How to invest in luxury alcohol [Guide]

It cannot be denied that alcohol in various forms has always been present in people's lives. The main application is well known to everyone, but alcohol, especially the more exclusive one, can also be a very interesting "base" for investments. In the era of ubiquitous deposits, investment funds, Forex market, investments in luxury alcohol can be an interesting alternative.

Every skilled investor knows that the portfolio belongs diversifyand a bottle of good wine or whiskey can be a great choice for that. In this article, we will tell you more about investing in luxury alcohol and present methods of such capital investment.

Luxury alcohol - general information

Each alternative investment has a chance to bring a satisfactory rate of return if one basic condition is met. One of the main laws of economics must be respected - demand must far exceed supply.

If you want to invest your funds in alcohol, it should be remembered that it is still a luxury good and the purchase of such goods should mainly serve to diversify the portfolio. When buying this type of asset, you should always remember that it cannot be a drink available in every store and at any time.

NThe highest rates of return are achieved by unique, one-time editions of wines, whiskey or brandy.

The rule is simple, the fewer bottles that hit the market, the better. The best vineyards or distilleries always introduce a limited number of bottles of a given vintage, which to some extent indicate the direction in which our investment may go. Properly expanding your wallet with bottles of the precious drink is not as easy as it might seem at first. Looking at our domestic market, the first investment offers in wine or whiskey appeared in Poland relatively recently, in 2009.

Return rates

Everyone, of course, will ask themselves the following question:

"How much can you earn on it?"

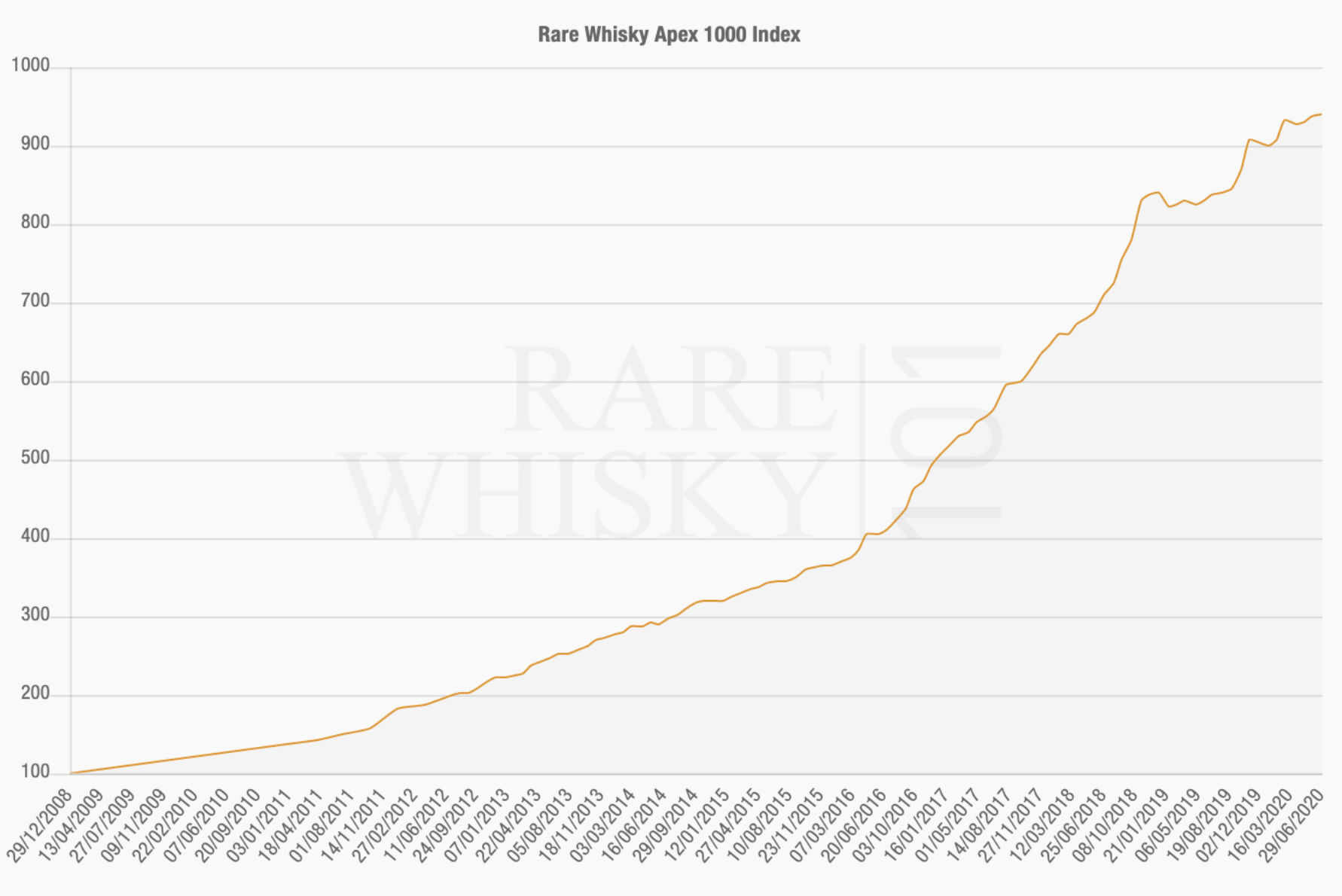

It turns out that you can skillfully choose alcoholic beverages for your collection, quite a lot. Looking at the annual turnover in the wine market, it has already surpassed 3 billion dollars. The whiskey market has been booming for the last 10 years, with an upward trend and a "textbook" boom. The index can be used as a reference point Rare Whiskey Apex 1000 (it reflects the change in the value of 1000 types of single mat Scotch whiskey most desired by investors).

Index Rare Whiskey Apex 1000. Source: RareWhiskey101.com

Two things are key to any luxury product:

- mark,

- country of origin.

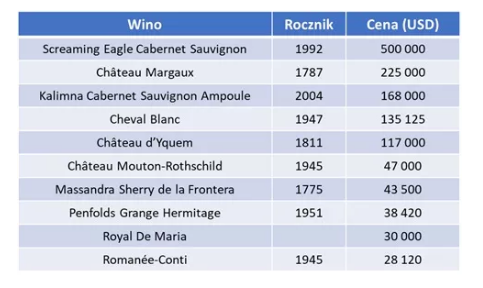

Of course, the wines are mainly France, whiskey Scotland and Ireland. However, if we want to invest in alcohol, we do not have to limit ourselves only to products from these countries. Liquors from non-standard producers can provide a very good profit. Interestingly, Japanese whiskey has appreciated the fastest in recent years, so this is also a remarkable market. In the case of whiskey, the packaging also always affects the price. It happens that it is set with diamonds, precious stones or gold. In the case of wine, we only pay for quality. Here, no importance is attached to the appearance of the individual bottles. At one time, Forbes published a list of the most expensive wines in the world - the prices are blistering.

The most expensive bottles of wine. Source: Forbes.pl

A bit about the disadvantages

While reading this article, you may get the impression that alternative alcohol investments do not have any disadvantages. This is of course not true. The biggest problem, and in fact a difficult one for some, will be the size and diversity of this market. Unfortunately, an investor who colloquially says "not sitting on the topic" may have a problem separating the proverbial grain from the chaff and choosing a good quality alcoholic beverage. Without proper preparation, we will not be able to assess the key factors affecting the price:

- storage method,

- the weather in which the original raw material matured,

- aging time,

- even the cork or the wood used for the barrel matters.

Of course, we can use the services of professionals or experienced sommeliers, but such services are not cheap, which will simply not be profitable if you want to invest a little less capital.

How to invest in luxury alcohol

If you want to invest in luxury alcohols, you have two options to choose from.

Physical purchase

The first way is to buy alcohol physically, with the intention of storing and storing it. When deciding on such a method of investment, we must remember that both wine and whiskey require appropriate storage conditions.

In the case of wine, it must be a room with a constant temperature of 12-14 degrees C, as well as a constant humidity oscillating in the range of 70-75%. It is also worth taking care of the best possible isolation of the room from light. Bottles should be lying down and should be turned from time to time.

Whiskey is stored in barrels (usually the barrel is about 200 liters). The size may be a problem here, but there is also a way. When buying wine or whiskey directly from the distillery, it is often possible to rent a place in a special warehouse, which of course meets all storage standards (we pay a small annual fee). There are no single strictly specific data, but it is estimated that for this type of investment to make sense, it is necessary to invest about 4-7 thousand dollars, and the investment horizon should be at least 3 years.

Private banking / investment funds

This method is intended for investors who do not want (or cannot) store alcohol. Currently, many banks offer investments in the wine or whiskey market. There are also specialized consultancy firms dealing with such services (eg Wealth Solutions). Unfortunately, in these cases, we must be prepared for high management fees. Looking strictly at the funds, the market in Poland does not offer such a possibility. There are, however, foreign investment funds that invest only and exclusively in luxury alcohol. It is of course possible to purchase units of such a fund.

The most popular funds of this type include:

- Wine Asset Managers,

- Single Malt Fund.

Summation

The luxury alcohol market can be quite an interesting supplement to the investment portfolio. Nevertheless, this type of investment should always be approached slowly, assuming a longer time horizon.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in luxury alcohol [Guide] how to invest in luxury alcohol](https://forexclub.pl/wp-content/uploads/2020/08/jak-inwestowac-w-alkohole-luksusowe.jpg?v=1596188170)

![How to invest in luxury alcohol [Guide] Elections, bailout and tick](https://forexclub.pl/wp-content/uploads/2020/08/Wybory-pakiet-pomocowy-oraz-tiktok-102x65.jpg?v=1596466101)

![How to invest in luxury alcohol [Guide] technology companies](https://forexclub.pl/wp-content/uploads/2020/08/spolki-technologiczne-102x65.jpg?v=1596466487)

Leave a Response