DAX - what characterizes the German stock index

DAX, or Deutscher Aktienindex, is the most important index of the German stock exchange. It was launched in 1988. The index includes the 30 largest joint stock companies in terms of capitalization and turnover. The DAX is a performance index, which means that it takes into account not only the increase in share prices, but also capital growth through the payment of dividends.

CHECK: DAX OFFERING BROKERS - LIST

Each company included in the DAX index is assigned a weight corresponding to its size. They are only taken into account stock freely traded on the stock exchange.

DAX index chart

Composition of the DAX index

The table below presents the list of companies included in the index in alphabetical order. The data shows its composition in September 2020.

| Company name | Symbol | Weight in the index | trade |

| Adidas | ADS | 4.4% | Clothing |

| Allianz | ALV | 7.89% | Insurance |

| BASF | BAS | 4.83% | Chemicals |

| Bayer | BAYN | 6.81% | Pharmacy and chemistry |

| Beiersdorf | AT | 1.05% | Cosmetics and chemicals |

| BMW | BMW | 1.92% | Automotive |

| Continental | with | 0.99% | Automotive |

| Covestro | 1VOC | 0.6% | Chemicals |

| Daimler | DAI | 3.2% | Automotive |

| Deutsche Bank | DBK | 1.84% | Banking |

| Deutsche Börse | DB1 | 3.11% | Insurance |

| Deutsche Post | dbw extension | 3.37% | Logistics |

| Deutsche Telekom | DTE | 5.08% | Telecommunication |

| German living | DWNI | 1.36% | Real Estate |

| E.ON | EOAN | 2.33% | Energetics |

| Fresenius | JO | 1.6% | Medicine |

| Fresenius Medical Care | FME | 1.91% | Medicine |

| HeidelbergCement | HEY | 0.74% | Building Materials |

| Henkel | HEN3 | 1.53% | Chemicals |

| Infineon Technologies | IFX | 2.86% | Electronic components |

| lime | LIN | 10.07% | Energetics |

| Merck | MRK | 1.41% | Pharmacy |

| MTU Aero Engines | MTX | 0.86% | Aircraft |

| Munich Re | MUV2 | 3.42% | Insurance |

| RWE | RWE | 2.02% | Energetics |

| SAP | SAP | 10.01% | Software |

| Siemens | SIE | 8.26% | Electronics |

| Volkswagen Group | VOW3 | 2.6% | Automotive |

| Vanovia | VNAO | 2.92% | Real Estate |

| Wirecard | WDI | 0.7% | Finances |

As can be seen in the table, different companies have a different share in the index. Therefore, they have a different effect on the final movement of the index price. The events in SAP, which is responsible for as much as 10% of the index, have a completely different impact on the index, and completely different, negligible for the price of the entire index, events and price movements of the energy giant RWE.

DAX: 5 largest companies

Below is a brief description of the 5 largest companies building the German DAX index. The companies are listed by size of the index share, so the companies that have the greatest impact on the DAX price movement are described first. In total, the 5 largest companies account for 43% of the index value.

lime

- Industry: Energetics

- Weight: 10.07%

Linde has been dealing with industrial gases for over 140 years. Currently, it is the largest company in the world in this industry. In 2018, Linde was acquired by the American concern Praxair.

Linde has been dealing with industrial gases for over 140 years. Currently, it is the largest company in the world in this industry. In 2018, Linde was acquired by the American concern Praxair.

Linde is rated A according to the ESG MSCI. It has been rated as a leader in the industry in terms of caring for employee health and safety. Aspects such as management, carbon dioxide emissions, use of water resources, emissions of toxic substances and waste, and the use of green technology opportunities were rated as industry average.

The company employs 60,000 people, and in 2019 generated $ 2.29 billion in net income.

SAP

- Industry: Software

- Weight: 10.01%

An IT company founded in 1972 in Walldorf. It currently employs nearly 100,000 people in 130 countries. SAP is a software provider for managing company resources, logistics, and relationships with customers and suppliers. It is estimated that SAP products are used by 12 million users in 120 countries around the world.

W ESG MSCI rating SAP has the highest AAA rating and is rated as a leader in its industry for good corporate management, human capital development, caring for data security and investing in green technologies.

The net income in 2019 was EUR 3,3 billion.

Siemens

- Industry: Electronics

- Weight: 8.26%

An international concern operating in the telecommunications, electronics, medicine, education, transport and energy sectors. The company was founded in the mid-nineteenth century and has made groundbreaking investments. Siemens built the first long-distance telegraph line between Berlin and Frankfurt, and then, after the invention of the DC generator by company founder Werner von Siemens, installed the world's first electric street lighting in Godalming, UK. During the Second World War, the company was involved in the production of cartridges. In 1950, Siemens began producing computers, and in 1980, it produced the first digital telephone switchboard. In 1997, Siemens introduced the world's first GSM mobile phone with a color display - the Siemens S10.

An international concern operating in the telecommunications, electronics, medicine, education, transport and energy sectors. The company was founded in the mid-nineteenth century and has made groundbreaking investments. Siemens built the first long-distance telegraph line between Berlin and Frankfurt, and then, after the invention of the DC generator by company founder Werner von Siemens, installed the world's first electric street lighting in Godalming, UK. During the Second World War, the company was involved in the production of cartridges. In 1950, Siemens began producing computers, and in 1980, it produced the first digital telephone switchboard. In 1997, Siemens introduced the world's first GSM mobile phone with a color display - the Siemens S10.

MSCI Siemens has a BBB rating in ESG, which is the industry average for corporate management, anti-corruption and investment in renewable technologies. Siemens has been recognized as a leader in terms of employee management.

The company currently employs nearly 400,000 people worldwide. In 2019, it achieved 5,6 billion euros in net income.

Allianz

- Industry: Insurance

- Weight: 7.89%

Allianz is a German insurance company currently operating in 70 countries around the world. The company serves approximately 80 million customers. The company was founded in 1890.

Allianz is a German insurance company currently operating in 70 countries around the world. The company serves approximately 80 million customers. The company was founded in 1890.

In the ESG rating prepared by the MSCI agency, Allianz received the AAA rating, i.e. it is a leader in its industry. Aspects such as corporate management, developing human capital, vulnerability to climate change, taking care of data security, responsible investing and responding to demographic and health changes in the society were positively assessed. Allianz was assessed negatively in the category of financial system instability.

Allianz employs 140,000 people worldwide and generated EUR 2019 billion in net income in 8,3.

Bayer

- Industry: Pharmacy and chemistry

- Weight: 6.81%

Bayer is another DAX company with a long tradition. It was founded in 1863 and initially produced dyes. The breakthrough for the company was the invention of aspirin, or acetylsalicylic acid, by Bayer employee Felix Hoffmann. Besides aspirin, Bayer has invented many drugs, dyes, plastics, fibers, and agricultural products. These were, for example, heroin or polyurethane. During World War II, the concern produced Zyklon B. Currently, the company's most popular products are Aspirin, Bepanthen, Claritine, Dicoflor, Iberogast and Rennie.

Bayer is another DAX company with a long tradition. It was founded in 1863 and initially produced dyes. The breakthrough for the company was the invention of aspirin, or acetylsalicylic acid, by Bayer employee Felix Hoffmann. Besides aspirin, Bayer has invented many drugs, dyes, plastics, fibers, and agricultural products. These were, for example, heroin or polyurethane. During World War II, the concern produced Zyklon B. Currently, the company's most popular products are Aspirin, Bepanthen, Claritine, Dicoflor, Iberogast and Rennie.

In the ESG MSCI rating, the company was rated BB, which is slightly below the average for its industry. It has been negatively assessed in terms of chemical safety and emissions of toxic substances to the environment. According to MSCI, the company is average in managing corporate structures and ensuring product safety and quality. Bayer has been recognized as a leader in counteracting corruption, developing human capital and providing access to healthcare.

The company employs over 100,000 people worldwide. The company's net income in 2019 was EUR 4 billion.

What affects the DAX valuation?

The condition of the German economy

The index of the largest German companies should reflect the condition of the German economy. If we expect the German economy to develop, we can expect the DAX's valuation to rise. On the other hand, however, I would be more cautious, it is worth remembering that the index includes international giants who may be more resistant to crises in the German economy, which may affect small and medium-sized companies to a greater extent than corporations with an international position.

Financial results of companies

The greatest impact on the DAX index valuation is the condition and financial results of the companies included in the index. As I wrote above, the 5 largest companies account for almost 44% of the index price movements. Therefore, it is worth focusing on the news and financial results of these companies.

Diversity of industries

It is worth remembering that indices are built to grow. The companies included in the DAX index are reliable companies from various industries, mostly future-proof and resistant to turbulence. The diversity of industries is conducive to DAX's resilience to possible crises and turbulences in individual industries (e.g. financial).

Inflation is driving prices up

Company stocks are assets whose valuation increases with increasing inflation. Due to rising inflation, ongoing reprinting and increasing social programs, in the long term, one can expect increases in the prices of the German index, rather than decreases based on the inflation forecast alone.

Properties of the DAX index and speculation

Low costs

DAX, despite relatively low liquidity, is characterized by very low costs (spreads) in relation to the index price.

Availability

The DAX index is available from most Forex brokers - it appears under various markings, eg DE30, GER30, GDAXI, Germany30, etc. Moreover, knowledge about it is widely available, it is a popular topic on websites and industry portals. On CFD based on DAX, the leverage is 1:20 in the European Union. Outside the EU, the leverage can be as high as 1: 100.

High volatility

DAX is characterized by high volatility, meaning the daily movements are clear and allow intraday traders to earn. And here we come back to the issue of costs - high volatility in relation to low commissions makes this index extremely popular among European speculators.

Relatively low liquidity

DAX is characterized by relatively low liquidity compared to currencies or US indices. Therefore, there are anomalies in the behavior of the index that can be used for speculative purposes.

Popular brokers offering DAX

Below is a compilation of the most popular brokers offering the best conditions for the DAX CFDs.

| Broker |  |

|

|

| End | Poland | Cyprus / Australia / Mauritius | Great Britain, Cyprus |

| DAX symbol | DE30 | DE30 | DE30 |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

200 USD | PLN 100 |

| Min. Lot value | price * 25 EUR | price * 1 EUR | price * 1 EUR |

| Commission | - | - | - |

| Platform | xStation | MT4 / MT5 / cTrader | MT4, MT5 |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

ETF based on the DAX index

For investors who prefer to invest with ETFThere are both ETFs that reflect the movements of the German index, such as the Global X DAX Germany ETF, as well as ETFs that give a wider exposure to the German market.

[DAX] Global X DAX Germany ETF

-

- Issuer: Mirae Asse

- Annual fees: 0.21%

The fund traces the movements of the DAX index. It comprises the 30 largest and most liquid companies listed on the Frankfurt Stock Exchange. It has very low annual fees (0.21%) and relatively low spreads (0.59%).

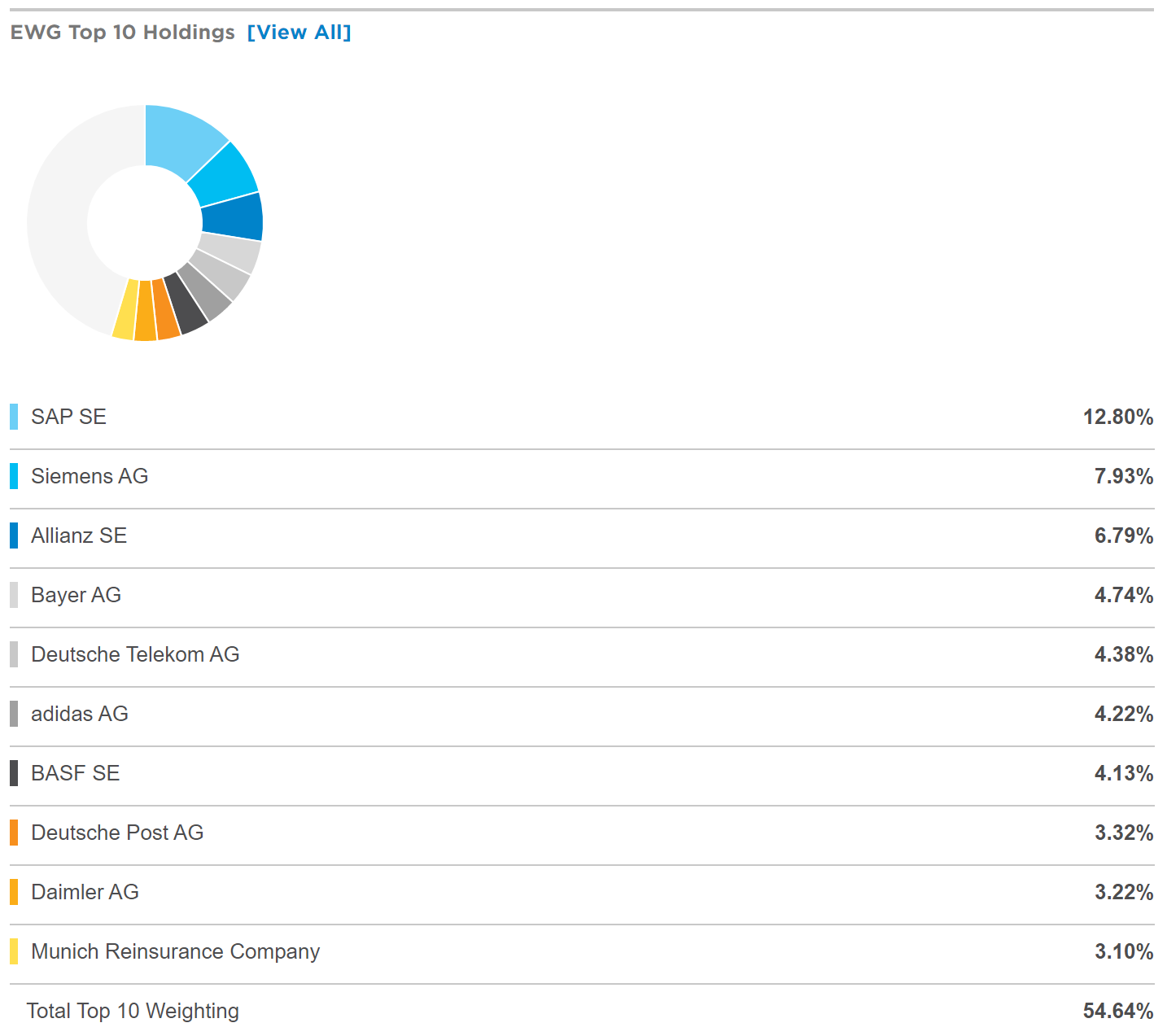

[EEC] iShares MSCI Germany ETF

-

- Issuer: Blackrock

- Annual fees: 0.49%

EEC is a fund that offers wider exposure to the German market than the companies included in the DAX. The fund includes both the largest German companies and medium-sized enterprises. However, the fund does not buy shares of small companies from the German stock exchange at all. The percentage share of the largest companies is different than in the DAX index, SAP accounts for 12.80% of the fund's value, and Linde only 0.87% (in the Linde DAX index it is as much as 10%). The percentage share of the remaining companies is similar.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

Leave a Response