The economy is rushing, interest rates will rise

The door to further interest rate increases is wide open. Even wider than before. This is indicated by the latest data from the Polish economy. The situation is more than obvious. Interest rates in Poland will most likely increase even more than the market now assumes. The Monetary Policy Council will have no choice but to raise them strongly. These are the conclusions of the data package from the Polish economy published today.

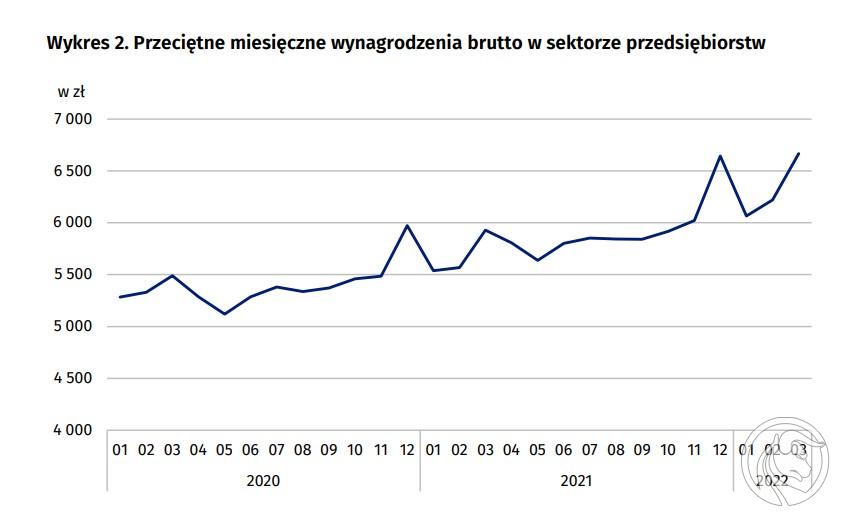

Wages are also rising

In March, salaries in companies increased by as much as 7,2% compared to February. Compared to March 2021, they increased by 12,4%, which is the highest dynamics since March 2008. In addition, the average gross salary soared to over PLN 6665, breaking the December peak and setting a new historical record.

If we compare all this with inflation in Poland at the level of 11% y / y it is from this picture that the price-wage spiral emerges. Especially since the economy is racing like crazy. In March, industrial production increased by 17,3% y / y, significantly exceeding the market forecast of 11,9%. This means that the economic growth in the first quarter was over 7% y / y. Another quarter already.

The MPC has no choice

The Monetary Policy Council, if it does not want to grow even higher inflation, which will stay in Poland for longer and eventually lead to an economic collapse, it must react. The current level of interest rates (the main rate at 4,50%) is not able to bring down inflation. The real interest rate in Poland is at the level of -6,5%, and it should be a positive value in the book. Therefore, one has to take into account that this year the interest rates in Poland may be increased by a total of 200 bp. This is confirmed by the recent comments of new MPC members.

The EUR / PLN exchange rate did not react to the data from the Polish economy, only slightly reacting to the fluctuations EUR / USD and being in consolidation for three weeks. The layout of forces on the EUR / PLN daily chart suggests that the breakout from the consolidation may be an upper.

EUR / PLN daily chart. Source: Tickmill

Today, in addition to data on wages and industrial production in Poland, the CSO also released data on March producer inflation (increase from 15,9% to 20% y / y) and employment in companies (2,4% y / y), as well as the April report on the consumer prosperity. The CSO also informed that in March the purchase prices of basic agricultural products increased by 15,9% compared to February.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response