Individual investors continue to support the leaders in weight loss drugs

Retail investors continued to support weight loss drug makers in the fourth quarter while locking in gains from some of the highest-grossing companies in 2023, according to the latest quarterly stock data from eToro investment platform.

In a nutshell:

- Novo Nordisk and Eli Lilly are high on eToro's Q4 'top gainer' stock list;

- In 12 months, Nvidia's share price increased by 239%. (the most in the index S & P 500);

- Investors also bought shares of unlucky companies such as pharmaceutical giant Bayer and Siemens Energy;

- Uber, Salesforce, Snapchat were among the 'biggest losers' as investors locked in profits for Christmas

Tesla and Amazon are the most popular companies

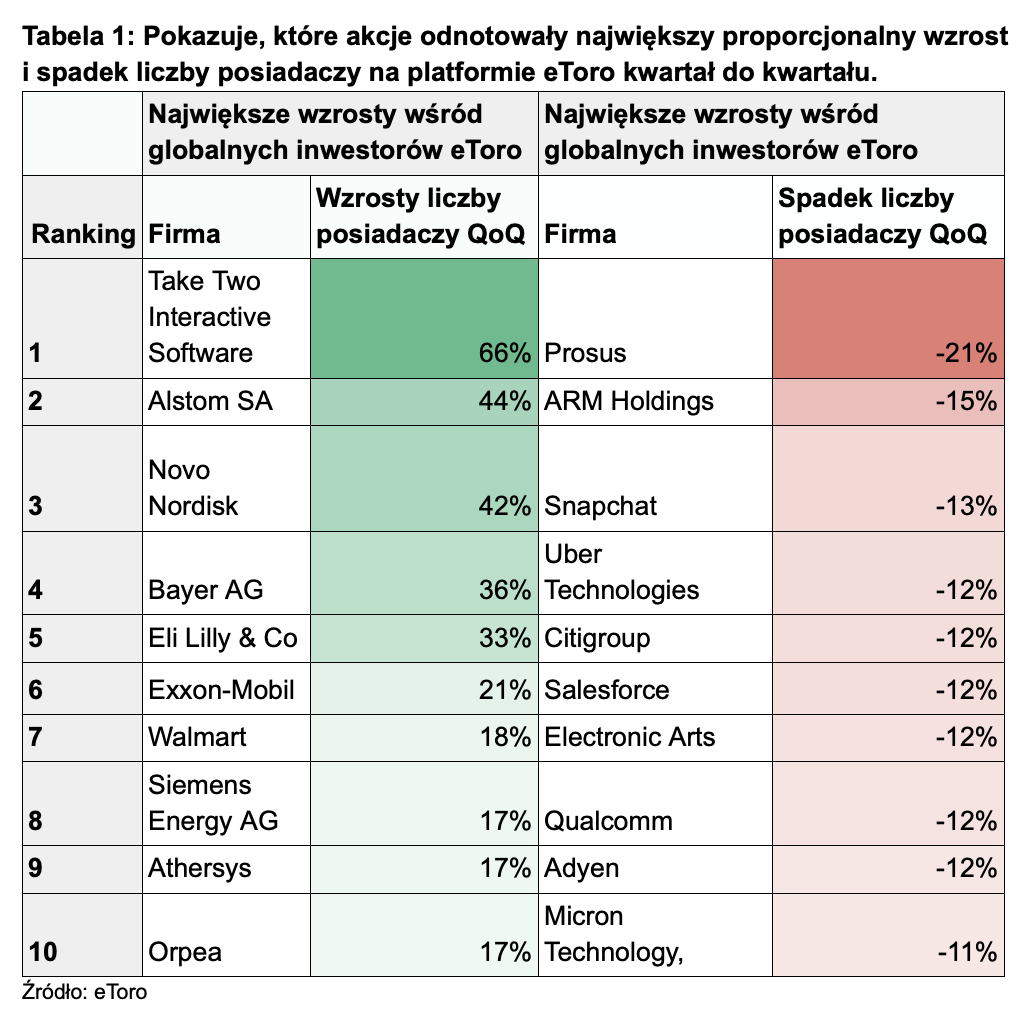

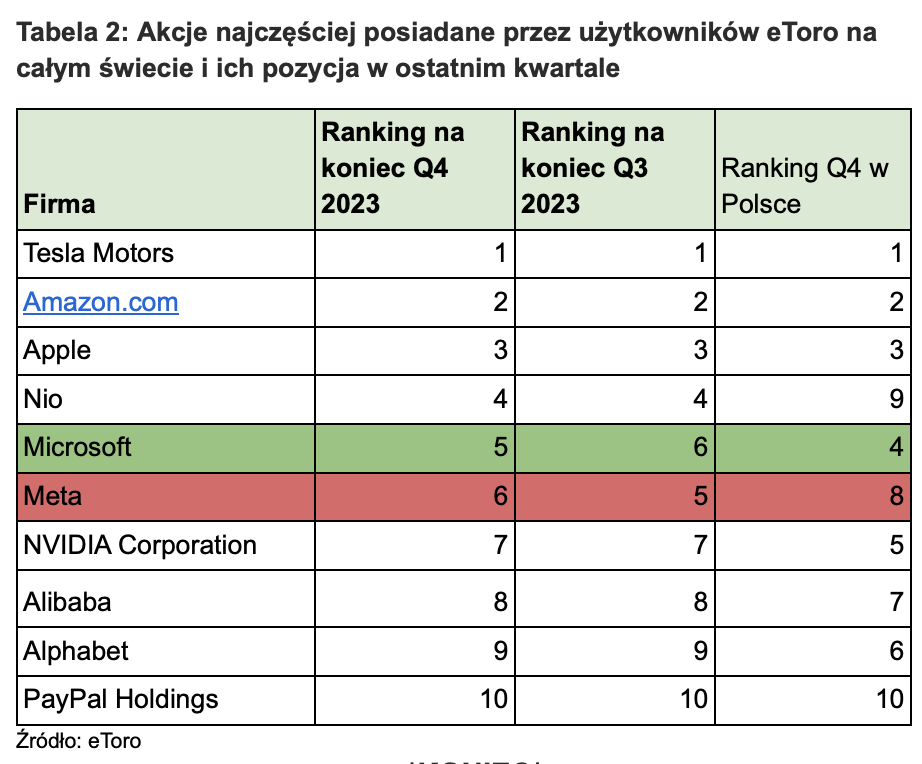

eToro analyzed which companies saw the largest proportional change in holders at the end of Q1 compared to the end of Q10 (Table 2), as well as the XNUMX most frequently held stocks on the platform (Table XNUMX).

They are once again on the list of the most frequently held shares Tesla i Amazon, which saw huge increases in share prices in 2023. After a phenomenal 12 months in which the share price Nvidia increased by 239 percent (the largest share in the S&P 500 index), the company strengthened its position in seventh place among the most frequently held shares on the eToro platform, overtaking the stalwart Alphabet.

Manufacturers of weight loss drugs are once again at the top of the list of the 10 "biggest growers". The Danish company Novo Nordisk, the manufacturer of the weight loss drug Wegovy, and Eli Lilly & Co., the manufacturer of the drug Tirzepatide, recorded an increase in the number of users in the fourth quarter eToro, owning their shares by 42% respectively. and 33 percent Both companies recorded 9-11 percent. share price growth in the last quarter of last year, although at "more modest" levels than the gains seen at the beginning of the year.

Retail investors also appeared to buy the dip in the fourth quarter, with several underperforming companies making the list of "biggest gainers" in terms of ownership. For example, German pharmaceutical giant Bayer saw a 36% increase in eToro holders after the company's share price hit a 12-year low. Meanwhile, Siemens Energy recorded a 17% increase. an increase in the number of eToro users owning shares after the company's share price hit a record low in October.

Commenting on the data, eToro market analyst Paweł Majtkowski said:

Individual investors strongly believe in the good prospects of anti-obesity drugs, which is why they willingly choose the two most important companies in this industry - Novo Nordisk and Eli Lilli. Although some people regretted not having bought these securities earlier, the growth rates of 9 and 11 percent in the fourth quarter alone are another very good result of these companies. Among investors, we also have bargain hunters looking for companies that have recently struggled with problems in order to make money once they overcome them. This wasn't a bad strategy, considering the recovery that many companies that were lower in 2022 experienced last year.

At the other end of the spectrum, eToro users appeared to lock in their profits on some of 2023's top performers by selling them. The list of "biggest decliners" included Salesforce, which recorded a 12% decline in the number of eToro holders in the 4th quarter. Uber and Micron Technologies also saw declines, losing 12% respectively. and 11 percent holders. All three companies have seen phenomenal share price gains in 2023.

Paweł Majtkowski adds:

The end of the year is usually a time when both domestic and global investors review their portfolios for the next year. Our observations show that this is also a period of profit-taking - some investors cash in on their most profitable shares. This is indicated by the decline in the number of holders of shares of several large technology companies that we recorded at the end of 2023. This may turn out to be reasonable if forecasts regarding the market rotation in the new year towards cheaper and cyclical companies are correct.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![CRB index – one of the popular commodity market benchmarks [Guide] crb index](https://forexclub.pl/wp-content/uploads/2024/05/indeks-crb-184x120.jpg?v=1715055656)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)