Martingale Forex - an effective strategy or instant deposit clearing?

Martingale Forex - an effective strategy or instant deposit clearing?

It is a natural process that investors and traders look for better and better trading systems or improvements for their strategies on the market. This happens when their trading method is no longer effective or is losing ground "Good entries". It is often caused by overconfidence, neglect of other elements of strategy building - position management and psychologyand not the plan for closing and opening positions. Without going too deep into the reasons for this, we will focus today on a rather unusual strategy.

Be sure to read: Grid Trading - order grid strategy

Martingale is a specific theory for making deals. It is worth mentioning at the outset that in order to use it effectively and skillfully, it is not enough to master its idea well and test it on demo account. You should have more capital or skillfully plan the management of small positions and the margin level. This is not a good system for traders in my opinion, with little capital that they tend to "Necessity" being on the market and adding positions everywhere, thinking that something amazing is about to happen on the market. Moreover, the idea itself is derived from game theory, so you can start at the very beginning "Fault" Martingale gambling approach.

Progression

Let's start with defining the strategy itself, step by step. Therefore, breaking it down into prime factors, we can distinguish several issues that we will discuss in more detail later in the text:

- orientation towards psychology,

- choice of market (instruments),

- leading and changing positions,

- exit strategy.

We could now say that these are the cornerstones of any strategy. In Martingale, it is worth defining them precisely, even before you start trading. An orientation towards psychology is primarily an orientation towards discipline. The inputs should be precise and, what is important, not random. In line with the strategy, it is also recommended to choose limited instruments for trading. We don't trade on anything we see an opportunity on. Our focus should remain those values that have good volatility. It is extremely important to study the sentiment, trend and pay maximum attention to the analysis of these elements. Why is it so important? Martingale trading itself focuses heavily on position size and building a progression system out of them (which in fact is often used in games of chance).

Martingale, or double the loss

It may sound very disturbing, but the whole system of progression in Martingale focuses on doubling your loss position. The theory behind this strategy is that once a deal is made, there is a 50% chance that it will "go" our way. It is true that the probability of such a movement is increased by trend and sentiment analyzes, where we are able to assess the greater possibility of a given situation on the market. In theory, we could say that Martingale is a way of mitigating losses rather than a full trading system. We only use it when our position is not going in the direction we expected.

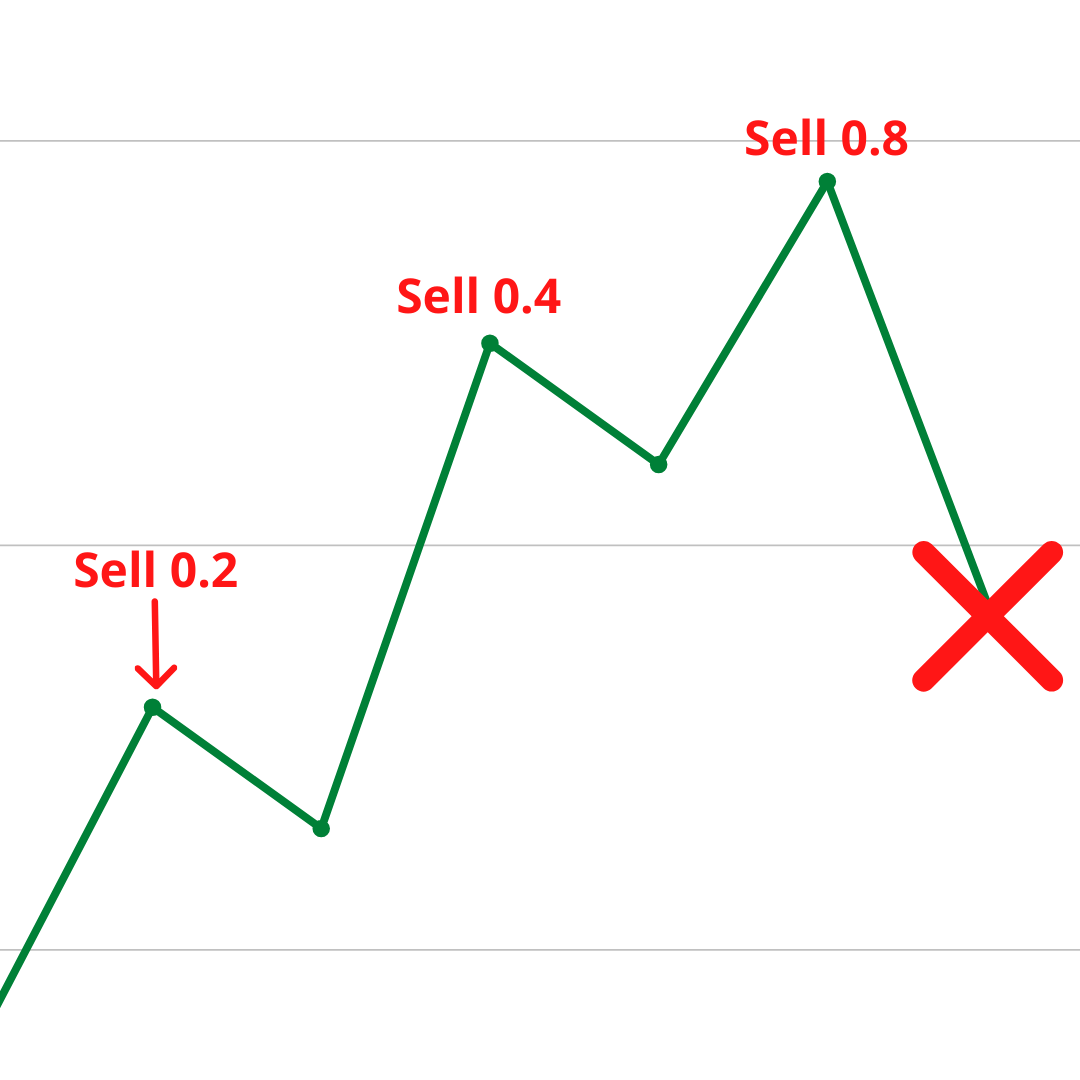

There are many different schools on how to increase the size of a losing position. Of course, they all come from the theory of games of chance. All the leads, however, are to lead to the proverbial breakthrough. Let's look at a simplified graphical representation of Martingale.

According to the above pattern, we assume that we have entered a short position in an uptrend in the expectation that the price of the instrument will be trading south. The quotes, however, continue to rise and we remain positioned at an increasing loss. There are also two approaches here. We can close a losing trade and re-enter it with the same direction, only twice as big. If it is at a loss again, we do exactly the same, concluding another transaction twice as large. The second approach is to not close your first trade and double it in exactly the same model as above.

For a statistical good, we are based on a probability that tends to our side as losing positions increase ... but it does not have to. Every trader is well aware that a series of losing trades, 5 or 6, does not mean that 7 will be our way. However, when calculating how much we can potentially earn by adding to the position, we can face greater disappointment. The whole system is structured so that our risk reward is 1: 1.

An infinitely great loss

When presenting various investment strategies in the Forex Club pages, I always try to describe those that, when used by the right trader, will bring him benefits in the right way. I cannot say that about Martingale. Its huge disadvantage is the need to have a large deposit. Let's look at a simple calculation.

Taking into account the risk-reward ratio assumed by Martingale (1: 1), it follows that we are making a large capital commitment for a small potential profit. Without going into the size of the position and the result we want to achieve, in fact, regardless of the number of losing positions in a row, the amount of "starting" earnings remains the same.

According to the example above, we assumed that we want to earn $ 5 on our position. The risk reward ratio (according to Martingale 1: 1) says that in case of failure, we will close the loss equal to the potential profit, which is also $ 5. The calculation assumes that we managed to close the 6th position in profit. So we are investing a lot of capital to earn $ 5, doubling each losing trade. So we have some conclusions about the effectiveness of this system:

- We need a lot of capital to be able (in theory) to hold infinitely large positions.

- Our chances of winning only make sense if we have enough funds to hold them.

100% effective, at the cost of ...

A lot of capital. The Martingale strategy is derived from roulette. It is not without reason that this game has been introduced with the possibility of betting more than two options (Red/black), such as betting on 0 and 00 and on specific numbers and number "100s" etc. This was mainly done to break the 50% effectiveness of Martingale in this gambling game. Why? Because the probability was no longer 50/XNUMX. There is no third factor in the currency market. It is true that the quotes may move in consolidation, but sooner or later they will exit the side trend.

The mechanism of raising the rate on losing bets (speaking of market positions) still has a wide range of users. Its use in currency trading has become extremely popular due to the fact that, unlike, for example, the stock markets, their value cannot drop to zero.

The Martingale theory is often used by traders who trade currency pairs with high interest rates. Such an investor will intend to buy a currency with a high interest rate and earn the interest, thereby selling the currency with a low interest rate. With a large number of positions, interest can be crucial and can significantly reduce our starting position. All this sounds very good in the theoretical description. However, supplementing it with practice and trading opportunities, you need to have really deep pockets to trade such a system without any obstacles. It may turn out that we do not have enough capital to conclude another transaction after a series of several losses. What's more, no one gives us a guarantee that this one will be the plus we assumed and will cover the losses generated earlier.

Summary of the Martingale strategy

From the perspective of the advantages of using this type of system, it guarantees 100% effectiveness ... as long as we have infinite cash resources. It does not require fundamental market analysis or detailed technical "research" from traders who use it. It is therefore a system based on statistics and probability, de facto "rigid", which always assumes a 50% chance of winning. Therefore, we are not looking for an advantage on the market, although this guarantees greater effectiveness. The main disadvantages of this system are the need for deep pockets. What's more, the person who uses it must certainly have a great appetite for high risk (we do not know how many transactions we have to make to earn) and a decent dose of discipline.

![Forex Club – Tax 9 – Settle tax on a foreign broker [Download the Application] Forex Club - Tax 9](https://forexclub.pl/wp-content/uploads/2024/02/Forex-Club-Podatek-9-184x120.jpg?v=1709046278)

![Trading View platform – solutions tailored to the needs of traders [Review] trading view review](https://forexclub.pl/wp-content/uploads/2024/03/trading-view-recenzja-184x120.jpg?v=1709558918)

![How to connect your FP Markets account to the Trading View platform [Guide] fp markets trading view](https://forexclub.pl/wp-content/uploads/2024/02/fp-markets-trading-view-184x120.jpg?v=1708677291)

![How to invest in ChatGPT and AI? Stocks and ETFs [Guide] how to invest in chatgpt and artificial intelligence](https://forexclub.pl/wp-content/uploads/2023/02/jak-inwestowac-w-chatgpt-i-sztuczna-inteligencje-184x120.jpg?v=1676364263)

![Izabela Górecka – “Success on the market depends not only on knowledge, but also on emotional stability” [Interview] Izabela Górecka - interview](https://forexclub.pl/wp-content/uploads/2024/04/Izabela-Gorecka-wywiad-184x120.jpg?v=1713870578)

![WeWork – the anatomy of the collapse of a company valued at $47 billion [WeWork, part II] wework bankruptcy story](https://forexclub.pl/wp-content/uploads/2024/04/wework-bankructwo-historia-184x120.jpg?v=1711729561)

![Adam Neumann – the man who screwed up Softbank [WeWork, part AND] adam neumann wework](https://forexclub.pl/wp-content/uploads/2024/04/adam-neumann-wework-184x120.jpg?v=1711728724)

![The most common mistakes of a beginner trader - Mr Yogi [VIDEO] Scalping - The most common mistakes of a beginner trader - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Najczestsze-bledy-poczatkujacego-tradera-VIDEO-184x120.jpg?v=1711601376)

![Learning patience: No position is also a position - Mr Yogi [VIDEO] Scalping - Learning patience - No position is also a position - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Nauka-cierpliwosci-Brak-pozycji-to-tez-pozycja-VIDEO-184x120.jpg?v=1710999249)

![When to exit a position and how to minimize losses - Mr Yogi [VIDEO] Scalping - When to exit a position and how to minimize losses - VIDEO](https://forexclub.pl/wp-content/uploads/2024/03/Scalping-Kiedy-wyjsc-z-pozycji-i-jak-minimalizowac-straty-VIDEO-184x120.jpg?v=1710336731)

![Forex Tester 5 - combine for testing strategies [Review] forex tester 5](https://forexclub.pl/wp-content/uploads/2023/04/forex-tester-5-300x200.jpg?v=1679423429)

![4-5 and exit. Highly effective strategy [Video] Trading strategy: 4-5 and exit](https://forexclub.pl/wp-content/uploads/2022/06/4-5_i_wyjscie-300x200.jpg)

Leave a Response