Forex swap. Swaps without secrets

Swap is one of the most enigmatic and at the same time basic concepts that a novice investor encounters. The issue should be of particular interest to people who plan to hold open positions for a long time (e.g. several subsequent sessions). This swap can ultimately decide or at least have a significant impact on whether the transaction will be closed with profit or loss.

What determines the height of swaps?

Brokers provide investors with a mechanism in the form of financial leverage. This mechanism allows you to enter into transactions with a value much greater than our financial resources. With a leverage of 1: 100, we can trade a position 100 times larger than it results from the account balance, and the broker temporarily freezes a certain amount of capital (the so-called margin), which is the coverage for this position. Such an action is possible due to the fact that there is no physical exchange on the currency market (at least not with the help of currency brokers known to us). In this case, only the differences in rates resulting from the opening and closing prices of the position are settled. Nevertheless, these measures come from somewhere ...

READ NECESSARY: What is financial leverage?

When entering into a currency pair transaction, we buy one currency for another. For example, if you open a long position at EUR / USD We buy euros for US dollars. We buy dollars in the case of a short position for the euro. The use of the leverage mechanism means, in simplified terms, that we take out a loan in a given currency and invest this capital in another. Every currency bears interest and the amount itself interest rates is determined by the central bank of the given country. If we borrow at an interest rate of 4%, and then place these funds in assets bearing an interest rate of 2%, we will lose such interest. Similarly, it works the other way around. Generally speaking, the greater the disproportion in interest rates of currencies in the pair on which we conclude the transaction, the higher the swap rates. Both plus and minus.

Let's analyze this with examples

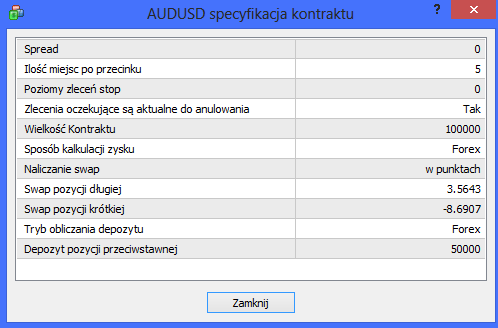

We trade on steam AUD / USD. Interest rates for AUD are 2,50%, while for USD less than 0,25%. In this situation, there is a clear disproportion and it can be immediately assumed that for a long position (we buy AUD for USD) the swap will be positive and for a short position (for AUD we buy USD) negative.

We trade on steam AUD / USD. Interest rates for AUD are 2,50%, while for USD less than 0,25%. In this situation, there is a clear disproportion and it can be immediately assumed that for a long position (we buy AUD for USD) the swap will be positive and for a short position (for AUD we buy USD) negative.

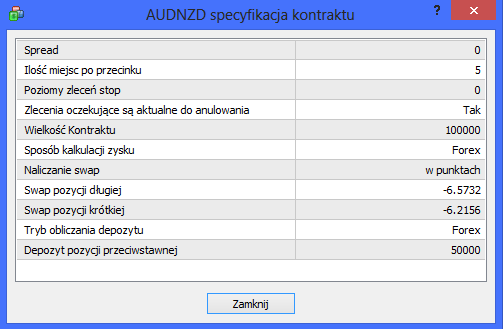

However, it may turn out that interest rates will be at a similar level for both currencies in a pair. This is also the case at AUD and NZD, where the interest rate is 2,5%. If there is no or little difference in% values, it may turn out that the swaps will be negative for both long and short positions due to the margin added to the swap points.

The swap can not quite be called an additional transaction cost, because depending on the type of position (long or short), it will be our additional income, increasing the profit or increasing the loss. Due to the fact that this is an article for beginners, we will omit the formulas based on which market swap rates are determined. In fact, it is of little importance anyway. The rates that will be charged on the platform are set individually by each broker. It is difficult to clearly identify the broker that would offer the best swap points. Some firms may have a policy of low or high margins on market swaps. It turns out, however, that it usually makes more sense to look for attractive rates for a specific instrument on which we plan to invest. However, when it comes to the moment of changing or updating rates, there is a "free American" and brokers can change them at any time they choose, not necessarily after lowering or increasing interest rates by a given central bank.

The swap can not quite be called an additional transaction cost, because depending on the type of position (long or short), it will be our additional income, increasing the profit or increasing the loss. Due to the fact that this is an article for beginners, we will omit the formulas based on which market swap rates are determined. In fact, it is of little importance anyway. The rates that will be charged on the platform are set individually by each broker. It is difficult to clearly identify the broker that would offer the best swap points. Some firms may have a policy of low or high margins on market swaps. It turns out, however, that it usually makes more sense to look for attractive rates for a specific instrument on which we plan to invest. However, when it comes to the moment of changing or updating rates, there is a "free American" and brokers can change them at any time they choose, not necessarily after lowering or increasing interest rates by a given central bank.

How do you calculate a currency pair swap?

Swaps are expressed in swap points. To know in advance how much money will be added to our account, you need to make simple calculations.

We will use the example from AUD / USD we used earlier. The table shows that for the long position the swap is approximately +3,6, and for the short position -8,7 (values in points). For brokers with quotes up to 5 decimal places, this means +0,36 pips and -0,87 pips. So what if, for example, we keep an account in Polish zloty and hold a position with a volume of 0.4 lots overnight?

READ ALSO: How much is one pips worth?

1.0 pip on AUD / USD for a 1.0 lot volume is worth 10 USD. For a 0.4 lot volume it will be 4 USD. Assuming an average USD / PLN exchange rate of 3,17, this gives us 12,68 PLN and this value should be multiplied by the swap point:

- Long position: 10 USD * 0.4 lot * 3,17 USDPLN * 0,36 swap = 4,56 PLN

- Short position: 10 USD * 0.4 lot * 3,17 USDPLN * (-0,87) swap = -11,03 PLN

Depending on the direction, the calculated value will be added to or subtracted from the balance sheet of the open position for retaining it for the following day.

Real account and demo

On the internet you can find many pages with tables or modules, which presents a list of swap points for selected instruments at many brokers. Unfortunately, they are usually not worth anything. Special attention should be paid to whether this data is from a real or demo account. It is also important how often they are updated and when this was last done. This is of great importance because usually demo accounts have completely different values set than those applicable on real accounts. This is due to the fact that the broker does not earn on the demo account. This is only a cost for him, hence he does not pay so much attention to updating swap rates. It is different on the real account, because here it is additional income for him.

On the internet you can find many pages with tables or modules, which presents a list of swap points for selected instruments at many brokers. Unfortunately, they are usually not worth anything. Special attention should be paid to whether this data is from a real or demo account. It is also important how often they are updated and when this was last done. This is of great importance because usually demo accounts have completely different values set than those applicable on real accounts. This is due to the fact that the broker does not earn on the demo account. This is only a cost for him, hence he does not pay so much attention to updating swap rates. It is different on the real account, because here it is additional income for him.

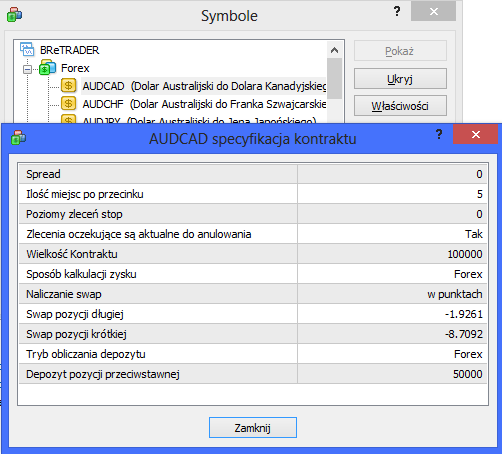

The current swap rates can be found on each broker's website in the form of a table or in the financial instruments specification document (and / or regulations). Additionally, they can be checked on the MetaTrader 4 platform using non-standard indicators (e.g. Spread and Swap Monitor) or by browsing the details of a given instrument. To do this, right-click on the quotes in the tab Market -> Symbols -> Select a symbol -> Properties.

With the last two solutions, it is extremely important that the check is made only after logging in to the real account.

When are swap points calculated?

Swap points are added to the balance of the open position (visible in the Swap column) when it is held for the next day. This usually happens at 23:00 or 00:00 Polish time, depending on the broker and his time zone (or server location). What about rates that should be charged for weekend days, i.e. the time when the currency market is sleeping? Brokers solved this in such a way that the values for Saturday and Sunday are calculated in the middle of the week. Most often they accumulate swap on Wednesday to triple value or on Wednesday and Thursday to double. So if we open the position on Friday and hold it until Monday, the swap will be charged only for rolling from Friday to Saturday. However, if we open the position on Wednesday and hold it on Thursday, then the broker will charge us double or even triple value.

Swap - who is it important for?

For mid-term traders, swap rates will be of limited significance and for day traders and scalpers they are completely irrelevant. However, it is one of the key factors for long-term traders who will hold one position for months. They have to take this into account before opening a position.

Every day, values are added to their balance that either increase or decrease its profit. A seemingly small value, on the order of +/- 0,5 pips, within three months (90 days) is already 45 pips of difference. On some charts, 90 days back is a traffic range of up to 600 pips. With such a swap value, 45 pips is 7,5% of the range and that could increase or decrease our position profit. Assuming, of course, that transactions would be concluded at extreme points (maximum and minimum).

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Swap points - What are they and why do they exist? [Video] swap points](https://forexclub.pl/wp-content/uploads/2021/10/punkty-swap-300x200.jpg?v=1635433636)

Leave a Response