BlackRock - the king of the ETF market. How to invest in this company? [Guide]

BlackRock is one of the most famous companies in the asset management industry. At the end of December 2019, he owned $ 7,43 trillion (Trillion) of assets under management (AUM). The company operates in over 100 countries around the world and employs 16 people (in 200 countries). BlackRock offers its clients products from the stock market, debt securities, alternative investments and the money market. However, to a wide range of customers, it is best known for ETFs from the iShares® brand. Until May 2020, the largest shareholder of BlackRock was PNC Bank (one of the largest banks in the US), which held over 22% of the company's shares. In May of the previous year, PNC sold its stake in BlackRock for $ 14,4 billion. The company's current capitalization is $ 111 billion.

In addition to asset management, BlackRock also provides investment management and risk management solutions. Its offer includes Aladdin®, Aladdin Wealth, eFront, Cachematrix and FutureAdvisor. Advisory services for institutional clients are a side activity.

The company has a very wide group of clients. They are pension funds, foundations, charities, banks, investment funds, national funds, government units and insurers. It is also worth mentioning individual investors who readily use cheap investment methods (ETFs).

BlackRock chart, interval W1. Source: xNUMX XTB.

The history of BlackRock

BlackRock was founded in 1988. The founders of the company were a dozen or so people with experience in finance. Among the creators of BlackRock were, among others Larry Fink, Robrt S. Kapito, Susan Wagner, Ralph Schlosstein, Barbara Novick, Ben Golub, Hugh Frater and Keith Anderson. Many of the founders still hold prominent positions in the company.

Due to its reputation, the company constantly increased the value of its assets under management. At the beginning of its history, the company was associated with the PNC bank. BlackRock debuted on the stock exchange in 1999 selling a 14% stake at $ 14 a share. At the end of 1999, the company had $ 165 billion in assets under management. The main shareholder was PNC, which owned 70% of the company's shares. 16% of the shares belonged to BlackRock employees.

Reasonable acquisitions also helped the company's development. An important step was the merger of BlackRock with MLIM (Merrill Lynch Investment Managers). The transaction was completed in 2006. As a result, a company that manages over 1 trillion assets was established. As a result of traction, Merill Lynch appeared in the shareholding structure with a 45% stake in the company, while PNC owned 38% of BlackRock shares. The year 2009 was very important in the company's development, when Barclays sold its shares in BGI (Barclays Global Investor) for $ 13,5 billion. With this transaction, Barclays had an approximately 20% stake in BlackRock. In the following years, the value of assets under management increased. Another major acquisition was the $ 1,3 billion acquisition of eFront. The acquired company deals with the management of alternative assets. In addition to acquisitions, the company also increases the types of its investments. An example is a stronger entry into "sustainable investing", ie in companies that meet ESG (environmental, social and corporate governance) standards.

An event occurred in August 2020 that could have an impact on the company's long-term growth in Asia. BlackRock has received approval from the CSRC (China Securities Regulatory Commission) to establish its own branch responsible for asset management. BlackRock does not have to enter into a Joint Venture with Chinese partners.

Managers

Even the best company means nothing if there is no good management team. BlackRock has it. Many of the leading positions are occupied by the founders of the company, which allows the continuation of the BlackRock development policy. At the same time, the company's brand allows you to attract external talent and allow the entire organization to grow.

Larry Fink

Larry Fink is a person holding the position of CEO. He is one of the creators of BlackRock. He has been one of the main architects of success since the founding of the company. Under his leadership, BlackRock has grown from a small boutique to one of the world's largest asset management companies. He is one of the most influential people in the asset management industry. Prior to founding BlackRock, Mr. Fink was Managing Director of FBC (First Boston Corporation) for 12 years. Larry Fink is a graduate of the University of California (UCLA). He also holds an MBA degree.

Ben Golub - was also one of the founders of BlackRock. For over 20 years, he has been a member of the PRMIA (Professional Risk Managers' International Association). From the beginning of his work at BlackRock, he is responsible for risk management. At BlackRock he is employed as a CRO (Chief Risk Officer). Before founding the company, he was, among others, VP (Vice President) at The First Boston Corporation (FBC). Ben Golub graduated from MIT (Massachusetts Institute of Technology).

Rob Kapito - this is another co-founder who holds a leading position (President) in BlackRock. Until 2007, Rob Kapito was the head of the Portfolio Management department. Prior to founding BlackRock, he was an FBC VP in charge of mortgage products. Rob Kapito holds an MBA (from Harvard Business School). He graduated from the University of Pennsylvania.

Geraldine Buckingham - is employed as the Head of Asia Pacific (from February 2019). In this position, she is responsible for the development of operations on the Chinese, Japanese, Australian, Indian, Korean and Singaporean markets. Previously, for 5 years she was responsible for the development of the corporate strategy. Between 2012 and 2014, she worked as a Partner at McKinsey & Company.

Edwin N. Conway - has been working at BlackRock since 2011. From 2019, he holds the position of Global Head of BlackRock Alternative Investors. Responsible for the development of alternative investment products (real estate, infrastructure, hedge fund, private equity). Previously, he was responsible for product development for business clients. Between 2005 and 2011, Edwin worked for the Blackstone Group as head of Investor and Business Relations.

Assets under the management of BlackRock

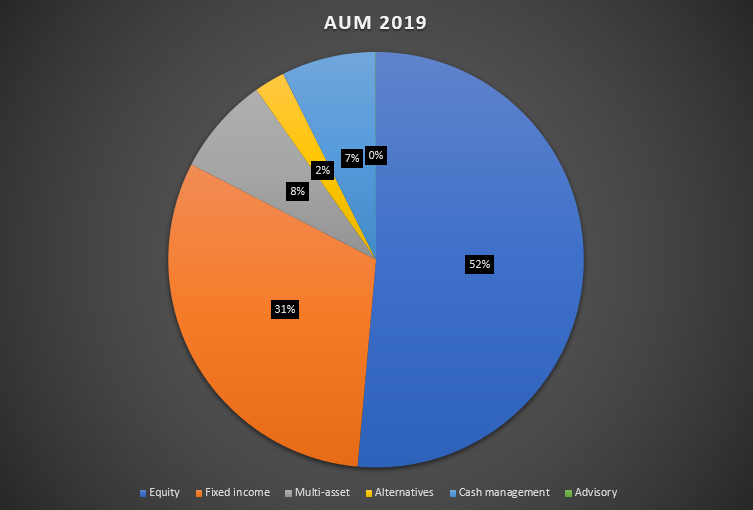

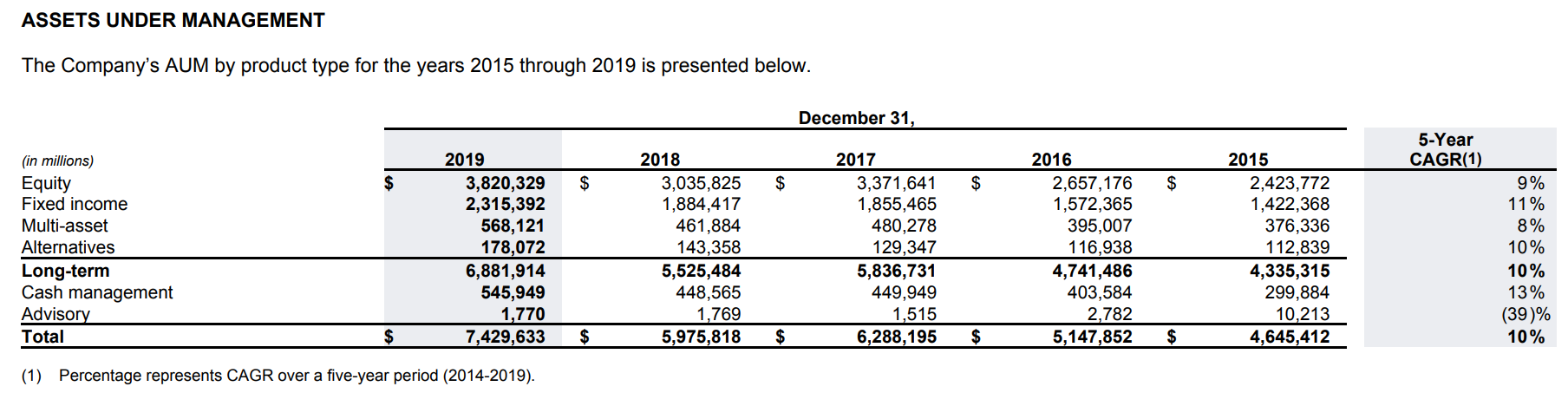

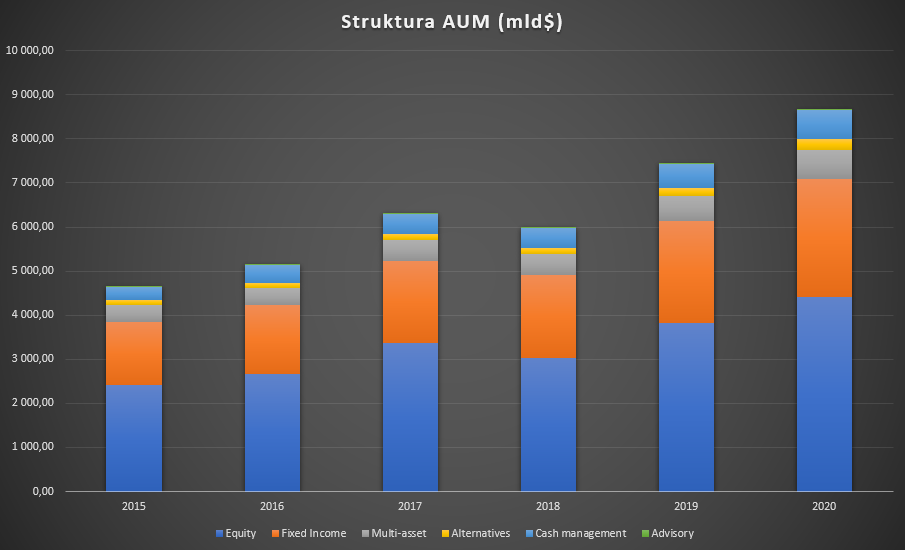

At the end of 2019, the company had over 7,4 trillion. Equity-related assets of $ 3,82 trillion (51,4%) have the largest share. Not surprisingly, the second largest category of assets are fixed interest rate instruments (31,2% of the total).

It's also worth taking a look at the money market asset offering, which increased from $ 2015 billion to $ 2019 billion between 300 and 546.

There are two sources of growth in assets under management. The first was the inflow of new assets, i.e. the situation when investors entrust new funds for management. Another impact was the change in the value of assets under management. It was caused by the bull market on the stock market and lower interest rates (increase in prices of debt instruments). Below is a table showing the influence of the factors mentioned:

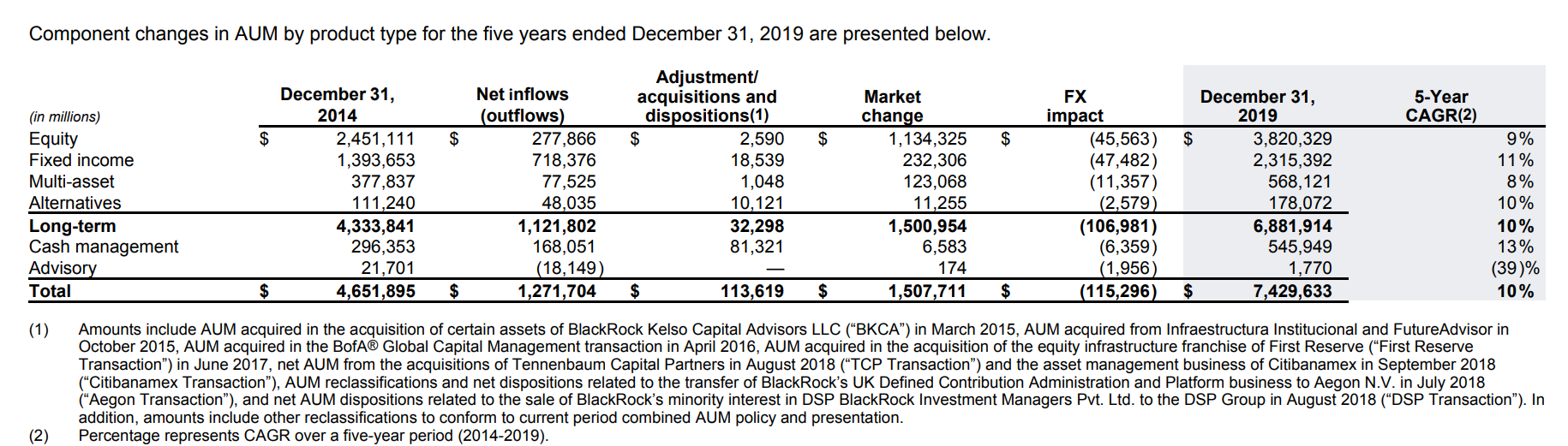

Most of the company's assets are kept on the American market. The Americas segment (North and South America) accounts for 66% of assets under management. The market, classified as Europe, Middle East and Africa (EMEA), accounts for 27% of AUM. It's worth noting that BlackRock has very little exposure to the Asia-Pacific market. In the long term, it is a very promising market.

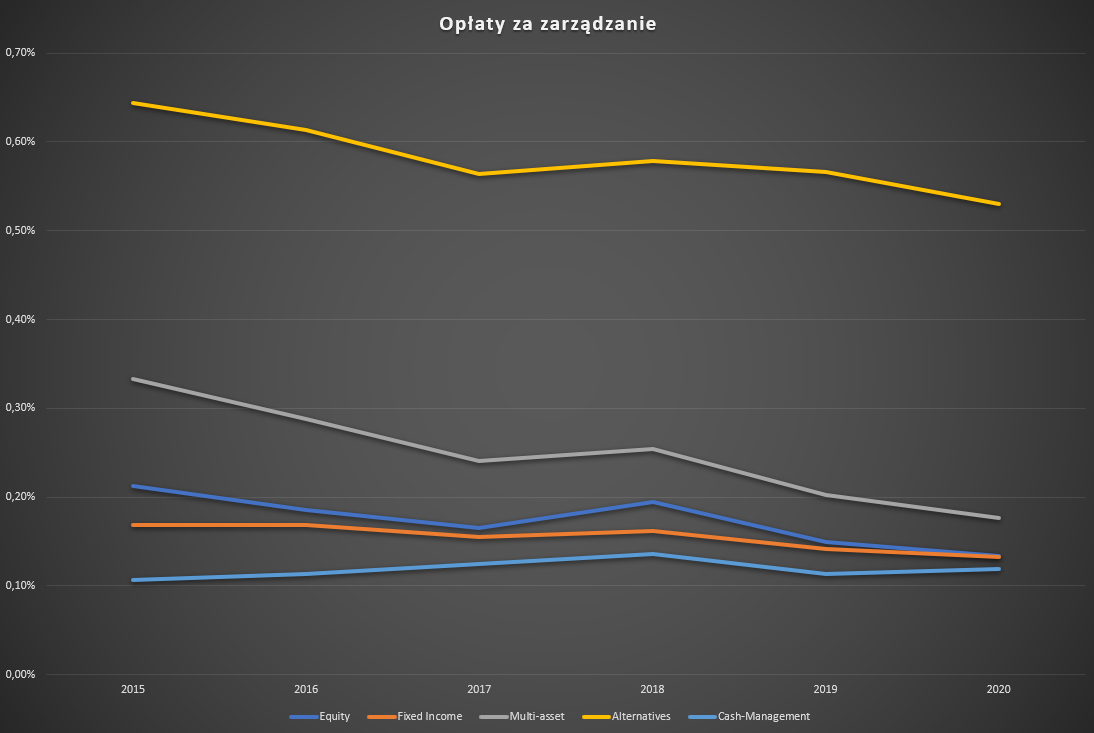

There is a different geographic breakdown depending on the asset class. The American market dominates in terms of AMU on the equity market (71% of the total AUM equity market), Multi-assets (68%) and the money market (74%). In the Asian market, the company is doing quite well on the alternative investment market (14% of the total segment). The EMEA market is strong in debt (34%) and alternative investments (34%). It's worth noting that alternative investments have a management fee of about 4 times higher than that of equity portfolios.

| 2019 | Americas | EMEA | Asia-Pacific |

| Equity | 71% | 23% | 6% |

| fixed income | 57% | 34% | 10% |

| Multi-asset | 68% | 27% | 5% |

| alternatives | 52% | 34% | 14% |

| Cash management | 74% | 25% | 2% |

| Advisory | 86% | 14% | 0% |

Source: own study based on the company's reports

BlackRock is systematically increasing the scale of the business. This can be seen in the increasing level of assets under management. Between 2015 and 2020, the company's assets increased by over 13,3% annually. Among the significant assets, the products related to the money market (+ 17,3%) and alternative investments (+ 15,8% annually) grew the most. The weakest growth was recorded in assets related to multi-assets (+ 11,9%) and the stock market (+ 12,8%).

BlackRock Clients

BlackRock divides its clients into individual, institutional and ETF buyers. For this reason, ETF buyers include both individual and institutional investors.

Individual clients

Assets under individual client management account for $ 714 billion (excluding ETFs). Customers accumulated the most funds in long-term assets ($ 703 billion). Interestingly, in 2019, most assets flowed into debt solutions ($ 21 billion). In turn, the outflow was visible from equity funds (-$ 652 million) and multi-assets (-$ 9,2 billion). At the end of 2019, over 43% of long-term assets were held in debt instruments ($ 305 billion). Individual investors gathered about $ 53 billion less in equity funds.

Individual clients purchase funds through intermediaries such as banks, brokerage houses, insurers, consulting companies and trusts.

It should be mentioned that BlackRock in terms of AUM is dominated by American clients, who account for approximately 70% of the assets under management. One quarter is funded by investors from EMEA (Europe, Middle East and Africa). Only 5% are assets of investors from the Asia-Pacific region. The Asian market seems to have a particularly great potential, with a growing middle class that will want to diversify its investment portfolios.

Due to the structure of retail clients, movements among US investors have the greatest impact on the short-term fluctuation of AUM. In the US market, BlackRock reported $ 23,4 billion in net inflows. The main components were investments in debt solutions (+ $ 22,7bn y / y / y) and an inflow to equity funds ($ 3,9bn y / y). This more than covered the large outflow from multi-assets solutions (-5,9 billion y / y), mainly due to customers resigning from solutions based on the global allocation strategy. $ 2,7 billion has flowed into "alternative" solutions.

2019 was characterized by a large outflow of funds among foreign clients (-$ 7,6 billion y / y). The main reason was the outflow of funds from the stock market (-$ 4,5 billion), multi-assets solutions (-$ 3,4 billion) and the debt market ($ 1,5 billion y / y). Outflows partially covered inflows to alternative solutions ($ 1,8bn y / y).

ETFs

The ETF market has been triumphant over the last decade. The high boom in developed markets made investing in indices a very accurate strategy. Interestingly, the ETF market is dominated by strategies classified as "aggressive". Of the $ 2 billion accumulated in ETFs, as much as 240% ($ 72,9 billion) are investments in ETFs on the equity market. Much of the money goes to debt market ETFs ($ 1 billion).

Be sure to read: ETFs - Physical or synthetic replication?

Looking at the inflows, in 2019 we managed to raise $ 183,5 billion for ETF solutions. As much as 61,2% of funds (112,3) went to the debt instruments market. Mainly for products based on treasury debt and MBS (mortgage-backed securities). $ 2019 billion flowed into ETFs on the stock market in 64,7. Funds flowed mainly to ETFs created under US jurisdiction (+ $ 117,9 billion). $ 65,6 billion flowed into the "foreign ETFs".

Institutional Clients

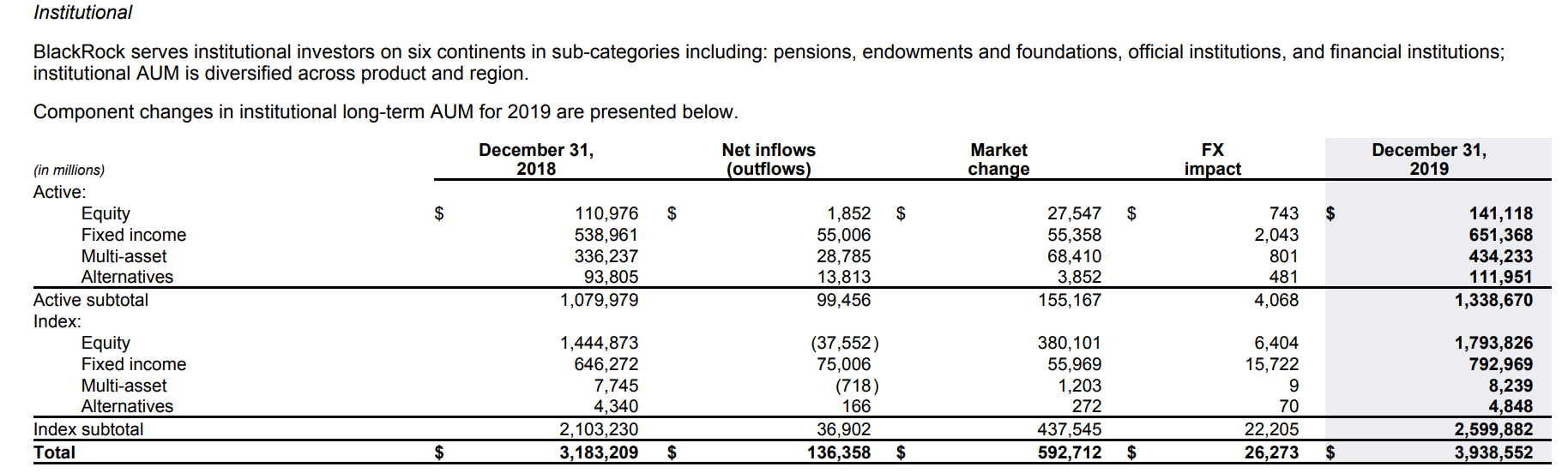

Assets managed by institutional clients account for over half of the entire AUM. This group of clients includes pension funds, foundations, governmental and financial institutions. Of the approximately $ 3 billion in assets accumulated from institutional investors, passive (index) solutions dominate.

The "indices" category collected around $ 2 billion AUM, ie 600% of the total. Two groups of assets dominate, accounting for approximately 66% of AUM. We are talking about equity solutions ($ 99,5 billion) and index solutions based on debt instruments ($ 1 billion). Multi-assets solutions and alternative investments amount to $ 793,8 billion. In 793,0, inflows were very modest. All categories raised $ 13,1 billion. This was due to a large inflow to debt solutions (+ $ 2019bn y / y), which covered the outflows from the stock market (-$ 36,9bn).

Active solutions at the end of 2019 had AUM of $ 1 billion. Interestingly, products related to the debt instruments market ($ 338,7 billion) and multi-assets ($ 651,4 billion) dominated. The remaining two groups of assets have a much smaller share: equity ($ 434,2 billion) and alternative solutions ($ 141,1 billion). Less than $ 112 billion flowed into active solutions. Institutionally, investors avoided solutions based on the stock market. In this group of assets, the inflow of funds during the year amounted to only $ 99,5 billion. Large inflows were made to debt funds (+ $ 1,8bn y / y) and Multi-assets (+ $ 55bn). The multi-assets was heavily influenced by the good sales of the LifePath (r) solution. In the case of alternative solutions, the inflow of $ 28,8 billion was due to the good sale of funds based on investments in infrastructure, REITs and the Private Equity category.

Technology services from BlackRock

BlackRock also offers risk management systems, investment management. Revenue from this segment increased by 2019% y / y in 24, reaching $ 974 million. The company's flagship product is the Aladdin platform, which allows investment firms to better manage their risk and investment portfolio. The product is divided into Aladdin Risk, Aladdin Provider and Aladdin Wealth.

In addition to Aladdin products, BlackRock also offers FutureAdvisor (investment management platform) and Cachematrix (simplifying bank cash management). The company also extended its offer to include alternative investment management by acquiring eFront for $ 1,3 billion. The transaction took place in May 2019. The company's offer is addressed to institutional clients who manage assets.

The company intends to invest more and more in line with ESG and emphasizes that investments should be more climate neutral. This means that a large proportion of BlackRock's funds will bypass industries with negative environmental impacts.

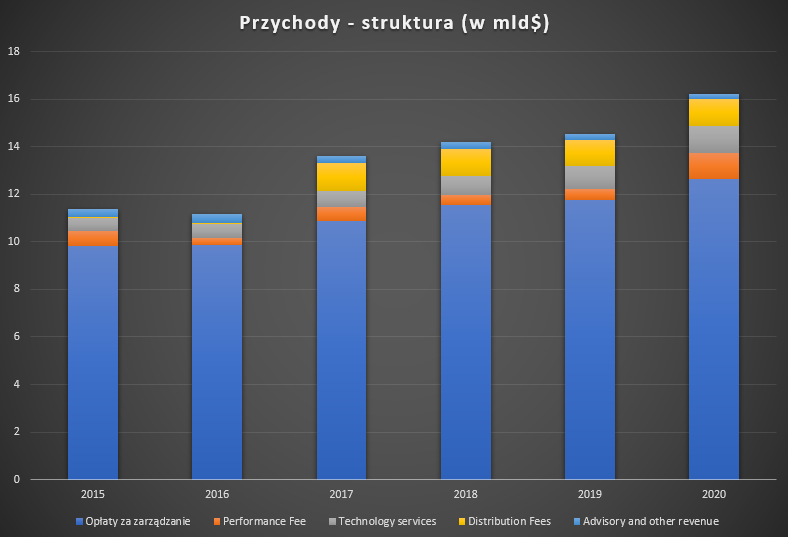

The company's financial results

Between 2015 and 2020, the company's revenues grew by 7,3% annually. The low dynamics of the fixed fee was pregnant with the increase by 5,1% annually. Revenues in the “Techology services” segment grew very quickly, which increased by 16,6% annually.

The company also makes money by lending securities to other financial institutions. The borrowed securities are secured either by cash or by a pledge on the borrower's assets. Typically collateral ranges from 102% to 112% of the value of the securities borrowed. The income generated by the company on this account is divided between BlackRock and the funds that borrow the shares. At the end of 2019, the company had $ 290 billion on loan.

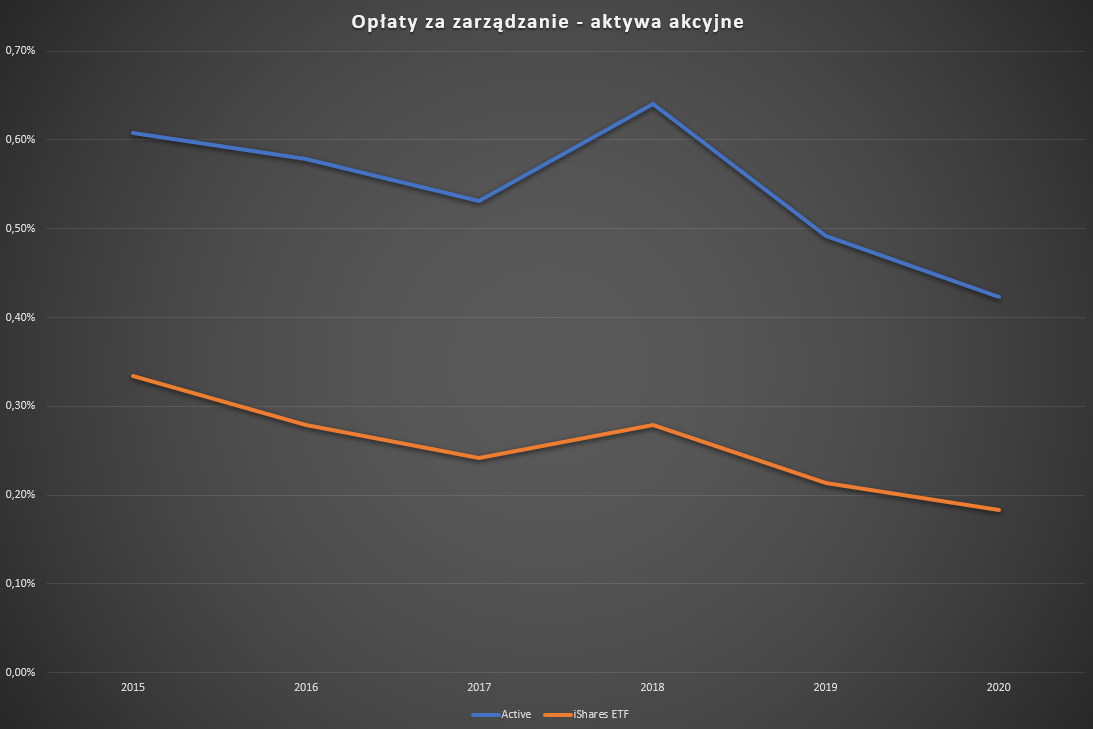

The company is under increasing pressure to reduce management fees. This can be seen in both equity and multi-assets as well as the most profitable alternative investments.

Managed fees also vary depending on how you invest. It is not surprising that the fees in active funds are usually more than twice the commission charged by passive funds.

The development of the asset management market causes the scale of the company's operations to grow. This increases the company's revenues and profits. The company is very profitable. The operating margin is well above 30%.

| BlackRock | 2016 | 2017 | 2018 | 2019 | 2020 |

| revenues | $ 11,155 billion | $ 13,600 billion | $ 14,198 billion | $ 14,539 billion | $ 16,205 billion |

| Operational profit | $ 4,565 billion | $ 5,254 billion | $ 5,457 billion | $ 5,551 billion | $ 5,695 billion |

| Operating margin | 40,92% | 38,63% | 38,43% | 38,18% | 35,14% |

| Net profit | $ 3,168 billion | $ 4,952 billion | $ 4,305 billion | $ 4,476 billion | $ 4,932 billion |

| EPS | 19,02$ | 30,12$ | 26,58$ | 28,43$ | 31,85$ |

Source: own study based on the company's reports

The company is a cash machine. Over the 2016-2019 period, BlackRock generated $ 11,331 billion in free cash. The cash was spent on acquisitions, dividends and share purchases.

| BlackRock | 2016 | 2017 | 2018 | 2019 |

| OCF * | $ 2 million | $ 3 million | $ 3 million | $ 2 million |

| CAPEX | -$ 119 million | - $ 155 million | - $ 204 million | - $ 254 million |

| FCF ** | $ 2 million | $ 3 million | $ 2 million | $ 2 million |

| Acquisitions | -$ 30 million | -$ 102 million | -$ 699 million | - $ 1 million |

| Dividend | $ -1 545 million | $ -1 662 million | $ -1 968 million | - $ 2 million |

| Purchase of shares | $ -1 339 million | $ -1 421 million | $ -2 087 million | $ -1 911 million |

Source: own study based on the company's prospectus;

* OCF - cash flows from operating activities, ** FCF = OCF - CAPEX

Company strategy

BlackRock is following relentless pressure to cut management fees. The price war is good for customers but "deadly" for the profitability of asset management companies. Investors who are used to low fees will react badly to an attempt to raise them. Increasing revenues in the ETF segment can only be done by increasing AUM. At the same time, the low fees and decent performance of ETFs distract funds from more-margin active solutions. This is a negative long-term factor for the industry in terms of profitability. For this reason, the company is constantly trying to increase product diversification. For this reason, it is reasonable to try to increase assets in more profitable investment categories. This especially applies to assets investing on the basis of the Multi-assets strategy and alternative investing. For this reason, it is not surprising that there are recent plans to create mutual funds investing in kryptowaluty.

BlackRock also strives to create products that are not "for the masses". We can mention less liquid strategies based on private equity, which require more specialist knowledge which entails higher management fees. Another type of product that the company intends to develop are high-risk fixed income assets. Another source of income is equity loans, which bring several hundred million additional revenues for the company. However, due to the scale of the business, the share lending fees will not absorb the impact of the "price war".

The price war does not only affect the asset management industry. The indirect victim is the industry of index providers, which are benchmarks for active and passive funds. Lower fees mean that companies have to lower their margins and start optimizing costs. As a result, the big three index providers (MSCI, S&P DJI and FTSE Russell) are under price pressure.

On the other hand, the reduction of management fees makes it difficult for new entrants in the passive asset management sector to enter the market, which slightly "concretes" the market. As ETFs and passive fund fees are currently low, it is harder for newcomers to distinguish their offerings as a result. They have to look for their niches because the "easiest" products are already dominated by the main players. Companies with a "brand" have the advantage in the market. This is the case of BlackRock (iShares®), Vanguard and StateStreet (SPDR®). These 3 companies control about 80% of the ETF market in the world. Not much less than 14 years ago.

BlackRock is also trying to expand its range of services with specialized services. An example is the SMA (Separately Managed Accounts) market. That is, a service tailored for investors who can usually invest at least six-digit amounts. Solutions of this type are tailored to the investor's preferences (e.g. tax preferences). At the same time, the investor usually has an ongoing overview of the investment portfolio. So it is a service different from the classic equity fund. BlackRock acquired in November 2020 a company operating in this area for $ 1 billion. As a result, assets under management in this segment increased by 30% to $ 160 billion. As a rule, fees for managing this type of solutions are in the range of 1-3%. The SMA market is growing at a rate of 15% annually. Currently, the US SMA market is estimated at $ 1 billion. Much faster than the asset management market itself.

An interesting issue is BlackRock's emphasis on the development of software for risk and investment management by financial institutions. At the end of 2020, a new solution was announced, called Aladdin Climate, which provides users with over 1200 measures ESG. Thanks to this tool, the user will be able to more precisely select companies that meet specific investment policy assumptions based on ESG. As a result, it is an interesting direction of diversification, which in the long term does not have to be related only to the asset management industry.

Company competition

While the ETF market is highly concentrated, the asset management market is very fragmented. The biggest competitor is the American Vanguard Group, which in 2019 has accumulated assets for management in excess of $ 6 billion. Other competitors already have a lower AUM level. State Street Group (company segment) managed $ 100 trillion in 2019. Fidelity Investments had a similar level of assets. Among the competitors are departments of American banks. Examples include JP Morgan ($ 3 trillion) or Goldman Sachs ($ 2,4 trillion). Competitors are also companies specializing in selected asset categories. An example is PIMCO, which focuses on debt asset management. In 1,9, PIMCO managed $ 2019 trillion.

Amundi

It is a French asset management company. The main shareholder is the French bank Credit Agricole, which at the end of 2019 held over 69% of the company's shares. Amundi has over € 1 billion in assets under management. Debt assets (€ 600bn) and multi-asset assets (€ 788bn) dominate. The company's capitalization exceeds € 266bn.

| Amundi | 2016 | 2017 | 2018 | 2019 |

| revenues | € 1 million | € 2 million | € 2 million | € 2 million |

| Operational profit | € 816 million | € 949 million | € 1 million | € 1 million |

| Operating margin | 48,17% | 42,05% | 44,74% | 47,76% |

| Net profit | € 568 million | € 681 million | € 855 million | € 959 million |

Amundi chart, interval W1. Source: xNUMX XTB.

Dws Group

It is a company excluded from Deutsche Bank. The company deals with asset management. At the end of Q2020 752, DWS managed € 240bn of assets. Debt assets (€ 145 billion), passive solutions (€ 93 billion) and alternative investment (€ 7,3 billion) dominate. The company is a component of the sDAX index. The company's capitalization exceeds € XNUMX billion.

| Dws Group | 2017 | 2018 | 2019 |

| revenues | € 2 million | € 2 million | € 3 million |

| Operational profit | € 865 million | € 721 million | € 1 million |

| Operating margin | 36,18% | 33,05% | 31,39% |

| Net profit | € 633 million | € 391 million | € 511 million |

How to Invest in BlackRock - ETFs and Stocks

An increasing number of forex brokers have quite a rich offer of stocks, ETFs and CFDs for these instruments.

For example on XTB Today, we can find over 3500 equity instruments and 400 ETFs, a Saxo Bank over 19 companies and 000 ETF funds.

| Broker |  |

|

|

| End | Poland | Denmark | Cyprus * |

| Number of exchanges on offer | 16 exchanges | 37 exchanges | 24 exchanges |

| Number of shares in the offer | approx. 3500 - shares circa 2000 - CFDs on shares |

19 - shares 8 - CFDs on shares |

approx. 3 - CFD on shares |

| The amount of ETF on offer | approx. 400 - ETF approx. 170 - CFD on ETF |

3000 - ETF 675 - CFD on ETF |

approx. 100 - CFD on ETF |

| Commission | 0% commission up to EUR 100 turnover / month | according to the price list | Spread depends on the instrument |

| Min. Deposit | PLN 0 (recommended min. PLN 2000 or USD 500, EUR) |

0 PLN / 0 EUR / 0 USD | PLN 500 |

| Platform | xStation | SaxoTrader Pro Saxo Trader Go |

Plus500 platform |

* PLUS500 CY offer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. From 72% to 89% of retail investor accounts record monetary losses as a result of trading CFDs. Think about whether you understand how CFDs work and whether you can afford the high risk of losing your money.

Summation

BlackRock is definitely a good quality asset management company. The shift in demand for "passive" solutions is a wind blow for the company. So far, the trend to move away from more expensive active solutions seems to be structural. Even the return to active solutions is not a problem for the company, because fees in this segment are much higher than passive portfolios. The company may also benefit from richer Asian societies that may entrust part of its investment portfolio to BlackRock's management. This is due to the brand that the company has developed in the world of asset management.

Another megatrend that may be used by the company is the greater focus on investments that take ESG strategies into account. The company is already seeing greater interest in these products, which will help reach more and more affluent young generations. The younger generations declare that they pay much more attention to the environment and sustainable development than the "boomers" generation. The company said that in December 2020 it had $ 152 billion in assets invested in accordance with the principles of sustainable investing. BlackRock declares that this asset group will grow to $ 1 billion AUM by the end of this decade.

The risk is a long bear market on the global stock market, which may affect two pillars of the company's development - the current level of assets under management and inflows to funds. A potential long bear market would reduce the size of assets, which will result in reduced revenues (the fees mostly consist of a commission based on the size of assets). In turn, the fall in valuations will have a negative impact on historical rates of return, which will be a factor weakening inflows (especially in the case of retail investors).

It is also worth noting that the company is constantly growing. It is true that the dynamics of revenues differs significantly from "hot" technology companies. However, still a single-digit increase in revenues is possible. As the company "melts" from excess cash, it tries to use it in three ways. One of them is the payment of dividends (which has been systematically increasing since 2010). Other ideas are reinvestment of cash in business and acquisitions.

BlackRock seems to be an interesting idea for a dividend company in the portfolio. It is also worth looking at the strategy implemented by the management board. The long-term approach is dominant, as mentioned at the Goldman Sachs US Financial Services conference. The company tries not to focus on the results for the coming quarter, but has a longer horizon in mind.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![BlackRock - the king of the ETF market. How to invest in this company? [Guide] how to invest in blackrock](https://forexclub.pl/wp-content/uploads/2021/02/jak-inwestowac-w-blackrock.jpg?v=1612514935)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-300x200.jpg?v=1676364263)

![BlackRock - the king of the ETF market. How to invest in this company? [Guide] xtb shares number of clients](https://forexclub.pl/wp-content/uploads/2020/02/xtb-ilos%CC%81c%CC%81-kliento%CC%81w-102x65.jpg?v=1580833276)

![BlackRock - the king of the ETF market. How to invest in this company? [Guide] Gamestop Wall Street Bets](https://forexclub.pl/wp-content/uploads/2021/02/gamestop-wall-street-bets-102x65.jpg?v=1612520611)

Leave a Response