Intel disappointed with its forecasts, giving an impetus to declines

On Thursday after the session, Intel published its financial report for the fourth quarter of 2023. Although the technology company boasted better-than-expected results in the reporting period, the forecasts for the first quarter of 2024 were disappointing, thus giving an impetus to the stock market decline.

In the last quarter of last year, Intel generated $0,54 in earnings per share, i.e 9 cents more than analysts estimated. Revenues increased by 10% in the reporting period. Y/Y to $15,4 billion, beating market estimates of $15,16 billion.

Intel's stock price drops

However, the company disappointed in terms of forecasts. Intel estimates that in the first quarter of this year will have USD 12,2-13,2 billion in revenues, which is below market forecasts of USD 14,2 billion. It looks even worse when it comes to earnings per share. The company forecasts that earnings per share will be 13 cents, while the market expected a profit of 34 cents.

The effect of these disappointing forecasts was a 10,94% drop in Intel's stock on Thursday in after-hours trading. Today, in pre-session trading, these declines are even greater. Intel shares are down 11,34%. to $43,93

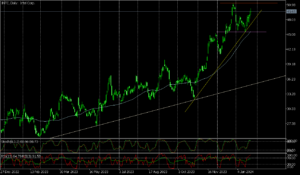

INTC daily chart. Source: Tickmill

If these declines continue during Friday's regular session on Wall Street, Intel's stock will not only reverse below its December peak of $51,28, but also will break the accelerated bull line (now at $47,20), will fall below the 50-day average (now at $45,60) and below the January low. There will be a strong enough set of supply signals that the risk of a drop below $40 will be real.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

Leave a Response