How does the market maker perceive the Forex market?

This article is devoted to the great "secret" of the Forex market and its specifics.

How is the Forex market different from other financial markets such as WSE, NYSE, NASDAQ or CBOE? According to the definition, the regulated market is:

"Dabandoned trading system of financial instruments. Each of them investors has equal access to market and information related to this market. Everyone can buy and sell Financial instruments. The regulated market must be organized. The competent authority specified in the Act supervises a given market. "

Investors have equal access to market information, such as volumes and the number of transactions concluded, as well as data on all pending orders. In other words, everything that happens on the stock market is displayed in the trader's terminal.

Be sure to read: Choosing an effective capital management method

In turn, Forex is a decentralized market, which means that there is no information about exchange. Therefore, most traders on this market only trade based on the price chart of the given instrument using the so-called technical analysis.

As you can guess, there is a big difference in market analysis only with the help of technical analysis or using AT and data such as: transaction volume, order book, delta, market profile and other trading tools. By the way, perhaps this is why the percentage of profitable investors is higher on the stock or futures market than on the Forex market.

Who is the market maker?

It is an entity that, under an appropriate agreement concluded with the stock exchange, undertook to ensure systematic liquidity on financial markets by making purchase and sale transactions of financial instruments on its own account, based on its own funds. It follows that the market maker has the ability to directly influence the price of the instrument on which it supports trading.

In the short term, the presence of market makers on the market has a positive effect for investors, because they can make transactions even on less popular stocks, where finding the other party to the transaction would be impossible or time-consuming. Unfortunately, in the long run, the above-mentioned activity can be considered harmful as it strongly distorts the market picture. These entities are undoubtedly needed in the market to maintain the continuity of trading on a given instrument by creating the impression of continuous movement and creating new opportunities for course volatility.

To be precise, we are not talking about a mythical person who "sits" in front of the monitor and concludes FX transactions, but about specific players on the market: banks, funds, as well as large private investors.

In addition to being able to influence the price, the market maker also has other advantages. Market makers have some information on the location of Limit and Stop orders, small market participants (e.g. retail clients). It may seem that the market maker is all-powerful, but the fact is that most of them can't simply reverse the price at any time; besides, there are other market makers who can prevent this.

What do investors see and how do market makers see it?

Let's consider an ordinary investor and look what he sees (what he uses) on his own chart every day. First:

- Technical indicators, including but not limited to oscillators. It is a mathematical formula that uses historical data to predict future movements or help in additional analysis of the chart and indicate the so-called levels of sell-out or purchase of a given instrument. They can also support the investor in his decisions, prompting where to carry out the transaction.

- Trend lines, upward and downward channels as well as support and resistances that help determine the prevailing market trend.

- Diagrams, waves, technical and candle formations.

Taking all this into account, we can conclude that investors are analyzing the market horizontally. This means that we take certain historical data (chart), look for regularities, draw lines, but still we do not know what is happening there and why the price was not in line with our indicator and did not react to it in a book-like manner.

In turn, market makers do not really care about the areas in which they are located MACD, nor that the harmonic formation of the "butterfly" was fully drawn and a possible scenario of entering the position began to appear. What's more, they don't even look at the chart and don't need trading volumes because all these things have already happened. They are past.

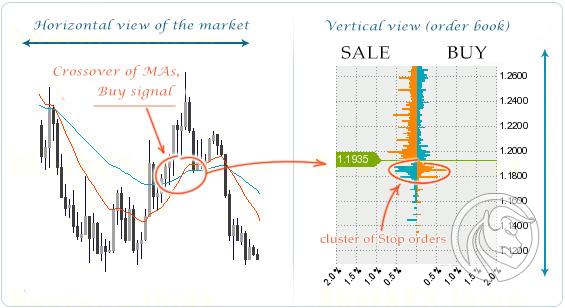

Market animators analyze the market vertically. They have the so-called "order book" (just like the one in the picture below), which displays all of our Take Profit orders, Stop Loss and pending orders. The animator needs nothing more than information about the location of our orders. Thanks to this knowledge, it can effectively influence price movements on the market.

Here's an example of how a vertical view differs from a horizontal view:

Order Book 1, source: fxssi.com

While the moving average signals the possibility of buying on the chart on the left, the cluster of Stop orders below the current price is clearly noticeable in the order book on the right. Such clusters are in the close interest of the market maker and, as we can see, the price reacts accordingly in this area.

The animator cannot simply reverse the price and set a new direction for the currency, because there are other "big" participants on the market who may have a slightly different opinion on the price of the instrument. However, the animator can push it to a certain level, move it towards the location of Stop Loss orders or participate in the formation of a formation, and then implement a possible scenario, if it is in his interest. In other words, on the one hand, it works against the crowd on the market, and on the other hand, it needs the rest of the crowd to push the price in the right direction.

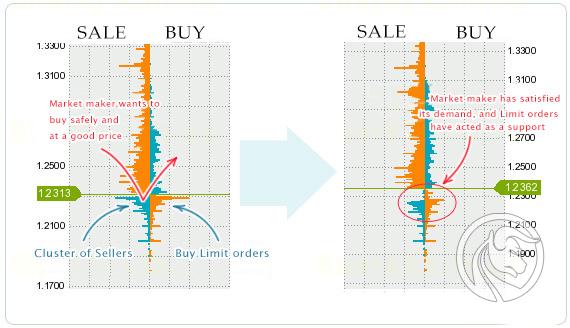

Order Book 2, source: fxssi.com

Let's analyze it in more detail. Assuming the market maker wants to buy the currency and obviously wants to do so at the best price possible. The left side of the image above shows a pretty good group of sellers and Stop Loss orders. This volume of sales orders will well meet the market maker demand. On the other hand, we see a group of buyers - they will be used as a safety cushion to prevent the price from rising further. Now the situation is clear and clear - the market maker is shifting the price towards the cluster by placing small orders, gathering all sellers in one place, and Limit orders acting as a support stop any further price movement.

Summation

The first obvious thing is as follows: it makes no sense to fight a market maker - after all, they are called "smart money" for a reason, and ordinary investors are mostly just "Capital donors". They know better than us how the price will behave and how to make money on it (they often influence the price themselves under certain conditions).

Unfortunately, we do not have precise tools to track the actions of the market maker, so all we can do is imitate his behavior. The question is, how can we do this? The answer is very simple: we must act against the crowd because it is the basic strategy of market makers. Otherwise, they would simply not make money.

The second obvious thing we need to realize is that indicators are just a suggestion that the market may or may not respond to. The market, and market makers in particular, do not take them into account in most situations, often playing the opposite of the crowd, driving investors into a dead end. In the best cases, such "games" end in severe investor loss, and in the worst cases - "clearing" the account.

The third obvious thing to remember: Forex does not tolerate negligence - understand what we do and why we do it, and not otherwise. Professional trading is a conscious approach and systematic learning throughout your professional life.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response