How to buy Tesla shares? Everything about investing in Tesla [Guide]

How to buy Tesla shares? Everything about investing in Tesla

Tesla is an automotive company co-founded and CEO of Elon Musk - entrepreneur and visionary. He currently holds the position of Chief Executive Officer (CEO) and Chief Architect at Tesla. In addition, he is also the CEO and Technical Director of SpaceX.

The main branch of Tesla's activity is the creation of electric cars. Tesla also manufactures batteries, solar panels, solar tiles and glass.

Chart - Tesla shares

Basic information about Tesla

| Logo |  |

| Name | Tesla |

| Headquarters | Palo Alto, USA |

| creation date | July 1 2003 |

| Stock symbol | TSLA |

| trade | motorization, energy |

| Capitalization (as of April 28) | 133,51 billion USD |

| Dividend | - |

| Web page | www.tesla.com |

Company history and information

Timeline with selected events

| 2003 | Founding of the company by Martin Eberhard and Marc Tarpenning |

| 2004 | Joining Elon Musk to the board of the company |

| 2003 – 2008 | Joint work with Lotus Cars on the first Roadster car model |

| 2008 | The premiere of Tesla Roadster |

| 2012 | The premiere of Tesla Model S |

| 2012 | Commencement of the construction of a supercharger network - electric car fast charging station |

| 2015 | The premiere of Tesla Model X |

| 2016 | The premiere of Tesla Model 3 |

| 2019 | The premiere of Tesla Model Y and Cybertruck |

Logo history

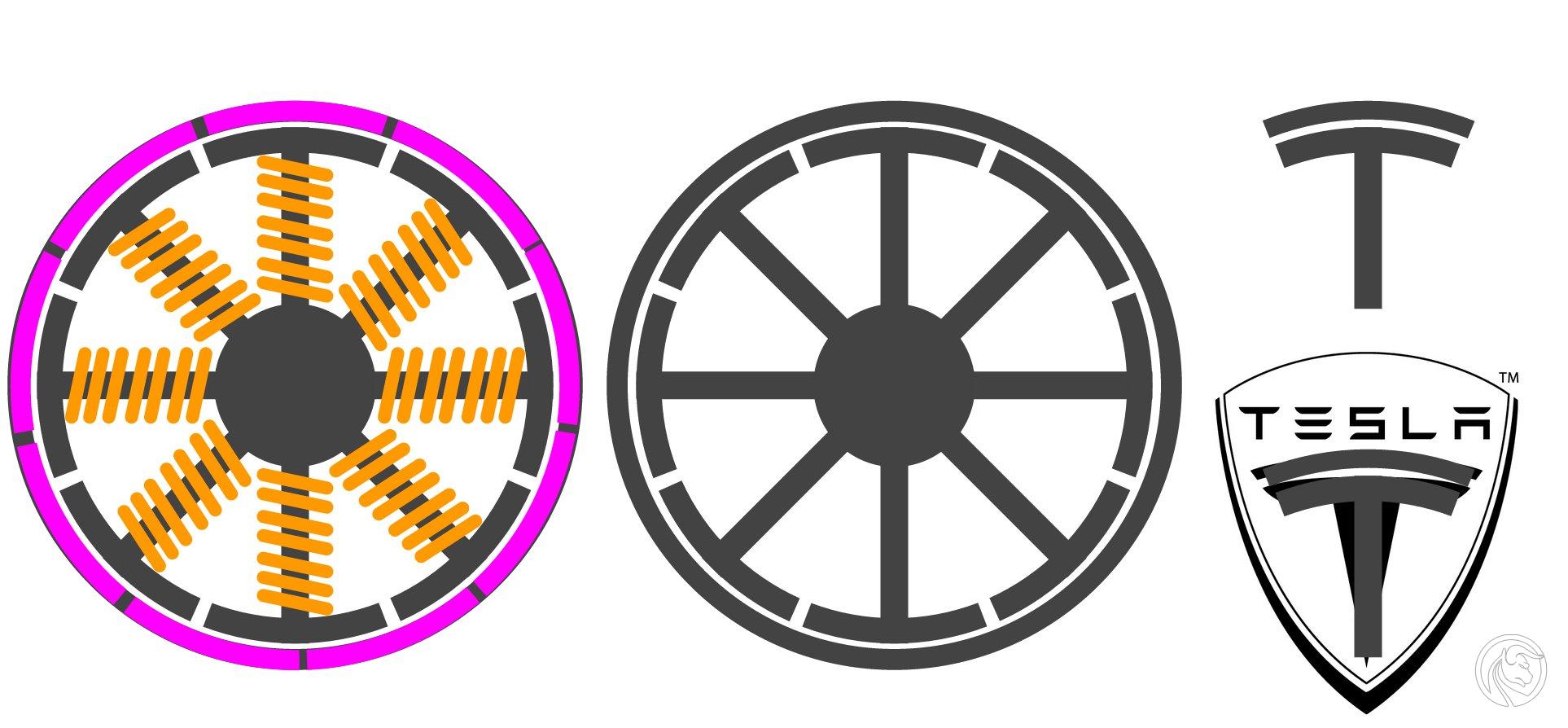

The company name refers to Nikola Tesla, a brilliant American inventor of Serbian origin. Nikola Tesla focused in his work on the construction of devices using alternating current. In the Tesla logo we see the letter "T", which represents the name of the company, but the logo itself has a deeper meaning. As Elon Musk explains on Twitter, the logo presents a fragment of the cross section of an electric motor.

Similar to SpaceX, the T is like a cross section of an electric motor, just as the X is like a rocket trajectory.

- Elon Musk (@elonmusk) January 19, 2017

The diagram below shows the cross section of the electric motor, the Tesla logo is inspired by its snip.

Company strategy

Tesla stands out with the company's original strategy. This is evident in several aspects of the business.

Putting on your own production facilities

While the norm in the automotive industry is outsourcing of cheap labor to countries, Tesla focuses on its own automated jig factories in the US and Europe and the production of key components (batteries, engines) inside the company. This generates huge costs, however, it gives security and full control over key resources on which the company bases its activities.

Solutions typical for the consumer electronics industry

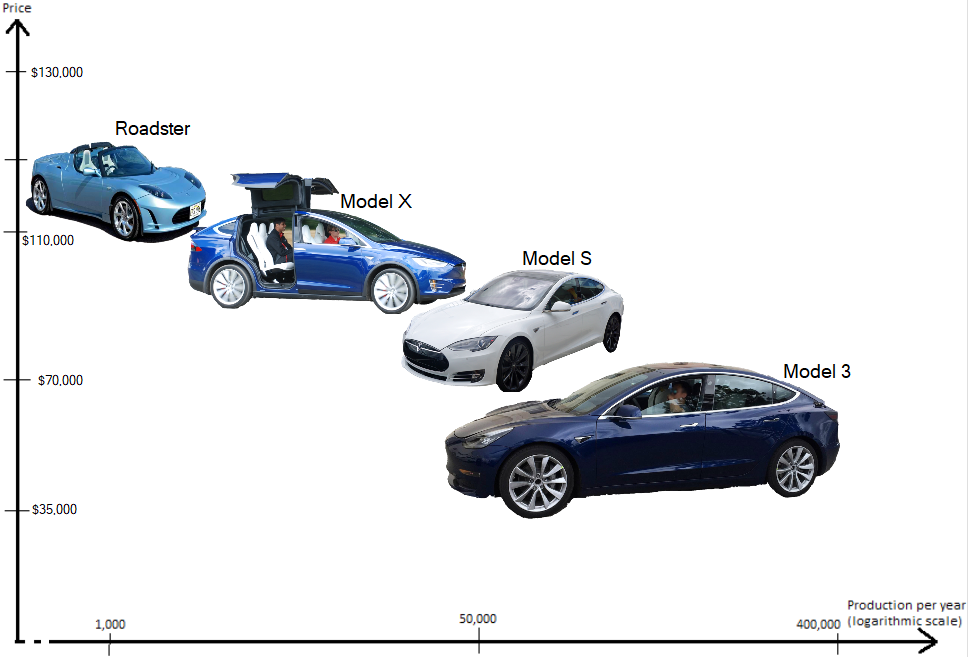

The entire development strategy of the company is based on the idea of life cycles of technological products. The typical life cycle of technology products is repeatable. First, an imperfect, breakthrough product goes to a handful of wealthy "geeks." Each subsequent generation of the product becomes more perfect, cheaper and goes to a growing number of recipients, until the product spreads at a low price and reaches the mass consumer.

This is also the plan behind the next generations of Tesla cars. The first model was the Roadster - an expensive sports car. It cost over $ 110 and sold several thousand units. Each subsequent model is cheaper and addressed to a wider audience.

Behind this strategy lies the assumption that the first versions of technology products are imperfect and contain many errors. They are addressed to rich customers who purchase the product as a "novelty", a kind of additional toy, and therefore are able to forgive mistakes and imperfections. Over time, the product becomes more and more reliable and thus reaches a wider audience.

Another solution inspired by consumer electronics is the construction of Tesla car batteries composed of small lithium-ion batteries used in consumer electronics, instead of the large batteries used by other companies producing electric cars.

Tesla products - status for 2020

Tesla Roadster

The first electric sports car to be produced by Tesla between 2008 and 2012. The premiere of the new Tesla Roadster is scheduled for 2020. The Roadster was the first mass-produced car to use lithium-ion batteries and the first electric car with a range of more than 320 km. The Tesla Roadster was also the first car launched into orbit during the Falcon Heavy rocket test in 2018.

Model S

Premium car produced from 2012. Model from 2020 has range of 630 km on one battery charge. This is the first mass-produced premium electric sedan. The body is made of aluminum. The number of models sold in 2018 exceeded 250. Models produced after 000 are equipped with Tesla Autopilot software.

Model 3

Electric middle class sedan produced from 2017. The minimum range on a single charge is 350 km. Body made of aluminum and steel. Equipped with Tesla Autopilot software. Tesla Model 3 is the best-selling electric car in the world. By March 2020, over 500 units were sold worldwide.

Model X

Premium electric SUV. Manufactured since 2015. The model is based in 30% on Model S. Available in version Long Range Plus range of 565 km and Performance with a range of 491km. By 2018, Tesla sold 106,689 X models.

Model Y

Electric crossover compact car. Produced since January 2020. It has range of 509 km in the Long Range Performance version.

Autopilot

Tesla cars stand out on the market not only because they are electric. The icing on the cake (and for some perhaps a key functionality) is the semi-autonomous software of the vehicles. As of today, Tesla is equipped with software enabling: automatic centering of the vehicle in the lane, automatic maintenance of a safe distance from the preceding vehicle, automatic parking, automatic change of lanes, autonomous driving of the vehicle on highways, autonomous arrival of the vehicle from the parking lot at the request of the owner. The company's goal is to create a completely autonomous vehicle that will be able to move on its own in all road conditions, without the participation of the owner.

Supercharger

In addition to electric cars, Tesla is also building stations for fast charging electric cars. Supercharger is the name for 480 volt charging stations. Within 40 minutes of stopping at such a station, the Tesla Model S battery will be charged to 80%. In March 2020, Tesla has over 16 Superchargers worldwide, including 100 fast charging stations in Poland where they are available (in Warsaw, Poznań, Katowice, Wrocław, Radom and Ciechocinek).

Powerwall

Energy accumulator for home use. We can accumulate energy produced by solar panels in it. Another way to use it at home is to charge it with electricity from the mains at times when the lower rate for electricity applies. The Powerwall capacity is 6.4 kWh and can be installed both indoors and outdoors. Powerwall can operate at temperatures from -20 * C to 50 * C.

According to the Swiss bank UBS Powerwall, it pays only in countries where the costs of electricity from the mains are high and the use of solar panels in households is widespread, e.g. in Germany or Australia.

Power Pack

A larger Powerwall equivalent for industrial use. It is able to accumulate 100 kWh.

megapack

A product that allows you to store huge amounts of energy on an industrial scale. It is an alternative to power plants that use fossil fuels. A single Megapack allows for storage of up to 3 MWh. It can be combined into modular networks to create an "energy storage" with a capacity of 250 MV. Tesla ensures that it is able to build such a power plant in less than 3 months. So far, Tesla has built two such power plants in Australia, one in Japan, Slovakia and Canada. There are plans to build another energy storage in California.

Solar panels

Tesla also offers solar panels. They stand out on the market with an aesthetic design and integration with the mobile application recording energy consumption.

Solar roof tiles

Solar roofing tiles are another innovative product of Tesla. Currently available for sale is 3 versions of solar roof tiles. According to Tesla, installation of solar tiles is expected to be cheaper than installation of ordinary tiles and solar panels.

Giga Tesla factory

Tesla stands out on the market with the concentration of production in the United States. Today, Tesla has 4 factories, 3 of which are located in the USA. In June 2021, it plans to open another factory - in Germany near Berlin.

The Factory - Fremont, California

The first Tesla factory, built in 1962. After being taken over by Tesla, it was redesigned and modernized. Model S, Model X and Model 3 are produced there. The factory employs 10,000 people. Most of the manual work is performed by 160 specialized robots, including the 10 largest robots existing in the world. Components including batteries and engine components are also manufactured on site at the factory.

Giga Nevada (Gigafactory 1) - Reno, Nevada

The second Tesla factory. It mainly produces lithium-ion batteries for cars as well as Powerwalle and Powerpack. Employs 7000 people. The factory was designed to be completely energetically independent and derive energy from solar panels, wind and geothermal sources.

Giga New York (Gigafactory 2) - Buffalo, New York

Third Tesla factory. It mainly produces solar roof tiles. It employs 1500 people.

Giga Shanghai (Gigafactory 3) - Shanghai, China

The Tesla factory producing Model 3 and Model Y. Has 2000 employees.

Giga Berlin (Gigafactory 4) - Grünheide, Germany

The first Tesla factory in Europe, the planned opening date is June 2021. The factory is to produce batteries, Powerpacks and power transmission systems for Tesla cars.

How to buy Tesla shares

Historical behavior of Tesla shares

Tesla is a company listed on the American stock exchange. Tesla's debut took place in 2010. The shares were then listed at USD 17 per share. The first rally took place in 2013. when shares soared to almost $ 200. After three years of price persistence, we observed another rally when in 2016 shares reached the price of $ 350. After another 3 years of stabilization in 2019, shares soared to $ 900.

Interestingly, after the crash that took place at the turn of February and March 2020, Tesla's shares rebounded very dynamically. The result of Tesla shares for the last quarter is as much as 43% growth. For comparison, Apple has lost 3% in the last 8 months, and Microsoft has gained 7%. Tesla is even better compared to the giants of the automotive industry. Volkswagen in the quarterly perspective is still 22% in the minus, and Ford over 41% in the minus. Many novice investors then began to ask themselves not "is it worth it" but how to buy Tesla shares.

Capitalization

Tesla's capitalization is currently $ 147 billion. Interestingly, Tesla has 2x market capitalization than the automotive giant Volkswagen ($ 64 billion). For comparison, Ford's capitalization is $ 17 billion, BMW's $ 31 billion. This demonstrates the huge trust investors place in Tesla's long-term strategy.

Brokers offering Tesla shares

If you are wondering how to buy Tesla shares, then international brokerage houses as well as Forex brokers, who also offer CFDs for shares. Below is a list of selected Forex brokers with Tesla shares in their offer.

How to Buy Tesla Stock: Brokers

| Broker |  |

|

|

| End | Poland | Denmark | Great Britain |

| Shares on offer | approx. 3500 - shares approx. 2000 - CFDs on stocks 16 exchanges |

19 - shares 8 - CFDs on stocks 37 exchanges |

approx. 3 - CFDs on stocks 16 exchanges |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 5 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

MetaTrader 5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Traditional shares and CFDs

How to buy Tesla shares, i.e. which instrument is better - traditional stocks or CFDs? There is no clear answer to this question. In practice, everything will depend on our expectations, strategy, and the time perspective of the planned investment.

| Traditional actions | CFD per share | |

| Investment time horizon | long | short |

| Financial leverage | None | max. 1: 5 (depends on value) |

| Swap points | None | so |

| Possibility of playing for declines | nie | so |

If we believe that the share price will increase in the long term, then traditional stocks certainly seem to be a better choice - we do not use financial leverage here and therefore, if we are successful, we earn less, but at the same time risk less and bear no costs due to fees holding positions (swap points).

In the case of short-term speculation, CFD instruments maximize profit. Although, as a rule, fees are higher than in the case of traditional shares, the financial leverage mechanism allows to generate higher profit with less volatility of the instrument. In addition, we have the option of betting on price drops.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![How to buy Tesla shares? Everything about investing in Tesla [Guide]](https://forexclub.pl/wp-content/uploads/2020/04/jak-kupic%CC%81-akcje-tesli.jpg?v=1588059889)

![How to buy Tesla shares? Everything about investing in Tesla [Guide] how to buy oil](https://forexclub.pl/wp-content/uploads/2020/04/jak-kupic%CC%81-rope%CC%A8-102x65.jpg?v=1587808933)

![How to buy Tesla shares? Everything about investing in Tesla [Guide]](https://forexclub.pl/wp-content/uploads/2020/05/Strategia-forex-na-koniec-dnia-6msc-102x65.jpg?v=1588575635)

In my opinion, Tesla was well inflated before the crash, but now I do not know myself, because it is making up for these drops faster than the Model S accelerates to a hundred ... 😛