IDM: The ESMA intervention did not improve the traders' performance

The Chamber of Brokerage Houses prepared an extensive report, which clearly shows that the product intervention by ESMA did not improve the investors' results on the OTC market. In addition, Polish brokerage houses are losing customers massively to foreign competition, which is able to offer them more favorable trading conditions.

Be sure to read: ESMA extends the leverage restrictions for another 3 months

IDM report

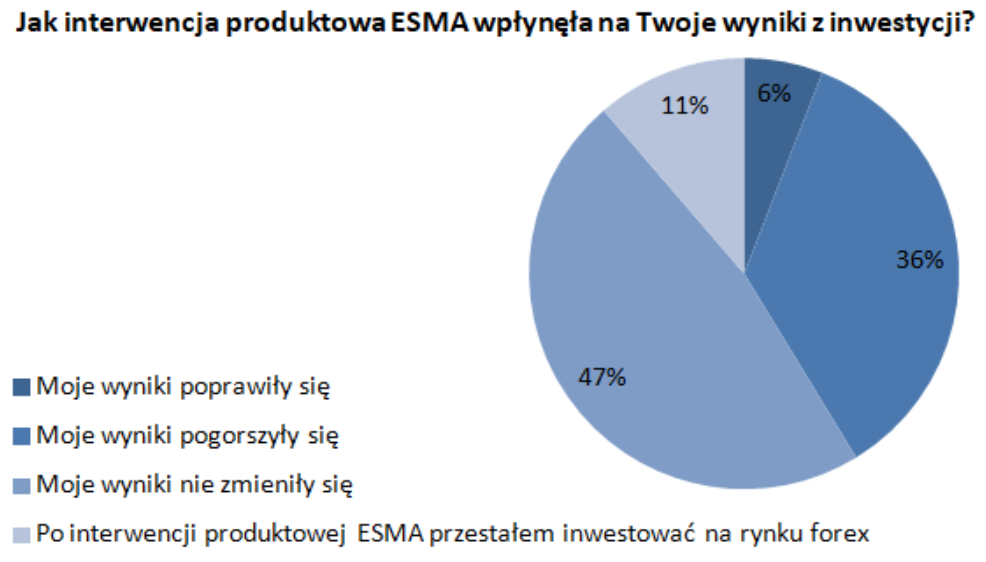

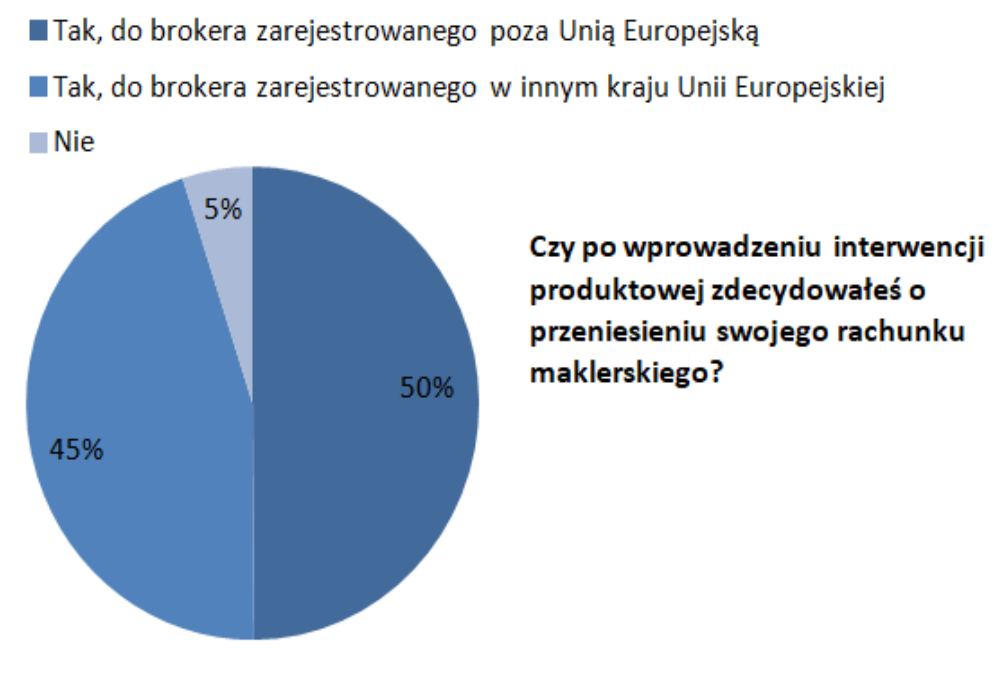

Currently, as many as 36% of traders declare that they report worse results on investments. Due to regulatory arbitrage, domestic brokerage houses are losing customers - every second experienced investor has already moved his brokerage account to brokers from outside the European Union, who offer better transaction conditions, including higher leverage. These are the results of the first Research on the impact of ESMA's product intervention on investors carried out by the Chamber of Brokerage Houses.

Marek Wołos, expert of the Chamber of Brokerage Houses for OTC markets:

“After the introduction of ESMA's product intervention, as many as 80% of investors achieve the same or worse results on investments in the OTC market. Every second experienced investor has moved his brokerage account outside the European Union. This exposes domestic clients to greater investment risks related to using the offer of entities outside the supervision of the Polish Financial Supervision Authority. If we do not take decisive steps to improve the competitiveness of the domestic brokerage industry, this important part of the financial market in Poland may be marginalized to the benefit of foreign entities ”.

No improvement in results

1 August 2018 European regulator ESMA introduced a product intervention on the OTC market, including significantly reduced the level of leverage available to individual investors. Leverage is the biggest advantage of investing in the forex market. According to 66,4% of respondents, the desired level of the lever for the most popular CFD instruments is 100: 1.

1 August 2018 European regulator ESMA introduced a product intervention on the OTC market, including significantly reduced the level of leverage available to individual investors. Leverage is the biggest advantage of investing in the forex market. According to 66,4% of respondents, the desired level of the lever for the most popular CFD instruments is 100: 1.

As a result of the changes, until 11% of traders stopped investing in the forex market. After the intervention, the results of 36% of investors deteriorated, and 47% of traders did not notice changes in the results of their investments.

Outflow of customers outside the EU

Half of the active and experienced traders, after introducing the product intervention of ESMA, decided to transfer their brokerage account to a country outside the European Union.

The regulations introduced by ESMA contributed to the migration of investors to countries outside the EU. The most active client is running away - an investor aware and experienced, accepting increased risk in exchange for the possibility of achieving high profits. These types of clients are not able to calibrate their strategies to the requirements imposed by ESMA "- says Marek Wołos.

The reason for transferring the brokerage account to countries not covered by the ESMA product intervention for 99,6% of investors was the possibility of using higher leverage. Among the reasons for which investors decided to change the broker into a registered in another European Union country, the possibility of obtaining the status of a professional client in that country, and thus the possibility of using a higher leverage, was indicated. Due to the domestic interpretation of the transaction value, obtaining a professional client status in Poland is more difficult than in other EU countries. Domestic investment companies, unlike foreign ones, are obliged to treat the value of the margin as the value of the transaction.

Read: FCA wants to introduce ESMA guidelines permanently

Safer with EU brokers

Domestic brokerage houses know the importance of their education for protecting clients' interests and providing reliable information about products available on the financial market. Therefore, already in 2017, IDM developed Standards in the field of good communication practices and marketing activities on the OTC market.

Domestic brokerage houses know the importance of their education for protecting clients' interests and providing reliable information about products available on the financial market. Therefore, already in 2017, IDM developed Standards in the field of good communication practices and marketing activities on the OTC market.

Long before the ESMA product intervention, national investment firms also introduced protection against negative balances on their clients' brokerage accounts.

84% of investors support the introduction of a negative balance protection on the brokerage account and 40% of traders the introduction of a standardized risk warning. This confirms that the direction of activities of domestic brokerage houses in order to increase the safety of investors on the domestic OTC market was good - emphasizes the IDM expert.

DOWNLOAD THE IDM REPORT RESULTS

The audit was carried out by the Chamber of Brokerage Houses in cooperation with the Comparic.pl portal. The survey was conducted on 20 February - 12 in March this year. The questionnaire consisted of 12 questions, the purpose of which was to check how the market for OTC was influenced by ESMA's product intervention. The survey was attended by 459 investors, of which 66,8% invests on the forex market more than 2 years and allocates funds to 10 thousand. zł.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response