Low Tek Jho - The Malaysian Wolf of Wall Street and the 1MDB scandal

Luxury life, parties with Leo DiCaprio or Paris Hilton. Dating famous models and singers. would you like that? Low Tek Jho, who may be called the Malaysian Wolf of Wall Street, spent tens of millions of dollars on parties and jewelry. This Malaysian financier was able to spend New Year's Eve in Australia first, only to have fun in Las Vegas a few hours later. His pockets seemed bottomless. No wonder he was a media figure and often made headlines. However, it turned out that he didn't always spend his money. His eccentric life and financial fraud led to the loss of power by the prime minister of one of the countries, a Goldman Sachs had to pay billions in fines. Despite his activities, he did not answer for his frauds. He has been hiding from international law enforcement for many years. Some say that he is currently in China, others bet on more exotic destinations.

Low Tek Jho. Source: wikipedia.org

The history of Low Tek Jho proves that people are similar to each other, the only thing that limits them is access to contacts and capital. You don't have to be born in the United States to be the Wolf of Wall Street. This Malaysian financier has embezzled billions of dollars using his charisma and network of contacts. He's created a financial scam that's sure to make a Hollywood movie.

Low Tek Jho was a co-founder of one of the biggest financial scandals in recent years. He was one of the people in the back seat 1MDB. He was often credited as the true originator of the affair. He is believed to have transferred approximately $4,5 billion into his private accounts as a result of his actions. The 1MDB scandal resulted in a prison sentence for the former Prime Minister of Malaysia. However, the main architect of this project (so far?) has avoided responsibility. Who is this person, and what theories arose after his disappearance? Playboy, billionaire and fraudster. We invite you to read!

Beginnings - building a network of contacts

Low Jho was not a lowly person. He belonged to a very wealthy Chinese family who had settled in Malaysia. It is worth mentioning that the Chinese diaspora is very numerous in Malaysia. It accounts for over 20% of the country's population. The wealth of the family is due to Low Meng Tak's grandfather, who was a businessman in Guangzhou. He invested in iron mines and alcohol distilleries in Thailand. In addition, he acquired real estate in Thailand, Malaysia and Hong Kong. In turn, Low Tek Jho's father founded an investment holding company called MWE Holdings.

Riza Aziz. Source: wikipedia.org

Low, after completing his education in Malaysia, was sent to the elite Harrow School in London. Alumni of the said school were Winston Churchill (former Prime Minister of Great Britain) and the first Prime Minister of India - Jawaharalal Nehru. While in London, young Low developed close relationships with Riza Azizwhose stepfather was the future Prime Minister of Malaysia, Najib Razak. After living in London, young Low continued his studies abroad. He went to Wharton School for his studies. Thanks to his charisma and party lifestyle, he has gained a network of contacts among many influential people from Malaysia, Kuwait and Jordan. He also started managing the money of friends and family. He graduated from Wharton in 2005. He was considered a brilliant person who was able to win many people over. As it turned out later, it came in handy in the future.

Developing a family business

The first major deal was with Kuwait Finance House. Low Tek Jho bought a luxury apartment building in Kuala Lumpur in 2006 for $87 million. A year later, he created an investment group that included a Malaysian prince, a Kuwaiti sheikh, and an influential citizen of the United Arab Emirates. This was possible thanks to his network of contacts.

In 2010, Low transferred most of his wealth to Jynwel Capital. Friendships with influential personalities allowed him to make transactions with some of the largest and most respected sovereign wealth funds. These include the ADMD (Abu Dhabi's Mubadala Development Co) and the Kuwait Investment Authority.

Already then, Low led a party lifestyle, thanks to which he met more and more people from the world of high society. This, in turn, allowed us to build business relationships and push our investment ideas. Jho was able to project great profits and bragged about the transactions he had carried out. The more contractors he acquired, the more credible he seemed.

It is worth mentioning that Low passed the naturalization process in 2011 and acquired the citizenship of St. Kitts and Nevis. Interestingly, the Malaysian government did not know at the time that Jho had a second nationality. It is worth noting that Malaysia does not allow Malaysians to have dual citizenship. Jho should therefore renounce his Malaysian citizenship in 2011. In retrospect, it seems that already in 2011 our hero sewed a parachute for a rainy day.

Way to the top

Jynwel was involved in the acquisition of the Park Lane Hotel in New York. The value of the transaction was approximately $600 million. The Witkoff Group and Mubadala helped in the transaction. In 2014, Jynwel participated in the $2,2 billion acquisition of Coastal Energy. EMI's publishing business was acquired for a similar amount. The transaction worth $ 2,2 billion involved, among others, Blackstone Group (one of the largest companies operating on the alternative investment market), Sony Corporation and Mubadala. In October 2014, Jynwel Capital wanted to acquire Reebok for $2,2 billion. In the end, Adidas did not accept the offer. In addition, Low supported his friend Aziz in the project Red Granite Pictures. He was a film producer who With The Wolf of Wall Street or Dumb and Dumber.

Low was a well-known person in the financial world who participated in transactions together with major institutions. This meant that he had a large impact on the operation of the 1MDB fund. Although he had no official role in 1MDB, he was a very influential figure. We can say that he practiced investment consulting. Thanks to his knowledge and experience in finance, he helped to construct a financial pyramid. Thanks to his reputation and network of contacts, he was able to participate in financial embezzlement for several years without being bothered by law enforcement.

During the operation of 1MDB, a number of cross-transactions between shell companies took place. The Wall Street Journal discovered that a property in Manhattan, the beneficial owner of which was a tax haven company, belonged to Low. Its value was $33,5 million and was transferred to another company registered in a tax haven, which belonged to the stepson of the Prime Minister of Malaysia. There were more such transactions and only their participants themselves knew why they made such exchanges of assets with each other.

Low Jho – Malaysian celebrity

Low Jho loved parties. It is estimated that between October 2009 and June 2010 he spent about $85 million on them. That's how much expensive alcohol, renting luxury hotels or inviting celebrities cost. The wealth he spent on parties earned Low Jho great popularity.

Between 2013 and 2014, the Malaysian spent around $200 million on jewelry alone. He loved luxury, fun and the casino. His favorite game was baccarat, which is a very simple and fast card game. One game lasts on average several dozen seconds. He could spend millions of dollars on gambling. He also loved the nightlife. In clubs, nightclubs and parties he felt like a fish in water. He spent huge sums to buy luxury champagne and give gifts to people. Gifts were given to both those who impressed Jho and “glass buddies”.

His life was extravagant. He would rent a plane to fly friends from Australia to Las Vegas, only to celebrate the New Year twice: in Australia and in the United States. Many people admired him for the momentum with which he played.

Not every billionaire can win the favor of actors. Low Jho was given this honor. After winning a Golden Globe in 2014 for his role in “Wolf of Wall Street” Leonardo DiCaprio thanked in his speech “Riz and Jho”. Six months later, the U.S. Department of Justice announced that Riza Aziz (Riz) and Jho Low are part of a billion-dollar corruption scandal. It turned out that Aziz financed the production of The Wolf of Wall Street with money stolen from a Malaysian fund.

Paris Hilton. Source: wikipedia.org

Low Jho was a person loved by the cream of society. Wasted money and was defined as “party animal” (party animal). On the yacht Jho Low, Paris Hilton was seen, who in 2010 was friends with the Malaysian billionaire. It is true that there were rumors that Low paid $ 1 million to have Paris Hilton on his yacht, but they were denied.

Low enjoyed life, access to large wealth allowed him to spend a lot of money on parties, gambling and going on dates with models and celebrities. He spent $250 million to buy a luxury yacht. The ship had a landing place for a helicopter, its own gym, cinema, massage room, sauna and small swimming pool.

Low was a very popular person and was able to gain recognition from big stars. He gave a white Ferrari to Kim Kardashian. In turn, Leo DiCaprio received several paintings from him (including by Picasso himself). In addition, during his relationship with the famous model Miranda Kerr, he gave her jewelry worth $ 8 million. Of course, all these gifts came from criminal activity and were recovered by the U.S. Department of Justice.

How did Low Tek Jho work?

The scam was made possible by the close collaboration between Low Tek Jho, Aziz and senior 1MDB fund managers. The scheme was not complicated. 1MDB borrowed money on the market, which was guaranteed in large part by the Malaysian government. The funds were not invested with reputable companies, but directed to shell companies established in tax havens. These companies were to invest funds in interesting investment projects. However, most of them were transferred to Jho and people associated with this scam.

Early on, 1MDB signed a joint venture agreement with Petrosaudi. However, the funds went to the account of Good Star, which belonged to Low Jho. Since this transaction was not controlled by the Malaysian services and authorities, Low quickly discovered that this fund would be a real goldmine. Officially, Good Star was a subsidiary of Petrosaudi. In practice, it belonged to Low Jho. The funds were divided between our hero and several people from 1MDB. The U.S. Department of Justice estimates that between 2009 and 2011, approximately $400 million was embezzled. Fictitious financial instruments were created in order to cover up this scam, which were then creatively used “pumped”. Thanks to this, everything was right in the books at first glance, and 1MDB was earning money.

The next stage of the scam involved another joint venture that 1MDB had formed with aabar. In theory, Aabar was a subsidiary of a fund owned by Abu Dhabi. In order to establish cooperation, 1MDB borrowed several billion dollars from investors. Goldman Sachs helped sell the bonds.

Most of the funds were guaranteed by a Malaysian fund and the International Petroleum Investment Company (IPIC), which was owned by the Abu Dhabi government. From these funds approximately $1,4 billion was transferred to Swiss bank accounts that belonged to Aabar. However, it turned out that Aabar is a company registered in the British Virgin Islands. The company established in the tax haven was called Aabar-BVI. This meant that 1MDB entered into a contract not with an Abu Dhabi company, but with a bush company. Where are the internal audit, investment team and legal department? Most likely, some people were bribed to “turned a blind eye”. In addition, representatives of IPIC and Akbar received cash. About $1 billion went to Singapore. The funds were intended to cover some of 1MDB's losses that resulted from Low Jho's lavish lifestyle. It was the beginning of the financial pyramid. Funds were wasted, but part of the new issue was directed to 1MDB so that the fund would pay its debts on time.

The third stage of the scam was the so-calledThe Tanore". It took place in 2013. During it, about $1,3 billion was embezzled from bonds issued by 1MDB worth $3 billion. Of course, Goldman Sachs helped in the issue. The funds were to be used to launch a joint venture with ADMIC (Abu Dhabi Malaysia Investment Company). However, once the funds arrived, they were quickly transferred to Singapore into the account of Tanore Finance Corporation. The real beneficiary of this company was, of course, Low Jho. The funds were spent on our hero's life and corrupting officials, analysts and anyone who could threaten the scam's exposure.

A small part of the funds also went to real investments. This was necessary because it was supposed to confirm that the fund was actually purchasing assets. This was to silence opposition voices in Malaysia and curious analysts. For example, 1MDB purchased shares in Sony Music for $100 million.

The scheme begins to crack

Since 2010, there have been allegations of a lack of transparency in the 1MDB fund. However, the ruling party did not care about these votes. In response to allegations, she presented annual reports audited by reputable companies. Of course, 1MDB did not share detailed data on its operations. At the October 2010 parliamentary session, representatives of 1MDB explained that the fund's operations were audited by KPMG, while Deloitte analyzed and valued the fund's assets. At the same time, E&Y dealt with tax consultancy. Such a response made it possible to lull the vigilance of the supervisory authorities.

More serious suspicions began to emerge in 2013. Then 1MDB asked the CCM (Companies Commission of Malaysia) for an additional 6 months to submit the annual report. Doubts were also raised by the frequent change of auditors. Within 4 years from the foundation of the fund, the books were audited by 3 companies. However, after a few months, the media stopped digging into the topic.

To calm the mood 1MDB invited to the board of directors Dr. Abdul Samad Alias, who was credited with “father of accounting in malaysia”. He was appointed a member of the supervisory board in January 2015. After a little over 6 months, he resigned from his position. At the very beginning, Dr. Alias wanted to obtain detailed data on the financial operations of the Malaysian fund. When, after 6 months, he did not receive any information, he informed that he had resigned as a member of the supervisory board.

In 2015, there was enough public criticism of the 1MDB fund that the Prime Minister of Malaysia (who was the Chairman of the Board of Advisors) asked Malaysia's Auditor General to review the 1MDB audit. However, the results of the report were classified as a state secret. The audit was available only to PAC (Public Accounts Committee) members.

Over the years, there have been more and more doubts about the origin of Low Jho's funds. After all, he did not come from a billionaire family, but from a wealthy Malaysian family.

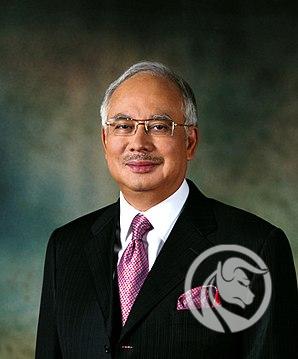

Najib Tun Razak. Source: wikipedia.org

However, as long as Najib Tun Razak ruled Malaysia, Low did not have to worry about the consequences of his actions. In 2018, Razak unexpectedly loses the election and 1MDB accounts are quickly verified. It turned out that billions of dollars had disappeared from the fund, which ended up in the private accounts of Najib Razak, Low Tek Jho and many politicians, officials and managers. The flavor of the whole case is added by the fact that some employees of Goldman Sachs were involved in the embezzlement of money. It's mainly about Timothy Leissne and Rocher Ng. They were convicted of fraud and aiding in money laundering.

Where is Low Tek Jho?

Where has Low Jho gone? No one knows. Some journalists believe that he is hiding in China (he was reportedly seen in Macau, which belongs to the People's Republic of China). Certainly, Low Jho is a valuable asset to many governments as he has had access to many politicians and celebrities. However, the PRC government replies that it is not hiding Low Jho. It is not known where the stolen money is. Some believe that Jho has long since been killed.

It is worth adding that MACC (Malaysian Anti-Corruption Commission) replied to Al Jazeera that Jho Low was hiding in Macau. If that's true, it shouldn't be surprising. Macau is known for its nightlife and plenty of casinos. This is the perfect place for a person like the hero of today's article. Low's presence in Macau was confirmed Kee Kok Thiam, who was also involved in the scandal. It is worth mentioning that Kee Kok died a month after returning to Malaysia. Rumors recently surfaced that Jho was under house arrest in Shanghai and awaiting extradition to Malaysia.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

!["Łowcy Nerjerów" - Interview with the Polish wolf from Wall Street [7 meters above the ground] hunters of suckers](https://forexclub.pl/wp-content/uploads/2018/10/kotlownie-1-300x200.jpg)

Leave a Response