ESMA is once again taking a closer look at the CFD market and... influencers

The European Securities and Markets Authority, ESMA, is once again targeting the market contracts for difference (CFDs). This time, there are reservations about unclear presentation of products and mixing real shares with contracts based on their price. But it is not everything. Accusations are also made against influencers who have too much influence on investment decisions made by retail traders.

ESMA wants to (re)regulate CFDs

In July 2018 regulations came into force permanently, which have radically changed the Forex/CFD industry in the European Union. Product intervention introduced completely ruled out binary options and introduced a number of restrictions for CFD brokers. Among other things, a lower financial leverage was imposed (maximum 1:30 for major currencies), the promotion of deposit bonuses and other incentives aimed at allegedly increasing market activity was banned, risk information was standardized and mandatory research on product adequacy was introduced (surveys on experience in potential customer's trade).

Has all this changed the market to a more civilized one? To some extent, for sure. Has this changed anything in terms of trader profitability statistics? Last KNF report showing the percentage of people earning money on the Forex market suggests that it is not. Nevertheless, ESMA sees another problem and comes back with further reservations regarding the activities of Forex brokers. and not only.

Are brokers misleading customers?

The European financial markets regulator has prepared a set of 40 questions addressed to companies offering retail investment services. The goal is to collect information regarding their activities. The topics covered include: issues of gamification, cooperation with the so-called influencers from the financial industry and offering CFD products.

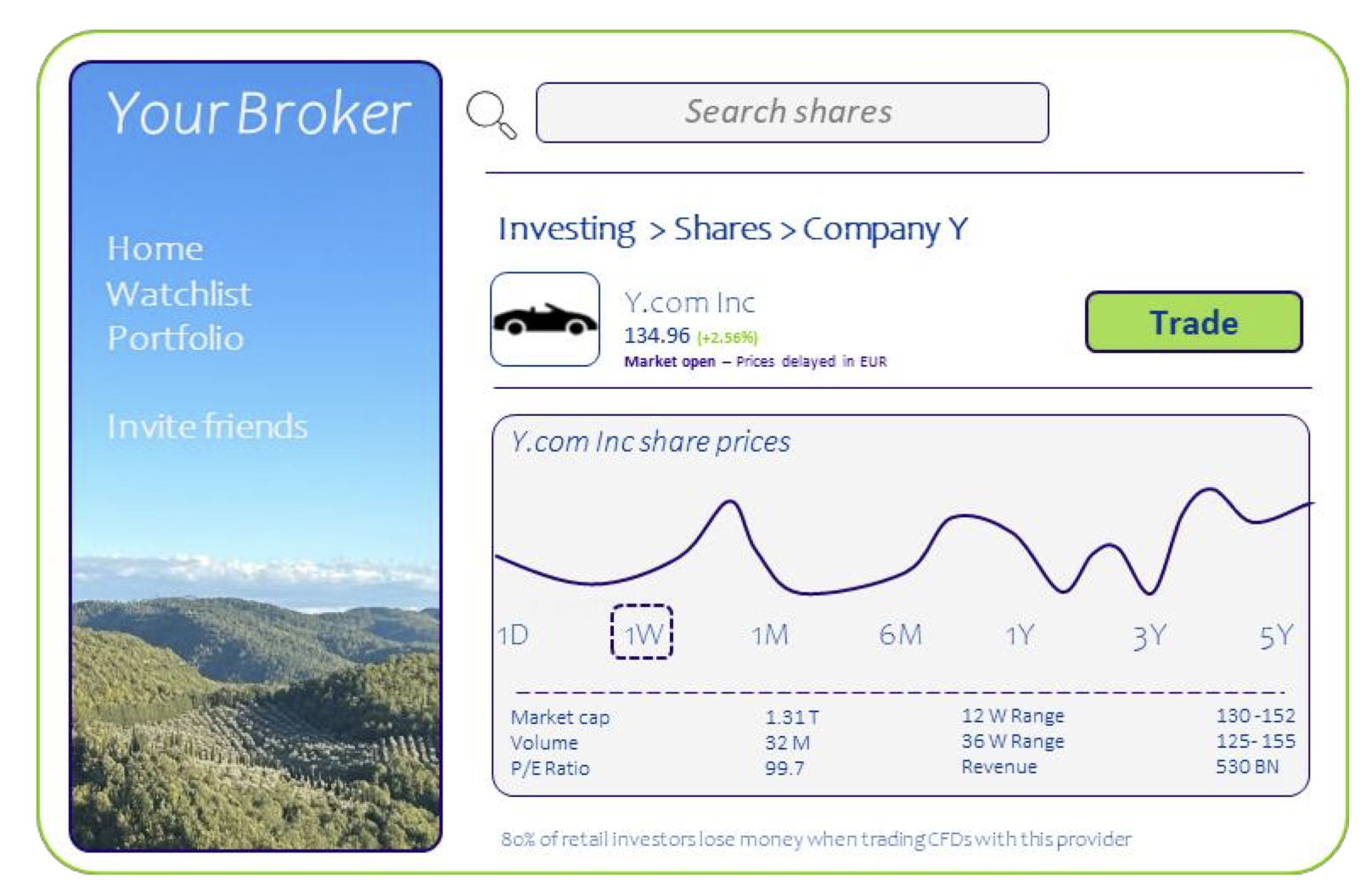

ESMA document presents recommendations addressed to brokers, which indicate the need to clearly specify whether a given instrument is the so-called an underlying instrument (e.g. a physical share) and which a contract (e.g. a CFD on shares). ESMA points out that some companies do it in an unclear way, which misleads the client - he ultimately does not know whether he has opened a position on a contract or whether he owns real shares.

“Furthermore, marketing communications may be structured in a way that does not make it easy to distinguish whether the instrument being sold is a CFD, a retail structured product or its underlying instrument. (…) This may lead to the mis-selling of such products, especially if unregulated products and/or services are made available on the same website as regulated products.” – ESMA mentions in the published document.

For the regulator, however, the difference is significant because CFDs on shares are usually leveraged, loaded with swap points and may be quoted at different hours (e.g. quotes are occasionally moved by a few minutes).

An example of a website where it is not easy to distinguish whether the product in which the investor will invest is a stock or a CFD. Source: ESMA

Influencers targeted by the regulator

The European regulator, citing research conducted in Australia and Poland, indicates that more and more young people are learning how to invest from influencers, YouTube channels or TikTok. And this is where further reservations arise.

“Customers search the Internet for information, including short videos, because they need fast, compressed and synthesized information on demand.” - comments ESMA.

He notes that such activities may be dangerous for potential, inexperienced investors. A similar threat may be caused by the so-called gamification, i.e. an approach that "flattens" investing into a form of competition, games or even casino gambling. All this may have an adverse impact on investment results and lead to financial losses.

Deadline for responses is March 2024

ESMA has set a deadline for answering 40 questions on the above issues by March 14, 2024. The survey results are to be taken into account when developing new rules and recommendations, which will probably come into force shortly after the specified date.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-300x200.jpg?v=1710999249)

Leave a Response