How to copy signals on the Forex market [FX Blue Copier]

Copying transactions on the Forex market is a way to make your life easier and even increase your profits. Despite this, popular opinions about copying are quite negative and not entirely rational. In this article I will try to introduce you to the issue copy trading, pay attention to technical aspects and show you how you can do it using the free FX Blue tool.

Popular myths:

- 'Copying doesn't pay off'

- 'Copying and inverting a lossy strategy is pointless as it also brings a loss'

- 'I don't understand - I don't copy'

We'll see how much truth there is in them.

Be sure to read: How to copy transactions to other Forex platforms

When do you need to copy?

There are many such situations, I will give two extreme examples.

The simplest case is when we try to neutralize our mental and psychological barriers. Suppose we discover that we are unable to play effectively when we have more than PLN 5 on the account, but we are great at up to PLN 000. Then we can try to trick our mind by copying the strategy from a smaller bill to a larger one. If only about this copying can be 'forgotten'…. In addition, the program options allow you to copy with a hidden Stop Loss on the target account.

Another example is the construction of a trading system "Diffused"operating on hundreds of strategies across multiple accounts. Here, we must necessarily use demo accounts, because most of these strategies will lose in the long run. However, in the short term, if we want to take advantage of temporary profitability periods, we must choose the appropriate strategies and copy their orders to a real or demo destination account. This process should be monitored and repeated periodically, preferably automatically.

Copy Tool - Fx Blue

From my market review, FX Blue offers a permanent free copy inside one computer - copier is available here. However, if we wanted to copy orders between different computers, unfortunately I did not find such a permanently free application. A workaround is to create a signal on the web service (example) of the signal transmission to target accounts via the interface built into MetaTrader 4.

In the following, I will focus on FX Blue, which I have been using for less than two years. Although free, however, FX Blue has other curiosities and discomforts. On this subject exists a short entry on the levelwander blog.

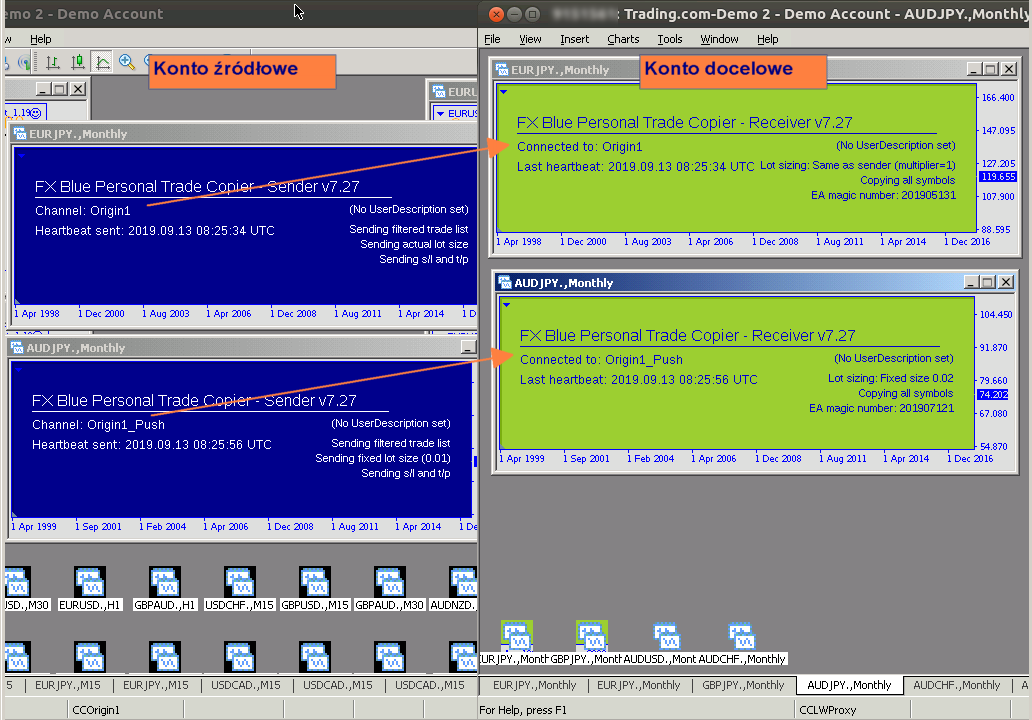

Settings

To start copying transactions we need a source account on which we set FX Blue Sender. We set FX Blue on the target account Receiver. These accounts need separate MT4 instances. FX Blue Sender i Receiver are programs .ex4 type Expert Advisor, a couple Sender Receiver is associated with the channel name, so many of these pairs can work on one computer without interference. The exchange of information takes place through RAM, and only emergency information is saved on the hard disk. On the graphic below you can see an example layout of two pairs Sender receiver.

S configurationender it is quite simple and actually comes down to two or three parameters. While Receiver it's very elaborate, it gives a great opportunity to influence copying.

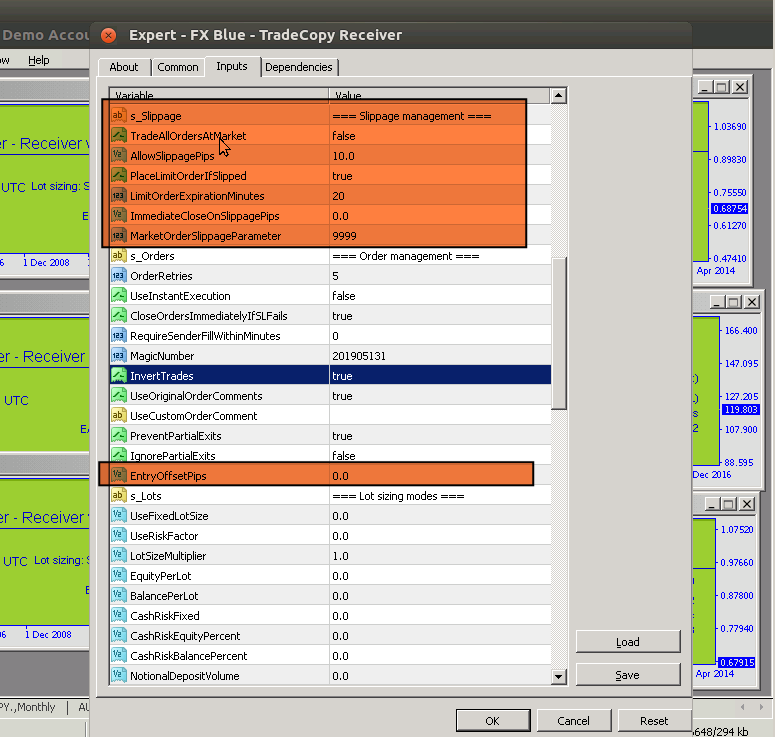

A description of all control parameters can be found in detailed documentation. I would like to draw attention to the possibility of inverting orders, which is configured as shown in the figure below, and the option of replacing the market order with a pending order using the parameter EntryOffsetPips.

Be aware that order reversal ends in application Risk: Reward (RR) 1: 1, regardless of the R: R of the source strategy. I have no opinion whether such a transformation is beneficial for the result, because everything depends on the percentage accuracy of the inverted strategy, which must be greater than 55% (taking into account the costs of 10%). Which means that the source strategy should have less accuracy than 45%.

How does copying affect results?

In one of the distributed systems I analyzed about 1700 copied orders carried out over the middle of the year 2018. Additional costs generated by copying are slip at opening and slip at closing.

Be sure to read: What are price slips and what do they result from

These slips are due to delays introduced by the finite processing power of the machine and the efficiency of the program, as well as by market changes in quotations. I calculated the number of ticks (the smallest unit by which the quotes can change).

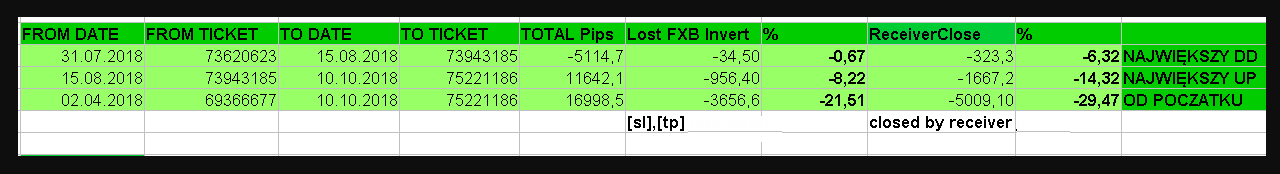

Here are the results for inverting:

- The opening cost is 12%.

- The cost of opening + closing through the SL or TP level is 21%.

- The cost of opening + closing with the Close () command is 29%.

This meant that in order to earn on it, the source strategy should lose more than 35% more ticks than gain, i.e. it should have Profit Factor less than 0.75. You can see, therefore, contrary to popular belief, that it is possible to profit from copying with flipping. Condition: the source strategy must be losing heavily enough, and its tick losses should be much greater than spread, commission i swap.

Other analyzes regarding copying clearly state that:

- The opening cost is 5%.

- The cost of opening + closing through the SL or TP level is 13%.

- The cost of opening + closing with the Close () command is 20%.

In this case, for profitable copying, all you need is that Profit Factor will stay above 1.30.

In both cases, the copying was performed from several accounts and concerned several dozen source strategies on each of them. I naturally did not go into the operation of these strategies, I was only interested in their results. Again, contrary to popular opinion, you do not need to know whether this strategy works on supports and resistances or maybe only in the console, or maybe with RSI and MACD. Even if it is available, knowledge about entries does not have to be up-to-date in a few weeks, which is especially visible in 'non-system' traders. It is worth checking if there was a downward averaging somewhere. And even if it did not occur, the parameter will protect us from this surprise in the future CheckForExistingPosition. To protect the balance and manage the size of positions, we also have several other options that are described in the FX Blue documentation.

How does the broker behave when we earn?

This is a key question when we are serious about trading real money accounts. Out of curiosity I checked what tick costs I have when my copied transactions are a profitable string, and what costs I have if the copied signals are loss making. I wonder if it is a coincidence that during increases in the bill, costs increase from 6% (DD) to 14% (UP)? 🙂

This is an extended version of an article that appeared some time ago on a blog about algo trading - read.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to copy signals on the Forex market [FX Blue Copier] copy trading forex fx blue](https://forexclub.pl/wp-content/uploads/2019/09/copy-trading-forex.jpg)

![Copy trading, or how to copy transactions between platforms [Video] copy trading forex video](https://forexclub.pl/wp-content/uploads/2021/06/copy-trading-forex-video-300x200.jpg?v=1624599867)

![How to copy signals on the Forex market [FX Blue Copier] xtb trading club](https://forexclub.pl/wp-content/uploads/2019/09/xtb-trading-club-102x65.png)

![How to copy signals on the Forex market [FX Blue Copier] forex brexit pound](https://forexclub.pl/wp-content/uploads/2018/12/forex-brexit-102x65.jpg)

Como copio con fx blue de XAUUSD a GOLD? me da un error y no me deja copiar. Pero las divisas las copia a todas