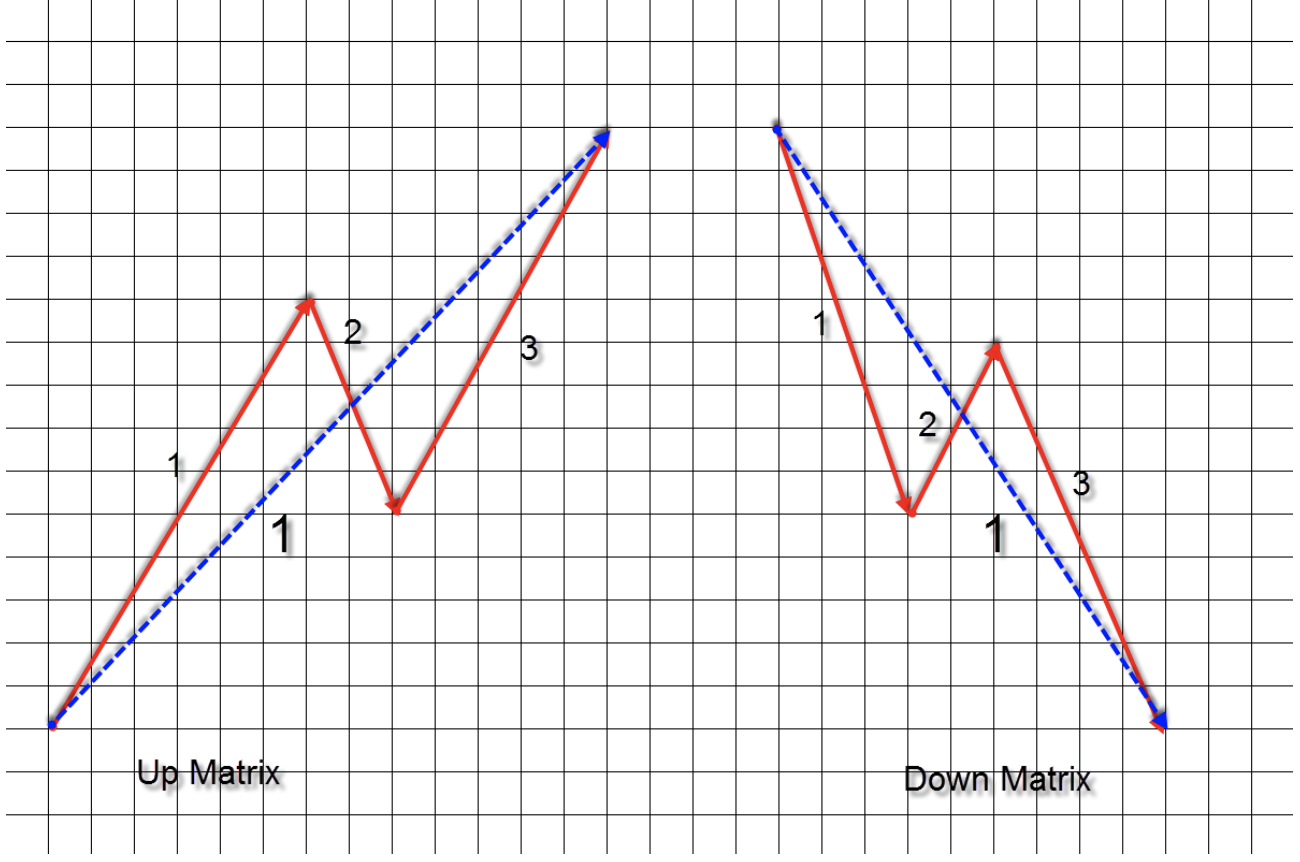

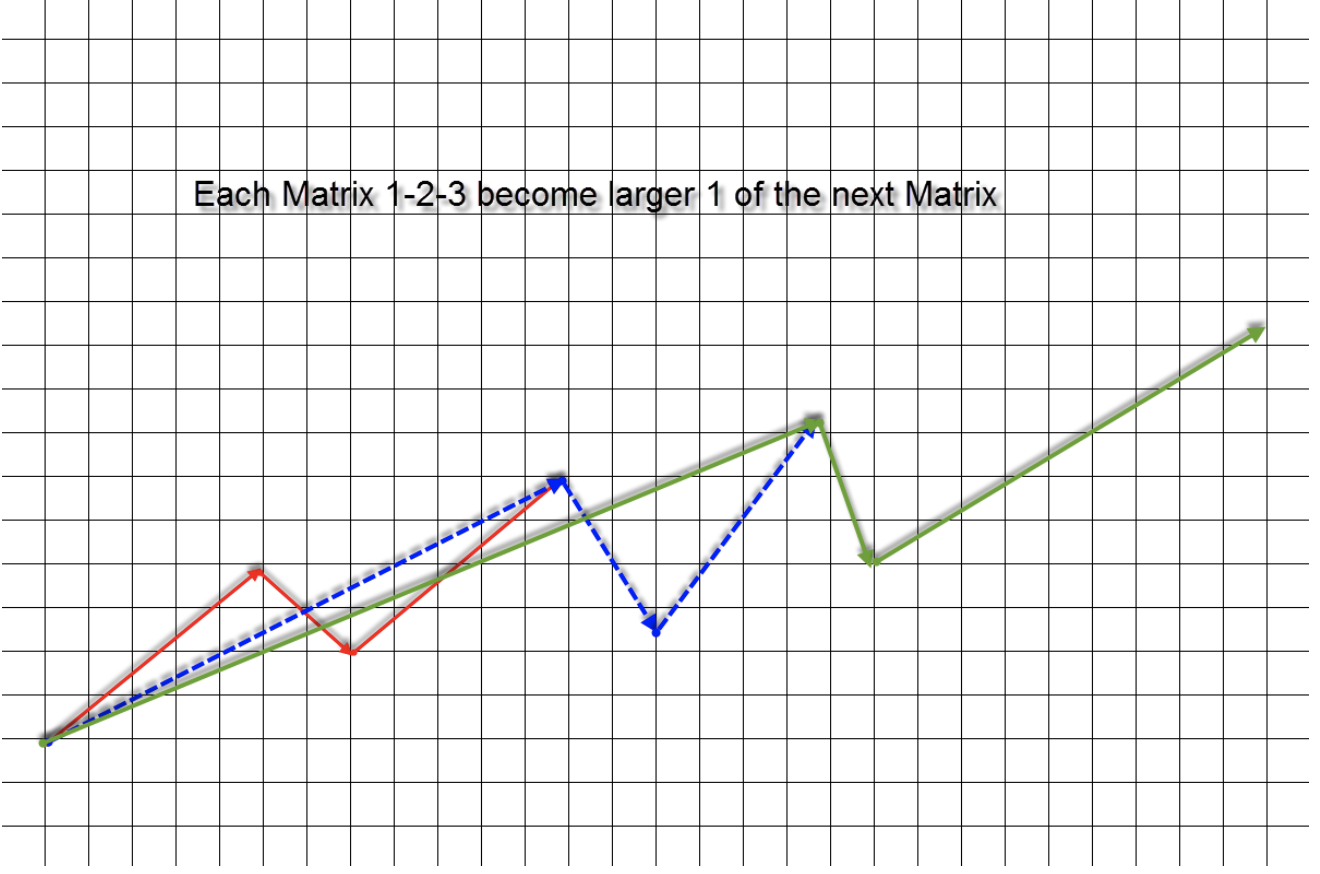

Axiom 1-2-3 is the basic building block of the market. The basics and principles of TFG tell us how 1-2-3 multiply the price levels in combination with the price on the chart, which we see in every market. The small matrix 1-2-3 is the basis for the larger 1-2-3 and this in turn grows into an even larger 1-2-3.

The perfect matrix

The basic formation of 1-2-3 is called the matrix Matrix). Let's look at the ideal Matrix, which is known to many traders as the principle of 50 measurement of swing change.

The 50% rule tells us that the price will find support or resistance on the 50% rollback price of the previous swing. The logic is very simple. At the 50% level, there is a balance of power, all buyers and sellers agree. Half of buyers and sellers made a profit, half of buyers and half of sellers have losses.

Goodman's wave theory was based on two publications:

- Burton PughSecrets of Wheat Trading ".

- Edward Dobson "The Trading Rule That Can Make You Rich. "

In TFG swing is a price trend greater than 25% reversal of correction.

When the movement starts, the price will form the third swing we are able to measure. Where at this point either all buyers have a profit or all sellers have a loss (swing up), or all sellers have a profit and all buyers have a loss (swing down).

The matrix is made of three swings:

- First Basic Swing - PPS (First Primary Swing - FPS),

- Second Basic Swing - DPS (Second Primary Swing - SPS)

- Secondary Swing - DS (Secondary Swing - SS).

There is no need to confirm and compare the matrix to the ideal dimensions, as long as the Secondary Swing represents at least 25% change in the First Basic Swing.

Each swing or matrix has its own Starting Point -PP (Beginning Point - BP).

Each swing or matrix has its own end point - PK (Ending Point - EP).

The 50% point of each swing or Matrix is a turning point - PZ (Tipping Point - TP)

Principle of Propagation

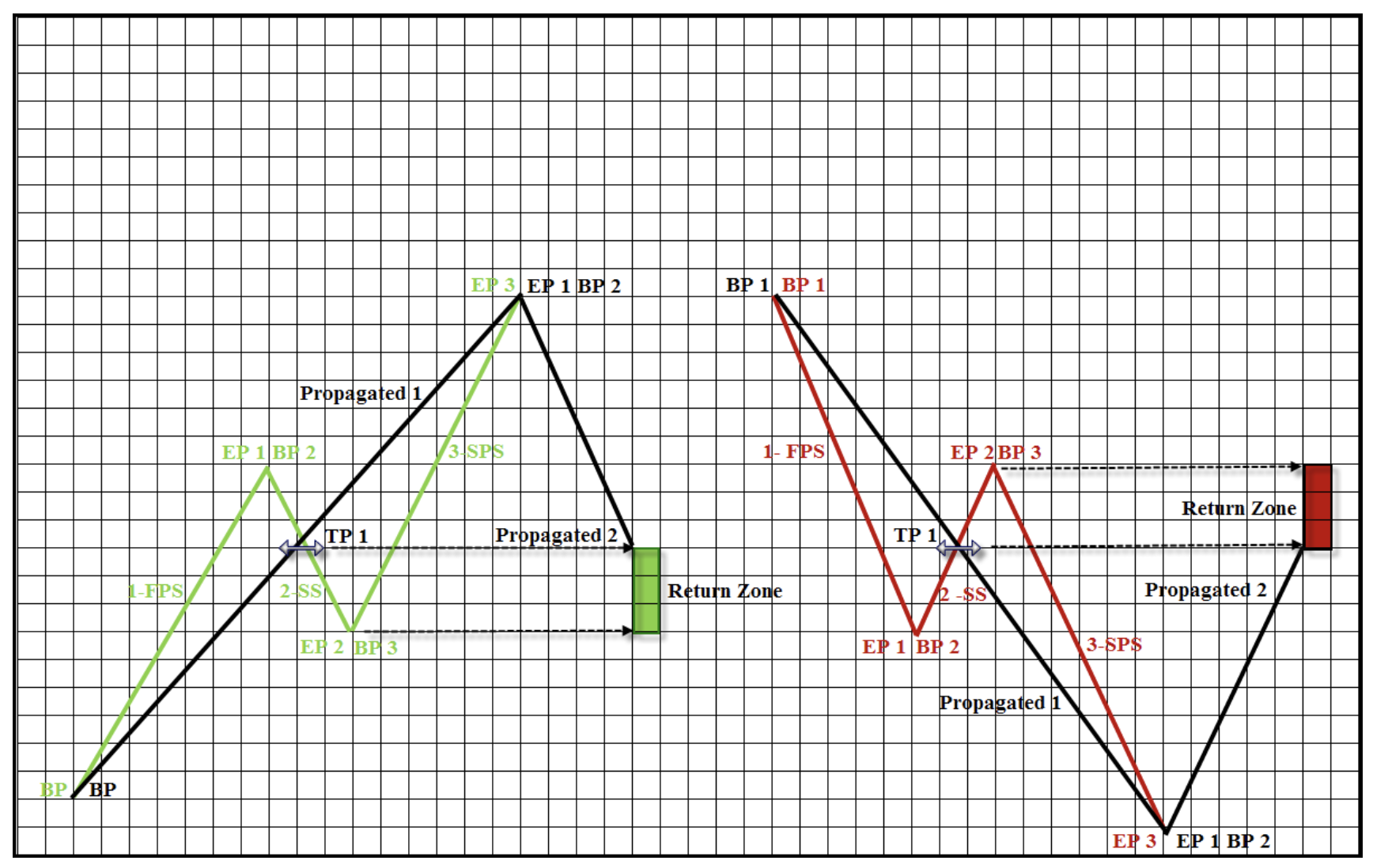

This is the most important principle in Goodman's Fall Theory. Just look at the graph and 1-2-3 propagation will give us a different perspective of chart analysis. After the formation of the 1-2-3 Matrix, it is entirely 1 - The First Basic PPS Swing of the next larger 1- 2-3 matrix.

1-2-3 ->1-2-3->1-2-3 ...

Goodman and Elliott

Of course, all wave theories are based on the same basis. But between TFG and Fal Elliot Theory, there are a few basic differences.

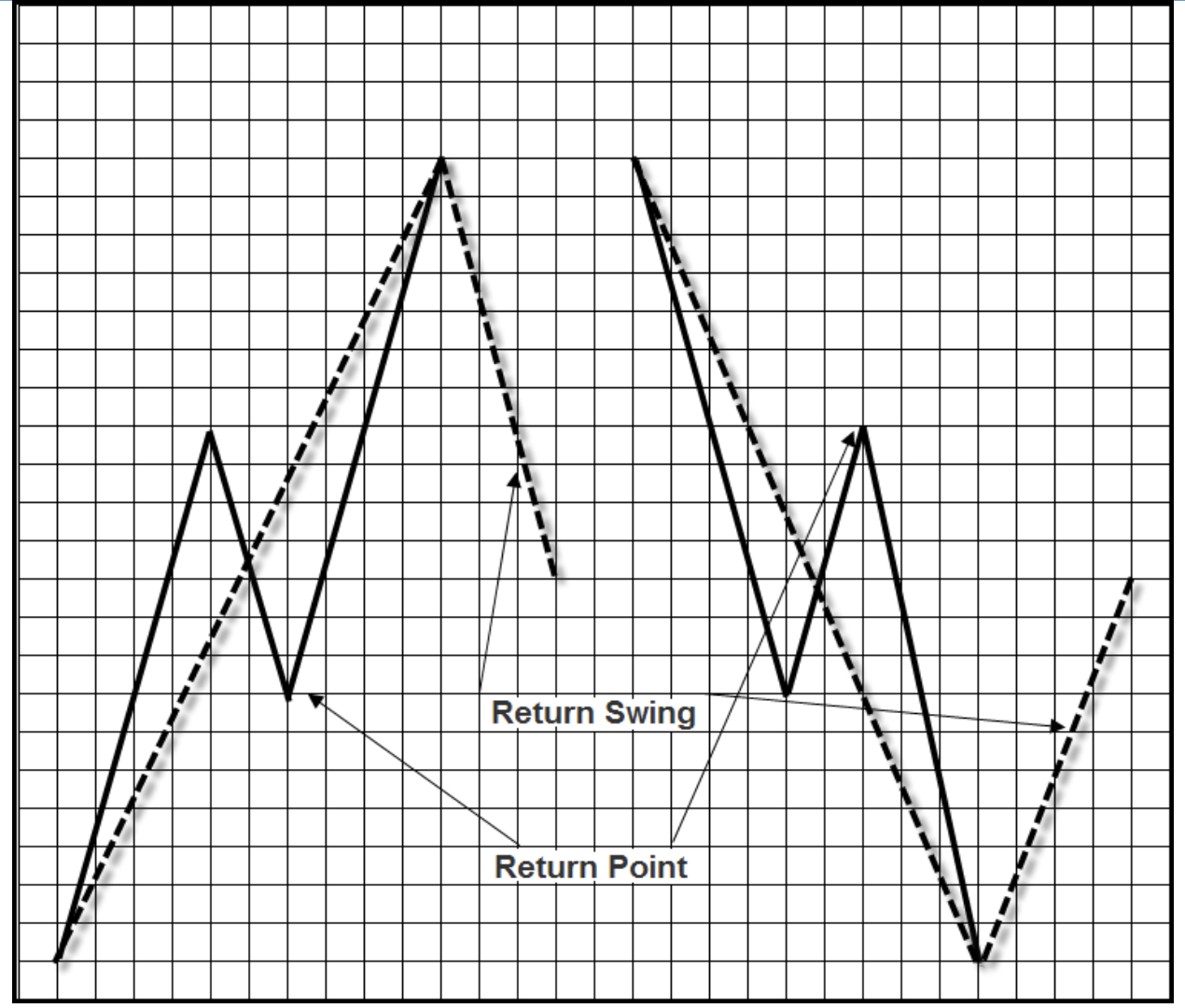

- TFG is based on the 1-2-3 matrix as the basic element, where TFE looks at 1-2-3-4-5 as the basis of theory. Due to the fact that matrices propagate, a critical difference in both theories is the fourth swing.

- In TFE, the relationship of the fourth swing depends on the third. In GSCS, the fourth swing is in relation to the entire 1-2-3 matrix.

- In TFG, the fourth swing is called Return Swing.

- The end point -KP of the previous Secondary Swing is the Return Point.

The price zone between the return and the return point is very strong and a very common result is its reversal or at least a strong price reflection - we call this zone the Return Zone. This is a recurring factor in all three settings (Setup).

If you've studied Fal Elliot Theory, you've probably noticed this problem - as a rule, the result is a lot of predictions starting with key swing four.

The key point according to TFG is that the fourth swing is not dependent on the third swing but on the entire 1-2-3 matrix based on which was the first basic swing of the new matrix.

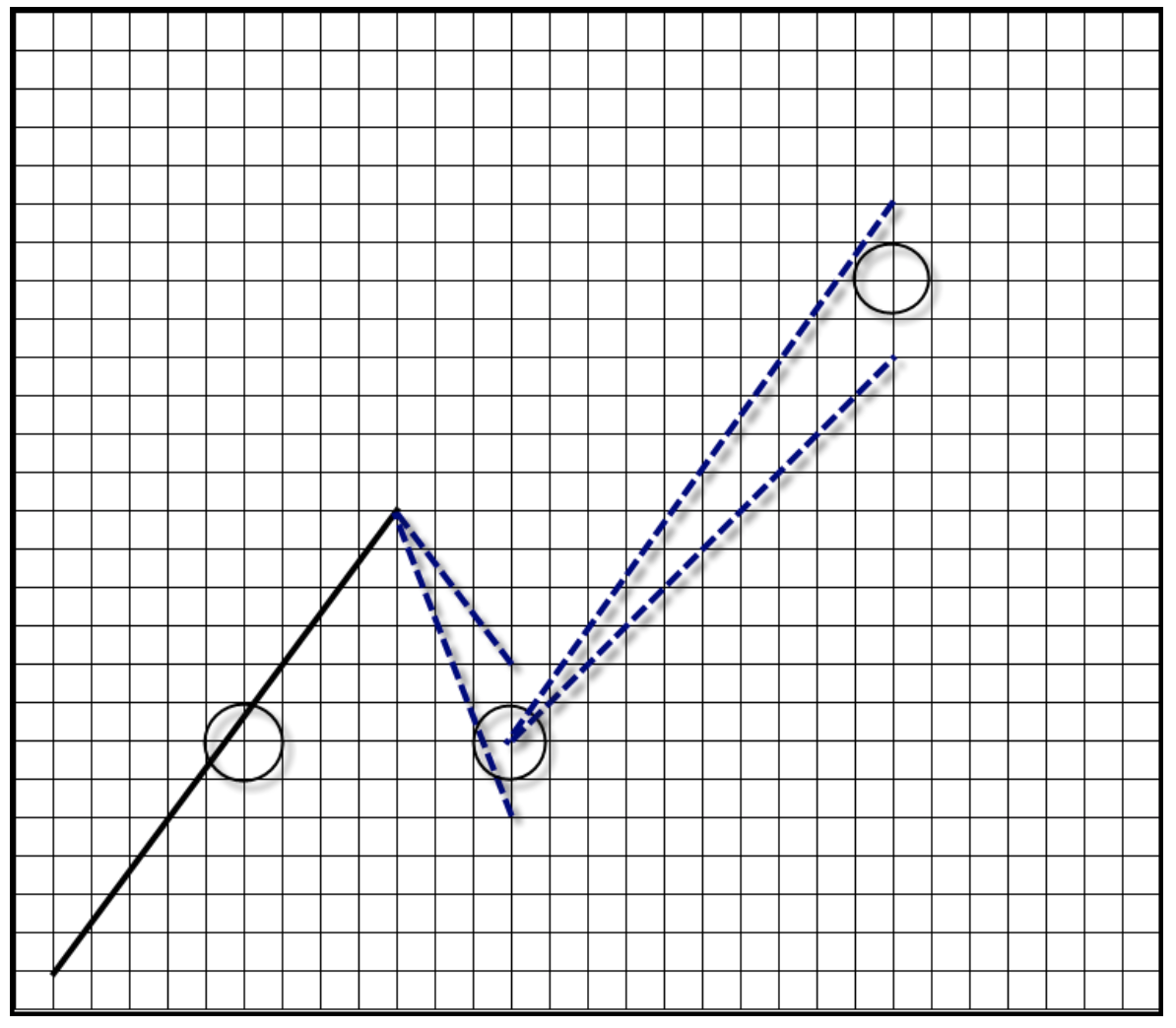

Intersection Principle

In Goodman's Theory of False, a junction is a situation where one or two points of one or two matrices intersect and where the swings meet.

To make it easier to understand the Crossing Rule, look at 1-2 swings below. At 50%, all swing buyers and sellers are in balance. Half of buyers and sellers made a profit, half of buyers and half of sellers have losses. The turning point is a very important balance point. If the swing and / or matrix points meet at the same price, the balance should be stronger.

Double intersection

9 chart. The ending point of the second swing crosses the turning point of the first (basic) swing. This is the third template in Goodman's Wave Theory.

Triple intersection

TFG identifies multiple intersection points during price changes ( Price Action), which we also call templates. These are Goodman's Propagation Templates. I always have a template file open and I can compare it with the chart I am doing the analysis on. I know from experience that 90% of charts are reflected in Propagation Templates.

3-C principle

Another difference between the two theories is the way of counting swings. By using templates, target identification is very precise. It is extremely important to know all three principles. You cannot do algebraic actions until you know addition, multiplication, subtraction and division.

3-C stands for - Compensation, Carryover and Cancellation.

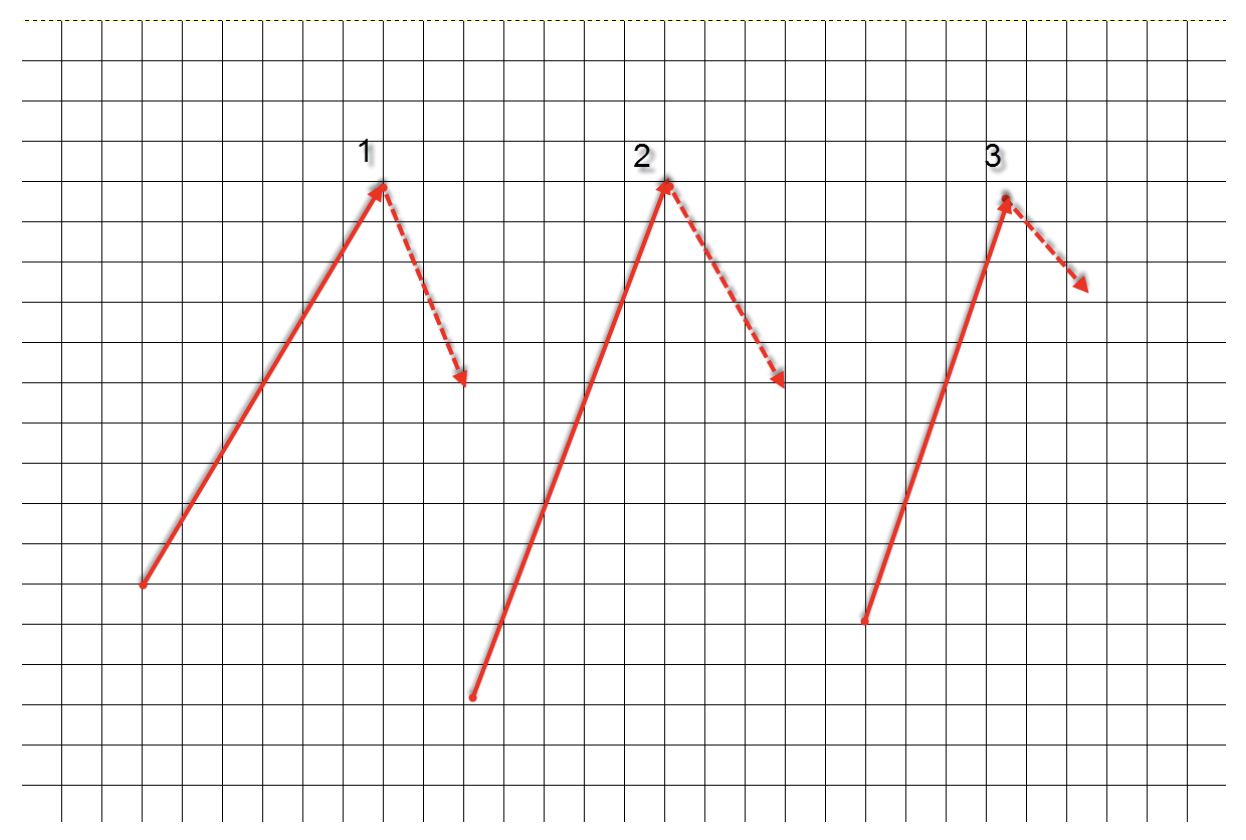

In TFG, if the price does not stop at 50% reversal First Basic Swing - Second Swing End Point either it will go too far or it will be too shallow (smaller than 50% and larger than 25%) - this difference will be compensated at the next swing on End Point of the Second Basic Swing.

If the reversal of the Second Swing is shorter than 50%, then very often the Second Basic Swing is longer than the First Basic Swing. This means that the momentum of price changes is still very strong. Look at some charts and you will quickly see the 3-C principle in action.

Goodman's basic setup

There are three Goodman setups - Return, Standard and PTS (ang. Propagation Trade Setup). How does it work in practice:

- We identify the 1-2-3 matrix

- 1-2-3 is the beginning of another new 1 swing

- We are waiting for propagation of 2 - swing back

- Watch '2' propagation when it enters the Return Zone and crosses near the Tilt Point (ang. Tipping Point).

- We identify the opening point of the position, we open the position on 3 swing propagation in the same direction as the first swing

Remember:

- in TFG the fourth swing is connected to the entire 1-2-3 swing.

- 1-2-3 propagates into the larger '1' and '4' propagates into '2'.

- In Goodman's theory, 1-2-3 -> 1-2 is a setting and -3 is the opening of a position.

- The basic setting uses Axiom 1-2-3, Propagation Principle and intersection principle.

Goodman Wave Theory - Advanced concept

Of course, there are many more TFG rules, e.g. Overlaydominance dominance), breaking out Breakaway), twin swings (ang. Siamese swing) and the fascinating Goodman knot Goodman Knot).

The combination of two elements - price and time - allows you to indicate where a potential intersection will occur and we call it the landing site. Landing Areas).

a summary

Of course, at this stage Goodman's Wave Theory does not end there. In this article, I have included only basic information that is the beginning to learn all TFG.

Goodman's wave theory has three important features:

- Propagation is extremely important, says the 1-2-3 matrix makes up the larger 1-2-3 matrix.

- The intersection principle narrows the possible forecasts.

- The 3-C policy provides a built-in method for forecasting target prices.

A novice can start the adventure with TFG with minimal knowledge on this subject. A trader with experience can integrate TFG with his / her strategy or system. Good luck!

Author Jim Poniat

Well-known Canadian financial market analyst and trader with 13 years of experience. Author of two books specializing in Forex trading. From 2006 to 2008, he trained and gained knowledge from traders such as Bill Williams, Steve Nison, Martin Pring, Michael Duane Archer and many others. From 2008 to 2015, he ran an investment fund with several million dollars. During this time he cooperated with one of Canadian banks.

Well-known Canadian financial market analyst and trader with 13 years of experience. Author of two books specializing in Forex trading. From 2006 to 2008, he trained and gained knowledge from traders such as Bill Williams, Steve Nison, Martin Pring, Michael Duane Archer and many others. From 2008 to 2015, he ran an investment fund with several million dollars. During this time he cooperated with one of Canadian banks.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-300x200.jpg?v=1709046278)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Hello.

As I wrote yesterday on the webinar, I can't find the file I paid for 69 PLN for. I will send an email, it will be best and if you can send it please. leslaw.d@interia.eu.Thanks in advance.

Leslaw Debski

Good morning, we gave your message to Jim. In case of what you can also contact him by email: jimmy@poniat.com