TMS competition is over! We know the winners of the 7th edition

Three weeks of competition on demo accounts in the TMS Brokers investment competition are behind us. Thus, we got to know the winners of the entire edition, who achieved the highest rates of return. How did the best play? We check!

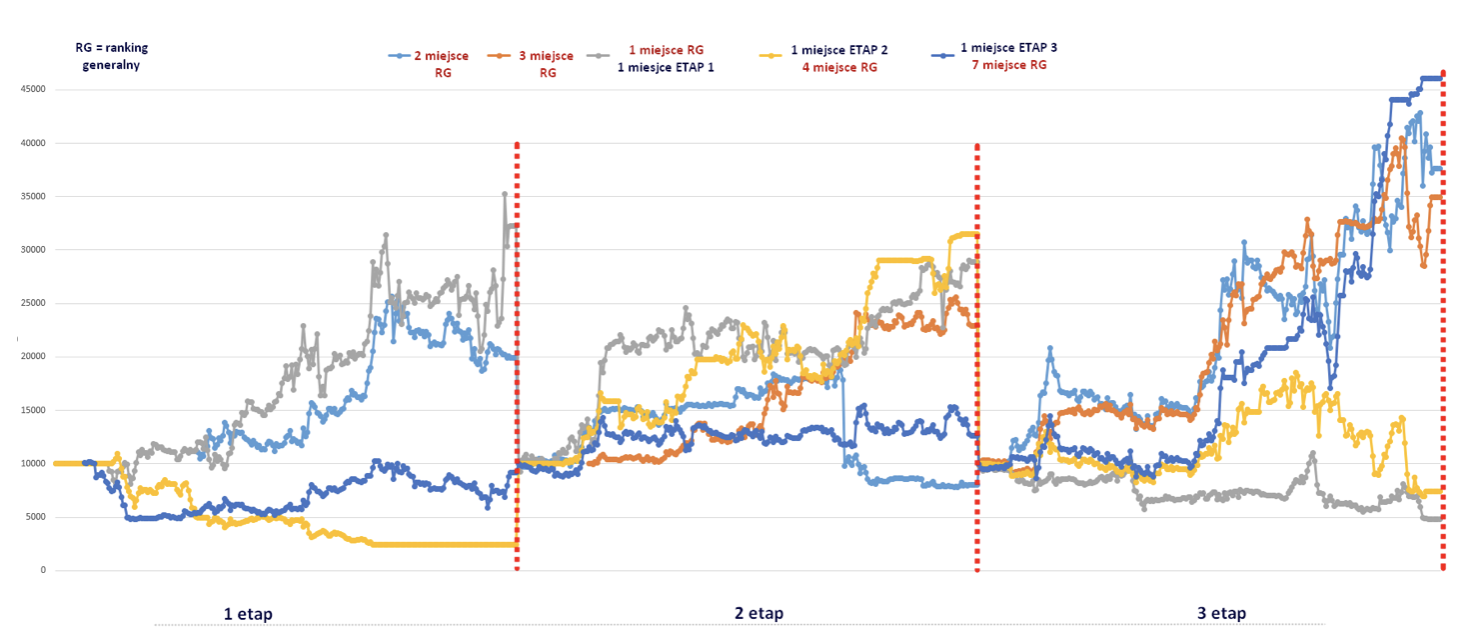

The adopted form of competition was based on a 3-week race for the highest possible rates of return. This time it had a new version - it was the supercar edition. The competition participants fought for the first three places in the general ranking (the winner of which will receive PLN 7, the silver medalist - PLN 2, and the person from the last step of the podium - PLN 1). The best in the general classification and the winners of each stage will also be invited to participate in supercar day, a day full of impressions with exclusive and very fast cars.

The competition was divided into three stages. Each of them was followed by a reset of deposits to the starting amount of 10. euro. One good day or one successful transaction was not enough to win the general classification. The best investor had to show that he can consistently earn and is high in the classification at every stage. Such rules efficiently eliminate those who count only on luck.

Each investor scored points in the competition. They were awarded for the first 50 places in each stage. For the 1st place, the trader received 50 points, for the 50th - only 1 point. Additionally, you could collect points for recommending the competition to your friends (for a maximum of 10 points).

Most popular markets

Again, among the most frequently chosen instruments was, among others DE30, a contract for German DAX index. The participants made the most transactions on it. Those who sold this CFD, they could count on a significant rate of return. The stock exchange index in Frankfurt fell from 13 points during the TMS competition. up to 115 11 points The downward trend prevailed, the rate from time to time made only symbolic, technical adjustments. The sell-off intensified in the last week of competition as markets began to discount the impact of wave 315 again.

The US indices were the second equally frequently chosen market. Participants most often opened a position on the US100, i.e. a contract based on the NASDAQ100 index, which brings together technology companies. In the period from 13 to 30 October, it dropped from 12 points to 246 points.

However, on the first day of the competition (October 12), the index made an impressive move up. The green session on Wall Street could definitely give investors hope that the benchmark of technology companies will soon even out the historical peaks. However, three weeks before the presidential election date, the market started discounting Biden's victory, leading in the polls by approx. 3 percentage points. Perhaps the markets feared the introduction of declared taxes? You can see that this sector was mainly afraid of the Democratic politician's victory. The lack of compromise on the fiscal package also contributed to the dominance of negative moods. The bearish sentiment on the American trading floor is also the aftermath of the second wave of the pandemic, which hit Europe with redoubled force.

Technically, the US100 was an ideal market for short term trading. The price respected the horizontal support and resistance. After dynamic sell-offs, the market made technical rebounds that a seasoned investor could use to open short positions.

How did the best play?

- The winner of the competition was a trader with the nickname "mjudu"who defeated everyone in the first week and finished 4th in the second round. The competition ended on the line - the third stage was completely unsuccessful for him. The victory gave him a return rate of 223 percent. and 189 percent It is worth noting that "mjudu" scored points only for trading, he did not take advantage of additional bonuses for recommending the competition to his friends.

At the beginning of the competition, the trader did not choose either the currency market or the stock indices. 100% engaged in the game on the natural gas market, making only 11 transactions. It is very likely that the investor expected a drop in the price of the raw material after the quotations reached the highs of the end of September 2020 and November 2019. Course NATGAS it adjusted from $ 2.93 to $ 2.61 / MMBtu in three days, then rebounded dynamically to $ 2.85 / MMBtu.

4th place in the middle of the competition is the result of only 3 transactions. Two on the gas market and one on the US 500 index. The "mjudu" trader belongs to the group of slightly more conservative traders, because you can see pending orders (Stop Loss and Take Profit types) in the investor's portfolio. This edition has shown that you can win without applying overtradingu - that is, notoriously having positions. Thoughtful trade turned out to be the best competition strategy.

- Silver medalist "Slawomir" perfectly hit the downtrend on stock indices. The great 3rd round of the competition, in which he took 2nd place (with a rate of return of 276%), is a display of trading on the US100 and DE30. Consistently opened short positions on these instruments resulted in a good investment. The first round was not without significance for the player, however. Although "Slawomir" was outside the top ten (he took 14th place), it was the first points he scored that certainly motivated him to continue the competition. Looking at the portfolio of the runner-up, you can notice a great commitment. Less than 200 positions during the last 5 trading days are proof of this.

The second round was quite favorable for the player. However, the Thursday's session, during which the German index made a technical adjustment, caused the participant's balance to decline to below 10. euro. This meant a negative rate of return. The XNUMXth edition of the competition shows, however, that the best in the general classification also experience worse moments. The most important thing is to quickly get yourself together and fight back.

- Twice the 6th place in the second and third week is the result of the trader z last place on the podium in the general ranking. The first time, the rate of return at the level of 129 percent was sufficient, the second time was much higher, 249 percent. This means that the volatility in the market was increasing week by week. We were in the heat of information about new infections, introduced lockdowns and uncertainty related to the US elections. In the second round, the investor chose similar indices as rivals (US2, DE100), but we also find single transactions on WTI crude oil or CFH / PLN. During the third week, he focused mainly on the index of technology companies. We also see positions on precious metals, which, however, did not significantly affect the final result on the player's portfolio.

Other interesting statistics

- The most popular markets were US100, DE30 and GOLD

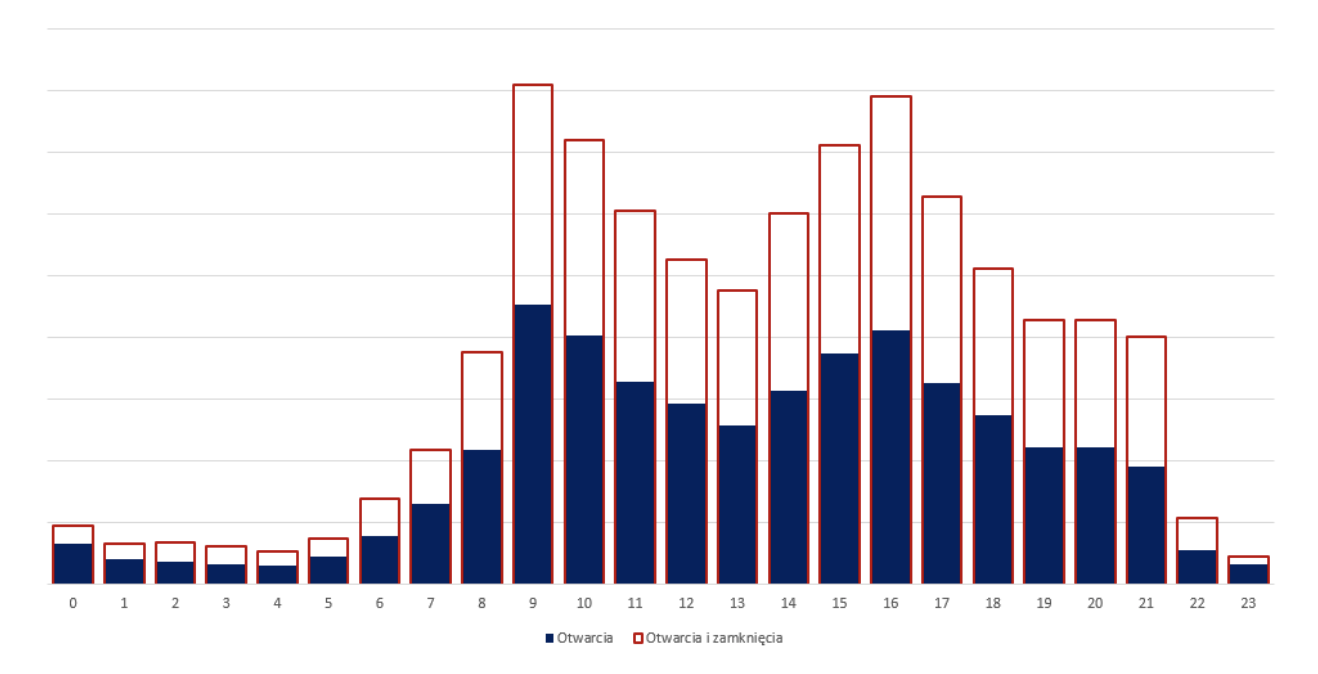

- Investors were most active in the following hours: 9:00 and 16: 00, which can be explained by the start of sessions in Europe and the USA

- The biggest one-time profit was the transaction on DE30 and was 14 174 euro

- During the entire competition, investors were active on 227 different markets

The maximum number of transactions that a participant has performed during one of the stages is 2125.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-300x200.jpg?v=1713870578)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-300x200.jpg?v=1709558918)

Leave a Response